Calculate Rate For Free Cash Flow - With these inputs, we can calculate the free cash flow conversion rate for each year, starting with year 1. Free cash flow, often abbreviate fcf, is an efficiency and liquidity ratio that calculates the how much more cash a company generates.

Free cash flow, often abbreviate fcf, is an efficiency and liquidity ratio that calculates the how much more cash a company generates. With these inputs, we can calculate the free cash flow conversion rate for each year, starting with year 1.

With these inputs, we can calculate the free cash flow conversion rate for each year, starting with year 1. Free cash flow, often abbreviate fcf, is an efficiency and liquidity ratio that calculates the how much more cash a company generates.

Free Cash Flow Conversion (FCF) (2025)

Free cash flow, often abbreviate fcf, is an efficiency and liquidity ratio that calculates the how much more cash a company generates. With these inputs, we can calculate the free cash flow conversion rate for each year, starting with year 1.

Free Cash Flow Plan Projections

With these inputs, we can calculate the free cash flow conversion rate for each year, starting with year 1. Free cash flow, often abbreviate fcf, is an efficiency and liquidity ratio that calculates the how much more cash a company generates.

Free Cash Flow (FCF) Definition, Formula and How to Calculate Stock

With these inputs, we can calculate the free cash flow conversion rate for each year, starting with year 1. Free cash flow, often abbreviate fcf, is an efficiency and liquidity ratio that calculates the how much more cash a company generates.

How to Calculate Free Cash Flow per Share Wisesheets Blog

With these inputs, we can calculate the free cash flow conversion rate for each year, starting with year 1. Free cash flow, often abbreviate fcf, is an efficiency and liquidity ratio that calculates the how much more cash a company generates.

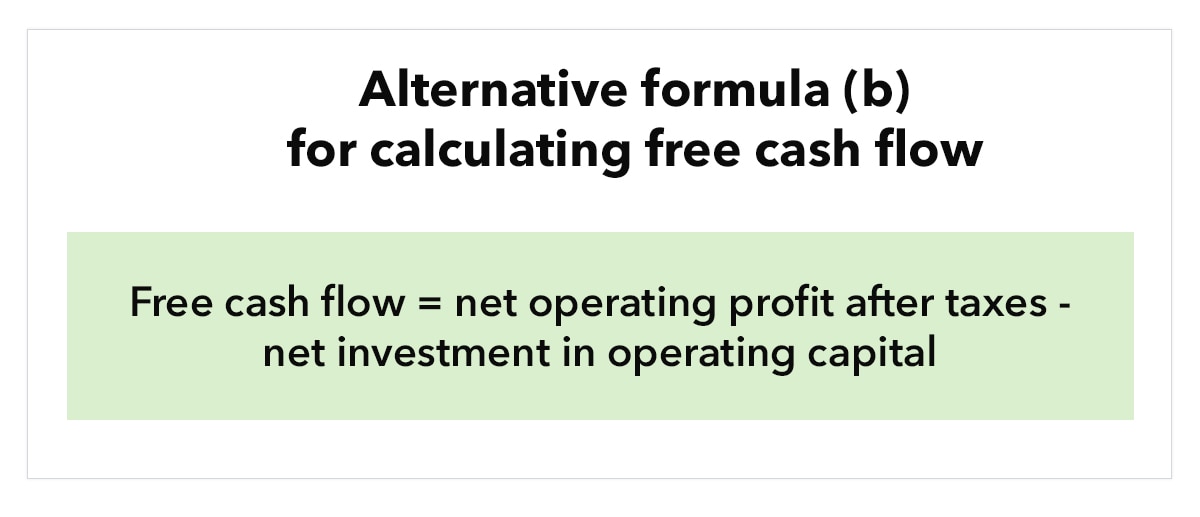

Free Cash Flow What it is and how to calculate it Example and

Free cash flow, often abbreviate fcf, is an efficiency and liquidity ratio that calculates the how much more cash a company generates. With these inputs, we can calculate the free cash flow conversion rate for each year, starting with year 1.

