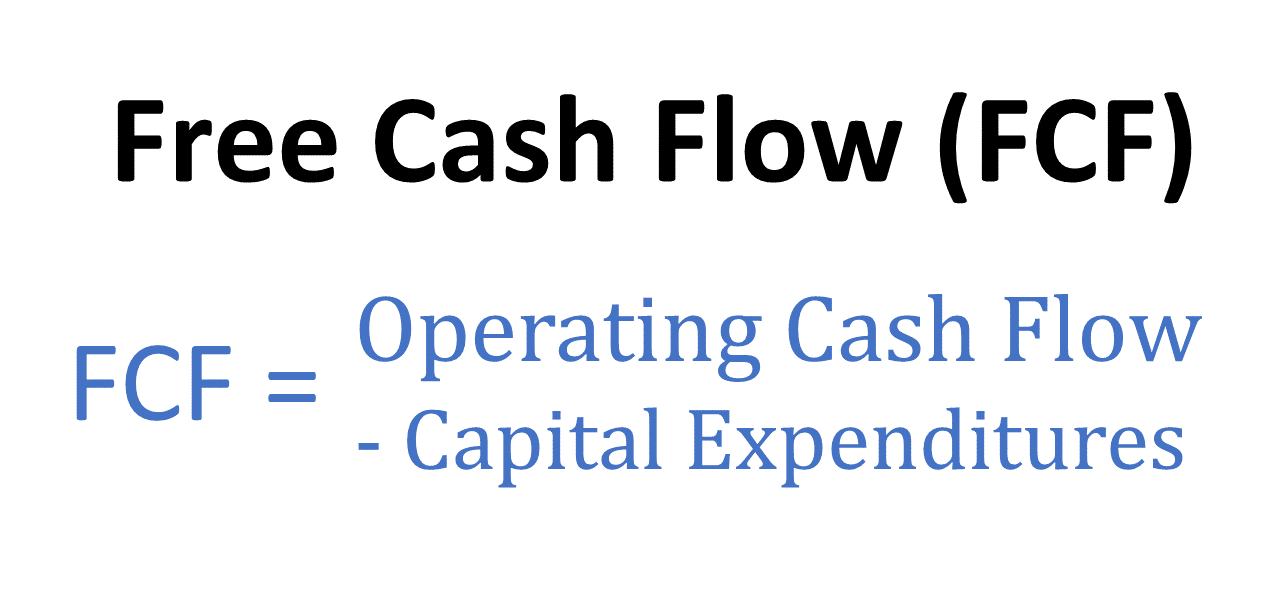

Formula Of Free Cash Flow - Free cash flow (fcf) formula is used to find the company's remaining cash after meeting expenses and is an important financial metric. Simple to usedownload our mobile app Free cash flow (fcf) is the amount of cash that a company has left after accounting for spending on operations and capital asset. What is the free cash flow (fcf) formula? The generic free cash flow (fcf) formula is equal to cash from operations minus capital.

Simple to usedownload our mobile app Free cash flow (fcf) formula is used to find the company's remaining cash after meeting expenses and is an important financial metric. The generic free cash flow (fcf) formula is equal to cash from operations minus capital. Free cash flow (fcf) is the amount of cash that a company has left after accounting for spending on operations and capital asset. What is the free cash flow (fcf) formula?

Free cash flow (fcf) is the amount of cash that a company has left after accounting for spending on operations and capital asset. Free cash flow (fcf) formula is used to find the company's remaining cash after meeting expenses and is an important financial metric. The generic free cash flow (fcf) formula is equal to cash from operations minus capital. Simple to usedownload our mobile app What is the free cash flow (fcf) formula?

(FCF) Free Cash Flow Formula and Calculation Financial

What is the free cash flow (fcf) formula? Free cash flow (fcf) is the amount of cash that a company has left after accounting for spending on operations and capital asset. Free cash flow (fcf) formula is used to find the company's remaining cash after meeting expenses and is an important financial metric. Simple to usedownload our mobile app The.

