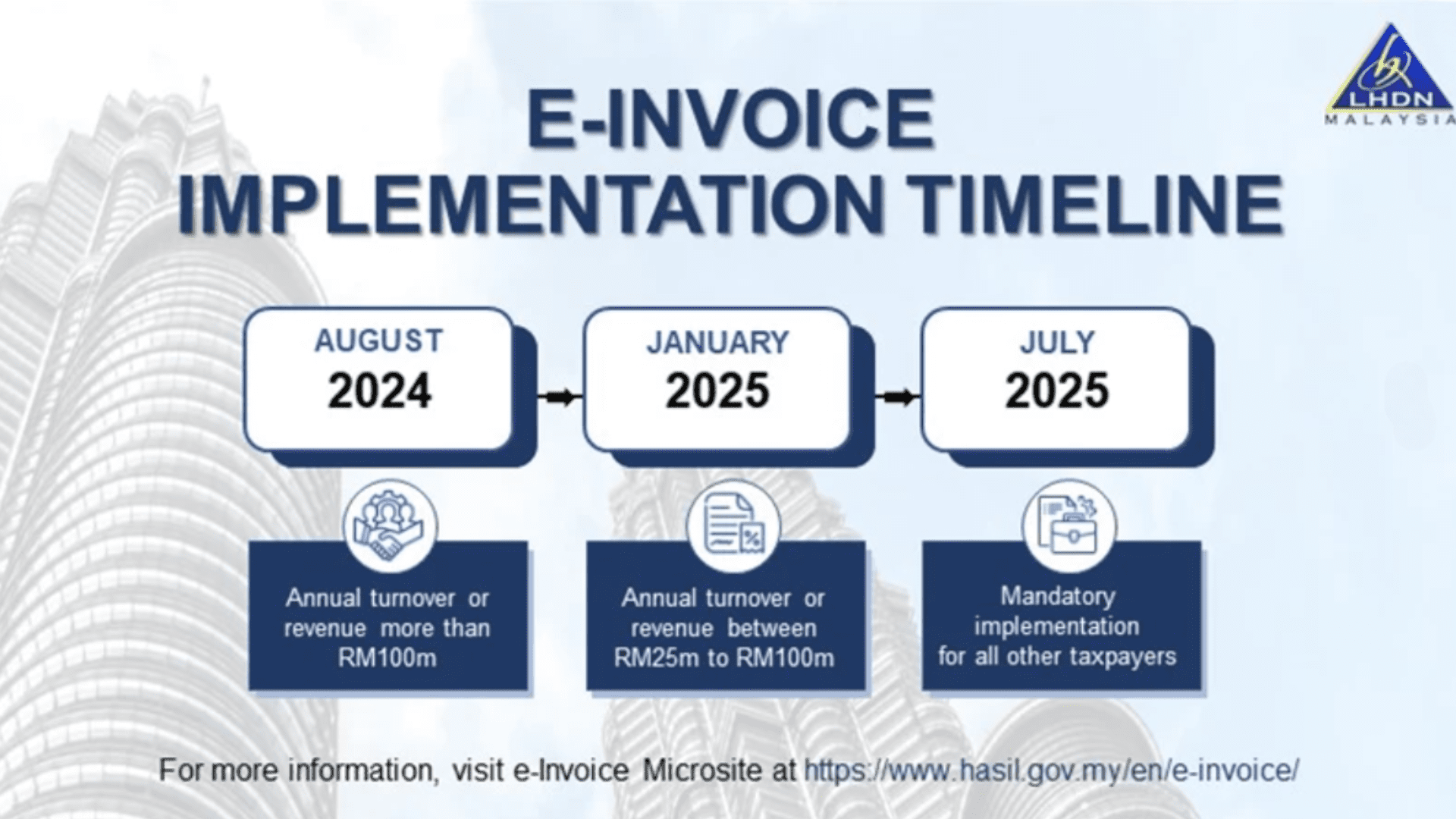

E Invoice Malaysia Implementation Date 2025 - Implementation for those with annual income or sales up to rm1 million will be deferred to 1 july 2026. This guide explains the phased implementation timeline, starting august 2024. Revenue board of malaysia (irbm) on 21 february 2025 and 22 february 2025 respectively.

Implementation for those with annual income or sales up to rm1 million will be deferred to 1 july 2026. This guide explains the phased implementation timeline, starting august 2024. Revenue board of malaysia (irbm) on 21 february 2025 and 22 february 2025 respectively.

Implementation for those with annual income or sales up to rm1 million will be deferred to 1 july 2026. Revenue board of malaysia (irbm) on 21 february 2025 and 22 february 2025 respectively. This guide explains the phased implementation timeline, starting august 2024.

