Example Of Npv Calculation - Example of net present value (npv) let’s look at an example of how to calculate the net present value of a series of cash flows. Here we learn how to calculate npv (net present value) step by step with the help of practical examples. Net present value is a financial metric used to determine the value of an investment by. Net present value, npv, is a capital budgeting formula that calculates the difference between the present value of the cash inflows and outflows. What is net present value (npv)?

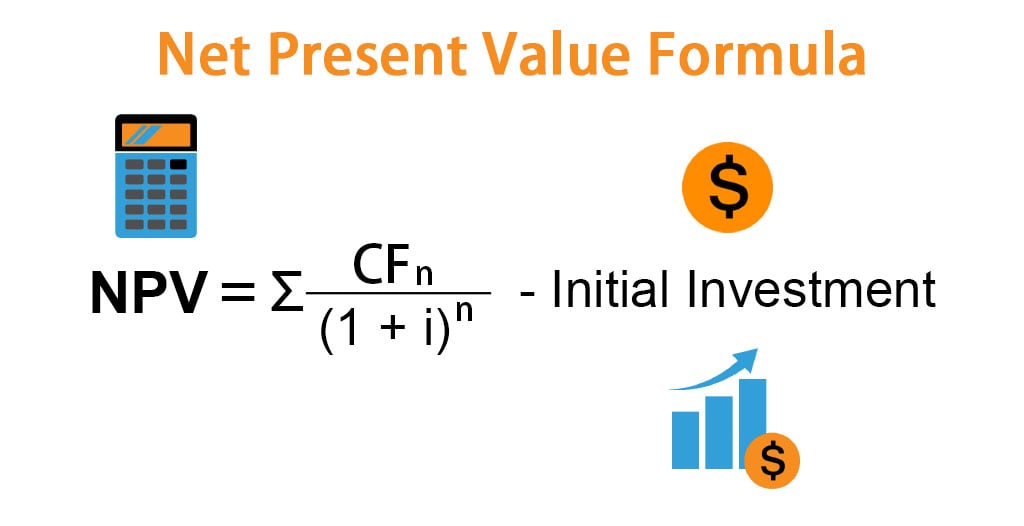

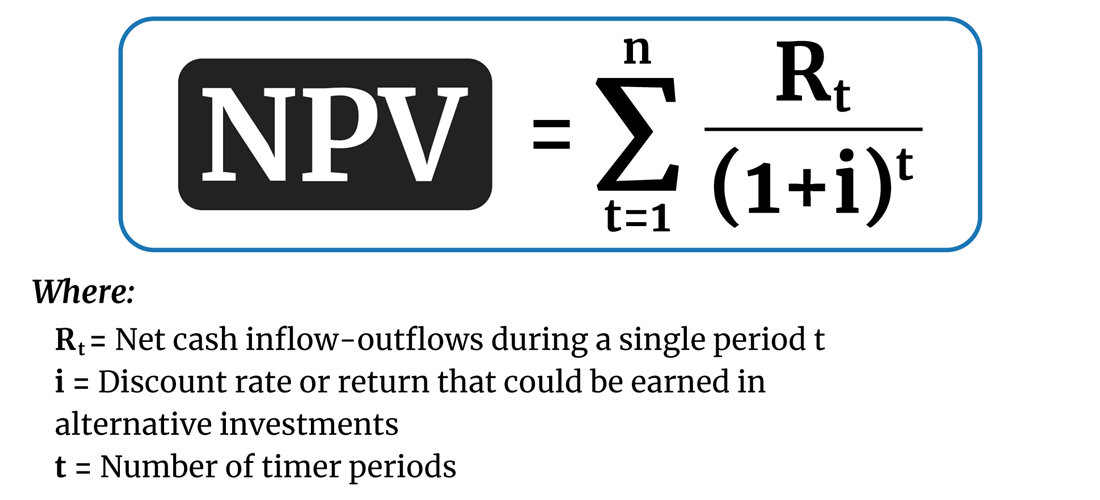

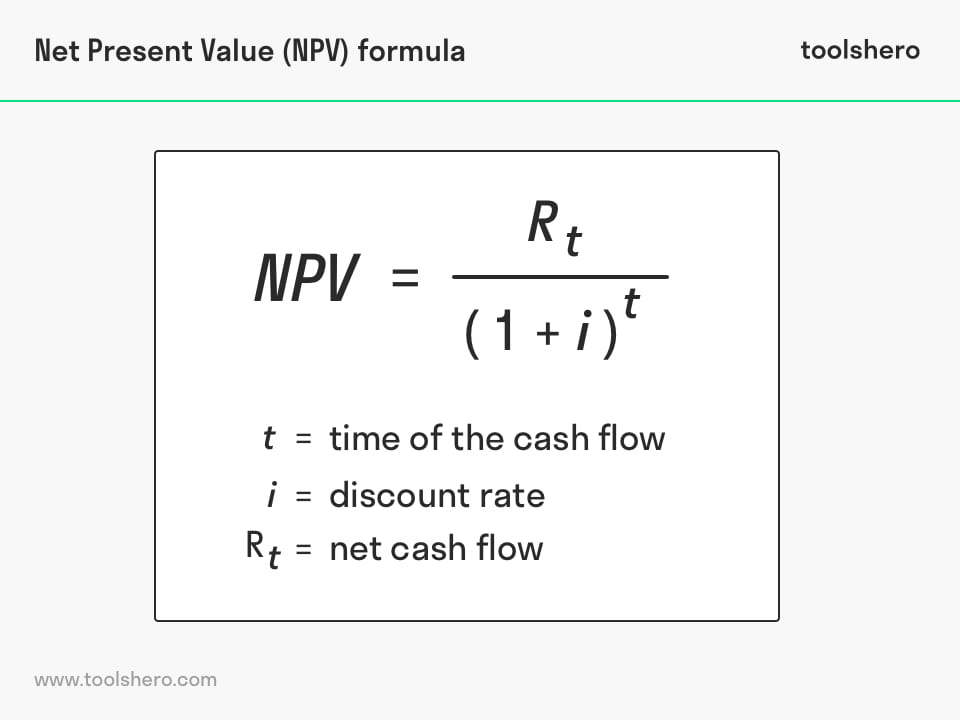

What is net present value (npv)? Net present value is a financial metric used to determine the value of an investment by. Net present value, npv, is a capital budgeting formula that calculates the difference between the present value of the cash inflows and outflows. Example of net present value (npv) let’s look at an example of how to calculate the net present value of a series of cash flows. Here we learn how to calculate npv (net present value) step by step with the help of practical examples.

Net present value, npv, is a capital budgeting formula that calculates the difference between the present value of the cash inflows and outflows. Example of net present value (npv) let’s look at an example of how to calculate the net present value of a series of cash flows. Here we learn how to calculate npv (net present value) step by step with the help of practical examples. Net present value is a financial metric used to determine the value of an investment by. What is net present value (npv)?

