Deductions From Pay Slip - Understand the various deductions from your paycheck, including federal, state, and voluntary contributions, to better manage your. Payroll deductions are wages withheld from an employee’s total earnings for the purpose of paying taxes, garnishments and benefits, like.

Payroll deductions are wages withheld from an employee’s total earnings for the purpose of paying taxes, garnishments and benefits, like. Understand the various deductions from your paycheck, including federal, state, and voluntary contributions, to better manage your.

Understand the various deductions from your paycheck, including federal, state, and voluntary contributions, to better manage your. Payroll deductions are wages withheld from an employee’s total earnings for the purpose of paying taxes, garnishments and benefits, like.

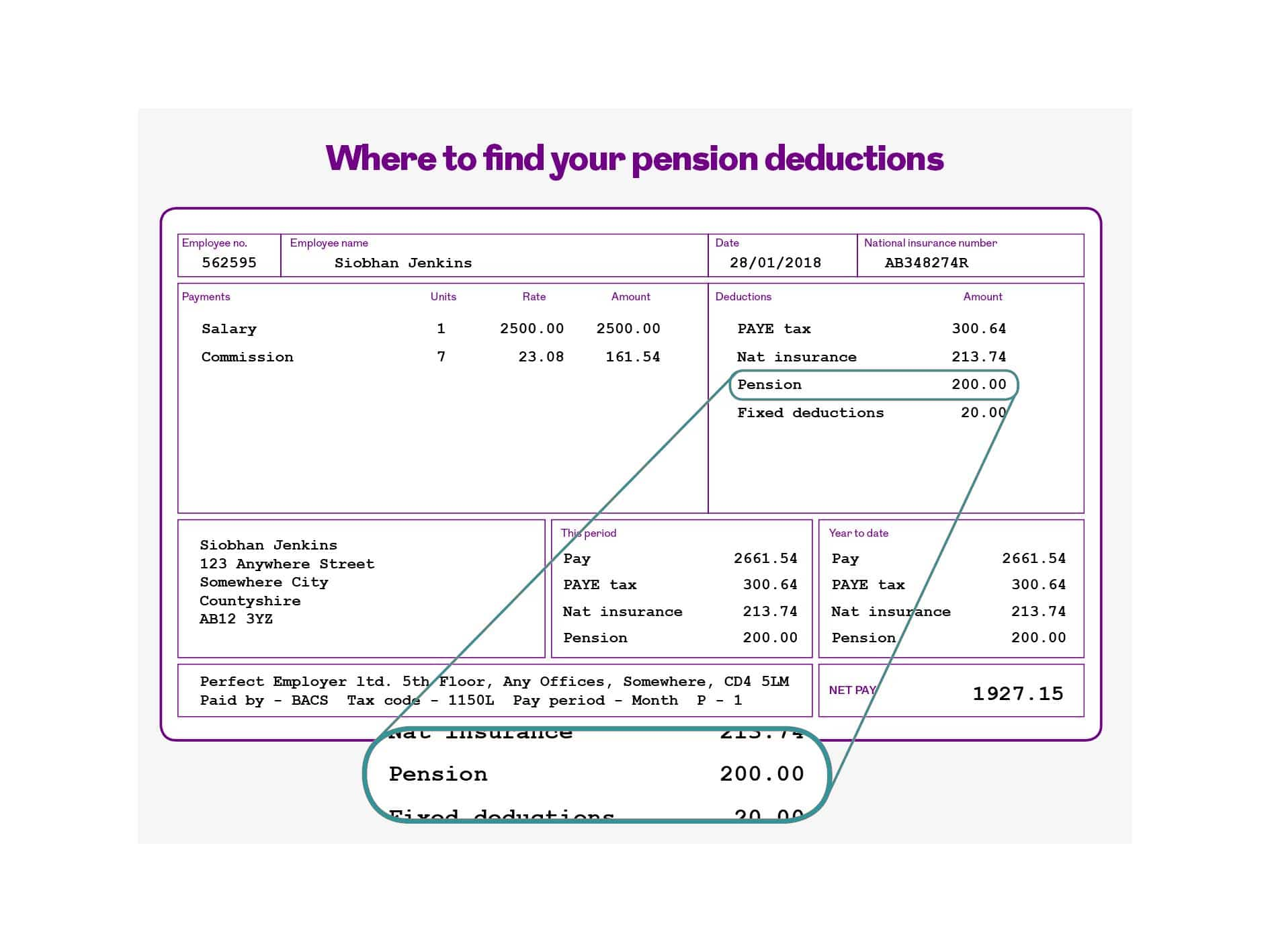

Payslip Deductions Explained Payslipsplus

Understand the various deductions from your paycheck, including federal, state, and voluntary contributions, to better manage your. Payroll deductions are wages withheld from an employee’s total earnings for the purpose of paying taxes, garnishments and benefits, like.

