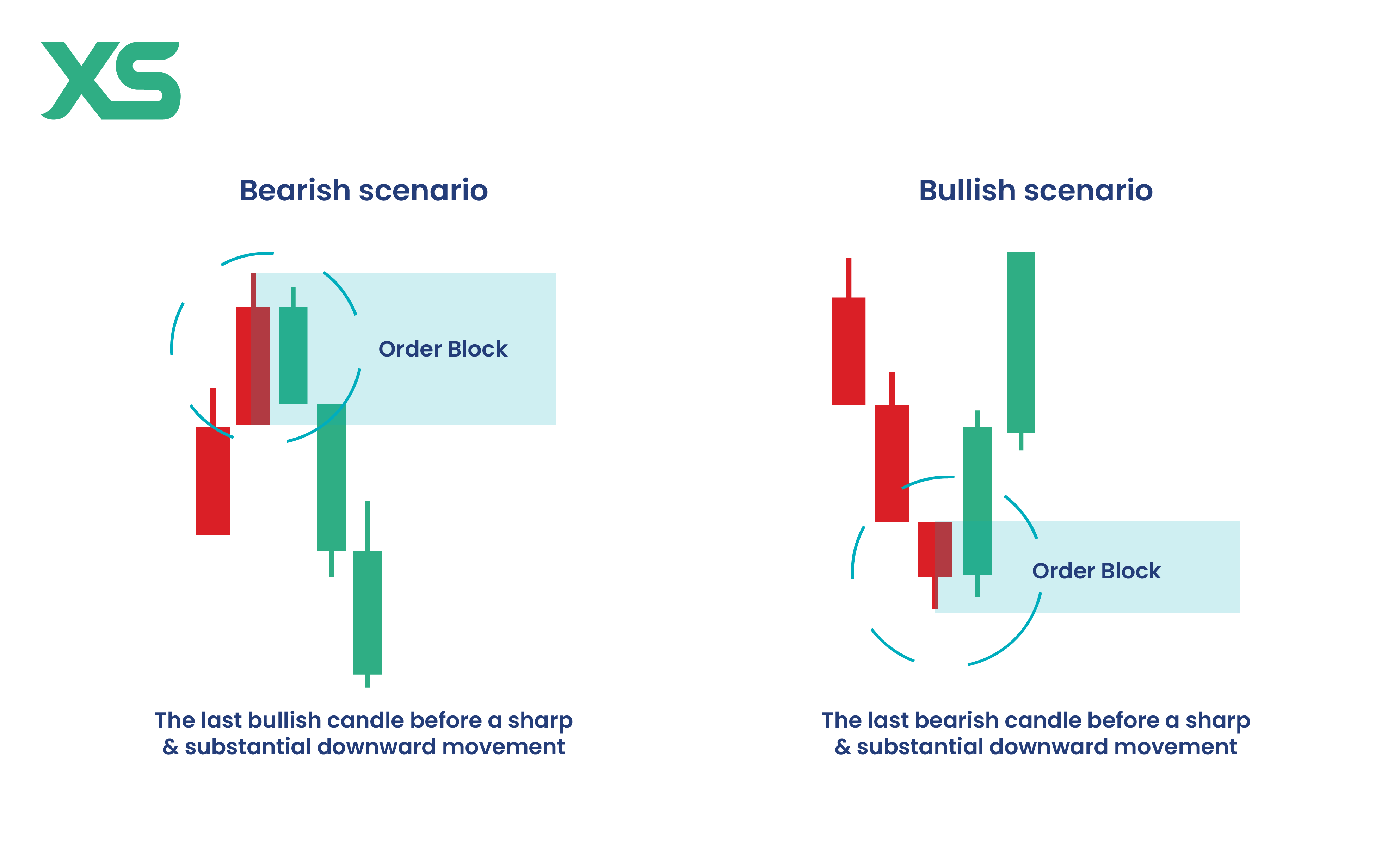

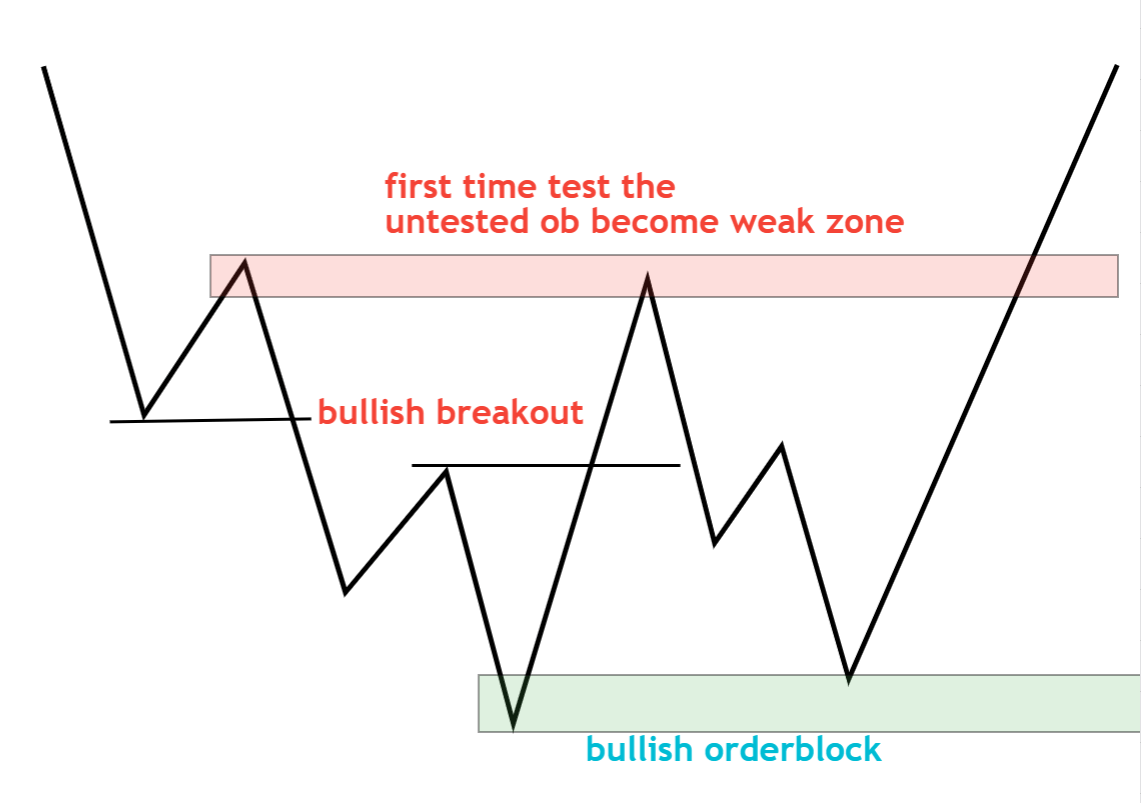

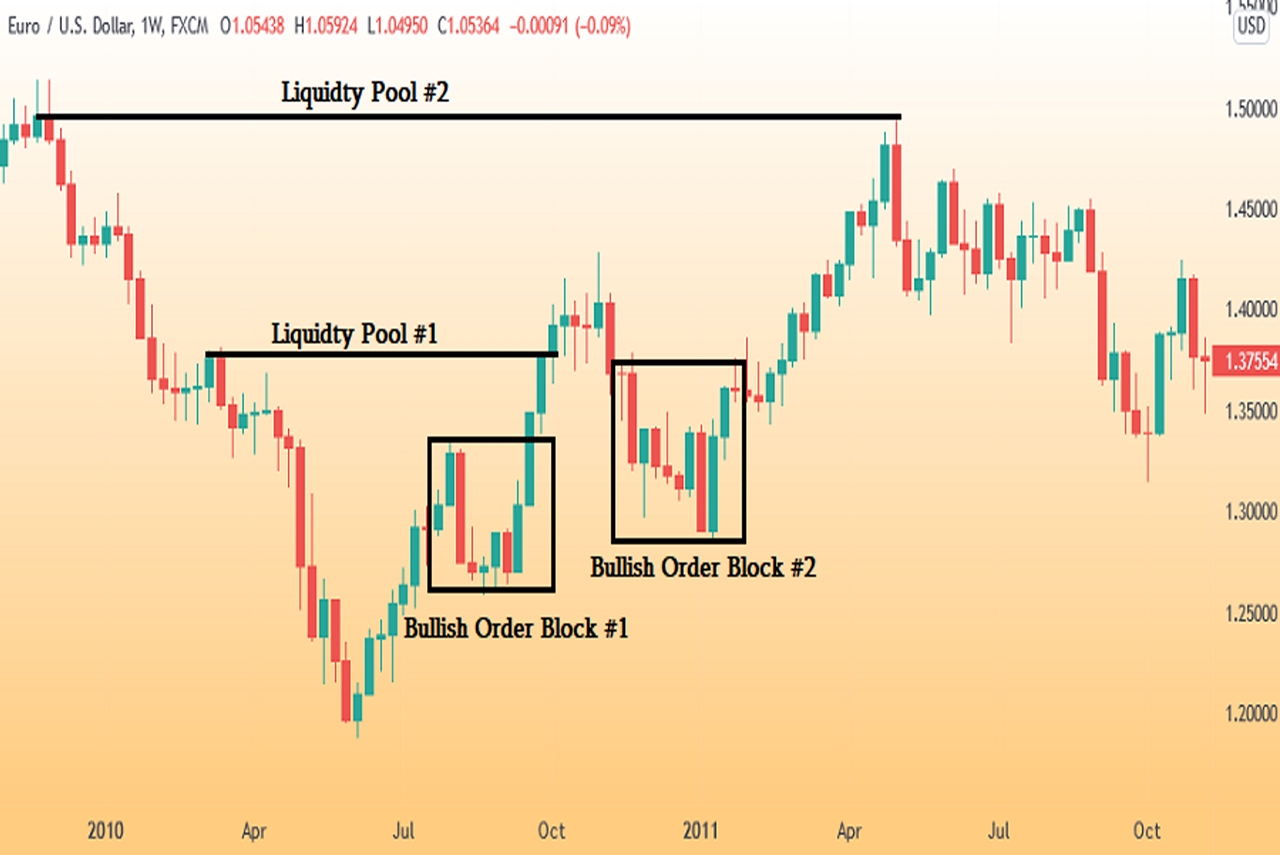

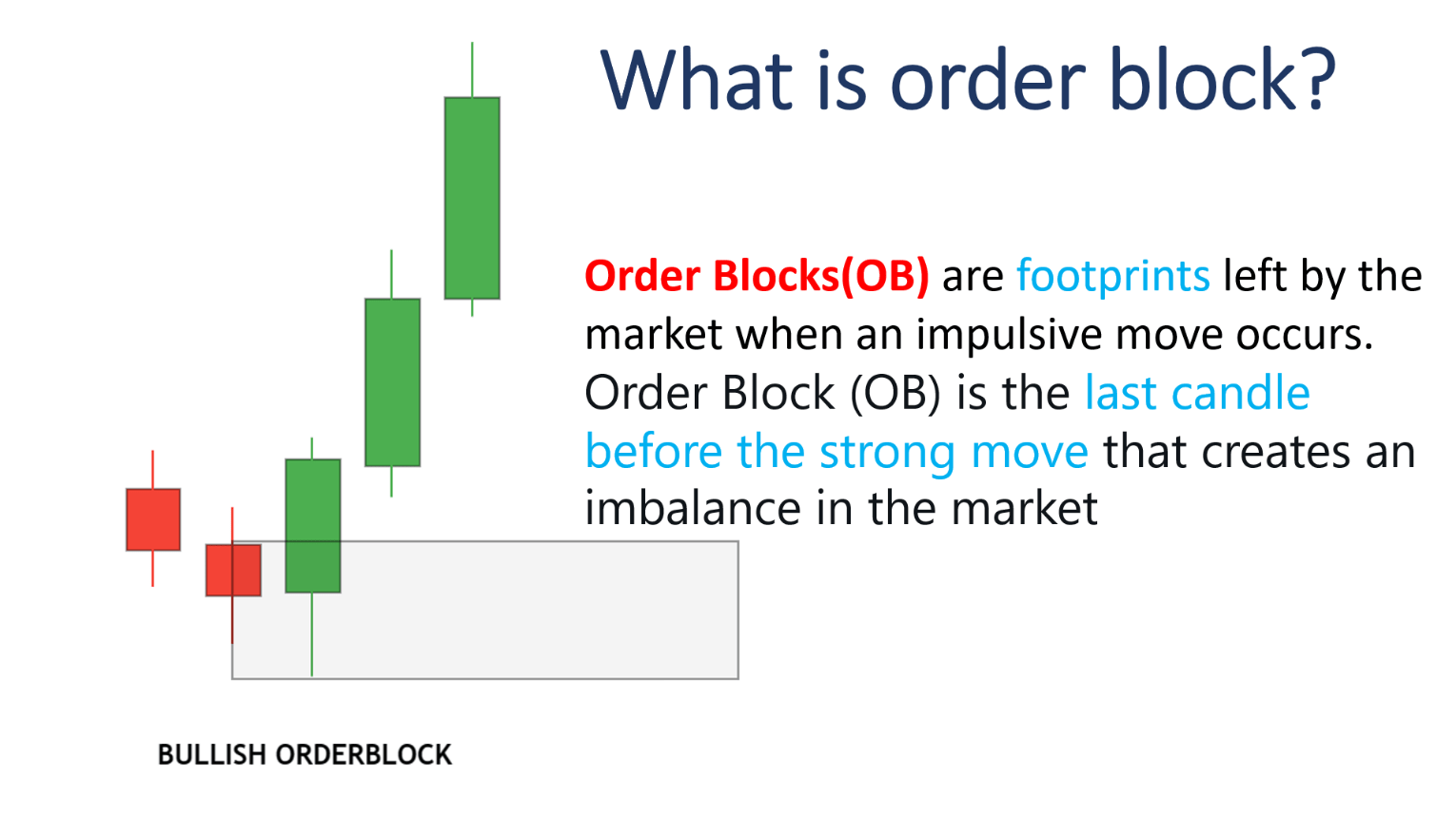

Example Of An Order Block - Order blocks are areas where there’s an outstanding amount of limit orders, causing large reactions in the market when price reaches. Order blocks are high probability price zones created when the banks split a single large trading position into many smaller. Order block trading strategy is a method that involves identifying and trading off significant price levels on a price chart.

Order block trading strategy is a method that involves identifying and trading off significant price levels on a price chart. Order blocks are high probability price zones created when the banks split a single large trading position into many smaller. Order blocks are areas where there’s an outstanding amount of limit orders, causing large reactions in the market when price reaches.

Order blocks are high probability price zones created when the banks split a single large trading position into many smaller. Order block trading strategy is a method that involves identifying and trading off significant price levels on a price chart. Order blocks are areas where there’s an outstanding amount of limit orders, causing large reactions in the market when price reaches.

How To Trade Order Blocks In Forex Trading Explained

