Discounted Cash Flow Valuation Formula - Discounted cash flow (dcf) is a financial valuation method used to estimate the value of an investment based on its expected. Discounted cash flow (dcf) arrives at a value by estimating how much cash an investment will produce in the future, and discounting that cash. Discounted cash flow (dcf) is a valuation method that estimates the value of an investment using its expected future cash. Calculating the sum of future discounted cash flows is the gold standard to determine how much an investment is worth.

Discounted cash flow (dcf) arrives at a value by estimating how much cash an investment will produce in the future, and discounting that cash. Discounted cash flow (dcf) is a financial valuation method used to estimate the value of an investment based on its expected. Discounted cash flow (dcf) is a valuation method that estimates the value of an investment using its expected future cash. Calculating the sum of future discounted cash flows is the gold standard to determine how much an investment is worth.

Discounted cash flow (dcf) is a financial valuation method used to estimate the value of an investment based on its expected. Calculating the sum of future discounted cash flows is the gold standard to determine how much an investment is worth. Discounted cash flow (dcf) arrives at a value by estimating how much cash an investment will produce in the future, and discounting that cash. Discounted cash flow (dcf) is a valuation method that estimates the value of an investment using its expected future cash.

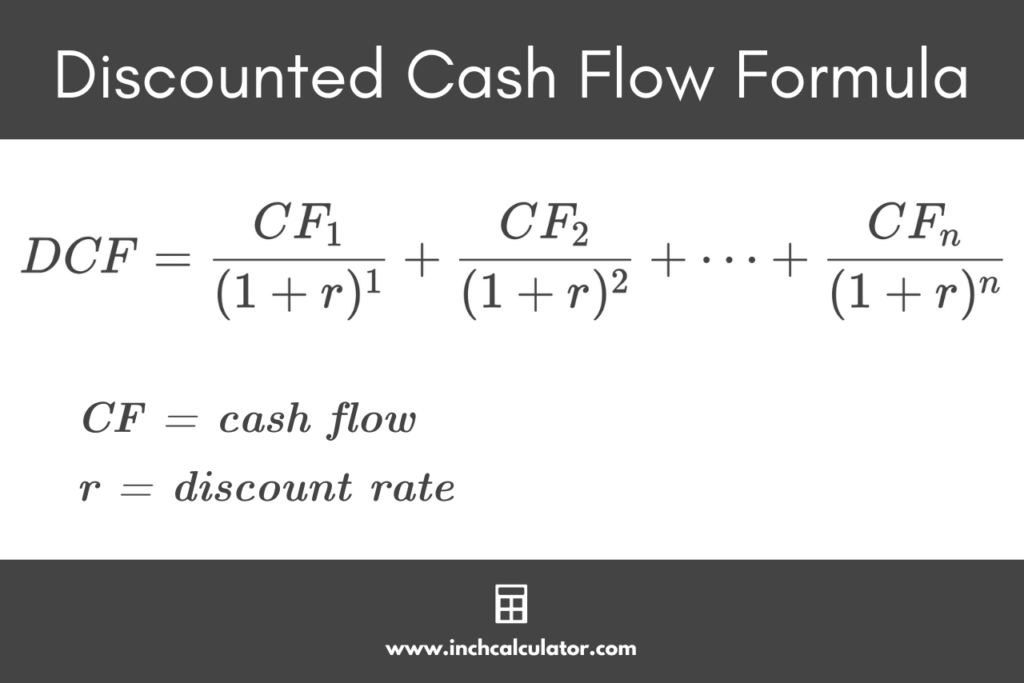

Discounted Cash Flow Calculator Inch Calculator

Discounted cash flow (dcf) is a valuation method that estimates the value of an investment using its expected future cash. Discounted cash flow (dcf) arrives at a value by estimating how much cash an investment will produce in the future, and discounting that cash. Discounted cash flow (dcf) is a financial valuation method used to estimate the value of an.

