Fillable Schedule C Form 1040 2024 - Go to www.irs.gov/schedulec for instructions and the latest information. If no separate business name, leave blank. The 2024 form 1040 schedule c profit or loss from business (sole proprietorship) is used to report the income and expenses of a sole. 51business income (schedule c) (cont.)

The 2024 form 1040 schedule c profit or loss from business (sole proprietorship) is used to report the income and expenses of a sole. Go to www.irs.gov/schedulec for instructions and the latest information. 51business income (schedule c) (cont.) If no separate business name, leave blank.

If no separate business name, leave blank. The 2024 form 1040 schedule c profit or loss from business (sole proprietorship) is used to report the income and expenses of a sole. 51business income (schedule c) (cont.) Go to www.irs.gov/schedulec for instructions and the latest information.

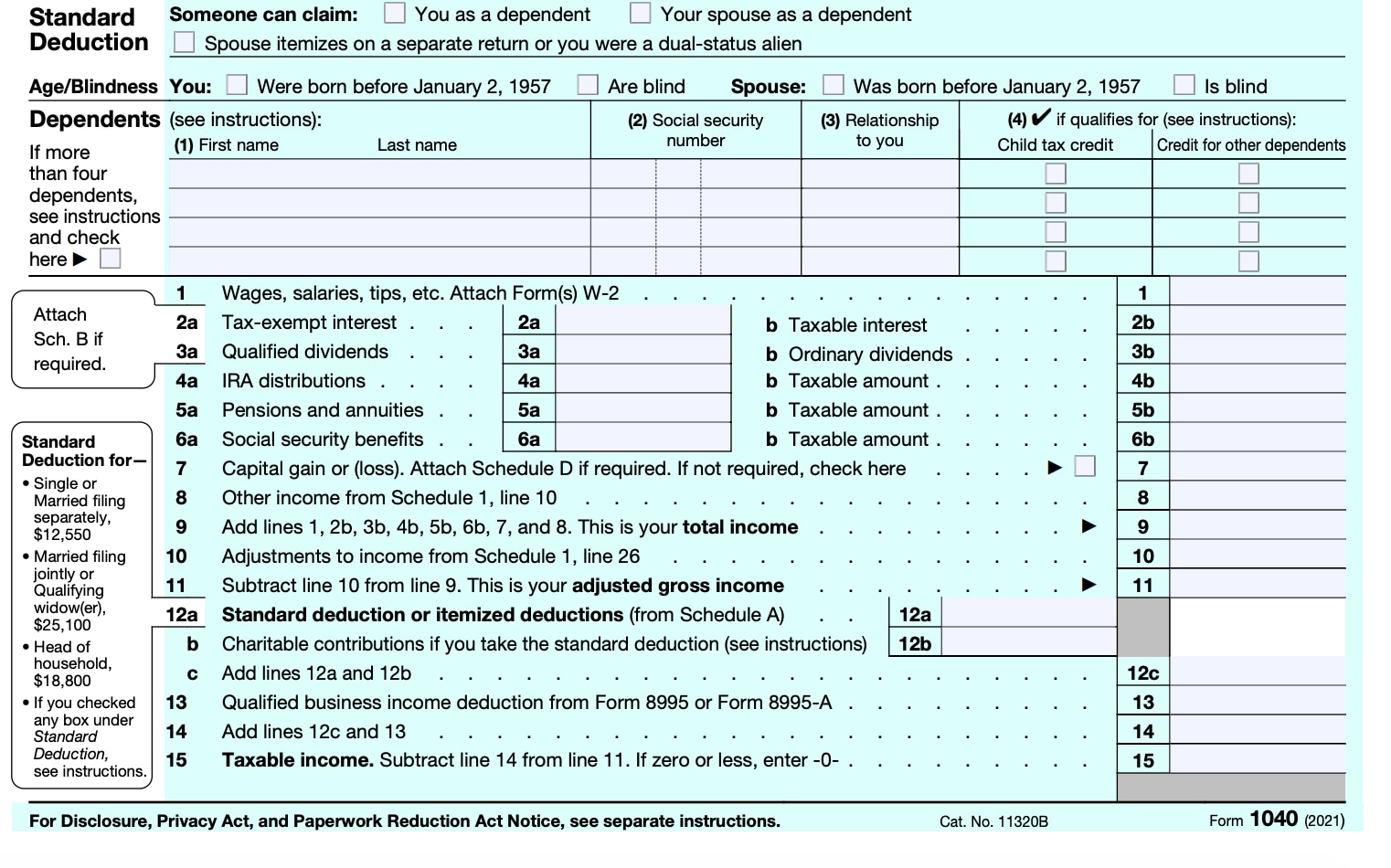

1040 form 2024 Fill out & sign online DocHub

The 2024 form 1040 schedule c profit or loss from business (sole proprietorship) is used to report the income and expenses of a sole. 51business income (schedule c) (cont.) Go to www.irs.gov/schedulec for instructions and the latest information. If no separate business name, leave blank.

Schedule C Form 1040 For 2024 Tax nike laurena

Go to www.irs.gov/schedulec for instructions and the latest information. If no separate business name, leave blank. The 2024 form 1040 schedule c profit or loss from business (sole proprietorship) is used to report the income and expenses of a sole. 51business income (schedule c) (cont.)

Schedule C Tax Form 2024 Libbi Roseanne

