E Invoice Malaysia Implementation - Irbm is actively conducting a series of engagement sessions with industry players, tax practitioners, professional bodies and identified. This guide explains the phased implementation timeline, starting august 2024. #1 ai crm for salestrusted ai for sellers

This guide explains the phased implementation timeline, starting august 2024. #1 ai crm for salestrusted ai for sellers Irbm is actively conducting a series of engagement sessions with industry players, tax practitioners, professional bodies and identified.

#1 ai crm for salestrusted ai for sellers This guide explains the phased implementation timeline, starting august 2024. Irbm is actively conducting a series of engagement sessions with industry players, tax practitioners, professional bodies and identified.

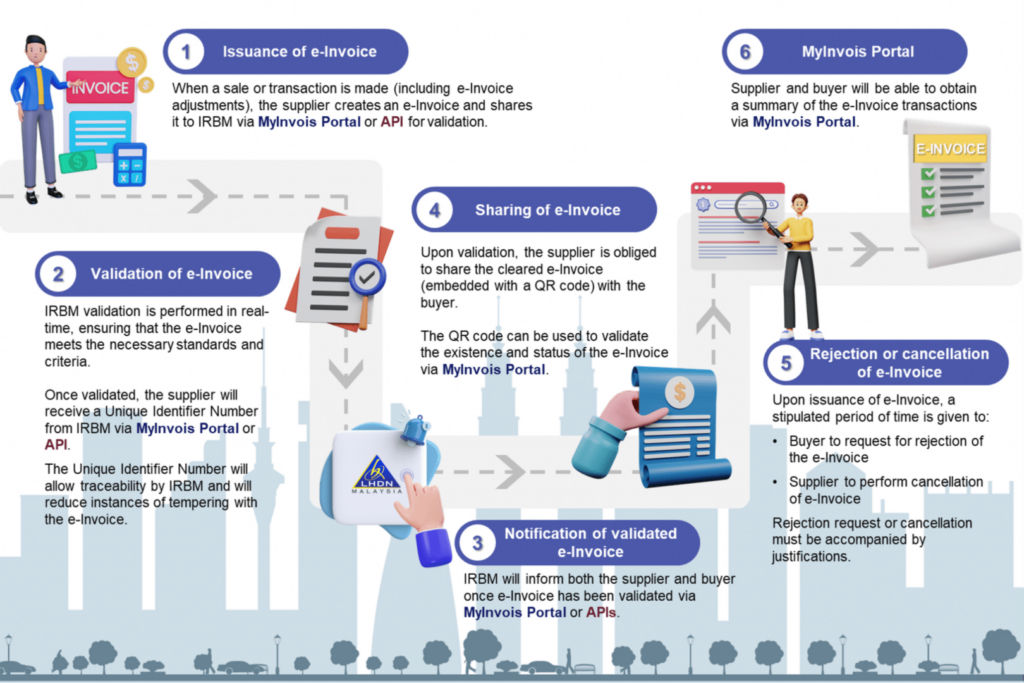

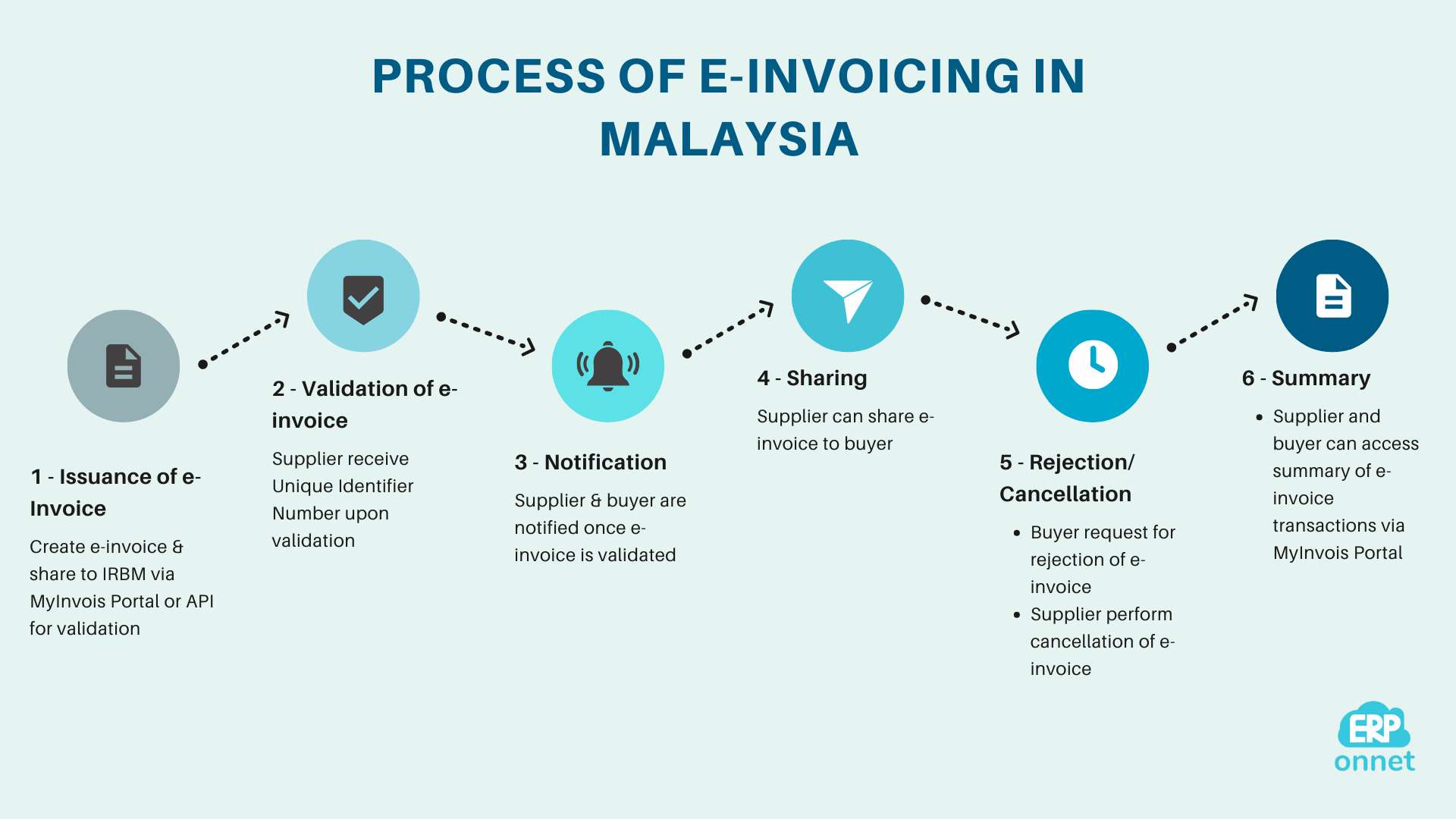

Introduction & Implementation of EInvoicing in Malaysia

This guide explains the phased implementation timeline, starting august 2024. Irbm is actively conducting a series of engagement sessions with industry players, tax practitioners, professional bodies and identified. #1 ai crm for salestrusted ai for sellers

Adapting to EInvoicing A New Era for Malaysian Businesses SiteGiant

Irbm is actively conducting a series of engagement sessions with industry players, tax practitioners, professional bodies and identified. This guide explains the phased implementation timeline, starting august 2024. #1 ai crm for salestrusted ai for sellers

Malaysia LHDN eInvoice Guidelines 50 QnA L & Co Accountants

Irbm is actively conducting a series of engagement sessions with industry players, tax practitioners, professional bodies and identified. This guide explains the phased implementation timeline, starting august 2024. #1 ai crm for salestrusted ai for sellers

The Implementation of EInvoicing in Malaysia A Digital Leap Forward

#1 ai crm for salestrusted ai for sellers This guide explains the phased implementation timeline, starting august 2024. Irbm is actively conducting a series of engagement sessions with industry players, tax practitioners, professional bodies and identified.

