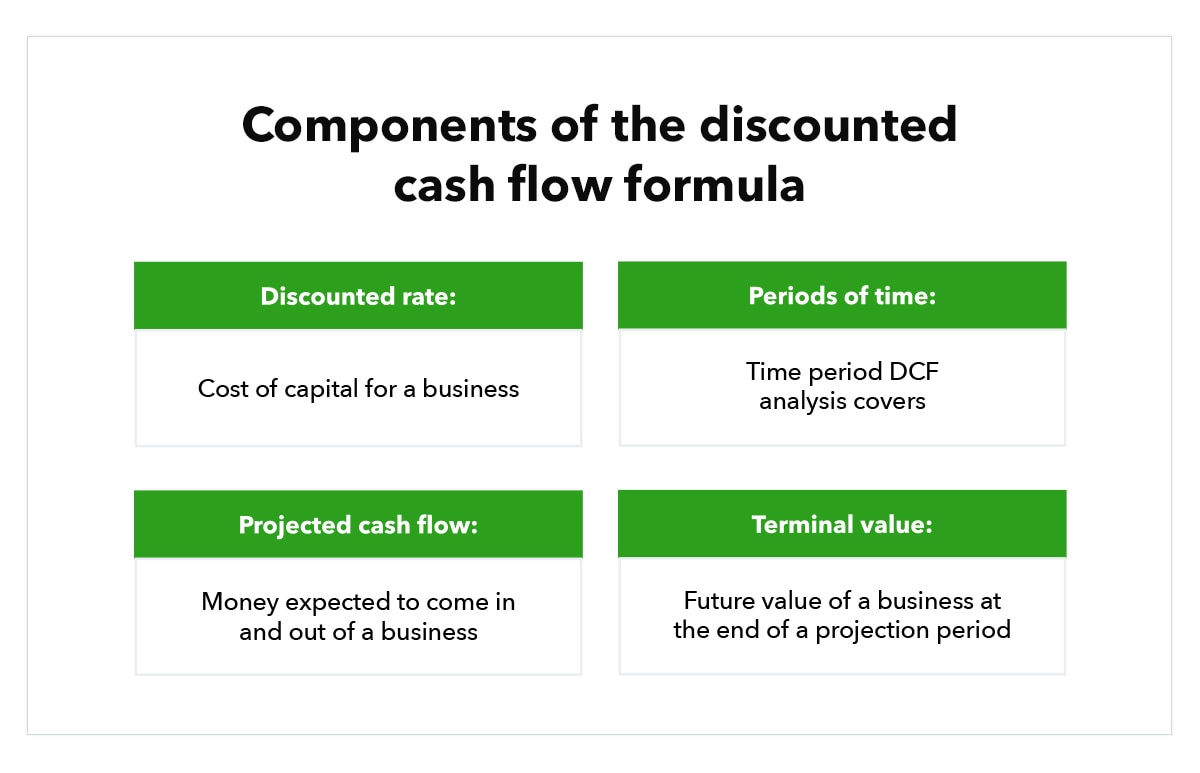

Formula For Discounted Cash Flow - Calculating the sum of future discounted cash flows is the gold standard to determine how much an investment is worth. Discounted cash flow (dcf) is a valuation method that estimates the value of an investment using its expected future cash. Discounted cash flow (dcf) is a financial valuation method used to estimate the value of an investment based on its expected.

Discounted cash flow (dcf) is a financial valuation method used to estimate the value of an investment based on its expected. Discounted cash flow (dcf) is a valuation method that estimates the value of an investment using its expected future cash. Calculating the sum of future discounted cash flows is the gold standard to determine how much an investment is worth.

Discounted cash flow (dcf) is a financial valuation method used to estimate the value of an investment based on its expected. Discounted cash flow (dcf) is a valuation method that estimates the value of an investment using its expected future cash. Calculating the sum of future discounted cash flows is the gold standard to determine how much an investment is worth.

