Discounted Cash Flow Valuation Excel - Learn how to calculate discounted cash flow in excel using npv, yearly cash flows, and variable discount rates with simple, clear. The discounted cash flow (dcf) model evaluates a company’s value by forecasting future cash flows and discounting.

The discounted cash flow (dcf) model evaluates a company’s value by forecasting future cash flows and discounting. Learn how to calculate discounted cash flow in excel using npv, yearly cash flows, and variable discount rates with simple, clear.

Learn how to calculate discounted cash flow in excel using npv, yearly cash flows, and variable discount rates with simple, clear. The discounted cash flow (dcf) model evaluates a company’s value by forecasting future cash flows and discounting.

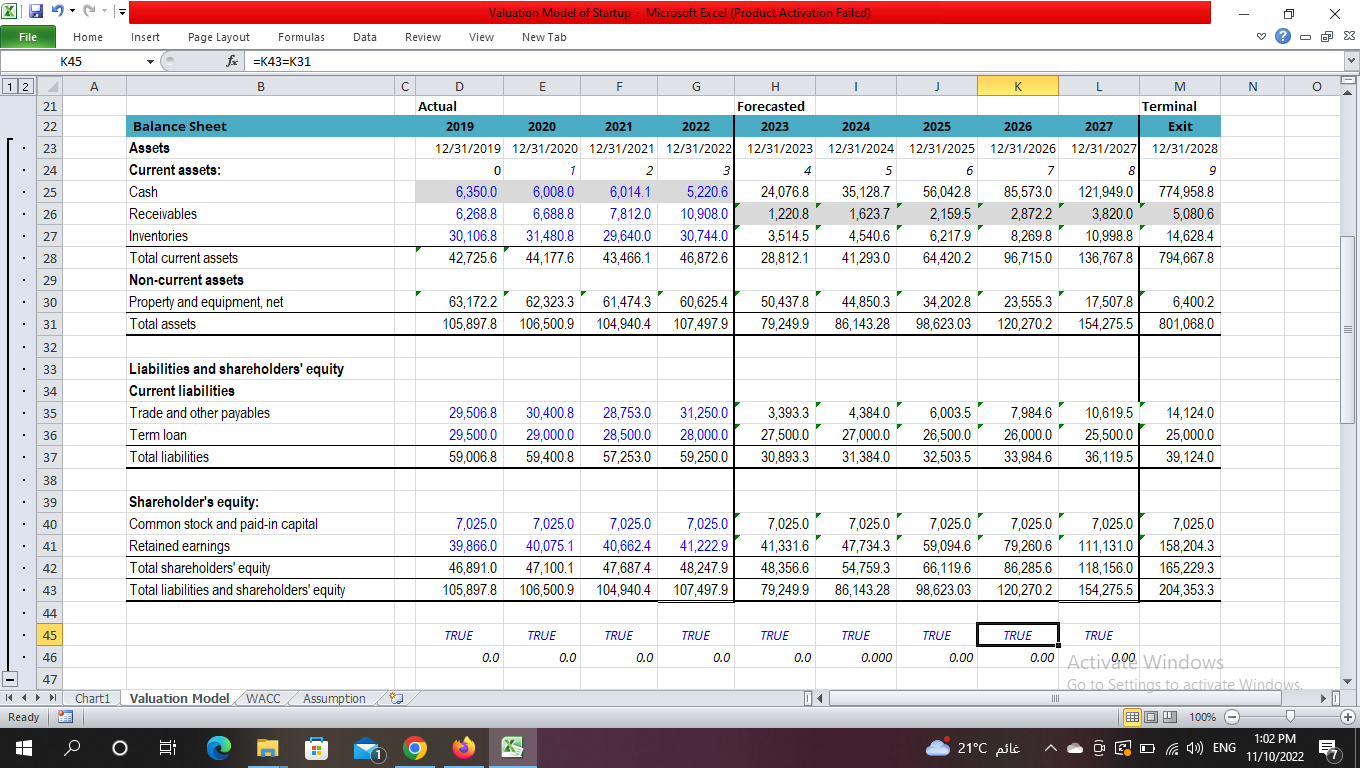

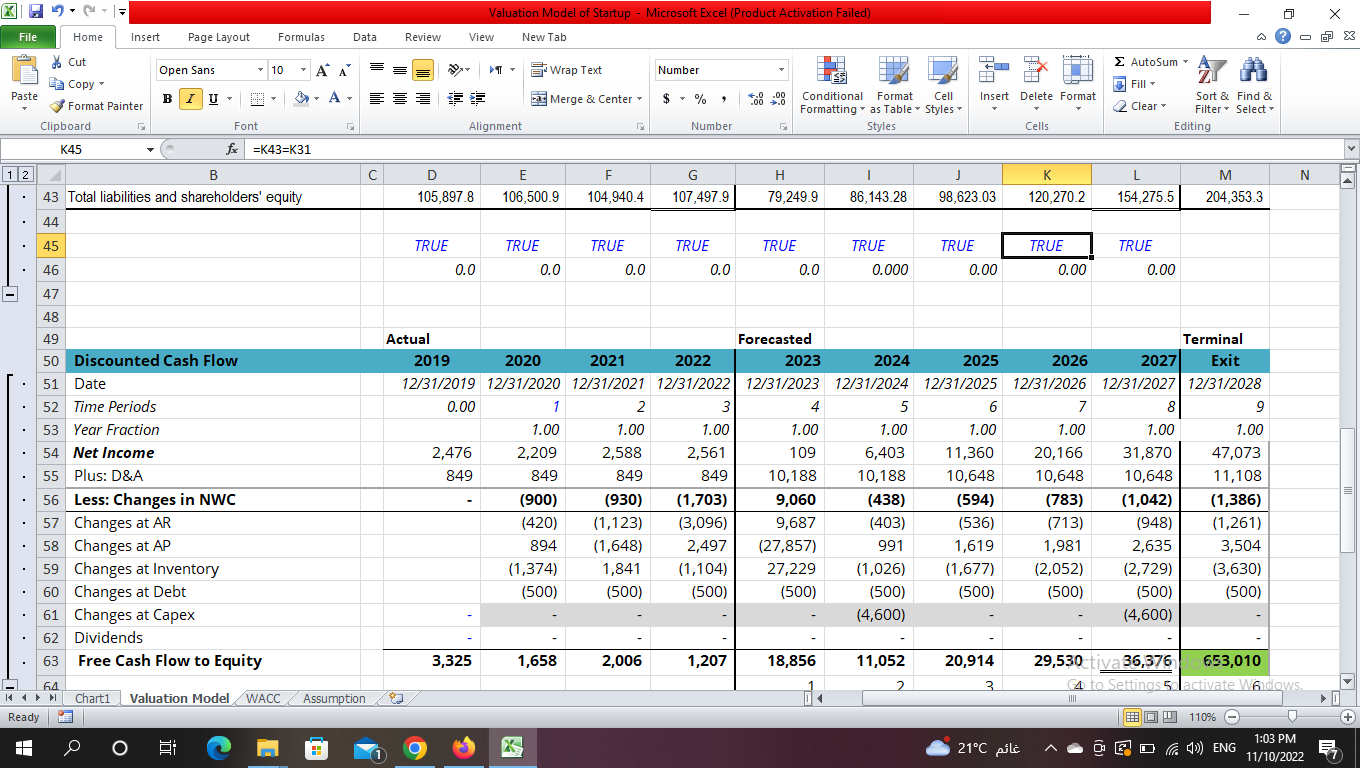

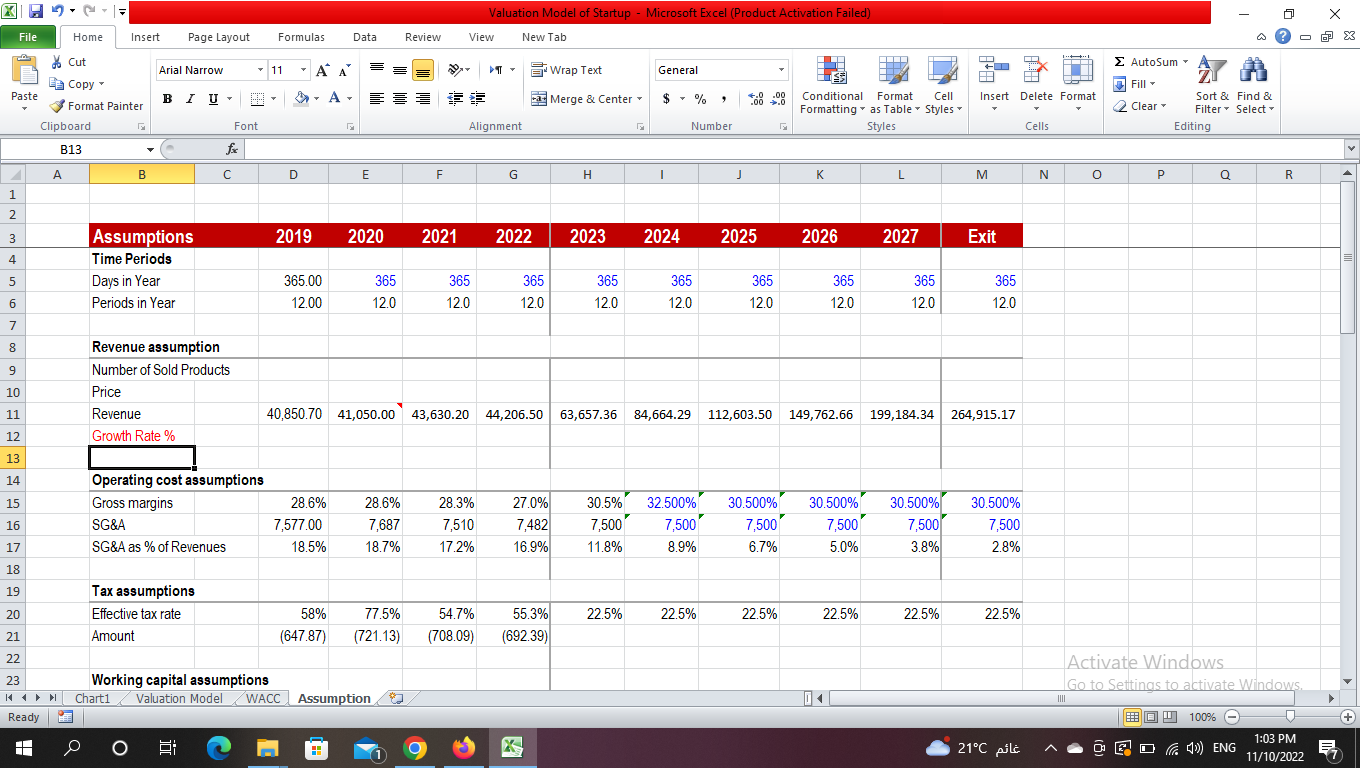

Discounted Cash Flow (DCF) Valuation Model by Excel for a Small

The discounted cash flow (dcf) model evaluates a company’s value by forecasting future cash flows and discounting. Learn how to calculate discounted cash flow in excel using npv, yearly cash flows, and variable discount rates with simple, clear.

Discounted Cash Flow (DCF) Valuation Model by Excel for a Small