2024 LHDN EInvoicing Malaysia How it impact your business

Irbm is actively conducting a series of engagement sessions with industry players, tax practitioners, professional bodies and identified. This guide explains the phased implementation timeline, starting august 2024. #1 ai crm for salestrusted ai for sellers

Understanding Malaysia's EInvoicing Landscape A Comprehensive Guide

Irbm is actively conducting a series of engagement sessions with industry players, tax practitioners, professional bodies and identified. #1 ai crm for salestrusted ai for sellers This guide explains the phased implementation timeline, starting august 2024.

Implementation of EInvoicing Malaysia IVAOTR

#1 ai crm for salestrusted ai for sellers Irbm is actively conducting a series of engagement sessions with industry players, tax practitioners, professional bodies and identified. This guide explains the phased implementation timeline, starting august 2024.

Implementation of eInvoicing Malaysia Sage 300 Malaysia

This guide explains the phased implementation timeline, starting august 2024. #1 ai crm for salestrusted ai for sellers Irbm is actively conducting a series of engagement sessions with industry players, tax practitioners, professional bodies and identified.

Malaysia E Invoicing 2024 Magda Roselle

#1 ai crm for salestrusted ai for sellers Irbm is actively conducting a series of engagement sessions with industry players, tax practitioners, professional bodies and identified. This guide explains the phased implementation timeline, starting august 2024.

EInvoicing in Malaysia System Overview and Implementation Process

#1 ai crm for salestrusted ai for sellers Irbm is actively conducting a series of engagement sessions with industry players, tax practitioners, professional bodies and identified. This guide explains the phased implementation timeline, starting august 2024.

#1 Ai Crm For Salestrusted Ai For Sellers

This guide explains the phased implementation timeline, starting august 2024. Irbm is actively conducting a series of engagement sessions with industry players, tax practitioners, professional bodies and identified.