Employees Pay Slip Jan 2024 10114831 PDF Taxes Tax Deduction

Payroll deductions are wages withheld from an employee’s total earnings for the purpose of paying taxes, garnishments and benefits, like. Understand the various deductions from your paycheck, including federal, state, and voluntary contributions, to better manage your.

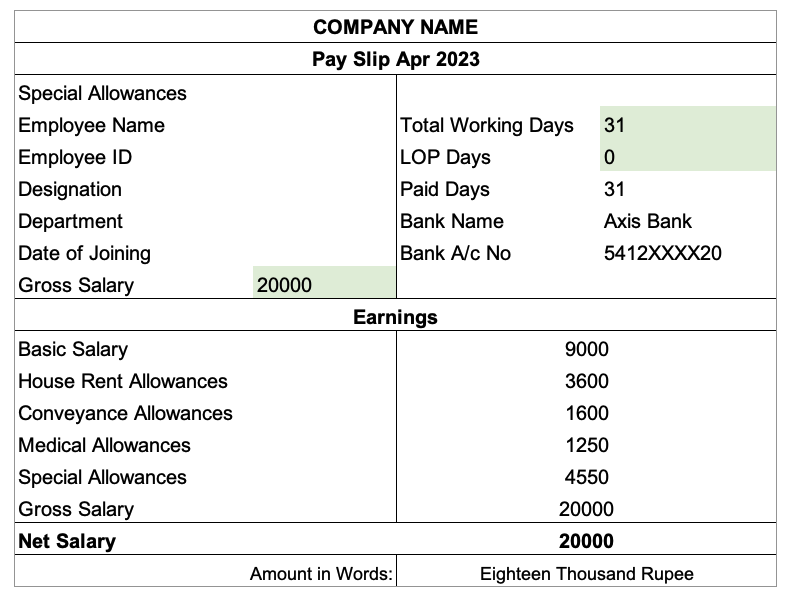

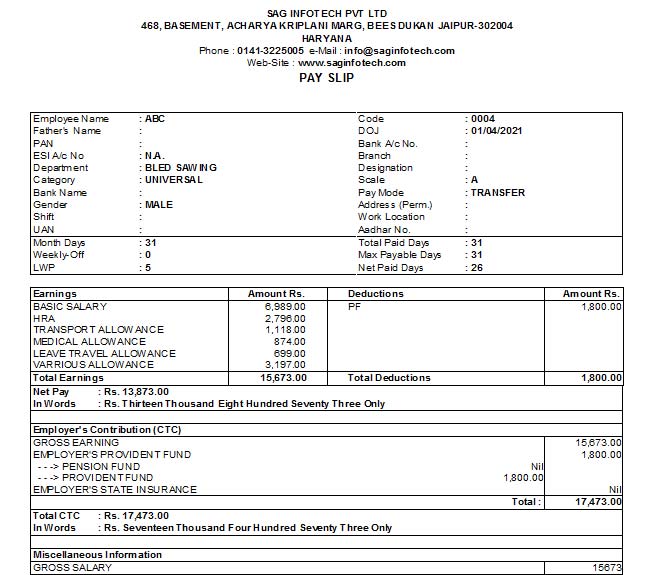

Salary Slip Meaning, Format and Components

Understand the various deductions from your paycheck, including federal, state, and voluntary contributions, to better manage your. Payroll deductions are wages withheld from an employee’s total earnings for the purpose of paying taxes, garnishments and benefits, like.