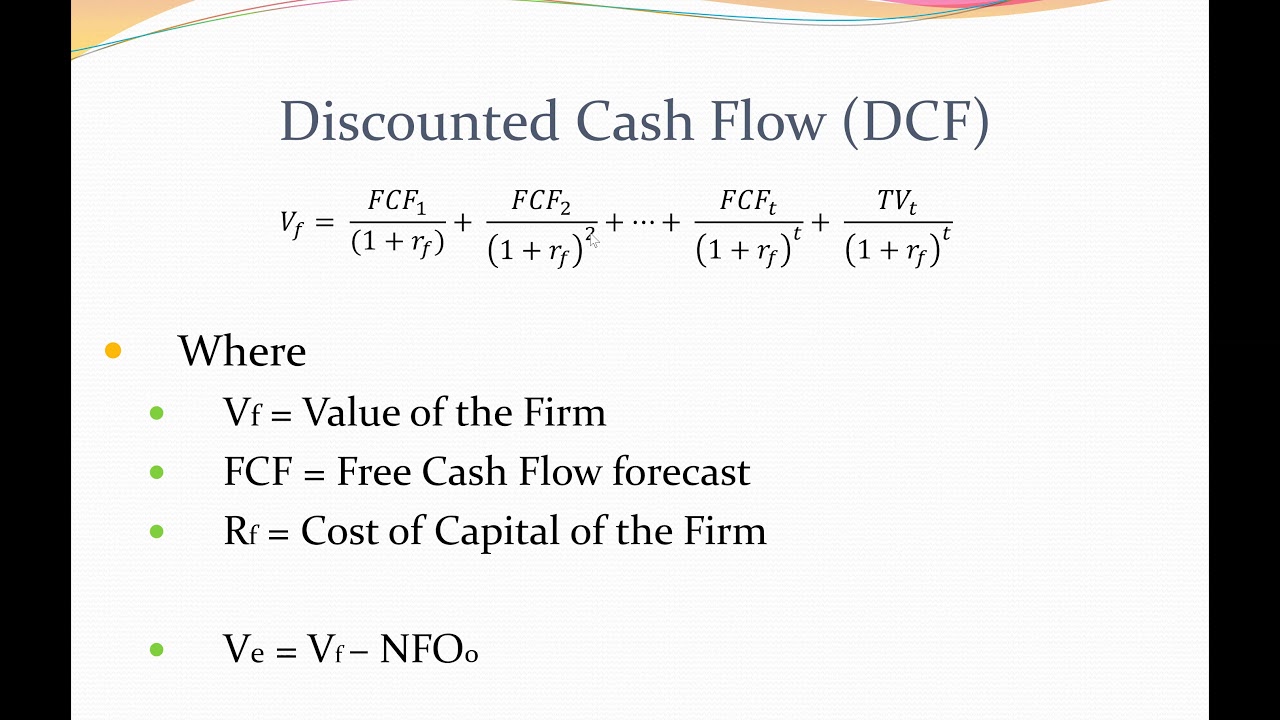

Discounted Cash Flow Model in Excel Solving Finance

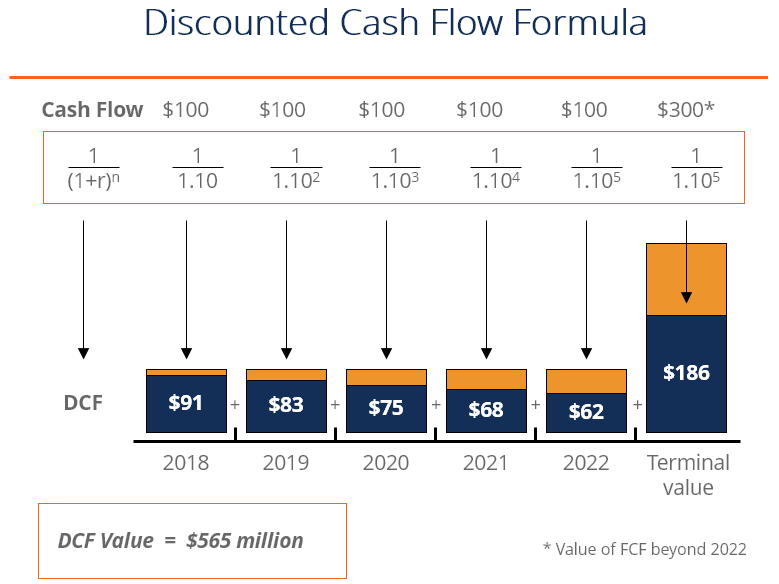

Calculating the sum of future discounted cash flows is the gold standard to determine how much an investment is worth. Discounted cash flow (dcf) arrives at a value by estimating how much cash an investment will produce in the future, and discounting that cash. Discounted cash flow (dcf) is a financial valuation method used to estimate the value of an.

