Freelance Expenses And Deductions - As a general rule of thumb, freelancers can write off many expenses including: The irs requirement for business tax.

As a general rule of thumb, freelancers can write off many expenses including: The irs requirement for business tax.

As a general rule of thumb, freelancers can write off many expenses including: The irs requirement for business tax.

Professional Tax for Freelancers in 2024

As a general rule of thumb, freelancers can write off many expenses including: The irs requirement for business tax.

Itemized Deductions For Freelancers FlyFin

As a general rule of thumb, freelancers can write off many expenses including: The irs requirement for business tax.

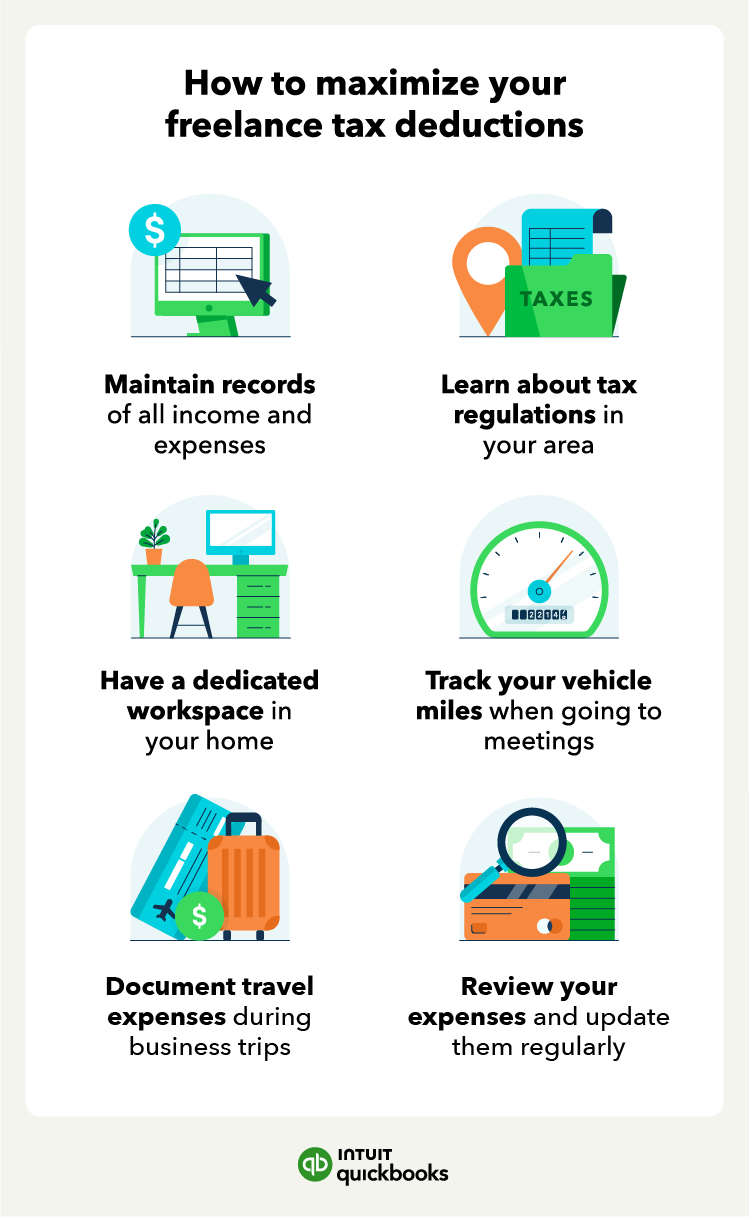

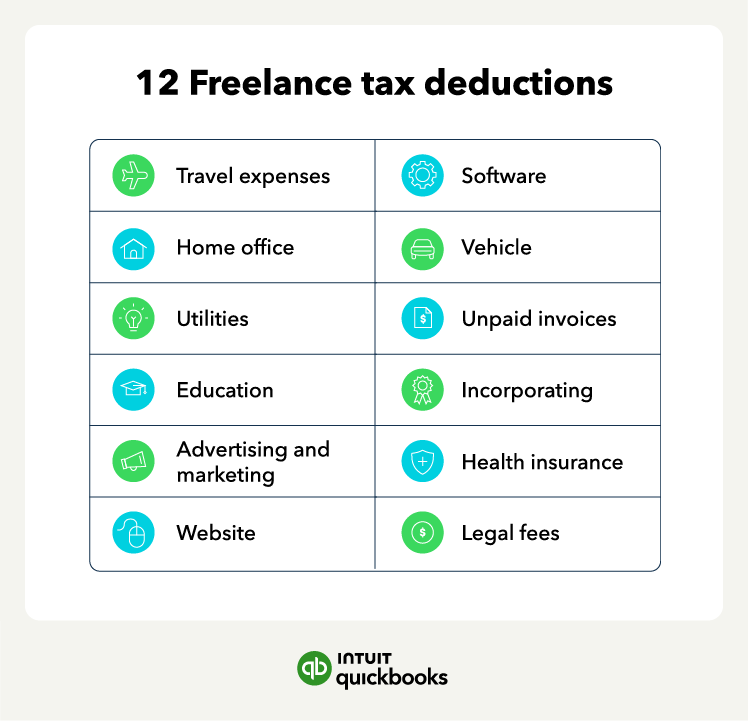

Tax deductions for freelancers for 2025 QuickBooks

As a general rule of thumb, freelancers can write off many expenses including: The irs requirement for business tax.

Tax deductions for freelancers QuickBooks

The irs requirement for business tax. As a general rule of thumb, freelancers can write off many expenses including:

Freelance Business Expenses, Explained

The irs requirement for business tax. As a general rule of thumb, freelancers can write off many expenses including:

Itemized Deductions For Freelancers FlyFin

The irs requirement for business tax. As a general rule of thumb, freelancers can write off many expenses including:

The 15 Best Freelancer Tax Deductions You Can Claim Moon Invoice

As a general rule of thumb, freelancers can write off many expenses including: The irs requirement for business tax.

What can you claim on tax? A guide for freelancers Rounded

As a general rule of thumb, freelancers can write off many expenses including: The irs requirement for business tax.

How to Deduct Moving Expenses From Your Taxes

As a general rule of thumb, freelancers can write off many expenses including: The irs requirement for business tax.

As A General Rule Of Thumb, Freelancers Can Write Off Many Expenses Including:

The irs requirement for business tax.