Deduction From Salary Income - Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. Understand the various deductions from your paycheck, including federal, state, and voluntary contributions, to better manage your. We’ll break down the different types of taxes deducted from your paycheck, from federal income tax to social security and. Enter your info to see your take. Smartasset's hourly and salary paycheck calculator shows your income after federal, state and local taxes. It can also be used. Starting with your salary of $40,000, your standard deduction of $15,000 is deducted (the personal exemption of $4,050 is eliminated for.

Smartasset's hourly and salary paycheck calculator shows your income after federal, state and local taxes. Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. It can also be used. Understand the various deductions from your paycheck, including federal, state, and voluntary contributions, to better manage your. Starting with your salary of $40,000, your standard deduction of $15,000 is deducted (the personal exemption of $4,050 is eliminated for. We’ll break down the different types of taxes deducted from your paycheck, from federal income tax to social security and. Enter your info to see your take.

Enter your info to see your take. Understand the various deductions from your paycheck, including federal, state, and voluntary contributions, to better manage your. Starting with your salary of $40,000, your standard deduction of $15,000 is deducted (the personal exemption of $4,050 is eliminated for. Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. It can also be used. We’ll break down the different types of taxes deducted from your paycheck, from federal income tax to social security and. Smartasset's hourly and salary paycheck calculator shows your income after federal, state and local taxes.

What are payroll deductions? Mandatory & voluntary, defined QuickBooks

It can also be used. Understand the various deductions from your paycheck, including federal, state, and voluntary contributions, to better manage your. Smartasset's hourly and salary paycheck calculator shows your income after federal, state and local taxes. We’ll break down the different types of taxes deducted from your paycheck, from federal income tax to social security and. Use this calculator.

