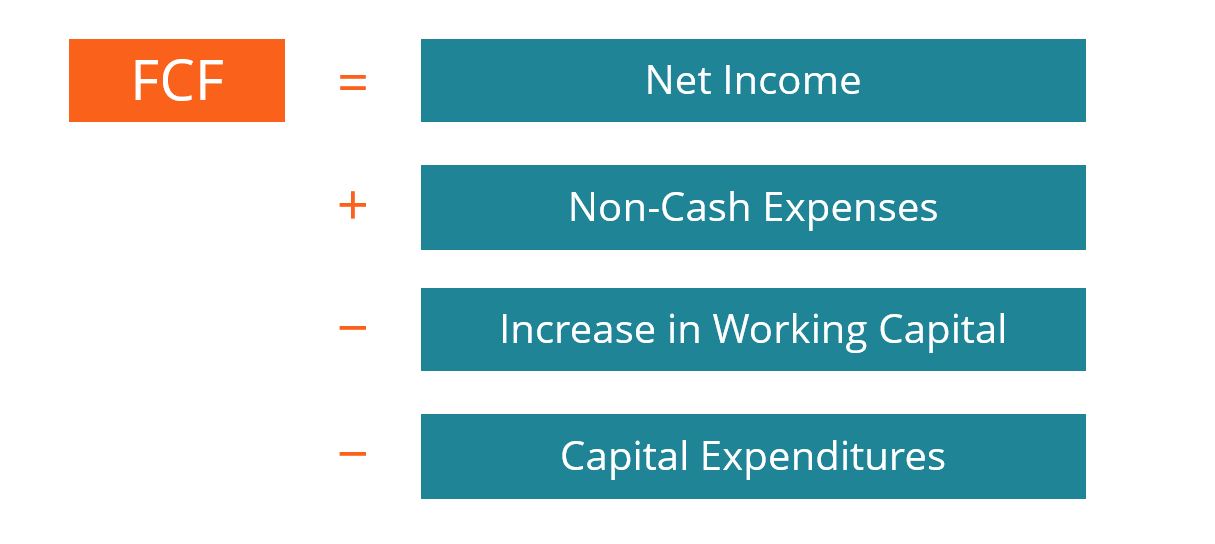

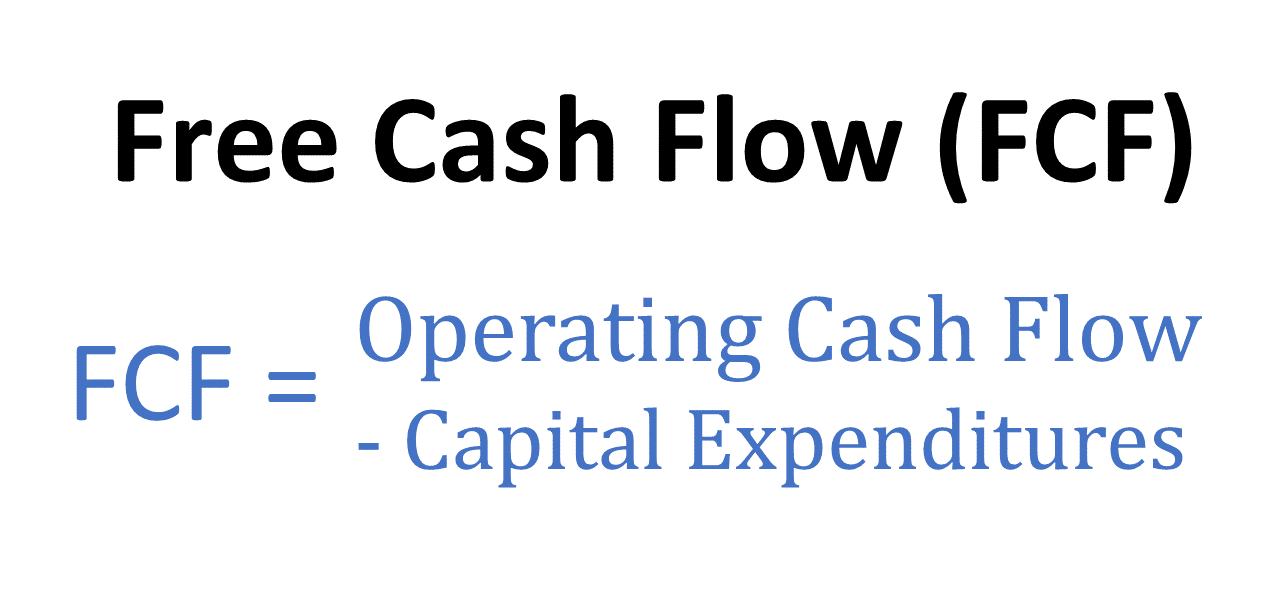

Free Operating Cash Flow Formula - The generic free cash flow (fcf) formula is equal to cash from operations minus capital. Free cash flow (fcf) is the amount of cash that a company has left after accounting for spending on operations and capital asset. What is the free cash flow (fcf) formula? Free cash flow, often abbreviate fcf, is an efficiency and liquidity ratio that calculates the how much more cash a company generates.

The generic free cash flow (fcf) formula is equal to cash from operations minus capital. What is the free cash flow (fcf) formula? Free cash flow, often abbreviate fcf, is an efficiency and liquidity ratio that calculates the how much more cash a company generates. Free cash flow (fcf) is the amount of cash that a company has left after accounting for spending on operations and capital asset.

Free cash flow, often abbreviate fcf, is an efficiency and liquidity ratio that calculates the how much more cash a company generates. What is the free cash flow (fcf) formula? Free cash flow (fcf) is the amount of cash that a company has left after accounting for spending on operations and capital asset. The generic free cash flow (fcf) formula is equal to cash from operations minus capital.

Free Cash Flow (FCF) Formula to Calculate and Interpret It