Free cash flow (FCF) Equation and meaning [2025]

The generic free cash flow (fcf) formula is equal to cash from operations minus capital. Free cash flow (fcf) formula is used to find the company's remaining cash after meeting expenses and is an important financial metric. Free cash flow (fcf) is the amount of cash that a company has left after accounting for spending on operations and capital asset..

Free cash flow (FCF) Equation and meaning [2025]

Simple to usedownload our mobile app Free cash flow (fcf) formula is used to find the company's remaining cash after meeting expenses and is an important financial metric. What is the free cash flow (fcf) formula? Free cash flow (fcf) is the amount of cash that a company has left after accounting for spending on operations and capital asset. The.

Free Cash Flow (FCF) Definition, Formula and How to Calculate Stock

The generic free cash flow (fcf) formula is equal to cash from operations minus capital. Simple to usedownload our mobile app Free cash flow (fcf) is the amount of cash that a company has left after accounting for spending on operations and capital asset. Free cash flow (fcf) formula is used to find the company's remaining cash after meeting expenses.

Free Cash Flow (FCF) Formula to Calculate and Interpret It

Free cash flow (fcf) formula is used to find the company's remaining cash after meeting expenses and is an important financial metric. Simple to usedownload our mobile app What is the free cash flow (fcf) formula? The generic free cash flow (fcf) formula is equal to cash from operations minus capital. Free cash flow (fcf) is the amount of cash.

Free Cash Flow Plan Projections

Free cash flow (fcf) is the amount of cash that a company has left after accounting for spending on operations and capital asset. The generic free cash flow (fcf) formula is equal to cash from operations minus capital. Free cash flow (fcf) formula is used to find the company's remaining cash after meeting expenses and is an important financial metric..

Discounted Cash Flow Formula

What is the free cash flow (fcf) formula? Simple to usedownload our mobile app The generic free cash flow (fcf) formula is equal to cash from operations minus capital. Free cash flow (fcf) is the amount of cash that a company has left after accounting for spending on operations and capital asset. Free cash flow (fcf) formula is used to.

Free Cash Flow (FCF) Formula to Calculate and Interpret It

The generic free cash flow (fcf) formula is equal to cash from operations minus capital. Free cash flow (fcf) formula is used to find the company's remaining cash after meeting expenses and is an important financial metric. Simple to usedownload our mobile app Free cash flow (fcf) is the amount of cash that a company has left after accounting for.

Free Cash Flow (FCF) Formula

Simple to usedownload our mobile app Free cash flow (fcf) is the amount of cash that a company has left after accounting for spending on operations and capital asset. The generic free cash flow (fcf) formula is equal to cash from operations minus capital. Free cash flow (fcf) formula is used to find the company's remaining cash after meeting expenses.

Prophix (Default) Spiegazione del free cash flow levered e unlevered

Free cash flow (fcf) is the amount of cash that a company has left after accounting for spending on operations and capital asset. The generic free cash flow (fcf) formula is equal to cash from operations minus capital. What is the free cash flow (fcf) formula? Simple to usedownload our mobile app Free cash flow (fcf) formula is used to.

Simple To Usedownload Our Mobile App

Free cash flow (fcf) formula is used to find the company's remaining cash after meeting expenses and is an important financial metric. The generic free cash flow (fcf) formula is equal to cash from operations minus capital. Free cash flow (fcf) is the amount of cash that a company has left after accounting for spending on operations and capital asset. What is the free cash flow (fcf) formula?

![Free cash flow (FCF) Equation and meaning [2025]](https://quickbooks.intuit.com/oidam/intuit/sbseg/en_us/Blog/Graphic/quickbooks_paymentseditorial9_graphic4.png)

![Free cash flow (FCF) Equation and meaning [2025]](https://quickbooks.intuit.com/oidam/intuit/sbseg/en_us/Blog/Graphic/quickbooks_paymentseditorial9_graphic1b.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-01-369e05314df242c3a81b8ac8ef135c52.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-02-9523034ce2944e6ebef6f54272396bfc.jpg)