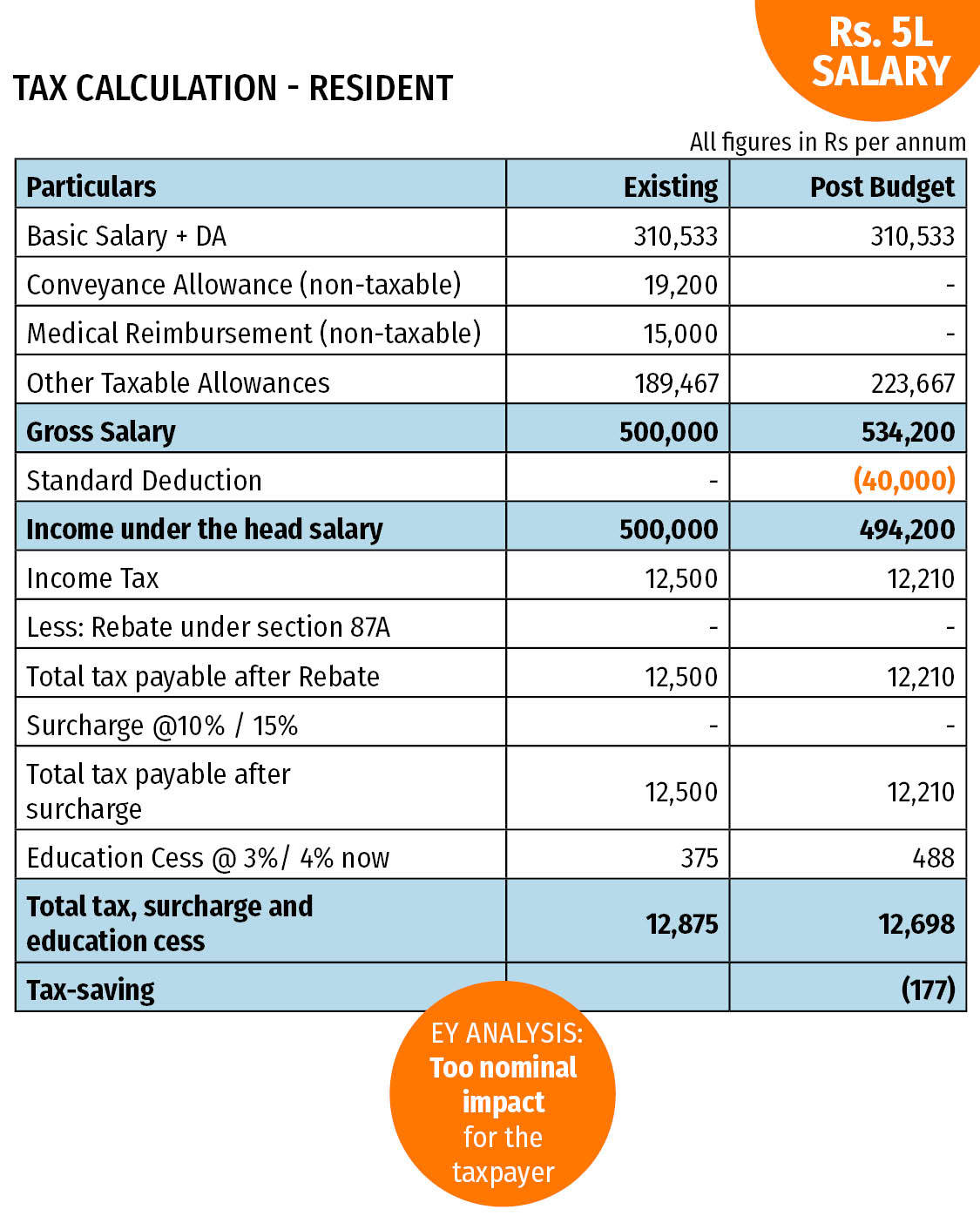

How to Calculate Tax on Salary (With Example)

Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. Understand the various deductions from your paycheck, including federal, state, and voluntary contributions, to better manage your. Smartasset's hourly and salary paycheck calculator shows your income after federal, state and local taxes. It can also be used. We’ll break down the.

Summary of tax deduction under Chapter VIACA Rajput

Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. We’ll break down the different types of taxes deducted from your paycheck, from federal income tax to social security and. It can also be used. Understand the various deductions from your paycheck, including federal, state, and voluntary contributions, to better manage.

How to Calculate Employee Salary Tax, pension, total deduction

Understand the various deductions from your paycheck, including federal, state, and voluntary contributions, to better manage your. Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. Enter your info to see your take. Smartasset's hourly and salary paycheck calculator shows your income after federal, state and local taxes. Starting with.

How to Calculate Tax on Salary (With Example)

Starting with your salary of $40,000, your standard deduction of $15,000 is deducted (the personal exemption of $4,050 is eliminated for. Understand the various deductions from your paycheck, including federal, state, and voluntary contributions, to better manage your. Enter your info to see your take. Use this calculator to estimate the actual paycheck amount that is brought home after taxes.

From Salaries PDF Tax Deduction Salary

Starting with your salary of $40,000, your standard deduction of $15,000 is deducted (the personal exemption of $4,050 is eliminated for. We’ll break down the different types of taxes deducted from your paycheck, from federal income tax to social security and. Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary..

Tax Deductions On Salary [Full Guide] • Chartered Tax

Starting with your salary of $40,000, your standard deduction of $15,000 is deducted (the personal exemption of $4,050 is eliminated for. Enter your info to see your take. Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. We’ll break down the different types of taxes deducted from your paycheck, from.

How To Calculate Tax Deduction From Salary Malaysia Printable Forms

Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. Smartasset's hourly and salary paycheck calculator shows your income after federal, state and local taxes. Starting with your salary of $40,000, your standard deduction of $15,000 is deducted (the personal exemption of $4,050 is eliminated for. Understand the various deductions from.

Missouri Source Business Deduction

Starting with your salary of $40,000, your standard deduction of $15,000 is deducted (the personal exemption of $4,050 is eliminated for. Understand the various deductions from your paycheck, including federal, state, and voluntary contributions, to better manage your. Enter your info to see your take. We’ll break down the different types of taxes deducted from your paycheck, from federal income.

What Is A Payroll Deduction? Sirmabekian Law Firm, PC

Smartasset's hourly and salary paycheck calculator shows your income after federal, state and local taxes. Enter your info to see your take. It can also be used. Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. We’ll break down the different types of taxes deducted from your paycheck, from federal.

We’ll Break Down The Different Types Of Taxes Deducted From Your Paycheck, From Federal Income Tax To Social Security And.

Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. It can also be used. Smartasset's hourly and salary paycheck calculator shows your income after federal, state and local taxes. Understand the various deductions from your paycheck, including federal, state, and voluntary contributions, to better manage your.

Starting With Your Salary Of $40,000, Your Standard Deduction Of $15,000 Is Deducted (The Personal Exemption Of $4,050 Is Eliminated For.

Enter your info to see your take.

![Tax Deductions On Salary [Full Guide] • Chartered Tax](https://chartered.tax/wp-content/uploads/2023/08/Income-Tax-Deductions-on-Salary-Income.webp)