The 2024 form 1040 schedule c profit or loss from business (sole proprietorship) is used to report the income and expenses of a sole. 51business income (schedule c) (cont.) If no separate business name, leave blank. Go to www.irs.gov/schedulec for instructions and the latest information.

IRS Schedule C (Form 1040) Instructions 2024 Guide Excel Capital

The 2024 form 1040 schedule c profit or loss from business (sole proprietorship) is used to report the income and expenses of a sole. If no separate business name, leave blank. Go to www.irs.gov/schedulec for instructions and the latest information. 51business income (schedule c) (cont.)

Taxes Schedule C Form 1040 (20242025) PDFliner

Go to www.irs.gov/schedulec for instructions and the latest information. If no separate business name, leave blank. The 2024 form 1040 schedule c profit or loss from business (sole proprietorship) is used to report the income and expenses of a sole. 51business income (schedule c) (cont.)

Irs 2024 Form 1040 Schedule C Tasha Fredelia

If no separate business name, leave blank. Go to www.irs.gov/schedulec for instructions and the latest information. The 2024 form 1040 schedule c profit or loss from business (sole proprietorship) is used to report the income and expenses of a sole. 51business income (schedule c) (cont.)

Irs Fillable Forms 2024 Schedule C Penny Blondell

51business income (schedule c) (cont.) If no separate business name, leave blank. The 2024 form 1040 schedule c profit or loss from business (sole proprietorship) is used to report the income and expenses of a sole. Go to www.irs.gov/schedulec for instructions and the latest information.