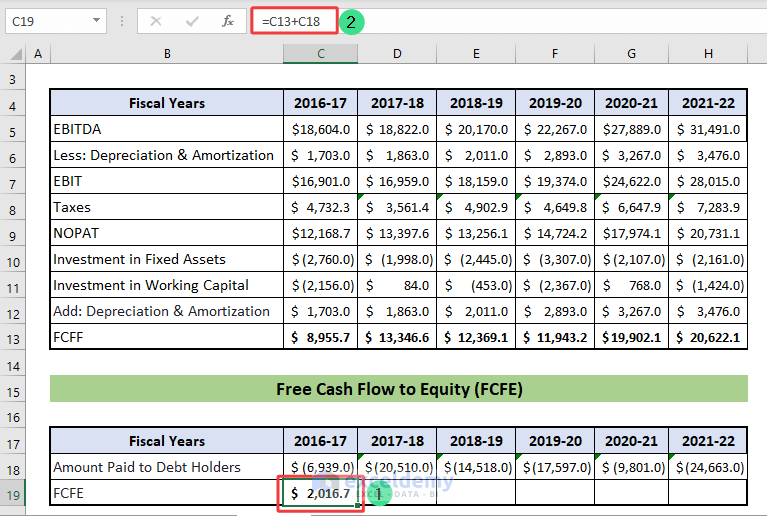

How to Calculate Free Cash Flow in Excel (to Firm and Equity)

With these inputs, we can calculate the free cash flow conversion rate for each year, starting with year 1. Free cash flow, often abbreviate fcf, is an efficiency and liquidity ratio that calculates the how much more cash a company generates.

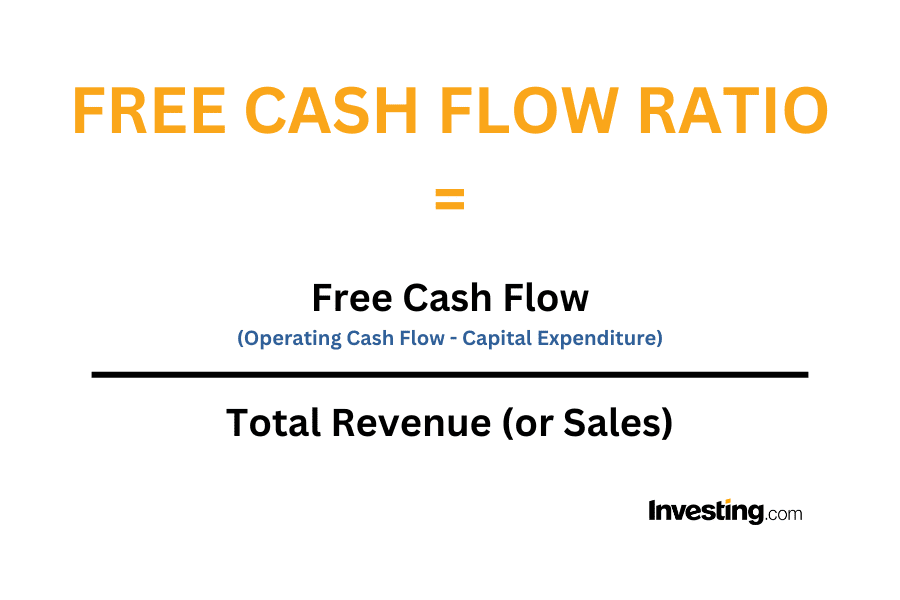

Free Cash Flow What You Need to Know

Free cash flow, often abbreviate fcf, is an efficiency and liquidity ratio that calculates the how much more cash a company generates. With these inputs, we can calculate the free cash flow conversion rate for each year, starting with year 1.

Free Cash Flow Excel Template

With these inputs, we can calculate the free cash flow conversion rate for each year, starting with year 1. Free cash flow, often abbreviate fcf, is an efficiency and liquidity ratio that calculates the how much more cash a company generates.

