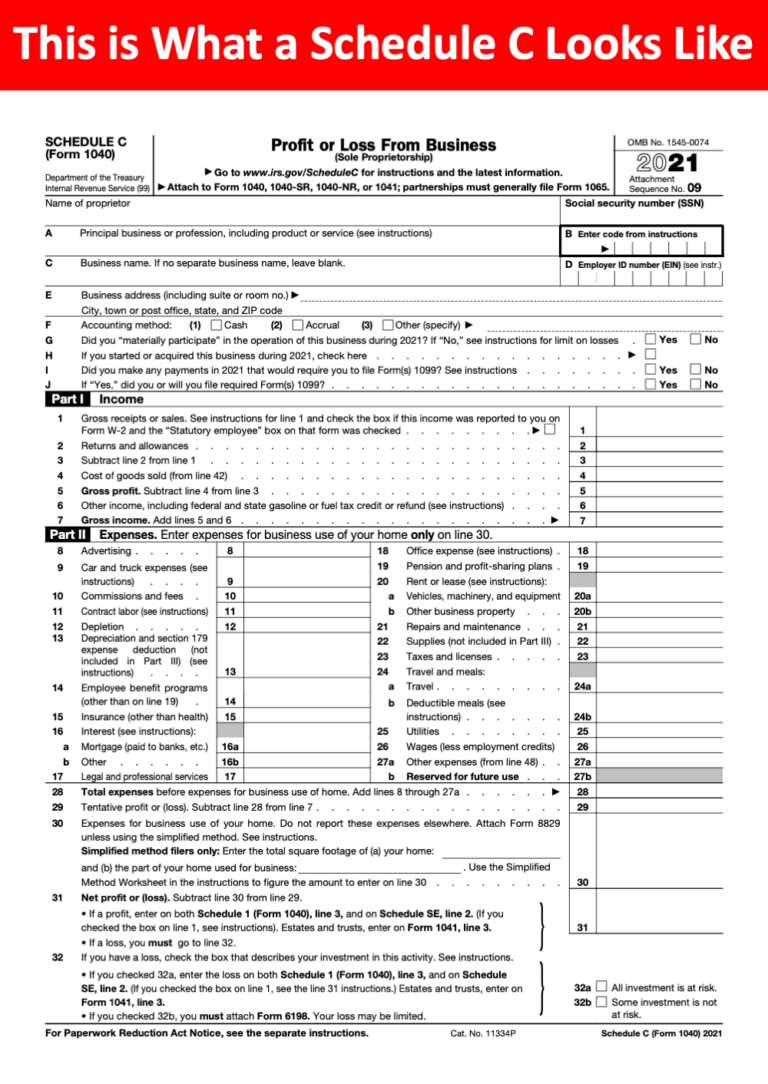

2024 Schedule C Form - Of what country are you a citizen or national?. Learn how to file schedule c to report the income and expenses of a sole proprietorship, which is a business owned and operated by one individual. File original and one copy. Go to www.irs.gov/form1040c for instructions and the latest information. This form is for tax year 2024,. Report income or loss from a business or profession as a sole proprietor using schedule c (form 1040). Download or print the 2024 federal 1040 (schedule c) form for profit or loss from business (sole proprietorship).

Go to www.irs.gov/form1040c for instructions and the latest information. Learn how to file schedule c to report the income and expenses of a sole proprietorship, which is a business owned and operated by one individual. Report income or loss from a business or profession as a sole proprietor using schedule c (form 1040). This form is for tax year 2024,. File original and one copy. Of what country are you a citizen or national?. Download or print the 2024 federal 1040 (schedule c) form for profit or loss from business (sole proprietorship).

This form is for tax year 2024,. Of what country are you a citizen or national?. Download or print the 2024 federal 1040 (schedule c) form for profit or loss from business (sole proprietorship). Go to www.irs.gov/form1040c for instructions and the latest information. Learn how to file schedule c to report the income and expenses of a sole proprietorship, which is a business owned and operated by one individual. File original and one copy. Report income or loss from a business or profession as a sole proprietor using schedule c (form 1040).

