Discounted Cash Flow Npv - A discounted cash flow analysis uses a discount rate to determine the present value of anticipated future cash flows. When it comes to valuing an investment or a business, two of the most commonly used methods are discounted cash. Discounted cash flow (dcf) is a valuation method that estimates the value of an investment using its expected future cash. The discounted cash flow (dcf) analysis represents the net present value (npv) of projected cash flows available to all providers.

Discounted cash flow (dcf) is a valuation method that estimates the value of an investment using its expected future cash. When it comes to valuing an investment or a business, two of the most commonly used methods are discounted cash. The discounted cash flow (dcf) analysis represents the net present value (npv) of projected cash flows available to all providers. A discounted cash flow analysis uses a discount rate to determine the present value of anticipated future cash flows.

When it comes to valuing an investment or a business, two of the most commonly used methods are discounted cash. A discounted cash flow analysis uses a discount rate to determine the present value of anticipated future cash flows. The discounted cash flow (dcf) analysis represents the net present value (npv) of projected cash flows available to all providers. Discounted cash flow (dcf) is a valuation method that estimates the value of an investment using its expected future cash.

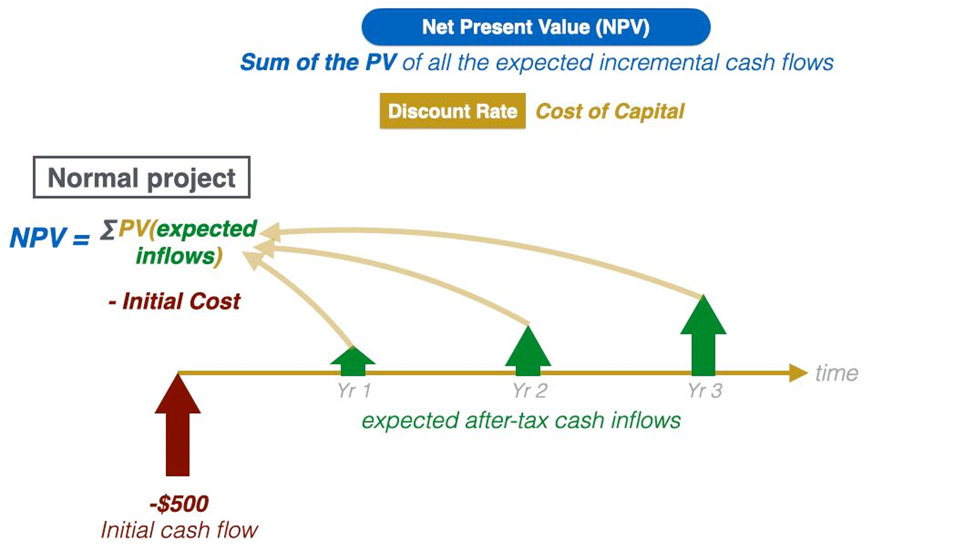

Net Present Value (NPV) What You Should Know PropertyMetrics

The discounted cash flow (dcf) analysis represents the net present value (npv) of projected cash flows available to all providers. A discounted cash flow analysis uses a discount rate to determine the present value of anticipated future cash flows. When it comes to valuing an investment or a business, two of the most commonly used methods are discounted cash. Discounted.

Net Present Value (NPV) What It Means and Steps to Calculate It

Discounted cash flow (dcf) is a valuation method that estimates the value of an investment using its expected future cash. A discounted cash flow analysis uses a discount rate to determine the present value of anticipated future cash flows. When it comes to valuing an investment or a business, two of the most commonly used methods are discounted cash. The.