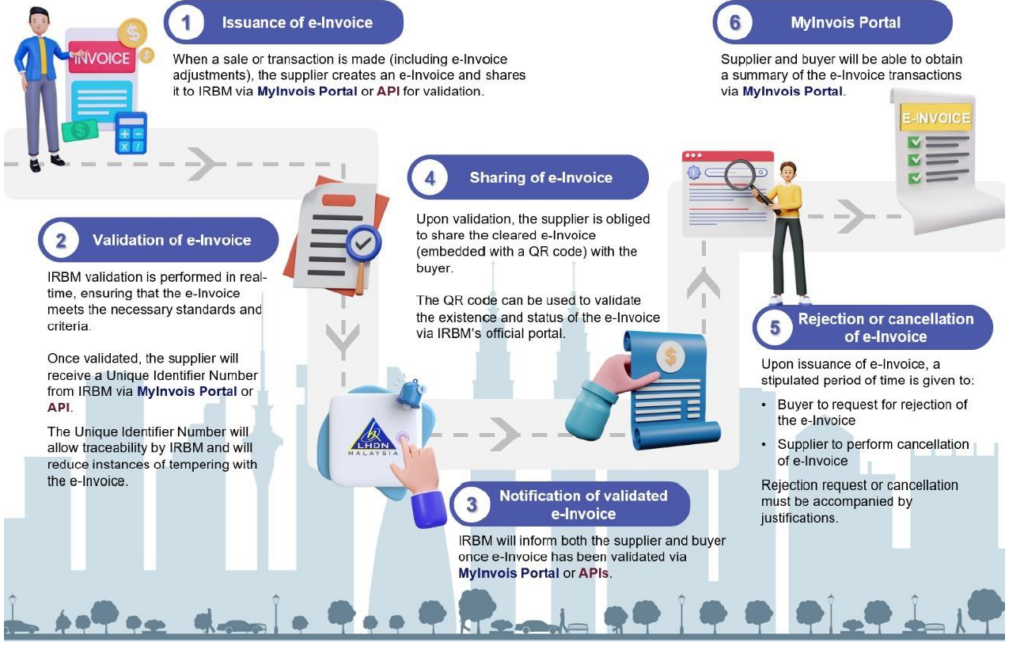

Navigating EInvoice Regulations IRB Malaysia's 2023 Guidelines

This guide explains the phased implementation timeline, starting august 2024. Revenue board of malaysia (irbm) on 21 february 2025 and 22 february 2025 respectively. Implementation for those with annual income or sales up to rm1 million will be deferred to 1 july 2026.