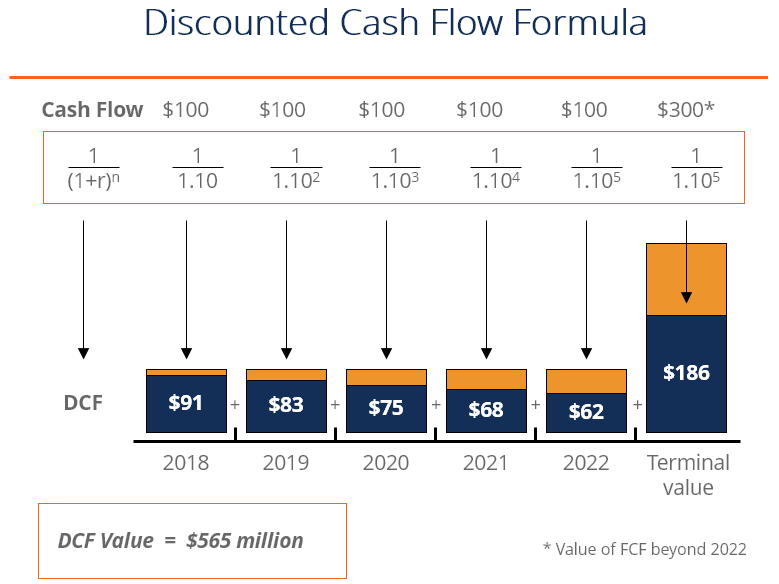

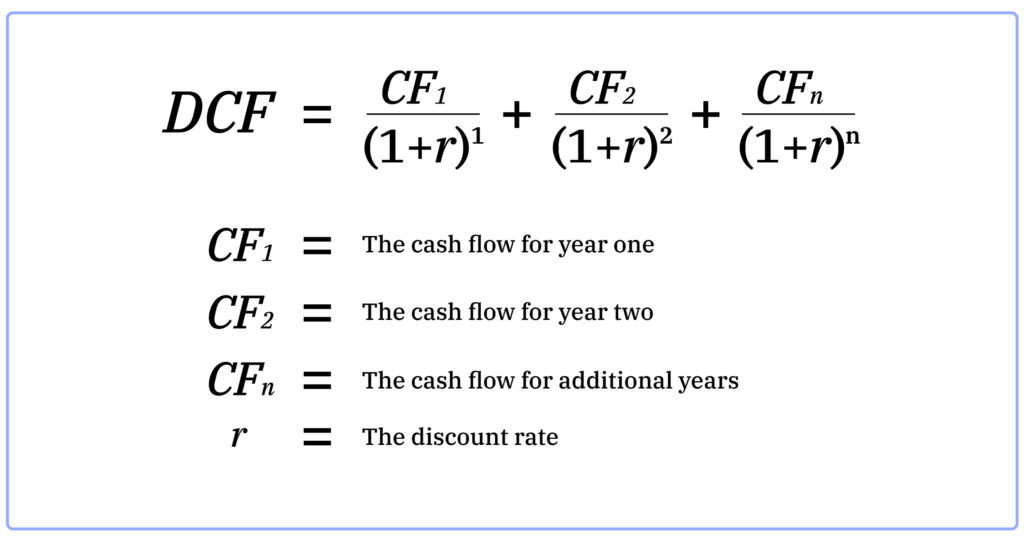

Discounted Cash Flow DCF Formula

Discounted cash flow (dcf) is a valuation method that estimates the value of an investment using its expected future cash. Discounted cash flow (dcf) is a financial valuation method used to estimate the value of an investment based on its expected. Calculating the sum of future discounted cash flows is the gold standard to determine how much an investment is.