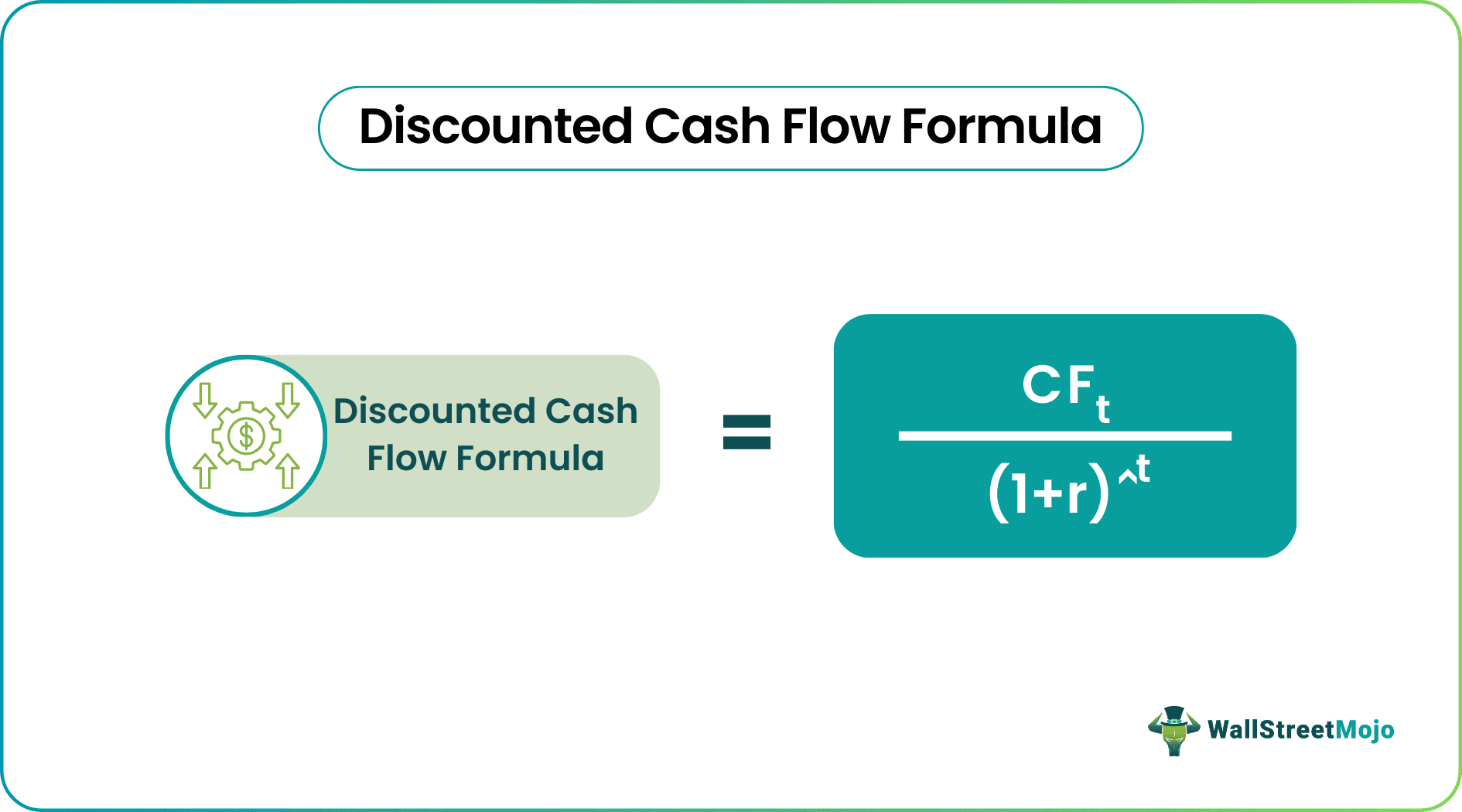

DCF Formula What Is It, Examples, How To Calculate

Discounted cash flow (dcf) is a valuation method that estimates the value of an investment using its expected future cash. Discounted cash flow (dcf) arrives at a value by estimating how much cash an investment will produce in the future, and discounting that cash. Calculating the sum of future discounted cash flows is the gold standard to determine how much.

DCF Formula What Is It, Examples, How To Calculate, 52 OFF

Calculating the sum of future discounted cash flows is the gold standard to determine how much an investment is worth. Discounted cash flow (dcf) arrives at a value by estimating how much cash an investment will produce in the future, and discounting that cash. Discounted cash flow (dcf) is a valuation method that estimates the value of an investment using.

Discounted future cash flow calculator JohnAnnaleigh

Discounted cash flow (dcf) is a valuation method that estimates the value of an investment using its expected future cash. Discounted cash flow (dcf) is a financial valuation method used to estimate the value of an investment based on its expected. Discounted cash flow (dcf) arrives at a value by estimating how much cash an investment will produce in the.

Discounted Cash Flow Method Discounted Cash Flow PowerPoint Templates,

Discounted cash flow (dcf) arrives at a value by estimating how much cash an investment will produce in the future, and discounting that cash. Discounted cash flow (dcf) is a valuation method that estimates the value of an investment using its expected future cash. Calculating the sum of future discounted cash flows is the gold standard to determine how much.

Discounted Cash Flow DCF Formula

