How To Calculate Free Cash Flow To Equity - The formula for free cash flow to equity is net income minus capital expenditures minus change in working capital plus net borrowing. Free cash flow to equity (fcfe) is a measure of how much cash is available to the equity shareholders of a company after all. Free cash flow to equity (fcfe) measures the cash remaining that belongs to equity holders after deducting operating. Free cash flow to equity (fcfe) is one of the discounted cash flow valuation approaches (along with fcff) to calculate the stock's fair.

Free cash flow to equity (fcfe) measures the cash remaining that belongs to equity holders after deducting operating. Free cash flow to equity (fcfe) is a measure of how much cash is available to the equity shareholders of a company after all. Free cash flow to equity (fcfe) is one of the discounted cash flow valuation approaches (along with fcff) to calculate the stock's fair. The formula for free cash flow to equity is net income minus capital expenditures minus change in working capital plus net borrowing.

Free cash flow to equity (fcfe) measures the cash remaining that belongs to equity holders after deducting operating. The formula for free cash flow to equity is net income minus capital expenditures minus change in working capital plus net borrowing. Free cash flow to equity (fcfe) is a measure of how much cash is available to the equity shareholders of a company after all. Free cash flow to equity (fcfe) is one of the discounted cash flow valuation approaches (along with fcff) to calculate the stock's fair.

Free Cash Flow to Equity (FCFE) Learn How to Calculate FCFE

Free cash flow to equity (fcfe) is one of the discounted cash flow valuation approaches (along with fcff) to calculate the stock's fair. The formula for free cash flow to equity is net income minus capital expenditures minus change in working capital plus net borrowing. Free cash flow to equity (fcfe) is a measure of how much cash is available.