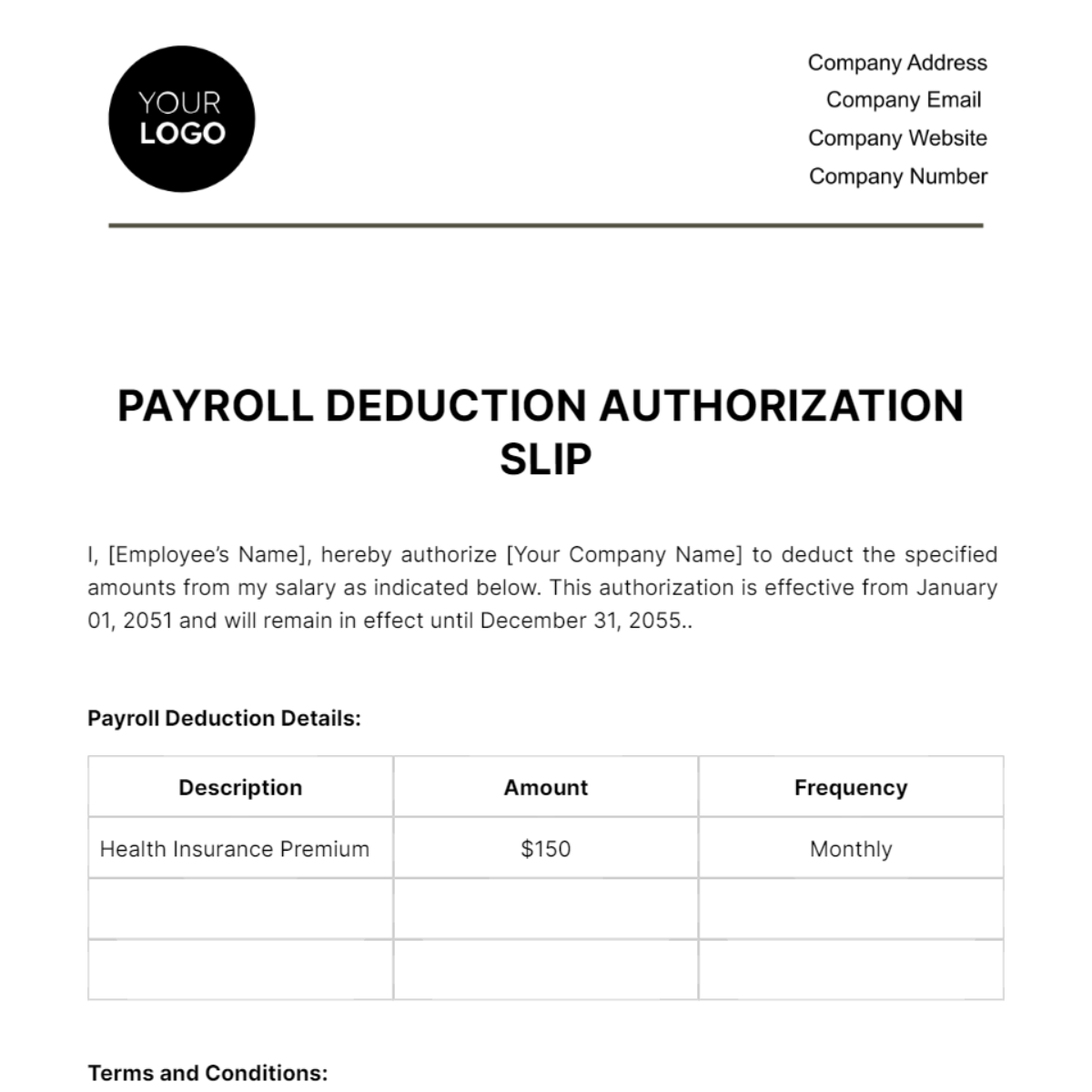

Free Payroll Deduction Authorization Slip HR Template to Edit Online

Understand the various deductions from your paycheck, including federal, state, and voluntary contributions, to better manage your. Payroll deductions are wages withheld from an employee’s total earnings for the purpose of paying taxes, garnishments and benefits, like.

How to read your payslip workplace pension payments Royal London

Understand the various deductions from your paycheck, including federal, state, and voluntary contributions, to better manage your. Payroll deductions are wages withheld from an employee’s total earnings for the purpose of paying taxes, garnishments and benefits, like.

All about Format of Salary SlipOne Should Know BestInvestIndia

Payroll deductions are wages withheld from an employee’s total earnings for the purpose of paying taxes, garnishments and benefits, like. Understand the various deductions from your paycheck, including federal, state, and voluntary contributions, to better manage your.

Simple salary slip format pdf msaeb

Understand the various deductions from your paycheck, including federal, state, and voluntary contributions, to better manage your. Payroll deductions are wages withheld from an employee’s total earnings for the purpose of paying taxes, garnishments and benefits, like.

Understanding Your Pay Stub Canada Part 2 Deductions YouTube

Payroll deductions are wages withheld from an employee’s total earnings for the purpose of paying taxes, garnishments and benefits, like. Understand the various deductions from your paycheck, including federal, state, and voluntary contributions, to better manage your.