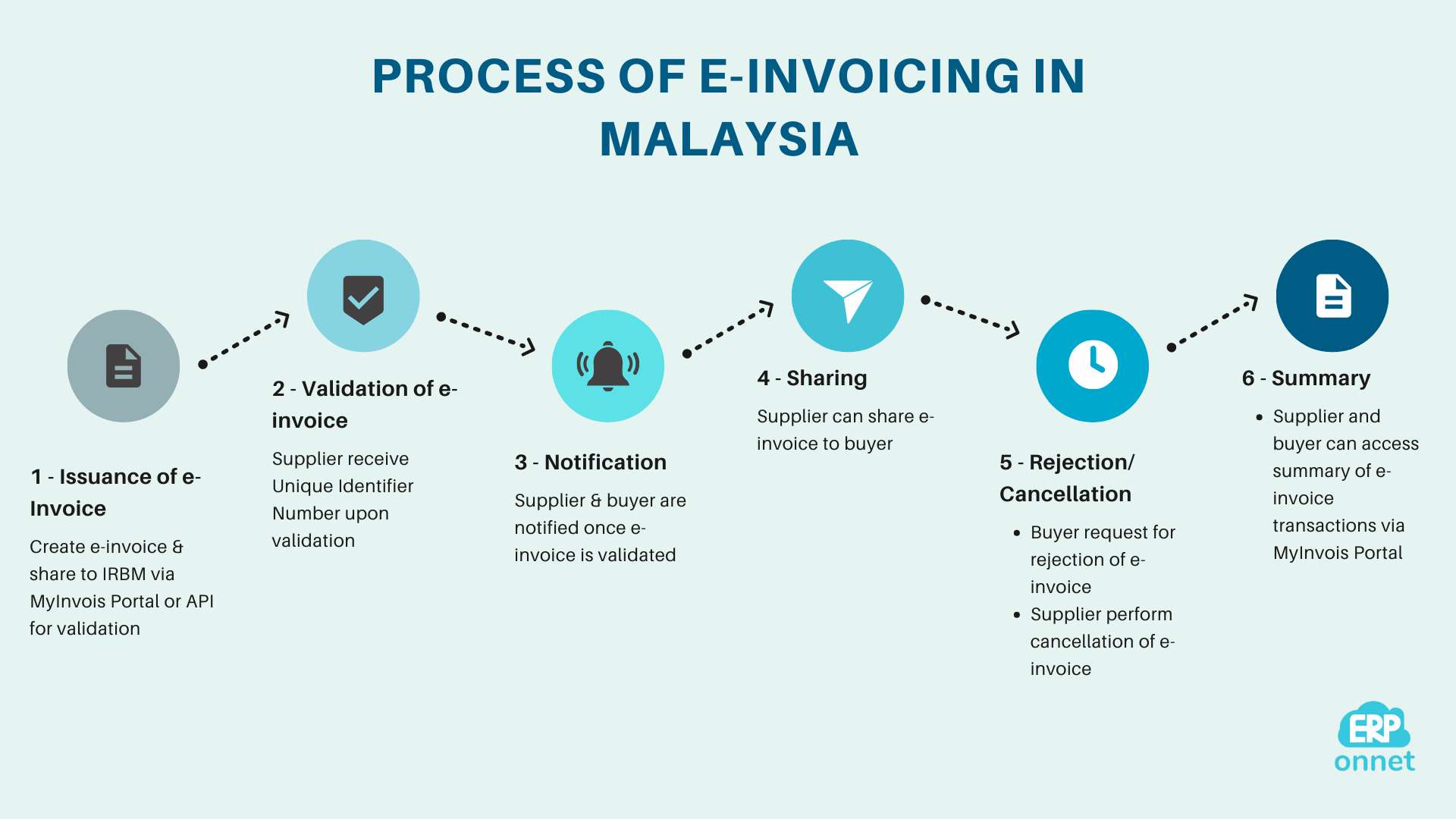

EInvoicing Malaysia 202526 & ERP Axxis Consulting

Implementation for those with annual income or sales up to rm1 million will be deferred to 1 july 2026. This guide explains the phased implementation timeline, starting august 2024. Revenue board of malaysia (irbm) on 21 february 2025 and 22 february 2025 respectively.

eInvoicing Malaysia The Definitive Guide Vetter

Implementation for those with annual income or sales up to rm1 million will be deferred to 1 july 2026. Revenue board of malaysia (irbm) on 21 february 2025 and 22 february 2025 respectively. This guide explains the phased implementation timeline, starting august 2024.

Adapting to EInvoicing A New Era for Malaysian Businesses SiteGiant

Revenue board of malaysia (irbm) on 21 february 2025 and 22 february 2025 respectively. This guide explains the phased implementation timeline, starting august 2024. Implementation for those with annual income or sales up to rm1 million will be deferred to 1 july 2026.

Understanding Malaysia's EInvoicing Landscape A Comprehensive Guide

Implementation for those with annual income or sales up to rm1 million will be deferred to 1 july 2026. Revenue board of malaysia (irbm) on 21 february 2025 and 22 february 2025 respectively. This guide explains the phased implementation timeline, starting august 2024.

National EInvoicing Initiative My Software Solutions

Revenue board of malaysia (irbm) on 21 february 2025 and 22 february 2025 respectively. Implementation for those with annual income or sales up to rm1 million will be deferred to 1 july 2026. This guide explains the phased implementation timeline, starting august 2024.

Implementation of EInvoicing Malaysia IVAOTR

Implementation for those with annual income or sales up to rm1 million will be deferred to 1 july 2026. This guide explains the phased implementation timeline, starting august 2024. Revenue board of malaysia (irbm) on 21 february 2025 and 22 february 2025 respectively.

Malaysia LHDN eInvoice Guidelines 50 QnA L & Co Accountants

Implementation for those with annual income or sales up to rm1 million will be deferred to 1 july 2026. This guide explains the phased implementation timeline, starting august 2024. Revenue board of malaysia (irbm) on 21 february 2025 and 22 february 2025 respectively.

Malaysia E Invoicing 2024 Magda Roselle

Implementation for those with annual income or sales up to rm1 million will be deferred to 1 july 2026. Revenue board of malaysia (irbm) on 21 february 2025 and 22 february 2025 respectively. This guide explains the phased implementation timeline, starting august 2024.

Pelaksanaan eInvois di Malaysia Apa maksudnya

This guide explains the phased implementation timeline, starting august 2024. Implementation for those with annual income or sales up to rm1 million will be deferred to 1 july 2026. Revenue board of malaysia (irbm) on 21 february 2025 and 22 february 2025 respectively.

Implementation For Those With Annual Income Or Sales Up To Rm1 Million Will Be Deferred To 1 July 2026.

This guide explains the phased implementation timeline, starting august 2024. Revenue board of malaysia (irbm) on 21 february 2025 and 22 february 2025 respectively.