Financial Modeling For Real Estate - Real estate financial modeling is an essential skill for investors, developers, and analysts aiming to make informed decisions in. Using professional models for residential, commercial, or fund projects can. In real estate financial modeling (refm), you analyze a property from the perspective of an equity investor (owner) or debt investor (lender). Financial modeling is a must if you’re in real estate.

Financial modeling is a must if you’re in real estate. Real estate financial modeling is an essential skill for investors, developers, and analysts aiming to make informed decisions in. Using professional models for residential, commercial, or fund projects can. In real estate financial modeling (refm), you analyze a property from the perspective of an equity investor (owner) or debt investor (lender).

Real estate financial modeling is an essential skill for investors, developers, and analysts aiming to make informed decisions in. Using professional models for residential, commercial, or fund projects can. In real estate financial modeling (refm), you analyze a property from the perspective of an equity investor (owner) or debt investor (lender). Financial modeling is a must if you’re in real estate.

REFM Real Estate Financial Modeling Ultimate Guide w/ Templates

Using professional models for residential, commercial, or fund projects can. Real estate financial modeling is an essential skill for investors, developers, and analysts aiming to make informed decisions in. In real estate financial modeling (refm), you analyze a property from the perspective of an equity investor (owner) or debt investor (lender). Financial modeling is a must if you’re in real.

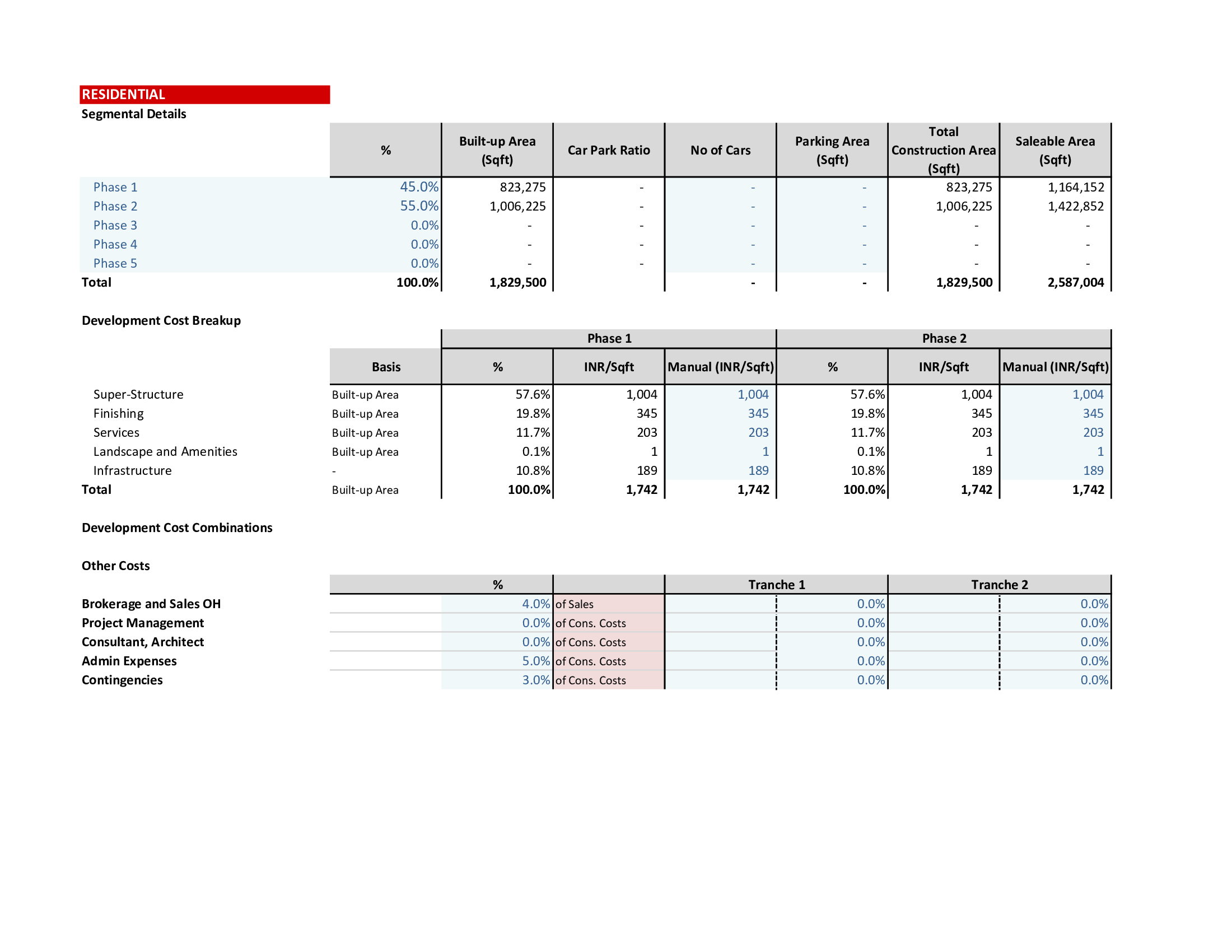

Real Estate Development Financial Model Template VIP Graphics

Financial modeling is a must if you’re in real estate. Real estate financial modeling is an essential skill for investors, developers, and analysts aiming to make informed decisions in. Using professional models for residential, commercial, or fund projects can. In real estate financial modeling (refm), you analyze a property from the perspective of an equity investor (owner) or debt investor.