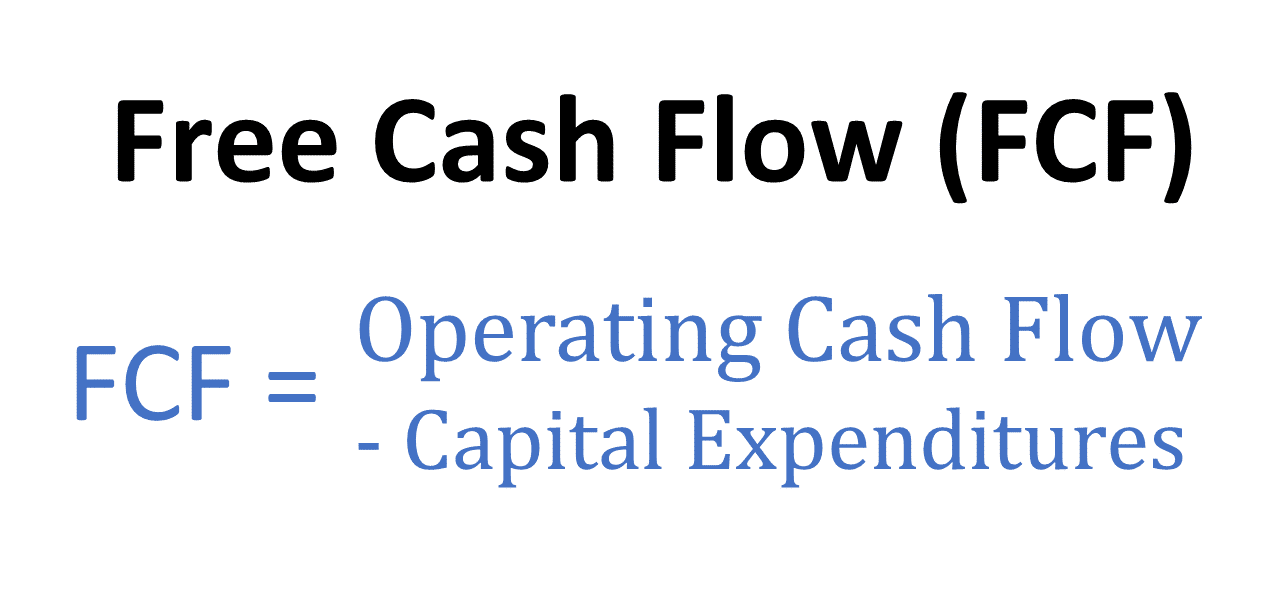

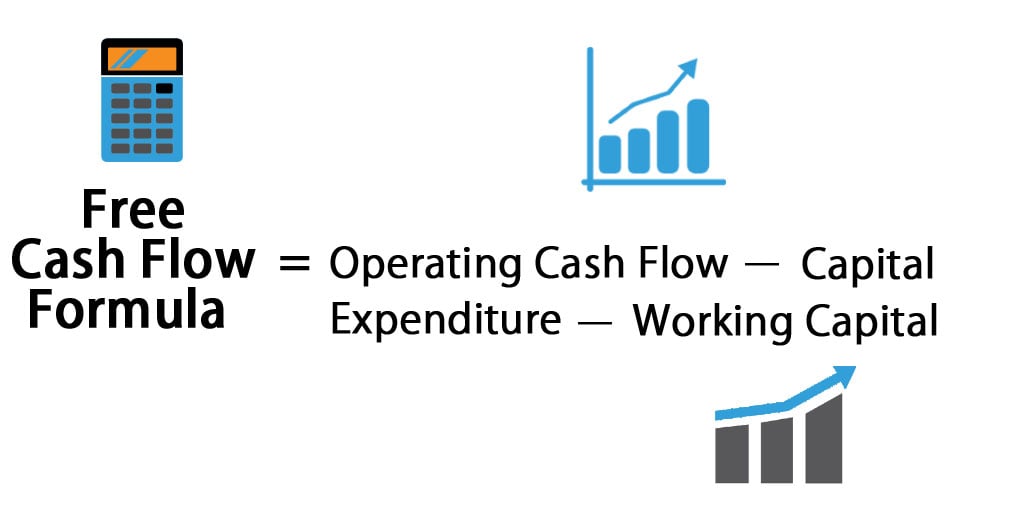

Free Cash Flow Formula

Free cash flow, often abbreviate fcf, is an efficiency and liquidity ratio that calculates the how much more cash a company generates. With these inputs, we can calculate the free cash flow conversion rate for each year, starting with year 1.

With These Inputs, We Can Calculate The Free Cash Flow Conversion Rate For Each Year, Starting With Year 1.

Free cash flow, often abbreviate fcf, is an efficiency and liquidity ratio that calculates the how much more cash a company generates.