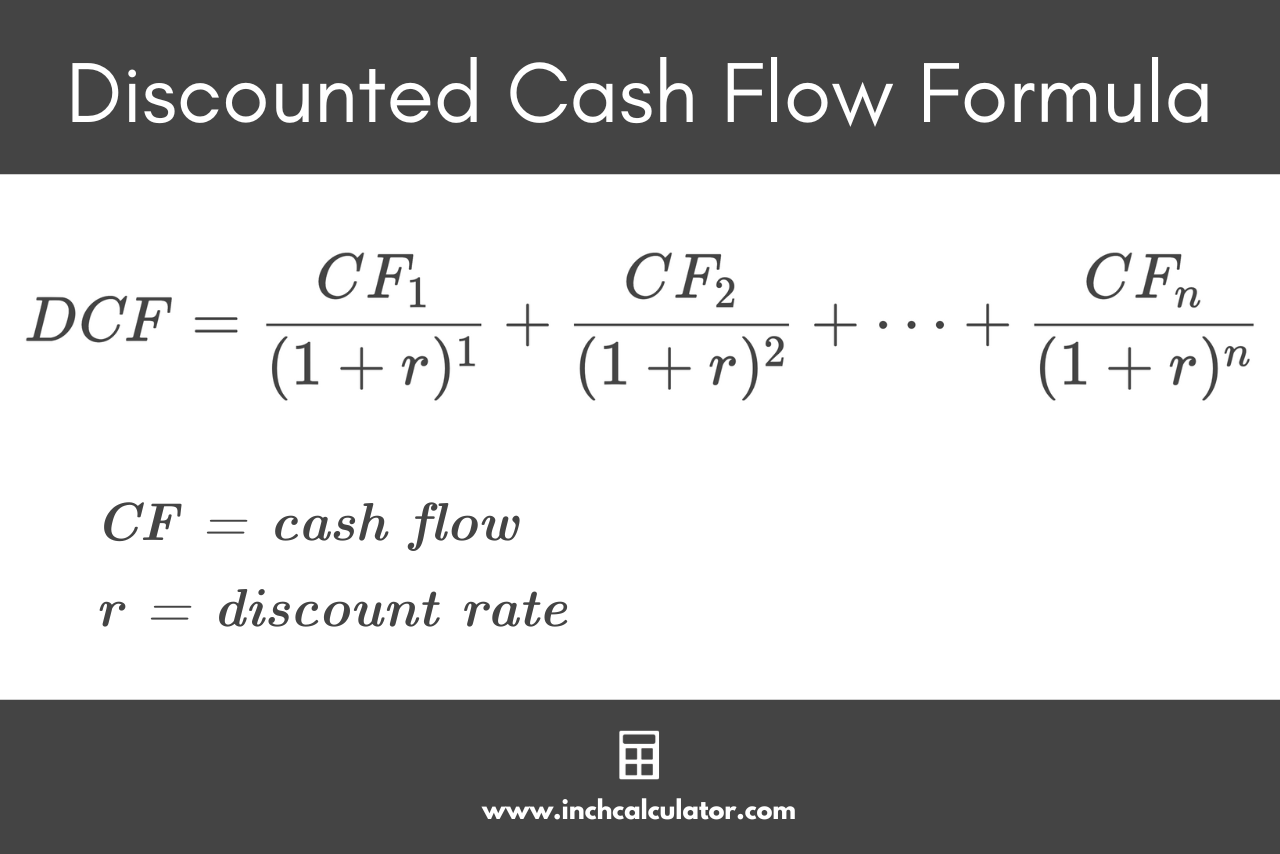

Discounted Cash Flow Calculator Inch Calculator

Calculating the sum of future discounted cash flows is the gold standard to determine how much an investment is worth. Discounted cash flow (dcf) is a financial valuation method used to estimate the value of an investment based on its expected. Discounted cash flow (dcf) is a valuation method that estimates the value of an investment using its expected future.

Discounted future cash flow calculator JohnAnnaleigh

Discounted cash flow (dcf) is a financial valuation method used to estimate the value of an investment based on its expected. Discounted cash flow (dcf) is a valuation method that estimates the value of an investment using its expected future cash. Calculating the sum of future discounted cash flows is the gold standard to determine how much an investment is.