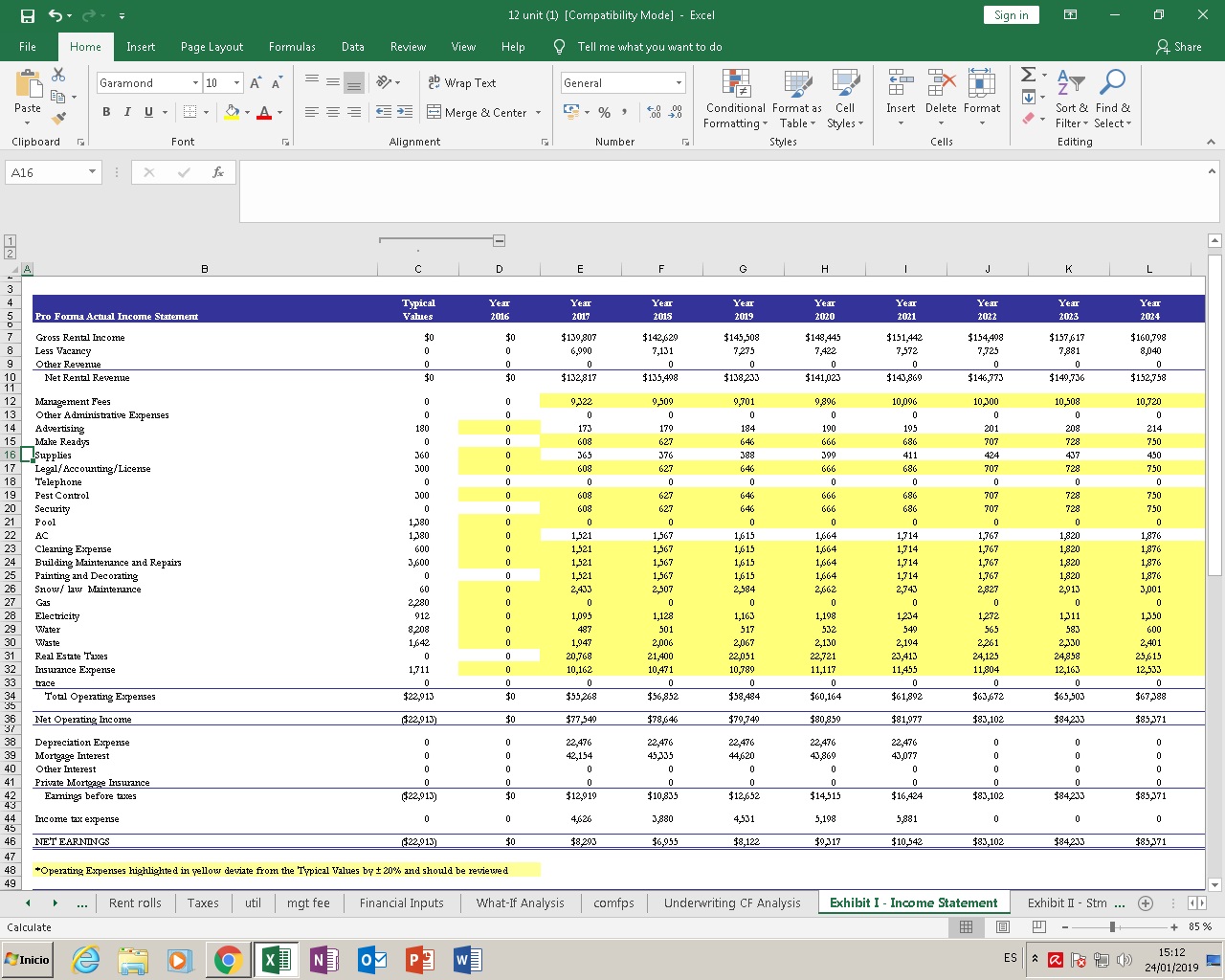

Real Estate Financial Model (Very Detailed) Eloquens

Using professional models for residential, commercial, or fund projects can. In real estate financial modeling (refm), you analyze a property from the perspective of an equity investor (owner) or debt investor (lender). Real estate financial modeling is an essential skill for investors, developers, and analysts aiming to make informed decisions in. Financial modeling is a must if you’re in real.