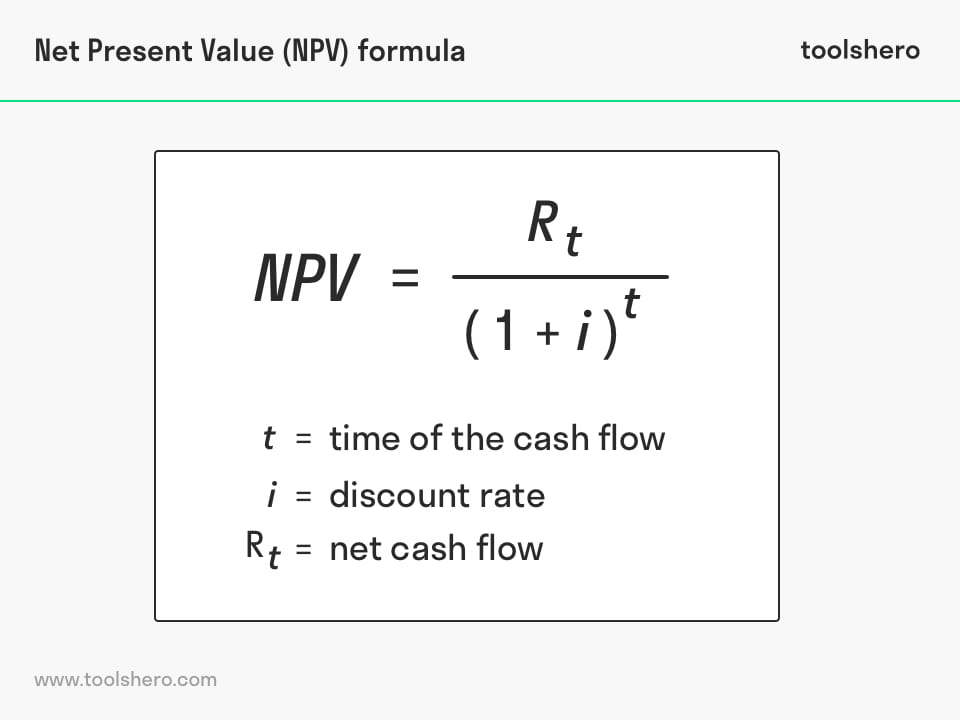

NPV Formula Learn How Net Present Value Really Works, Examples

A discounted cash flow analysis uses a discount rate to determine the present value of anticipated future cash flows. The discounted cash flow (dcf) analysis represents the net present value (npv) of projected cash flows available to all providers. When it comes to valuing an investment or a business, two of the most commonly used methods are discounted cash. Discounted.