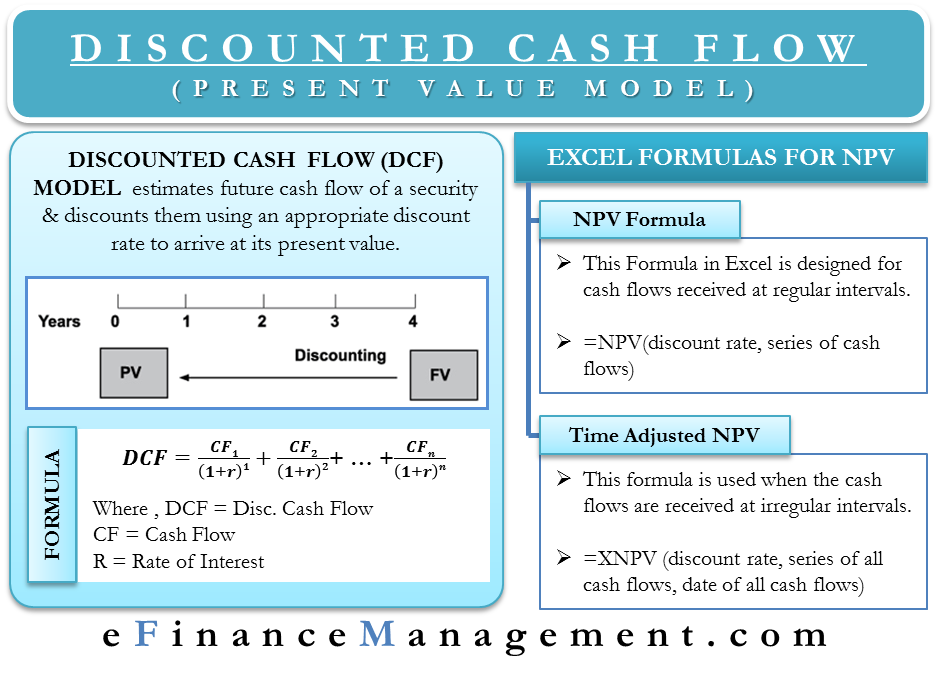

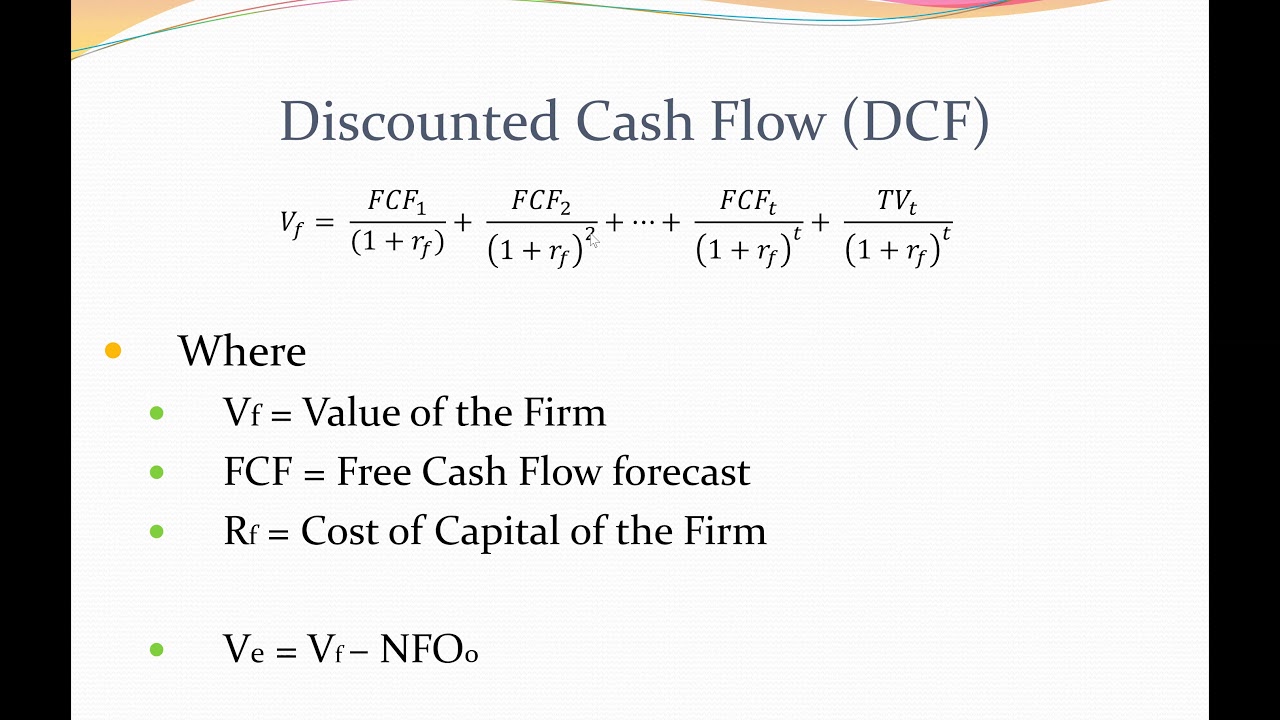

Discounted Cash Flow Method Definition, Formula, and Example

Discounted cash flow (dcf) is a valuation method that estimates the value of an investment using its expected future cash. Discounted cash flow (dcf) is a financial valuation method used to estimate the value of an investment based on its expected. Calculating the sum of future discounted cash flows is the gold standard to determine how much an investment is.