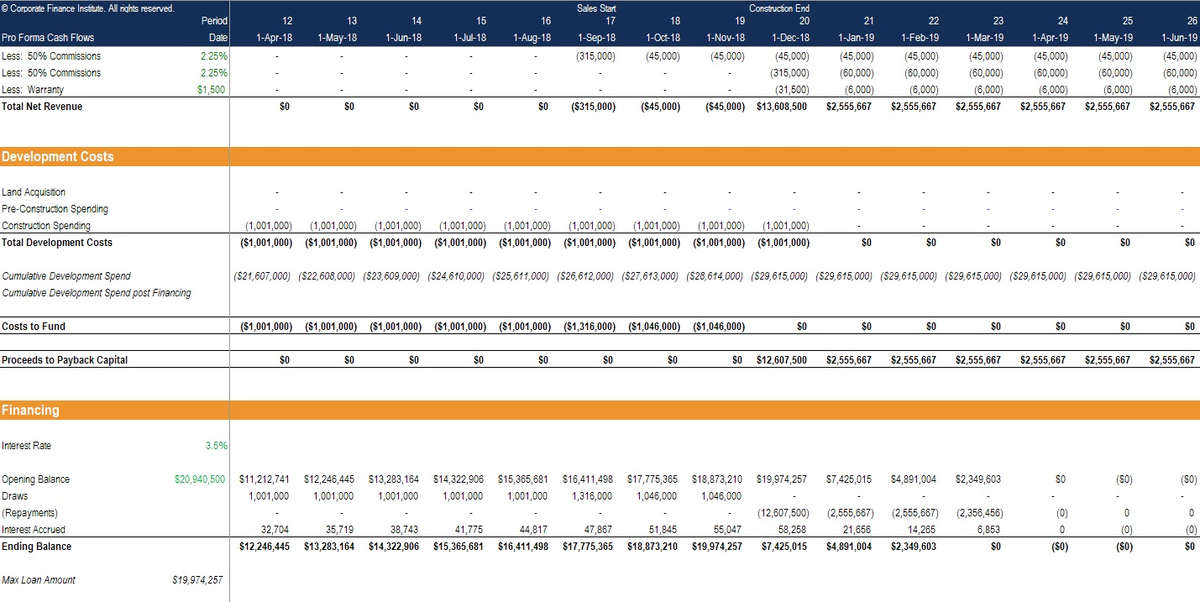

Mastering Real Estate Development Financial Modeling (REFM) Synario

In real estate financial modeling (refm), you analyze a property from the perspective of an equity investor (owner) or debt investor (lender). Real estate financial modeling is an essential skill for investors, developers, and analysts aiming to make informed decisions in. Financial modeling is a must if you’re in real estate. Using professional models for residential, commercial, or fund projects.

REFM Real Estate Financial Modeling Ultimate Guide w/ Templates

Using professional models for residential, commercial, or fund projects can. In real estate financial modeling (refm), you analyze a property from the perspective of an equity investor (owner) or debt investor (lender). Real estate financial modeling is an essential skill for investors, developers, and analysts aiming to make informed decisions in. Financial modeling is a must if you’re in real.

REFM Real Estate Financial Modeling Ultimate Guide w/ Templates

Financial modeling is a must if you’re in real estate. Real estate financial modeling is an essential skill for investors, developers, and analysts aiming to make informed decisions in. In real estate financial modeling (refm), you analyze a property from the perspective of an equity investor (owner) or debt investor (lender). Using professional models for residential, commercial, or fund projects.

How to Create a Real Estate Investment Model in Excel Financial Edge

Financial modeling is a must if you’re in real estate. Using professional models for residential, commercial, or fund projects can. Real estate financial modeling is an essential skill for investors, developers, and analysts aiming to make informed decisions in. In real estate financial modeling (refm), you analyze a property from the perspective of an equity investor (owner) or debt investor.

Real Estate Financial Model Excel Template for Complete Valuation with

Financial modeling is a must if you’re in real estate. Real estate financial modeling is an essential skill for investors, developers, and analysts aiming to make informed decisions in. In real estate financial modeling (refm), you analyze a property from the perspective of an equity investor (owner) or debt investor (lender). Using professional models for residential, commercial, or fund projects.

Real Estate Financial Modeling in Excel

In real estate financial modeling (refm), you analyze a property from the perspective of an equity investor (owner) or debt investor (lender). Financial modeling is a must if you’re in real estate. Using professional models for residential, commercial, or fund projects can. Real estate financial modeling is an essential skill for investors, developers, and analysts aiming to make informed decisions.

How to Create a Real Estate Investment Model in Excel Financial Edge

Using professional models for residential, commercial, or fund projects can. In real estate financial modeling (refm), you analyze a property from the perspective of an equity investor (owner) or debt investor (lender). Financial modeling is a must if you’re in real estate. Real estate financial modeling is an essential skill for investors, developers, and analysts aiming to make informed decisions.

Financial Modeling Is A Must If You’re In Real Estate.

Real estate financial modeling is an essential skill for investors, developers, and analysts aiming to make informed decisions in. Using professional models for residential, commercial, or fund projects can. In real estate financial modeling (refm), you analyze a property from the perspective of an equity investor (owner) or debt investor (lender).