PPT Capital Budeting with the Net Present Value Rule PowerPoint

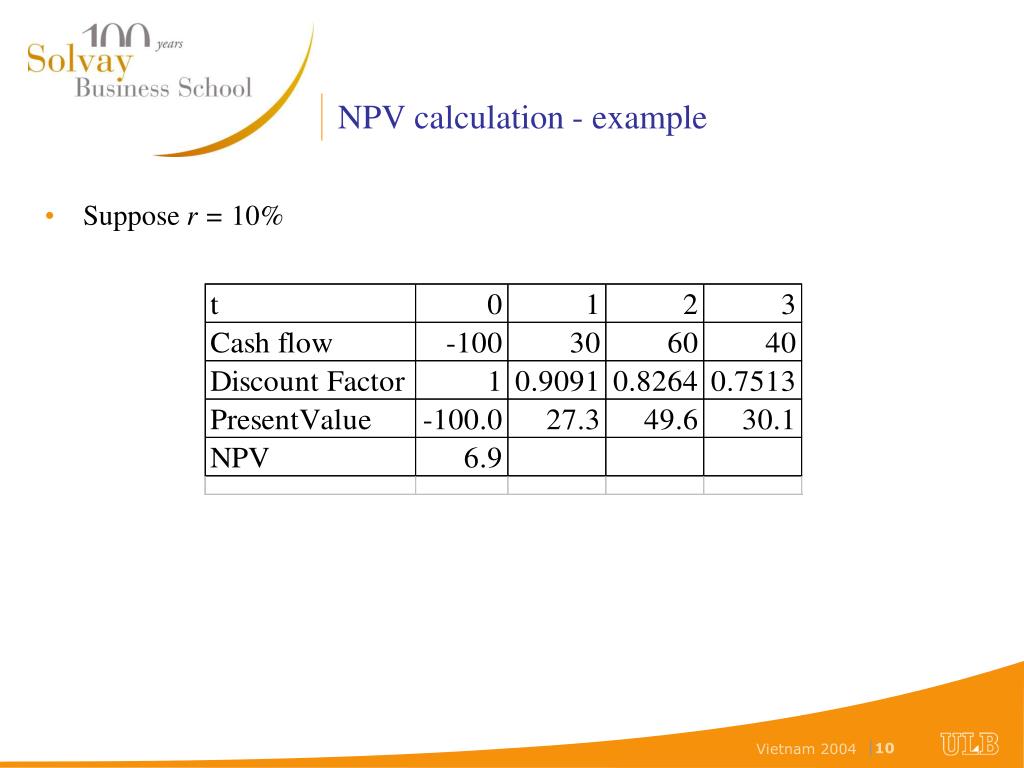

Example of net present value (npv) let’s look at an example of how to calculate the net present value of a series of cash flows. What is net present value (npv)? Net present value is a financial metric used to determine the value of an investment by. Here we learn how to calculate npv (net present value) step by step.

Net Present Value formula and example Toolshero

Net present value is a financial metric used to determine the value of an investment by. Net present value, npv, is a capital budgeting formula that calculates the difference between the present value of the cash inflows and outflows. Example of net present value (npv) let’s look at an example of how to calculate the net present value of a.

Capital Budgeting Presentation

Here we learn how to calculate npv (net present value) step by step with the help of practical examples. Example of net present value (npv) let’s look at an example of how to calculate the net present value of a series of cash flows. What is net present value (npv)? Net present value, npv, is a capital budgeting formula that.

Net Present Value (NPV) What It Means and Steps to Calculate It (2022)

Example of net present value (npv) let’s look at an example of how to calculate the net present value of a series of cash flows. Net present value, npv, is a capital budgeting formula that calculates the difference between the present value of the cash inflows and outflows. Here we learn how to calculate npv (net present value) step by.

How To Calculate Net Present Value With Discount Rate In Excel Design

Net present value is a financial metric used to determine the value of an investment by. Example of net present value (npv) let’s look at an example of how to calculate the net present value of a series of cash flows. Here we learn how to calculate npv (net present value) step by step with the help of practical examples..

Detailed Steps To Calculate Net Present Value And Internal Rate Of

Net present value is a financial metric used to determine the value of an investment by. Here we learn how to calculate npv (net present value) step by step with the help of practical examples. Net present value, npv, is a capital budgeting formula that calculates the difference between the present value of the cash inflows and outflows. Example of.

Net Present Value Calculator with Example + Steps

Example of net present value (npv) let’s look at an example of how to calculate the net present value of a series of cash flows. Here we learn how to calculate npv (net present value) step by step with the help of practical examples. Net present value, npv, is a capital budgeting formula that calculates the difference between the present.

Net Present Value Npv Formula And Calculation vrogue.co

Example of net present value (npv) let’s look at an example of how to calculate the net present value of a series of cash flows. Net present value is a financial metric used to determine the value of an investment by. What is net present value (npv)? Net present value, npv, is a capital budgeting formula that calculates the difference.

How To Calculate Net Present Value Method Haiper

Net present value, npv, is a capital budgeting formula that calculates the difference between the present value of the cash inflows and outflows. Example of net present value (npv) let’s look at an example of how to calculate the net present value of a series of cash flows. Net present value is a financial metric used to determine the value.

Net Present Value (NPV) What It Means and Steps to Calculate It

Net present value, npv, is a capital budgeting formula that calculates the difference between the present value of the cash inflows and outflows. Net present value is a financial metric used to determine the value of an investment by. Here we learn how to calculate npv (net present value) step by step with the help of practical examples. Example of.

Net Present Value, Npv, Is A Capital Budgeting Formula That Calculates The Difference Between The Present Value Of The Cash Inflows And Outflows.

Example of net present value (npv) let’s look at an example of how to calculate the net present value of a series of cash flows. What is net present value (npv)? Here we learn how to calculate npv (net present value) step by step with the help of practical examples. Net present value is a financial metric used to determine the value of an investment by.

:max_bytes(150000):strip_icc()/dotdash_Final_Net_Present_Value_NPV_Jul_2020-01-eea50904f90744e4b1172a9ef38df13f.jpg)

:max_bytes(150000):strip_icc()/ScreenShot2019-06-20at10.46.59AM-f30499c2303c44a5a883c6c1e676569b.png)