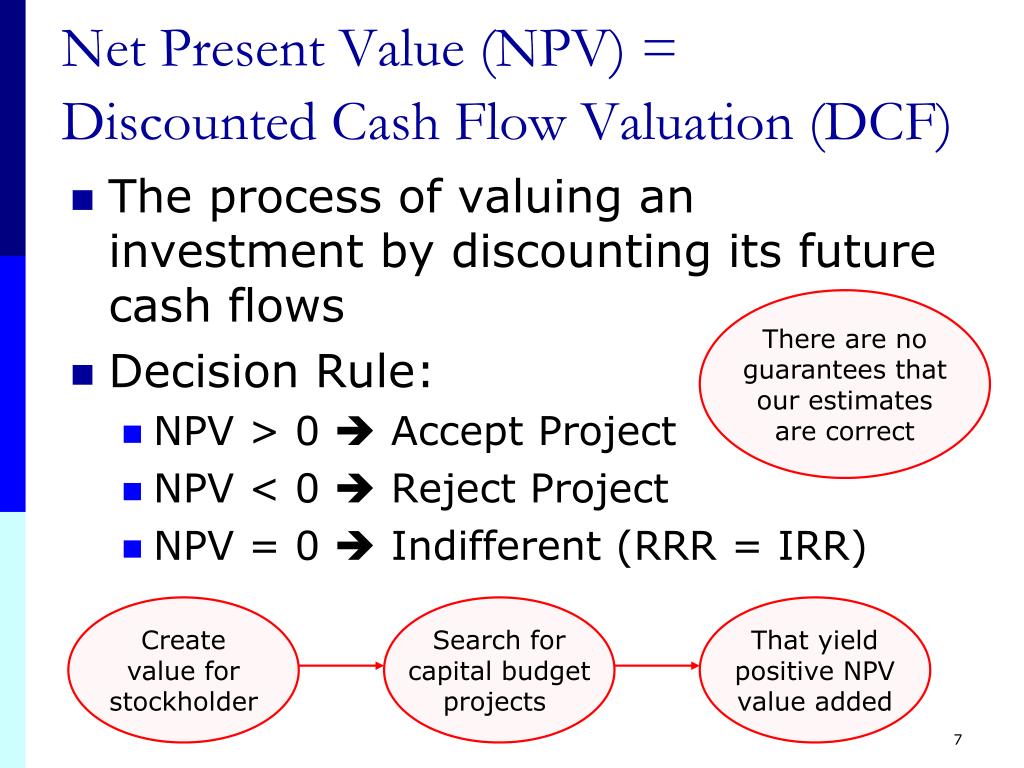

PPT Net Present Value And Other Investment Criteria PowerPoint

When it comes to valuing an investment or a business, two of the most commonly used methods are discounted cash. Discounted cash flow (dcf) is a valuation method that estimates the value of an investment using its expected future cash. The discounted cash flow (dcf) analysis represents the net present value (npv) of projected cash flows available to all providers..

Net Present Value (NPV) What It Means and Steps to Calculate It (2025)

Discounted cash flow (dcf) is a valuation method that estimates the value of an investment using its expected future cash. A discounted cash flow analysis uses a discount rate to determine the present value of anticipated future cash flows. When it comes to valuing an investment or a business, two of the most commonly used methods are discounted cash. The.

pros and cons of net present value method What is a discounted cash

The discounted cash flow (dcf) analysis represents the net present value (npv) of projected cash flows available to all providers. Discounted cash flow (dcf) is a valuation method that estimates the value of an investment using its expected future cash. When it comes to valuing an investment or a business, two of the most commonly used methods are discounted cash..

Understanding Net Present Value and The Basics of Discounted Cash Flow

A discounted cash flow analysis uses a discount rate to determine the present value of anticipated future cash flows. When it comes to valuing an investment or a business, two of the most commonly used methods are discounted cash. The discounted cash flow (dcf) analysis represents the net present value (npv) of projected cash flows available to all providers. Discounted.

Net Present Value formula and example Toolshero

Discounted cash flow (dcf) is a valuation method that estimates the value of an investment using its expected future cash. When it comes to valuing an investment or a business, two of the most commonly used methods are discounted cash. A discounted cash flow analysis uses a discount rate to determine the present value of anticipated future cash flows. The.

Strategy and Management Control system ppt download

The discounted cash flow (dcf) analysis represents the net present value (npv) of projected cash flows available to all providers. When it comes to valuing an investment or a business, two of the most commonly used methods are discounted cash. Discounted cash flow (dcf) is a valuation method that estimates the value of an investment using its expected future cash..