The discounted cash flow (dcf) model evaluates a company’s value by forecasting future cash flows and discounting. Learn how to calculate discounted cash flow in excel using npv, yearly cash flows, and variable discount rates with simple, clear.

Discounted Cash Flow Method

Learn how to calculate discounted cash flow in excel using npv, yearly cash flows, and variable discount rates with simple, clear. The discounted cash flow (dcf) model evaluates a company’s value by forecasting future cash flows and discounting.

Discounted Cash Flow Formula

The discounted cash flow (dcf) model evaluates a company’s value by forecasting future cash flows and discounting. Learn how to calculate discounted cash flow in excel using npv, yearly cash flows, and variable discount rates with simple, clear.

Discounted Cash Flow Excel Template

The discounted cash flow (dcf) model evaluates a company’s value by forecasting future cash flows and discounting. Learn how to calculate discounted cash flow in excel using npv, yearly cash flows, and variable discount rates with simple, clear.

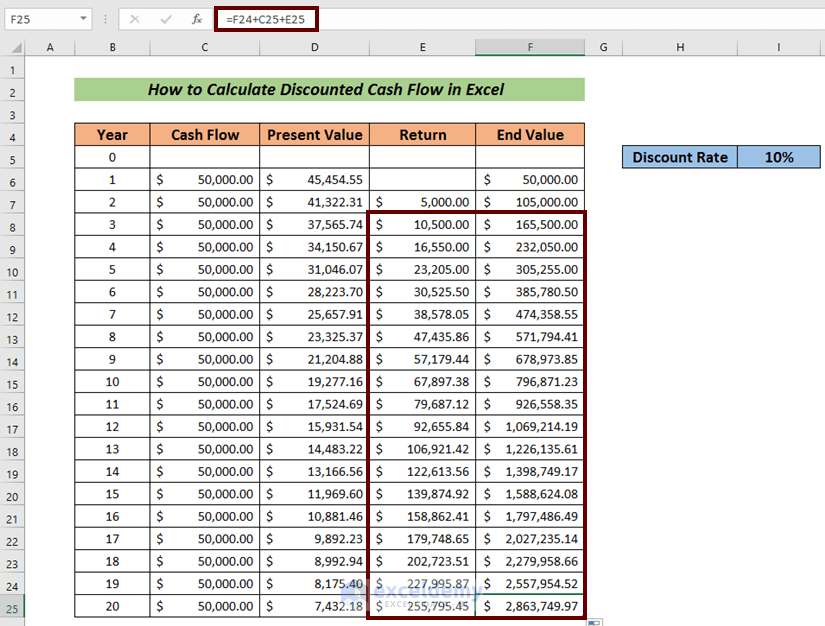

How to Calculate the Discounted Cash Flow in Excel 3 Easy Steps

Learn how to calculate discounted cash flow in excel using npv, yearly cash flows, and variable discount rates with simple, clear. The discounted cash flow (dcf) model evaluates a company’s value by forecasting future cash flows and discounting.

Excel Valuation Template

The discounted cash flow (dcf) model evaluates a company’s value by forecasting future cash flows and discounting. Learn how to calculate discounted cash flow in excel using npv, yearly cash flows, and variable discount rates with simple, clear.

Mining Discounted Cash Flow DCF Valuation Model Template Excel XLS

Learn how to calculate discounted cash flow in excel using npv, yearly cash flows, and variable discount rates with simple, clear. The discounted cash flow (dcf) model evaluates a company’s value by forecasting future cash flows and discounting.

Discounted Cash Flow (DCF) Valuation Model by Excel for a Small

The discounted cash flow (dcf) model evaluates a company’s value by forecasting future cash flows and discounting. Learn how to calculate discounted cash flow in excel using npv, yearly cash flows, and variable discount rates with simple, clear.

Learn How To Calculate Discounted Cash Flow In Excel Using Npv, Yearly Cash Flows, And Variable Discount Rates With Simple, Clear.

The discounted cash flow (dcf) model evaluates a company’s value by forecasting future cash flows and discounting.