Order block trading strategy is a method that involves identifying and trading off significant price levels on a price chart. Order blocks are areas where there’s an outstanding amount of limit orders, causing large reactions in the market when price reaches. Order blocks are high probability price zones created when the banks split a single large trading position into many.

Order Block An Essential Guide For Traders XS

Order blocks are high probability price zones created when the banks split a single large trading position into many smaller. Order block trading strategy is a method that involves identifying and trading off significant price levels on a price chart. Order blocks are areas where there’s an outstanding amount of limit orders, causing large reactions in the market when price.

How To Trade Order Blocks In Forex Trading Explained

Order blocks are high probability price zones created when the banks split a single large trading position into many smaller. Order blocks are areas where there’s an outstanding amount of limit orders, causing large reactions in the market when price reaches. Order block trading strategy is a method that involves identifying and trading off significant price levels on a price.

Order Block Trading Strategy with Examples Dot Net Tutorials

Order blocks are high probability price zones created when the banks split a single large trading position into many smaller. Order block trading strategy is a method that involves identifying and trading off significant price levels on a price chart. Order blocks are areas where there’s an outstanding amount of limit orders, causing large reactions in the market when price.

How To Trade Order Blocks In Forex Trading Explained

Order block trading strategy is a method that involves identifying and trading off significant price levels on a price chart. Order blocks are areas where there’s an outstanding amount of limit orders, causing large reactions in the market when price reaches. Order blocks are high probability price zones created when the banks split a single large trading position into many.

What Are Order Blocks In Forex and How Can You Profit From

Order blocks are areas where there’s an outstanding amount of limit orders, causing large reactions in the market when price reaches. Order blocks are high probability price zones created when the banks split a single large trading position into many smaller. Order block trading strategy is a method that involves identifying and trading off significant price levels on a price.

Order Block Trading Strategy with Examples Dot Net Tutorials

Order blocks are areas where there’s an outstanding amount of limit orders, causing large reactions in the market when price reaches. Order block trading strategy is a method that involves identifying and trading off significant price levels on a price chart. Order blocks are high probability price zones created when the banks split a single large trading position into many.

Forex Order Block Strategy for Beginners Lux Trading Firm

Order blocks are high probability price zones created when the banks split a single large trading position into many smaller. Order blocks are areas where there’s an outstanding amount of limit orders, causing large reactions in the market when price reaches. Order block trading strategy is a method that involves identifying and trading off significant price levels on a price.

Order Block forex Definition, Types, Trading strategy ForexBee

Order blocks are areas where there’s an outstanding amount of limit orders, causing large reactions in the market when price reaches. Order block trading strategy is a method that involves identifying and trading off significant price levels on a price chart. Order blocks are high probability price zones created when the banks split a single large trading position into many.

Order Blocks in forex PDF Guide Trading PDF

Order blocks are areas where there’s an outstanding amount of limit orders, causing large reactions in the market when price reaches. Order blocks are high probability price zones created when the banks split a single large trading position into many smaller. Order block trading strategy is a method that involves identifying and trading off significant price levels on a price.

Order Blocks Are Areas Where There’s An Outstanding Amount Of Limit Orders, Causing Large Reactions In The Market When Price Reaches.

Order blocks are high probability price zones created when the banks split a single large trading position into many smaller. Order block trading strategy is a method that involves identifying and trading off significant price levels on a price chart.