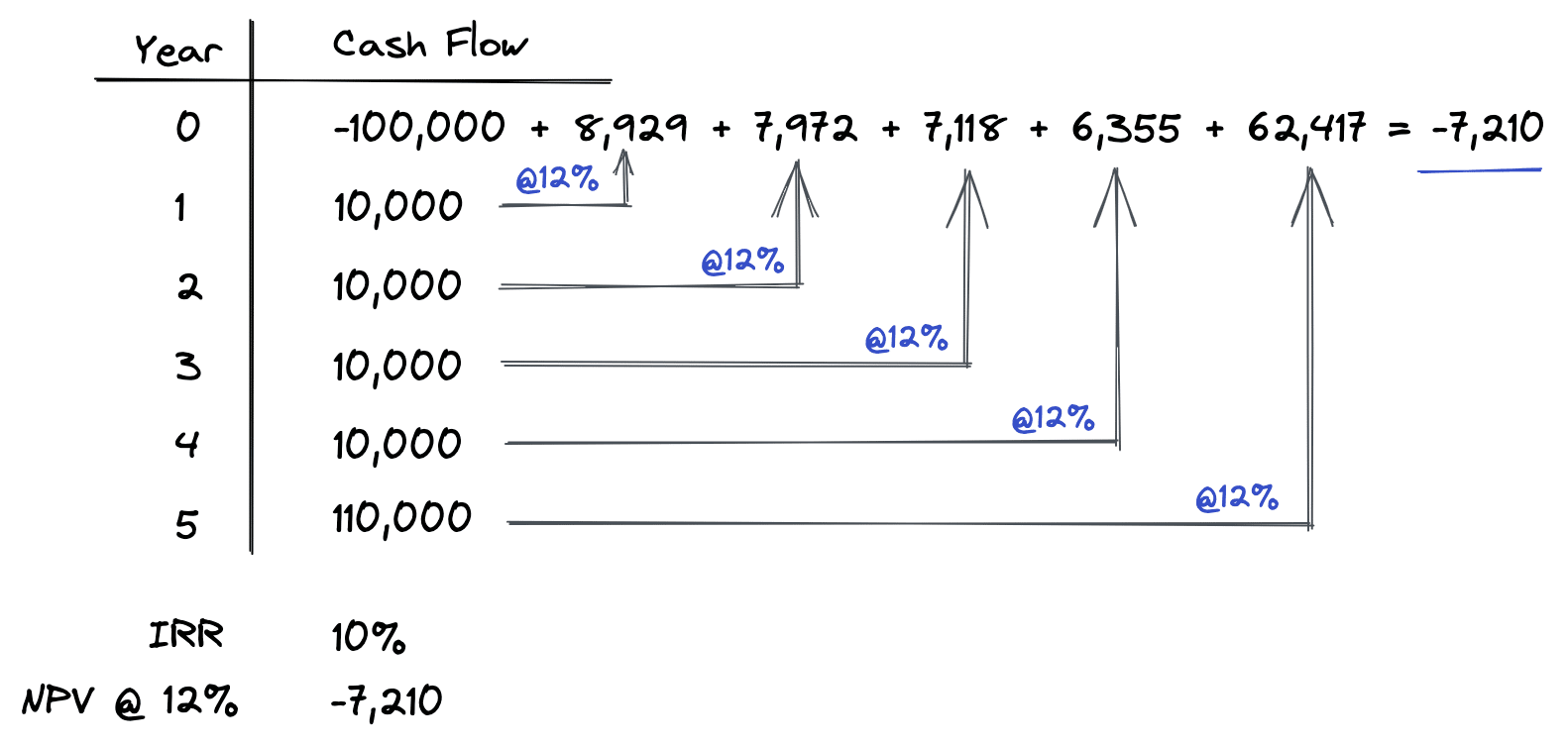

Discounted Cash Flow DCF Formula Calculate NPV CFI

A discounted cash flow analysis uses a discount rate to determine the present value of anticipated future cash flows. The discounted cash flow (dcf) analysis represents the net present value (npv) of projected cash flows available to all providers. Discounted cash flow (dcf) is a valuation method that estimates the value of an investment using its expected future cash. When.

When It Comes To Valuing An Investment Or A Business, Two Of The Most Commonly Used Methods Are Discounted Cash.

The discounted cash flow (dcf) analysis represents the net present value (npv) of projected cash flows available to all providers. A discounted cash flow analysis uses a discount rate to determine the present value of anticipated future cash flows. Discounted cash flow (dcf) is a valuation method that estimates the value of an investment using its expected future cash.

:max_bytes(150000):strip_icc()/dotdash_Final_Net_Present_Value_NPV_Jul_2020-01-eea50904f90744e4b1172a9ef38df13f.jpg)