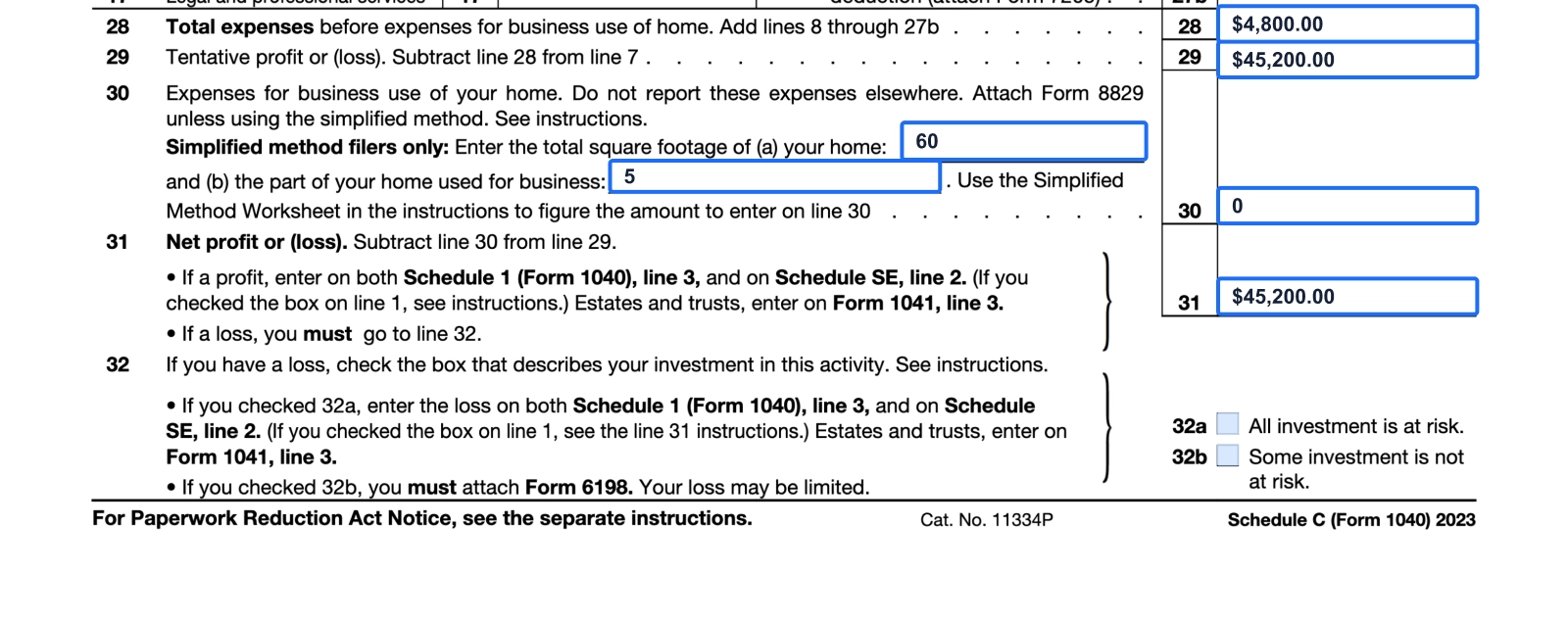

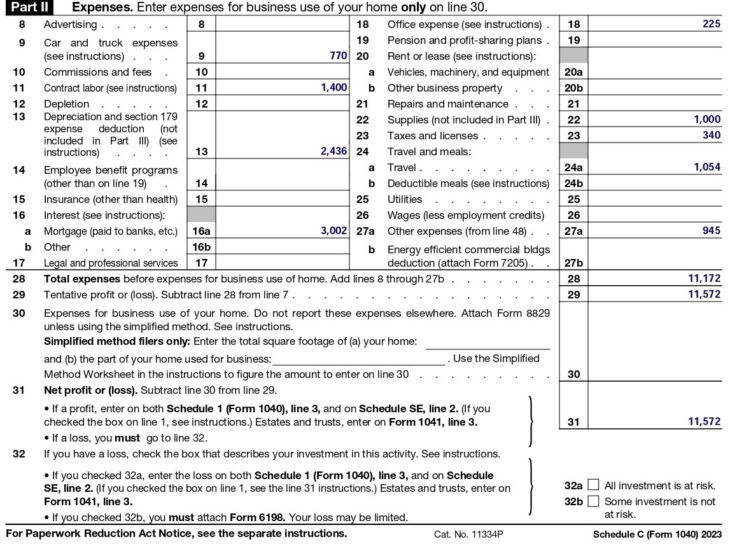

How To Fill Out Schedule C in 2024 (With Example)

51business income (schedule c) (cont.) The 2024 form 1040 schedule c profit or loss from business (sole proprietorship) is used to report the income and expenses of a sole. If no separate business name, leave blank. Go to www.irs.gov/schedulec for instructions and the latest information.

2024 Form 1040 Schedule C Ez Glen Philly

Go to www.irs.gov/schedulec for instructions and the latest information. 51business income (schedule c) (cont.) If no separate business name, leave blank. The 2024 form 1040 schedule c profit or loss from business (sole proprietorship) is used to report the income and expenses of a sole.

2024 Irs Schedule C 2024 Calendar Template Excel

Go to www.irs.gov/schedulec for instructions and the latest information. 51business income (schedule c) (cont.) The 2024 form 1040 schedule c profit or loss from business (sole proprietorship) is used to report the income and expenses of a sole. If no separate business name, leave blank.

51Business Income (Schedule C) (Cont.)

If no separate business name, leave blank. Go to www.irs.gov/schedulec for instructions and the latest information. The 2024 form 1040 schedule c profit or loss from business (sole proprietorship) is used to report the income and expenses of a sole.