2024 Form 1040 Schedule C Instructions Meaning Lydia Rochell

Learn how to file schedule c to report the income and expenses of a sole proprietorship, which is a business owned and operated by one individual. File original and one copy. Go to www.irs.gov/form1040c for instructions and the latest information. Report income or loss from a business or profession as a sole proprietor using schedule c (form 1040). Download or.

2024 Schedule C Form Lizzy Margarete

This form is for tax year 2024,. Go to www.irs.gov/form1040c for instructions and the latest information. Of what country are you a citizen or national?. File original and one copy. Report income or loss from a business or profession as a sole proprietor using schedule c (form 1040).

Irs Schedule C 2024 Tove Ainslie

Go to www.irs.gov/form1040c for instructions and the latest information. This form is for tax year 2024,. Download or print the 2024 federal 1040 (schedule c) form for profit or loss from business (sole proprietorship). Learn how to file schedule c to report the income and expenses of a sole proprietorship, which is a business owned and operated by one individual..

Emnlp 2024 Schedule C Crista Kaycee

Report income or loss from a business or profession as a sole proprietor using schedule c (form 1040). Of what country are you a citizen or national?. Go to www.irs.gov/form1040c for instructions and the latest information. File original and one copy. Download or print the 2024 federal 1040 (schedule c) form for profit or loss from business (sole proprietorship).

Irs Fillable Forms 2024 Schedule C Penny Blondell

This form is for tax year 2024,. Learn how to file schedule c to report the income and expenses of a sole proprietorship, which is a business owned and operated by one individual. Go to www.irs.gov/form1040c for instructions and the latest information. Report income or loss from a business or profession as a sole proprietor using schedule c (form 1040)..

2024 Schedule C Form Orel Tracey

Learn how to file schedule c to report the income and expenses of a sole proprietorship, which is a business owned and operated by one individual. Of what country are you a citizen or national?. Report income or loss from a business or profession as a sole proprietor using schedule c (form 1040). This form is for tax year 2024,..

2024 Schedule C Form Orel Tracey

File original and one copy. Download or print the 2024 federal 1040 (schedule c) form for profit or loss from business (sole proprietorship). Go to www.irs.gov/form1040c for instructions and the latest information. Report income or loss from a business or profession as a sole proprietor using schedule c (form 1040). Learn how to file schedule c to report the income.

2024 Irs Schedule C 2024 Calendar Template Excel

File original and one copy. Learn how to file schedule c to report the income and expenses of a sole proprietorship, which is a business owned and operated by one individual. Go to www.irs.gov/form1040c for instructions and the latest information. This form is for tax year 2024,. Of what country are you a citizen or national?.

Schedule C Instructions 2024 Tax Form Aurie Carissa

Download or print the 2024 federal 1040 (schedule c) form for profit or loss from business (sole proprietorship). File original and one copy. Go to www.irs.gov/form1040c for instructions and the latest information. Learn how to file schedule c to report the income and expenses of a sole proprietorship, which is a business owned and operated by one individual. Of what.

IRS Schedule C (Form 1040) Instructions 2024 Guide Excel Capital

Of what country are you a citizen or national?. File original and one copy. Download or print the 2024 federal 1040 (schedule c) form for profit or loss from business (sole proprietorship). Go to www.irs.gov/form1040c for instructions and the latest information. Report income or loss from a business or profession as a sole proprietor using schedule c (form 1040).

Of What Country Are You A Citizen Or National?.

Download or print the 2024 federal 1040 (schedule c) form for profit or loss from business (sole proprietorship). This form is for tax year 2024,. Report income or loss from a business or profession as a sole proprietor using schedule c (form 1040). File original and one copy.

Learn How To File Schedule C To Report The Income And Expenses Of A Sole Proprietorship, Which Is A Business Owned And Operated By One Individual.

Go to www.irs.gov/form1040c for instructions and the latest information.