Eservices Uae Vat Filing - How to file vat return? Once you have registered for vat in the uae, you are required to file your vat return and make related vat payments within 28 days. A vat of 5 per cent is levied at the point of sale. You must file for tax return electronically through the fta portal: Value added tax or vat is a tax on the consumption or use of goods and services.

Value added tax or vat is a tax on the consumption or use of goods and services. Once you have registered for vat in the uae, you are required to file your vat return and make related vat payments within 28 days. How to file vat return? A vat of 5 per cent is levied at the point of sale. You must file for tax return electronically through the fta portal:

Once you have registered for vat in the uae, you are required to file your vat return and make related vat payments within 28 days. A vat of 5 per cent is levied at the point of sale. Value added tax or vat is a tax on the consumption or use of goods and services. How to file vat return? You must file for tax return electronically through the fta portal:

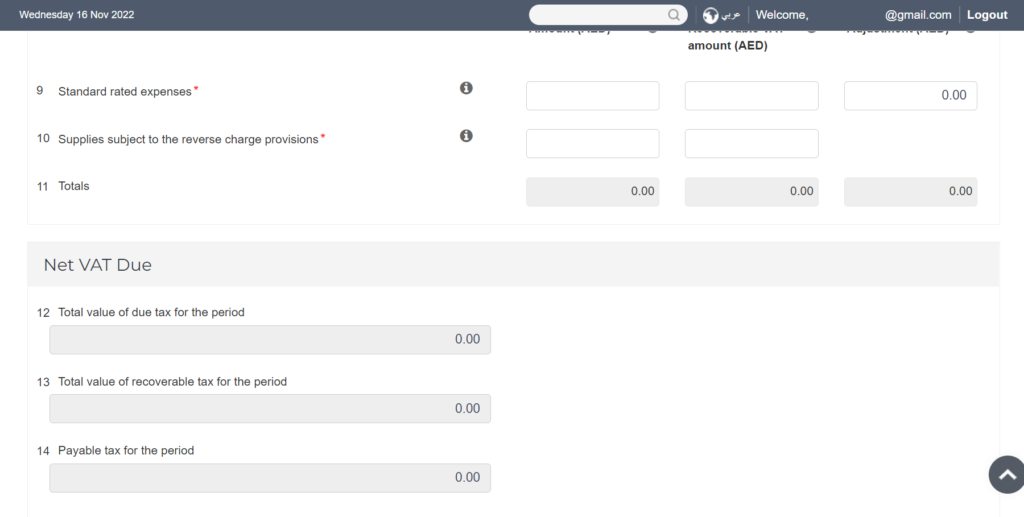

How to File VAT Returns in UAE? A stepbystep VAT Returns User Guide

You must file for tax return electronically through the fta portal: A vat of 5 per cent is levied at the point of sale. Once you have registered for vat in the uae, you are required to file your vat return and make related vat payments within 28 days. Value added tax or vat is a tax on the consumption.

VAT Return Filing Dubai UAE Highmark VAT Consultants UAE

Value added tax or vat is a tax on the consumption or use of goods and services. A vat of 5 per cent is levied at the point of sale. How to file vat return? You must file for tax return electronically through the fta portal: Once you have registered for vat in the uae, you are required to file.

How to File a VAT Return in the UAE

Value added tax or vat is a tax on the consumption or use of goods and services. Once you have registered for vat in the uae, you are required to file your vat return and make related vat payments within 28 days. You must file for tax return electronically through the fta portal: How to file vat return? A vat.

A StepByStep Guide On VAT Filing in UAE Tulpar Global Taxation

Once you have registered for vat in the uae, you are required to file your vat return and make related vat payments within 28 days. Value added tax or vat is a tax on the consumption or use of goods and services. A vat of 5 per cent is levied at the point of sale. You must file for tax.

StepbyStep Guide to Filing VAT Return in UAE

Once you have registered for vat in the uae, you are required to file your vat return and make related vat payments within 28 days. How to file vat return? You must file for tax return electronically through the fta portal: Value added tax or vat is a tax on the consumption or use of goods and services. A vat.

How to File VAT Return in UAE BSD Prime Services

A vat of 5 per cent is levied at the point of sale. Once you have registered for vat in the uae, you are required to file your vat return and make related vat payments within 28 days. How to file vat return? Value added tax or vat is a tax on the consumption or use of goods and services..

VAT Filing in UAE, Dubai VAT Return UAE VAT Submissions

You must file for tax return electronically through the fta portal: Once you have registered for vat in the uae, you are required to file your vat return and make related vat payments within 28 days. How to file vat return? A vat of 5 per cent is levied at the point of sale. Value added tax or vat is.

VAT Return Filing UAE File VAT Return How To File VAT Returns in UAE

Value added tax or vat is a tax on the consumption or use of goods and services. You must file for tax return electronically through the fta portal: Once you have registered for vat in the uae, you are required to file your vat return and make related vat payments within 28 days. A vat of 5 per cent is.

PPT VAT Return Filing Service in UAE pptx PowerPoint Presentation

How to file vat return? Value added tax or vat is a tax on the consumption or use of goods and services. Once you have registered for vat in the uae, you are required to file your vat return and make related vat payments within 28 days. A vat of 5 per cent is levied at the point of sale..

Filing Vat Return in UAE Vat Return UAE How to file VAT Return in

You must file for tax return electronically through the fta portal: A vat of 5 per cent is levied at the point of sale. Value added tax or vat is a tax on the consumption or use of goods and services. How to file vat return? Once you have registered for vat in the uae, you are required to file.

Value Added Tax Or Vat Is A Tax On The Consumption Or Use Of Goods And Services.

How to file vat return? You must file for tax return electronically through the fta portal: Once you have registered for vat in the uae, you are required to file your vat return and make related vat payments within 28 days. A vat of 5 per cent is levied at the point of sale.