Free cash flow, often abbreviate fcf, is an efficiency and liquidity ratio that calculates the how much more cash a company generates. What is the free cash flow (fcf) formula? The generic free cash flow (fcf) formula is equal to cash from operations minus capital. Free cash flow (fcf) is the amount of cash that a company has left after.

Free cash flow (FCF) Equation and meaning [2025]

What is the free cash flow (fcf) formula? Free cash flow, often abbreviate fcf, is an efficiency and liquidity ratio that calculates the how much more cash a company generates. Free cash flow (fcf) is the amount of cash that a company has left after accounting for spending on operations and capital asset. The generic free cash flow (fcf) formula.

Free Cash Flow Plan Projections

What is the free cash flow (fcf) formula? Free cash flow, often abbreviate fcf, is an efficiency and liquidity ratio that calculates the how much more cash a company generates. Free cash flow (fcf) is the amount of cash that a company has left after accounting for spending on operations and capital asset. The generic free cash flow (fcf) formula.

Free Cash Flow (FCF) Formula

Free cash flow, often abbreviate fcf, is an efficiency and liquidity ratio that calculates the how much more cash a company generates. Free cash flow (fcf) is the amount of cash that a company has left after accounting for spending on operations and capital asset. What is the free cash flow (fcf) formula? The generic free cash flow (fcf) formula.