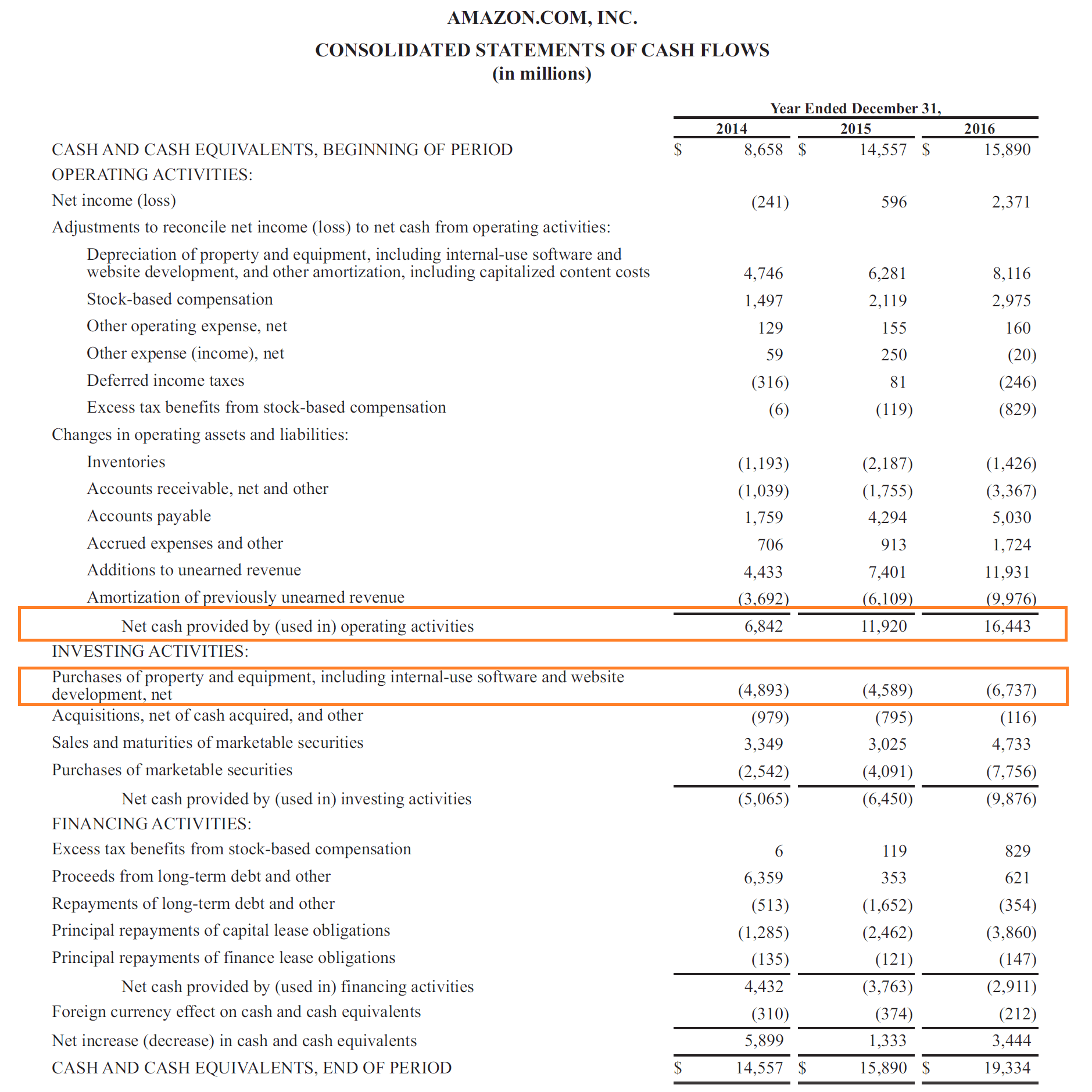

How to Calculate Free Cash Flow to Equity 11 Steps

Free cash flow to equity (fcfe) is one of the discounted cash flow valuation approaches (along with fcff) to calculate the stock's fair. Free cash flow to equity (fcfe) measures the cash remaining that belongs to equity holders after deducting operating. The formula for free cash flow to equity is net income minus capital expenditures minus change in working capital.

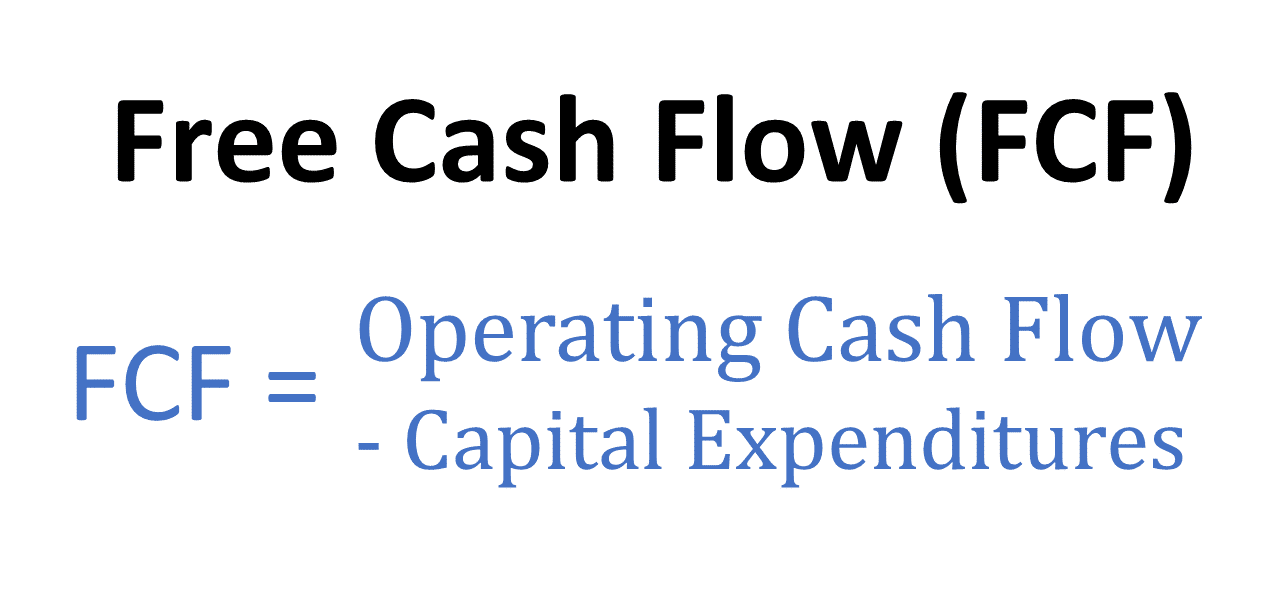

Free Cash Flow (FCF) Formula to Calculate and Interpret It

Free cash flow to equity (fcfe) is one of the discounted cash flow valuation approaches (along with fcff) to calculate the stock's fair. Free cash flow to equity (fcfe) measures the cash remaining that belongs to equity holders after deducting operating. Free cash flow to equity (fcfe) is a measure of how much cash is available to the equity shareholders.

