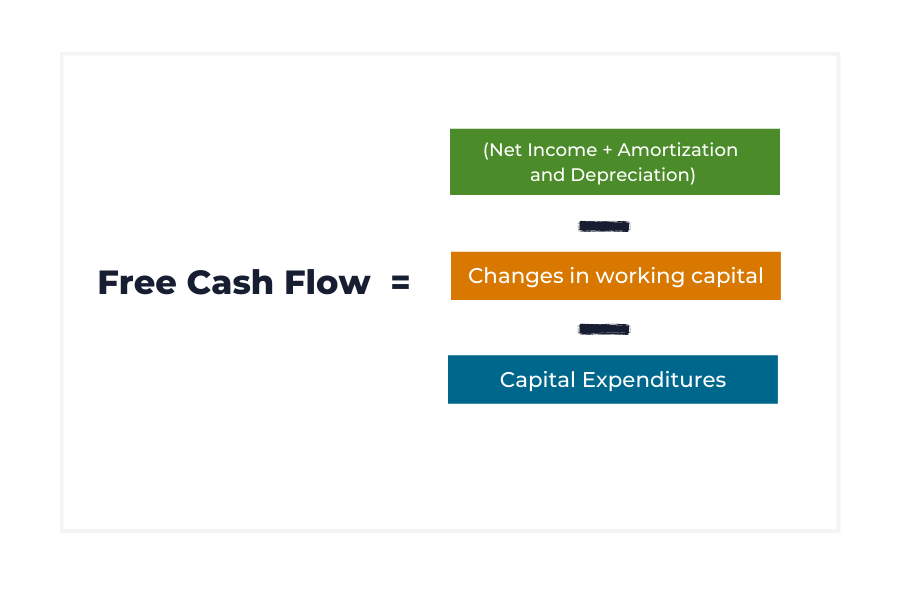

Free Cash Flow Calculation From Net Income - Free cash flow (fcf) is the cash that remains after a company pays to support its operations and makes any capital expenditures. Free cash flow, often abbreviate fcf, is an efficiency and liquidity ratio that calculates the how much more cash a company generates. Free cash flow (fcf) formula is used to find the company's remaining cash after meeting expenses and is an important financial metric.

Free cash flow (fcf) formula is used to find the company's remaining cash after meeting expenses and is an important financial metric. Free cash flow (fcf) is the cash that remains after a company pays to support its operations and makes any capital expenditures. Free cash flow, often abbreviate fcf, is an efficiency and liquidity ratio that calculates the how much more cash a company generates.

Free cash flow (fcf) formula is used to find the company's remaining cash after meeting expenses and is an important financial metric. Free cash flow (fcf) is the cash that remains after a company pays to support its operations and makes any capital expenditures. Free cash flow, often abbreviate fcf, is an efficiency and liquidity ratio that calculates the how much more cash a company generates.

(FCF) Free Cash Flow Formula and Calculation Financial

Free cash flow, often abbreviate fcf, is an efficiency and liquidity ratio that calculates the how much more cash a company generates. Free cash flow (fcf) is the cash that remains after a company pays to support its operations and makes any capital expenditures. Free cash flow (fcf) formula is used to find the company's remaining cash after meeting expenses.

How Can You Maximize Your Free Cash Flow? [Formula + Example]

Free cash flow (fcf) formula is used to find the company's remaining cash after meeting expenses and is an important financial metric. Free cash flow, often abbreviate fcf, is an efficiency and liquidity ratio that calculates the how much more cash a company generates. Free cash flow (fcf) is the cash that remains after a company pays to support its.

Free Cash Flow (FCF) Formula

Free cash flow, often abbreviate fcf, is an efficiency and liquidity ratio that calculates the how much more cash a company generates. Free cash flow (fcf) is the cash that remains after a company pays to support its operations and makes any capital expenditures. Free cash flow (fcf) formula is used to find the company's remaining cash after meeting expenses.