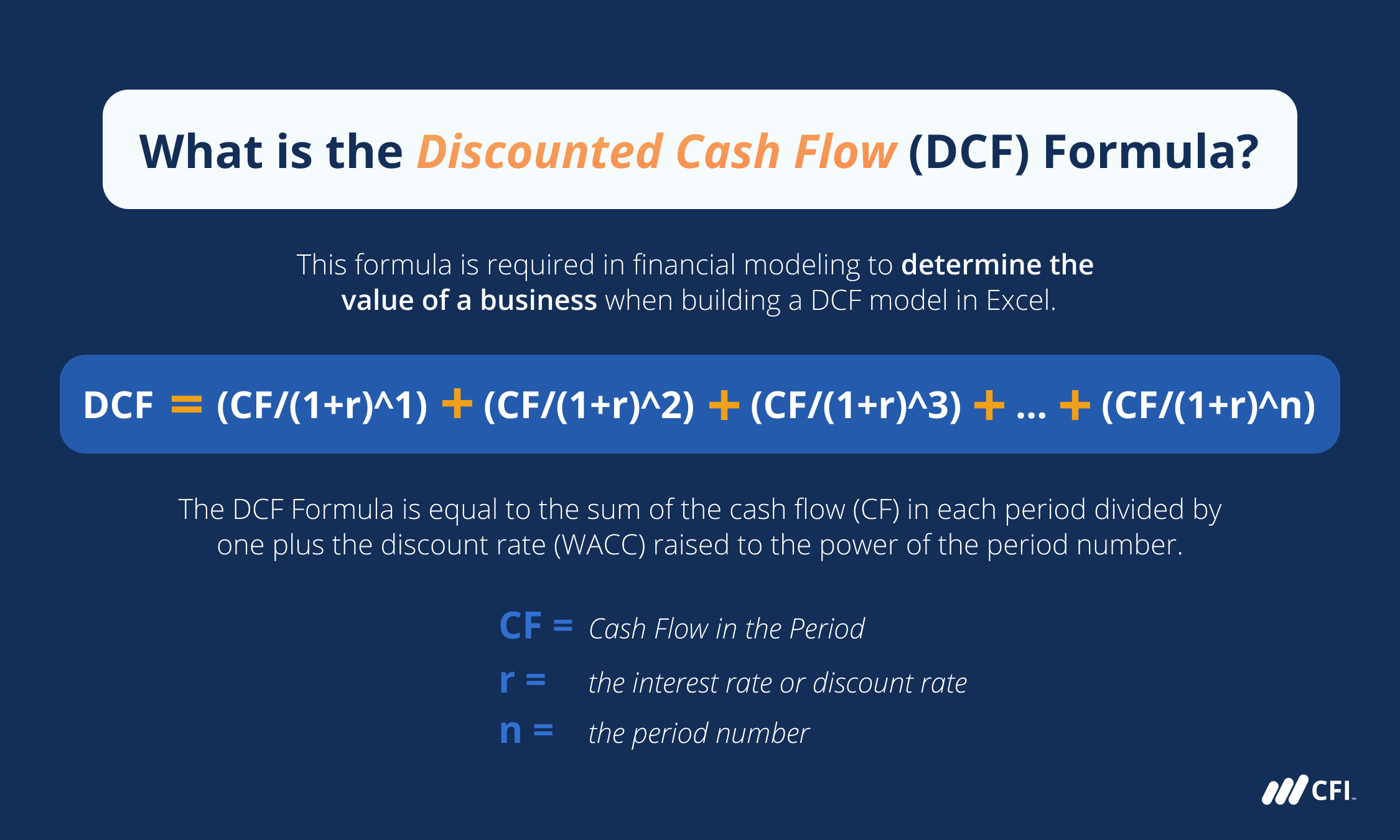

DCF Formula What Is It, Examples, How To Calculate

Discounted cash flow (dcf) is a valuation method that estimates the value of an investment using its expected future cash. Discounted cash flow (dcf) is a financial valuation method used to estimate the value of an investment based on its expected. Calculating the sum of future discounted cash flows is the gold standard to determine how much an investment is.

How to Apply Discounted Cash Flow Formula in Excel ExcelDemy

Calculating the sum of future discounted cash flows is the gold standard to determine how much an investment is worth. Discounted cash flow (dcf) is a valuation method that estimates the value of an investment using its expected future cash. Discounted cash flow (dcf) is a financial valuation method used to estimate the value of an investment based on its.

Discounted Cash Flow Model in Excel Solving Finance

Calculating the sum of future discounted cash flows is the gold standard to determine how much an investment is worth. Discounted cash flow (dcf) is a valuation method that estimates the value of an investment using its expected future cash. Discounted cash flow (dcf) is a financial valuation method used to estimate the value of an investment based on its.

Discounted Cash Flow DCF Formula

Discounted cash flow (dcf) is a valuation method that estimates the value of an investment using its expected future cash. Calculating the sum of future discounted cash flows is the gold standard to determine how much an investment is worth. Discounted cash flow (dcf) is a financial valuation method used to estimate the value of an investment based on its.

DCF Formula What Is It, Examples, How To Calculate, 52 OFF

Calculating the sum of future discounted cash flows is the gold standard to determine how much an investment is worth. Discounted cash flow (dcf) is a valuation method that estimates the value of an investment using its expected future cash. Discounted cash flow (dcf) is a financial valuation method used to estimate the value of an investment based on its.

Formula for Discounted Cash Flow in Excel Quant RL

Discounted cash flow (dcf) is a financial valuation method used to estimate the value of an investment based on its expected. Discounted cash flow (dcf) is a valuation method that estimates the value of an investment using its expected future cash. Calculating the sum of future discounted cash flows is the gold standard to determine how much an investment is.

Discounted Cash Flow (Dcf) Is A Financial Valuation Method Used To Estimate The Value Of An Investment Based On Its Expected.

Calculating the sum of future discounted cash flows is the gold standard to determine how much an investment is worth. Discounted cash flow (dcf) is a valuation method that estimates the value of an investment using its expected future cash.