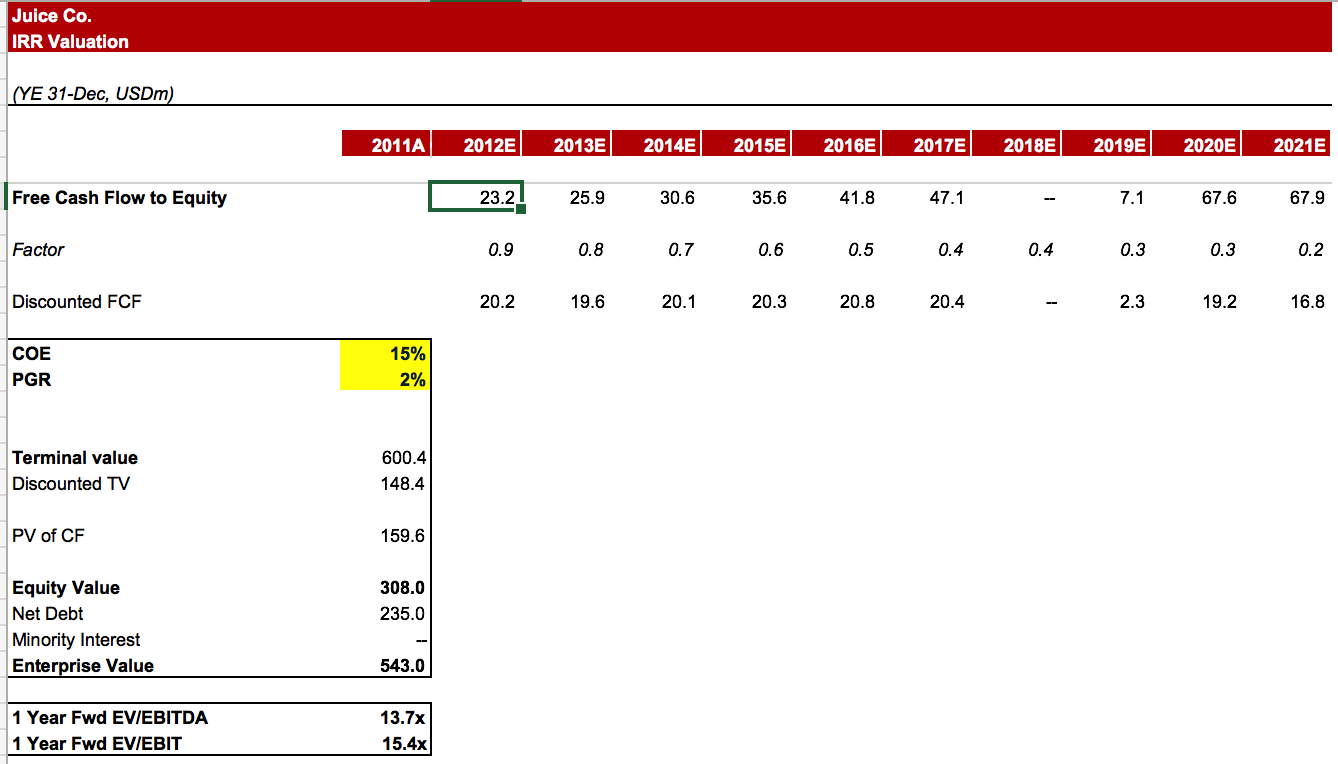

Free Cash Flow To Equity Model Template Wall Street Oasis

Free cash flow to equity (fcfe) is one of the discounted cash flow valuation approaches (along with fcff) to calculate the stock's fair. Free cash flow to equity (fcfe) measures the cash remaining that belongs to equity holders after deducting operating. The formula for free cash flow to equity is net income minus capital expenditures minus change in working capital.