Discounted cash flow (dcf) is a valuation method that estimates the value of an investment using its expected future cash. Discounted cash flow (dcf) is a financial valuation method used to estimate the value of an investment based on its expected. Discounted cash flow (dcf) arrives at a value by estimating how much cash an investment will produce in the.

Discounted Cash Flow Formula Intrinsic Value Stock Analysis Method

Discounted cash flow (dcf) is a valuation method that estimates the value of an investment using its expected future cash. Discounted cash flow (dcf) is a financial valuation method used to estimate the value of an investment based on its expected. Calculating the sum of future discounted cash flows is the gold standard to determine how much an investment is.

Discounted Cash Flow Formula

Discounted cash flow (dcf) is a financial valuation method used to estimate the value of an investment based on its expected. Discounted cash flow (dcf) arrives at a value by estimating how much cash an investment will produce in the future, and discounting that cash. Discounted cash flow (dcf) is a valuation method that estimates the value of an investment.

Discounted Cash Flow Method Definition, Formula, and Example

Discounted cash flow (dcf) arrives at a value by estimating how much cash an investment will produce in the future, and discounting that cash. Calculating the sum of future discounted cash flows is the gold standard to determine how much an investment is worth. Discounted cash flow (dcf) is a valuation method that estimates the value of an investment using.

Discounted Cash Flow (Dcf) Arrives At A Value By Estimating How Much Cash An Investment Will Produce In The Future, And Discounting That Cash.

Discounted cash flow (dcf) is a financial valuation method used to estimate the value of an investment based on its expected. Discounted cash flow (dcf) is a valuation method that estimates the value of an investment using its expected future cash. Calculating the sum of future discounted cash flows is the gold standard to determine how much an investment is worth.