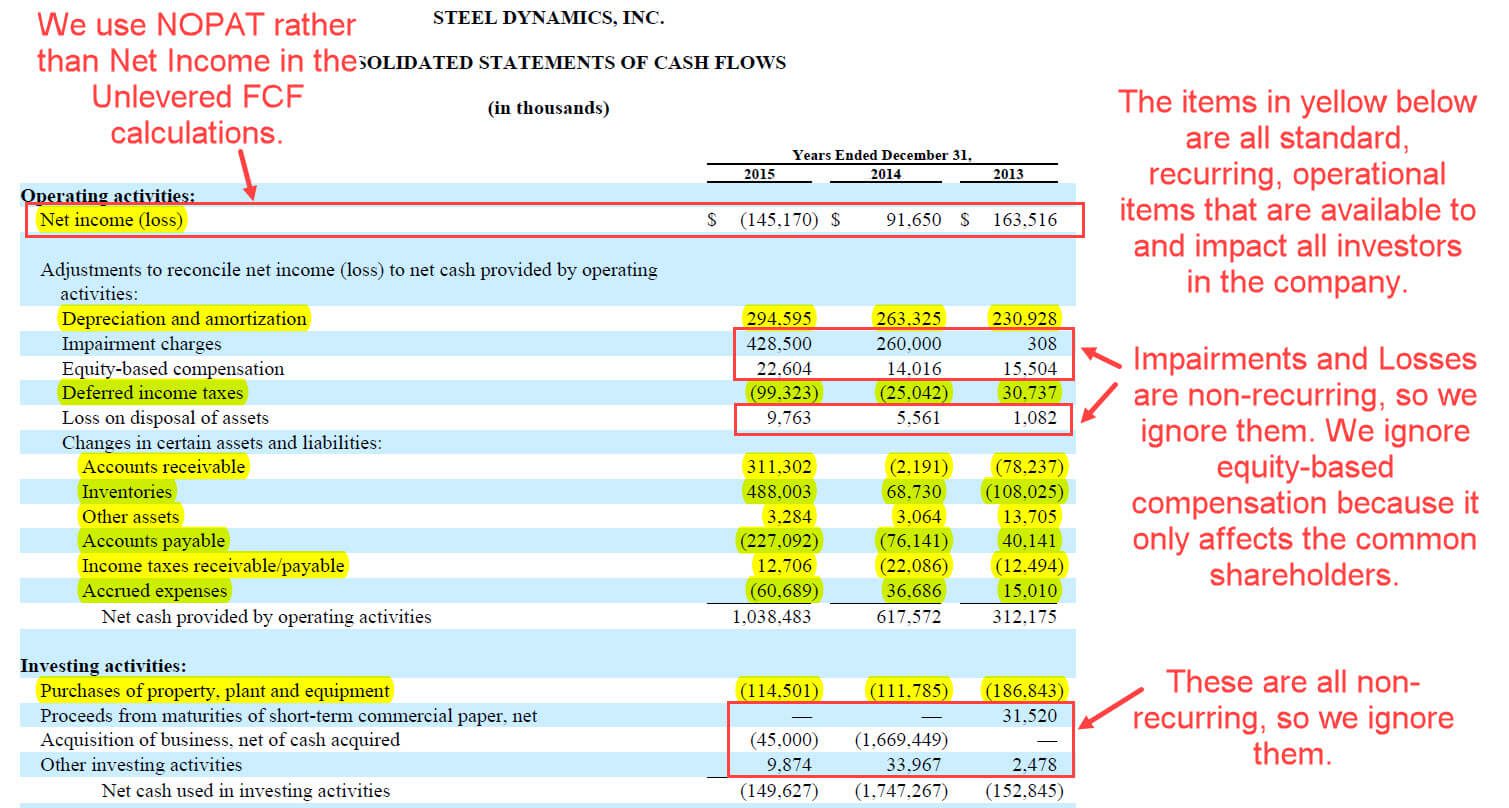

Unlevered Free Cash Flow Formulas, Calculations, and Full Tutorial

Free cash flow, often abbreviate fcf, is an efficiency and liquidity ratio that calculates the how much more cash a company generates. Free cash flow (fcf) is the cash that remains after a company pays to support its operations and makes any capital expenditures. Free cash flow (fcf) formula is used to find the company's remaining cash after meeting expenses.

Free Cash Flow (FCF) Formula to Calculate and Interpret It

Free cash flow (fcf) formula is used to find the company's remaining cash after meeting expenses and is an important financial metric. Free cash flow, often abbreviate fcf, is an efficiency and liquidity ratio that calculates the how much more cash a company generates. Free cash flow (fcf) is the cash that remains after a company pays to support its.

Levered vs. unlevered free cash flow explained (formulas, examples

Free cash flow (fcf) formula is used to find the company's remaining cash after meeting expenses and is an important financial metric. Free cash flow (fcf) is the cash that remains after a company pays to support its operations and makes any capital expenditures. Free cash flow, often abbreviate fcf, is an efficiency and liquidity ratio that calculates the how.

3 Cash Flow KPIs Every Business Leader Should Track

Free cash flow (fcf) formula is used to find the company's remaining cash after meeting expenses and is an important financial metric. Free cash flow, often abbreviate fcf, is an efficiency and liquidity ratio that calculates the how much more cash a company generates. Free cash flow (fcf) is the cash that remains after a company pays to support its.

Free Cash Flow (FCF) Formula to Calculate and Interpret It

Free cash flow (fcf) is the cash that remains after a company pays to support its operations and makes any capital expenditures. Free cash flow (fcf) formula is used to find the company's remaining cash after meeting expenses and is an important financial metric. Free cash flow, often abbreviate fcf, is an efficiency and liquidity ratio that calculates the how.

Awesome Equation For Free Cash Flow Preparing A Profit And Loss

Free cash flow, often abbreviate fcf, is an efficiency and liquidity ratio that calculates the how much more cash a company generates. Free cash flow (fcf) is the cash that remains after a company pays to support its operations and makes any capital expenditures. Free cash flow (fcf) formula is used to find the company's remaining cash after meeting expenses.

Free Cash Flow Plan Projections

Free cash flow (fcf) formula is used to find the company's remaining cash after meeting expenses and is an important financial metric. Free cash flow, often abbreviate fcf, is an efficiency and liquidity ratio that calculates the how much more cash a company generates. Free cash flow (fcf) is the cash that remains after a company pays to support its.

Free Cash Flow, Often Abbreviate Fcf, Is An Efficiency And Liquidity Ratio That Calculates The How Much More Cash A Company Generates.

Free cash flow (fcf) formula is used to find the company's remaining cash after meeting expenses and is an important financial metric. Free cash flow (fcf) is the cash that remains after a company pays to support its operations and makes any capital expenditures.

![How Can You Maximize Your Free Cash Flow? [Formula + Example]](https://cfoperspective.com/wp-content/uploads/2023/02/Free-Cash-Flow-Example-1024x576.png)

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-01-369e05314df242c3a81b8ac8ef135c52.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-02-9523034ce2944e6ebef6f54272396bfc.jpg)