Free Cash Flow (FCF) Formula

Free cash flow to equity (fcfe) is a measure of how much cash is available to the equity shareholders of a company after all. Free cash flow to equity (fcfe) measures the cash remaining that belongs to equity holders after deducting operating. The formula for free cash flow to equity is net income minus capital expenditures minus change in working.

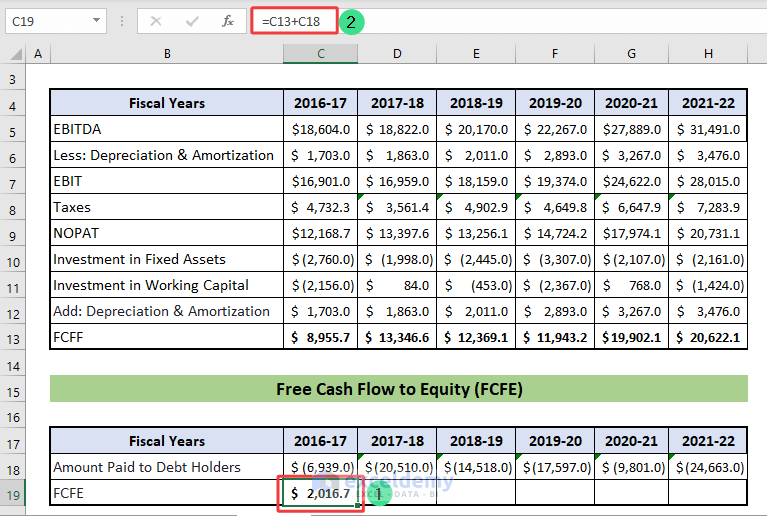

How to Calculate Free Cash Flow in Excel (to Firm and Equity)

The formula for free cash flow to equity is net income minus capital expenditures minus change in working capital plus net borrowing. Free cash flow to equity (fcfe) is a measure of how much cash is available to the equity shareholders of a company after all. Free cash flow to equity (fcfe) measures the cash remaining that belongs to equity.

Free Cash Flow To Equity What Is It, Formula, How To Calculate?

Free cash flow to equity (fcfe) is one of the discounted cash flow valuation approaches (along with fcff) to calculate the stock's fair. Free cash flow to equity (fcfe) measures the cash remaining that belongs to equity holders after deducting operating. Free cash flow to equity (fcfe) is a measure of how much cash is available to the equity shareholders.

Free Cash Flow (FCF) Definition, Formula and How to Calculate Stock

Free cash flow to equity (fcfe) is one of the discounted cash flow valuation approaches (along with fcff) to calculate the stock's fair. The formula for free cash flow to equity is net income minus capital expenditures minus change in working capital plus net borrowing. Free cash flow to equity (fcfe) measures the cash remaining that belongs to equity holders.

Free Cash Flow to Equity (FCFE) Formula and Example

Free cash flow to equity (fcfe) measures the cash remaining that belongs to equity holders after deducting operating. Free cash flow to equity (fcfe) is a measure of how much cash is available to the equity shareholders of a company after all. The formula for free cash flow to equity is net income minus capital expenditures minus change in working.

Free Cash Flow Plan Projections

The formula for free cash flow to equity is net income minus capital expenditures minus change in working capital plus net borrowing. Free cash flow to equity (fcfe) measures the cash remaining that belongs to equity holders after deducting operating. Free cash flow to equity (fcfe) is one of the discounted cash flow valuation approaches (along with fcff) to calculate.

Free Cash Flow To Equity (Fcfe) Is One Of The Discounted Cash Flow Valuation Approaches (Along With Fcff) To Calculate The Stock's Fair.

Free cash flow to equity (fcfe) measures the cash remaining that belongs to equity holders after deducting operating. The formula for free cash flow to equity is net income minus capital expenditures minus change in working capital plus net borrowing. Free cash flow to equity (fcfe) is a measure of how much cash is available to the equity shareholders of a company after all.

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-02-9523034ce2944e6ebef6f54272396bfc.jpg)

:max_bytes(150000):strip_icc()/FCFE_Final-d9ef0104bab14a9a8b622a6a9a60a3bb.png)