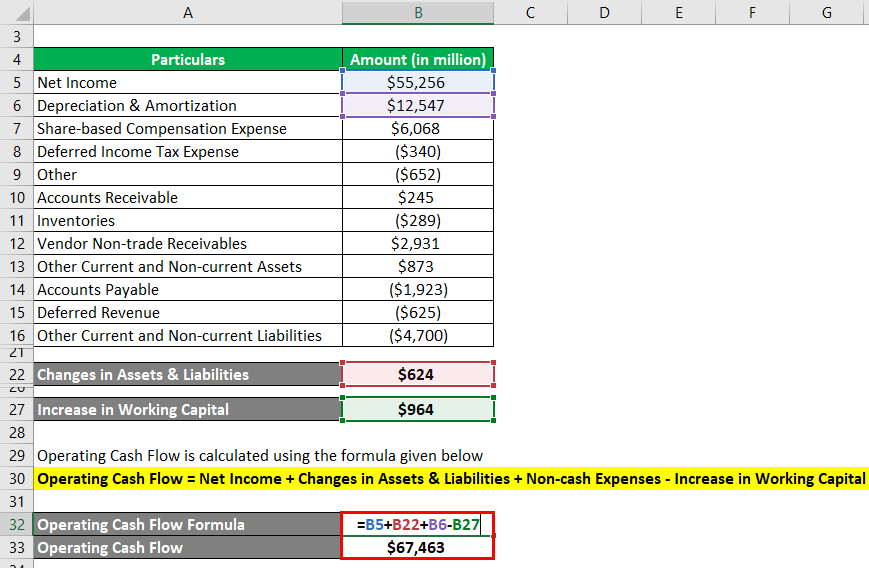

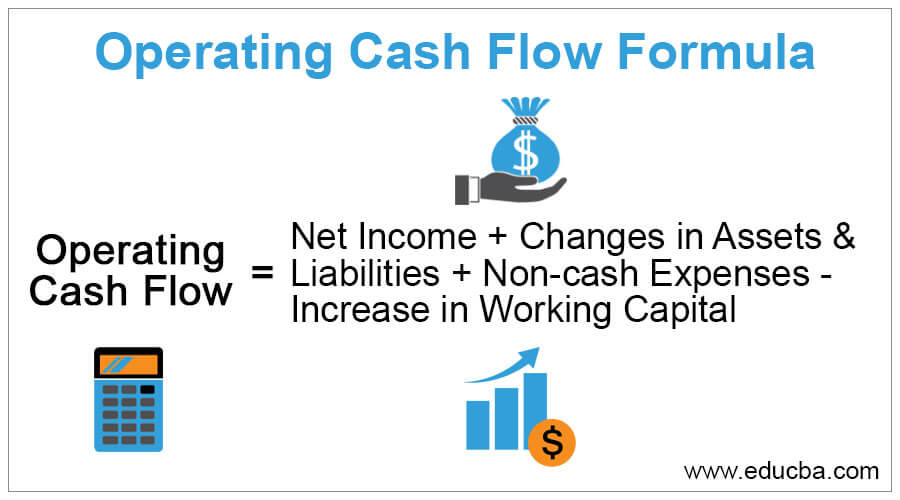

Operating Cash Flow Formula Examples with excel template & calculator

Free cash flow (fcf) is the amount of cash that a company has left after accounting for spending on operations and capital asset. The generic free cash flow (fcf) formula is equal to cash from operations minus capital. What is the free cash flow (fcf) formula? Free cash flow, often abbreviate fcf, is an efficiency and liquidity ratio that calculates.

Operating Cash Flow Formula Examples with excel template & calculator

The generic free cash flow (fcf) formula is equal to cash from operations minus capital. Free cash flow, often abbreviate fcf, is an efficiency and liquidity ratio that calculates the how much more cash a company generates. Free cash flow (fcf) is the amount of cash that a company has left after accounting for spending on operations and capital asset..

Free Cash Flow Formula

Free cash flow, often abbreviate fcf, is an efficiency and liquidity ratio that calculates the how much more cash a company generates. Free cash flow (fcf) is the amount of cash that a company has left after accounting for spending on operations and capital asset. The generic free cash flow (fcf) formula is equal to cash from operations minus capital..

(FCF) Free Cash Flow Formula and Calculation Financial

Free cash flow, often abbreviate fcf, is an efficiency and liquidity ratio that calculates the how much more cash a company generates. Free cash flow (fcf) is the amount of cash that a company has left after accounting for spending on operations and capital asset. What is the free cash flow (fcf) formula? The generic free cash flow (fcf) formula.

Free Cash Flow (FCF) Definition, Formula and How to Calculate Stock

Free cash flow (fcf) is the amount of cash that a company has left after accounting for spending on operations and capital asset. Free cash flow, often abbreviate fcf, is an efficiency and liquidity ratio that calculates the how much more cash a company generates. What is the free cash flow (fcf) formula? The generic free cash flow (fcf) formula.