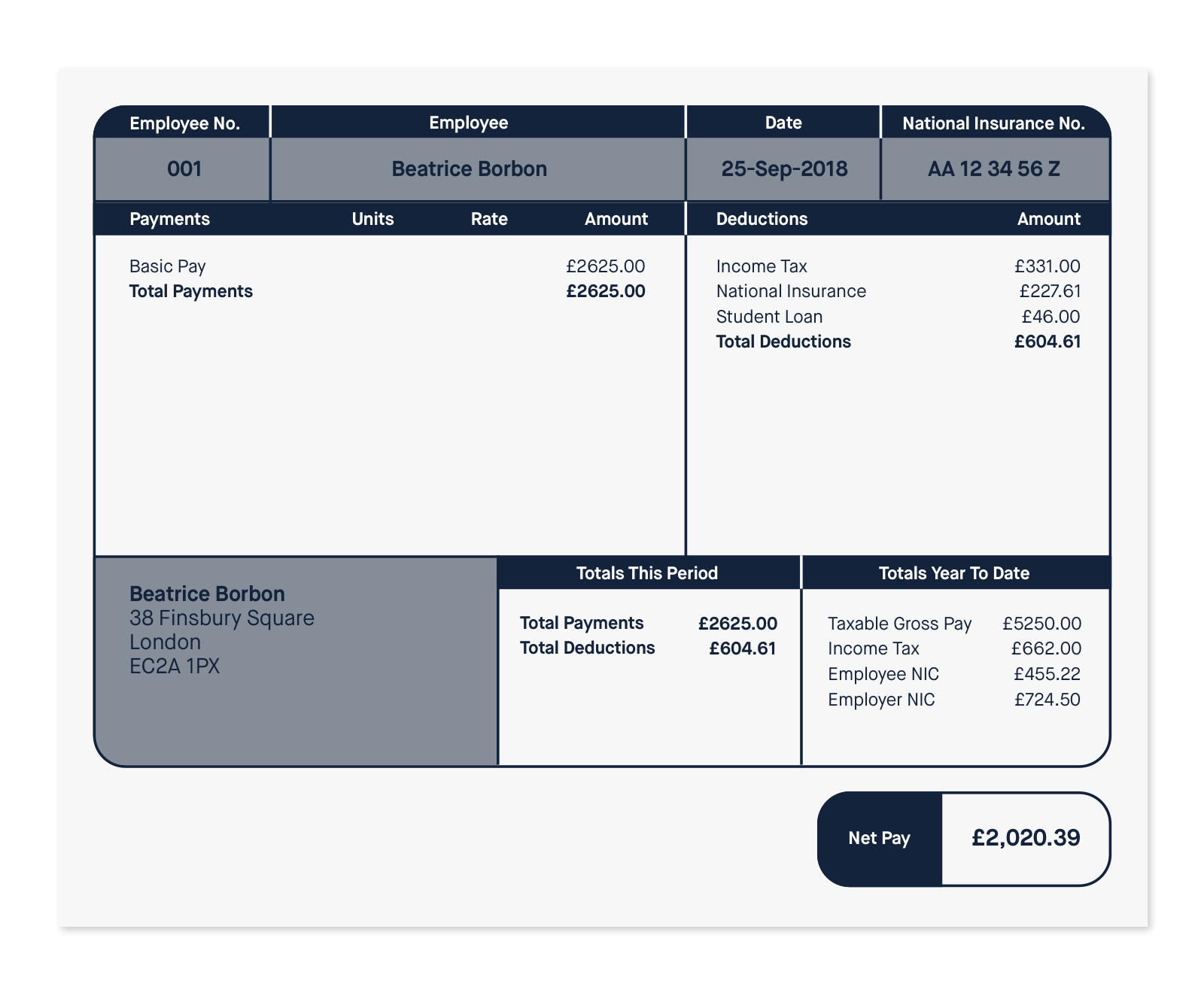

Payslip Explained Planday Images

Payroll deductions are wages withheld from an employee’s total earnings for the purpose of paying taxes, garnishments and benefits, like. Understand the various deductions from your paycheck, including federal, state, and voluntary contributions, to better manage your.

All About Salary Slip with Format and Its Important Parts

Understand the various deductions from your paycheck, including federal, state, and voluntary contributions, to better manage your. Payroll deductions are wages withheld from an employee’s total earnings for the purpose of paying taxes, garnishments and benefits, like.

Understand The Various Deductions From Your Paycheck, Including Federal, State, And Voluntary Contributions, To Better Manage Your.

Payroll deductions are wages withheld from an employee’s total earnings for the purpose of paying taxes, garnishments and benefits, like.