Free Cash Flow What it is and how to calculate it Example and

Free cash flow (fcf) is the amount of cash that a company has left after accounting for spending on operations and capital asset. What is the free cash flow (fcf) formula? The generic free cash flow (fcf) formula is equal to cash from operations minus capital. Free cash flow, often abbreviate fcf, is an efficiency and liquidity ratio that calculates.

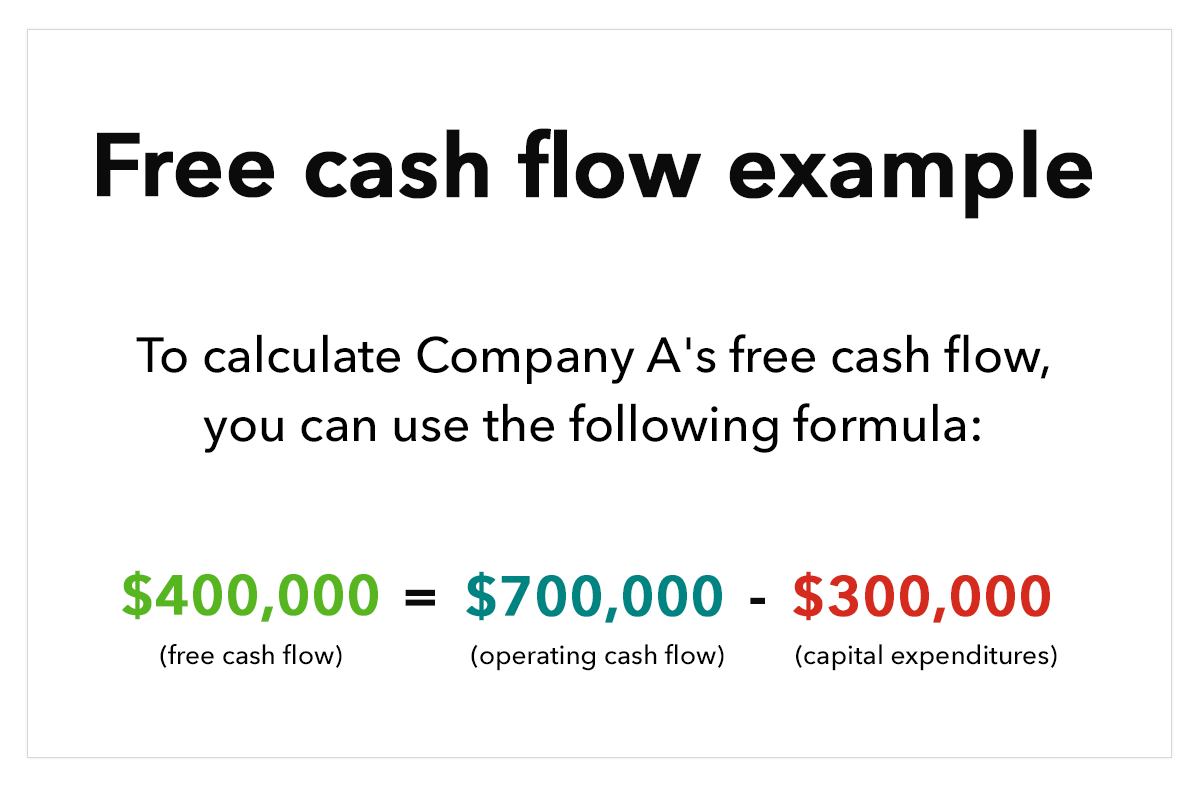

The Generic Free Cash Flow (Fcf) Formula Is Equal To Cash From Operations Minus Capital.

Free cash flow (fcf) is the amount of cash that a company has left after accounting for spending on operations and capital asset. What is the free cash flow (fcf) formula? Free cash flow, often abbreviate fcf, is an efficiency and liquidity ratio that calculates the how much more cash a company generates.

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-01-369e05314df242c3a81b8ac8ef135c52.jpg)

![Free cash flow (FCF) Equation and meaning [2025]](https://quickbooks.intuit.com/oidam/intuit/sbseg/en_us/Blog/Graphic/quickbooks_paymentseditorial9_graphic1b.jpg)