How To Calculate Npv Of Future Cash Flows - How to calculate net present value (npv) the net present value (npv) represents the discounted values of future cash inflows and. Net present value is a financial metric used to determine the value of an investment by calculating the difference. Calculate the npv (net present value) of an investment with an unlimited number of cash flows.

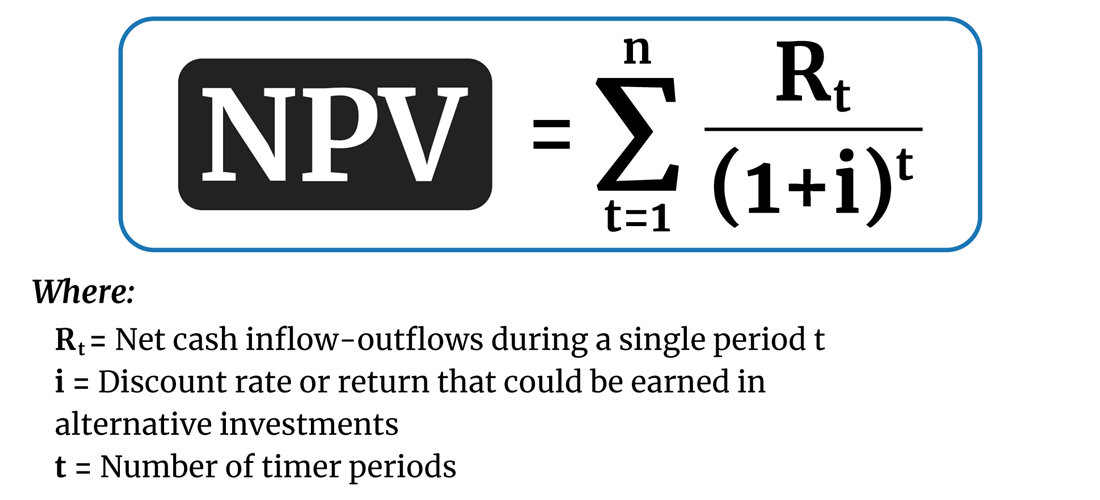

Net present value is a financial metric used to determine the value of an investment by calculating the difference. Calculate the npv (net present value) of an investment with an unlimited number of cash flows. How to calculate net present value (npv) the net present value (npv) represents the discounted values of future cash inflows and.

How to calculate net present value (npv) the net present value (npv) represents the discounted values of future cash inflows and. Net present value is a financial metric used to determine the value of an investment by calculating the difference. Calculate the npv (net present value) of an investment with an unlimited number of cash flows.

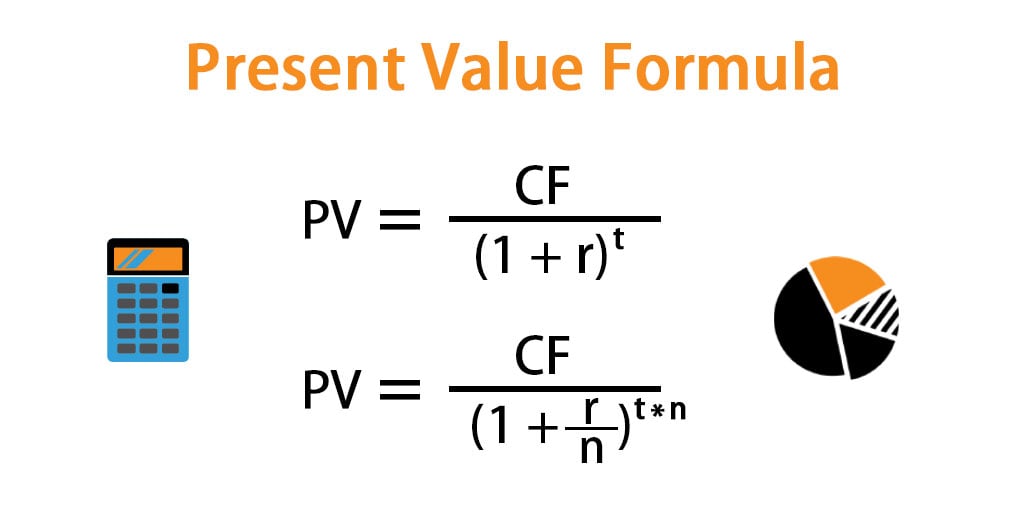

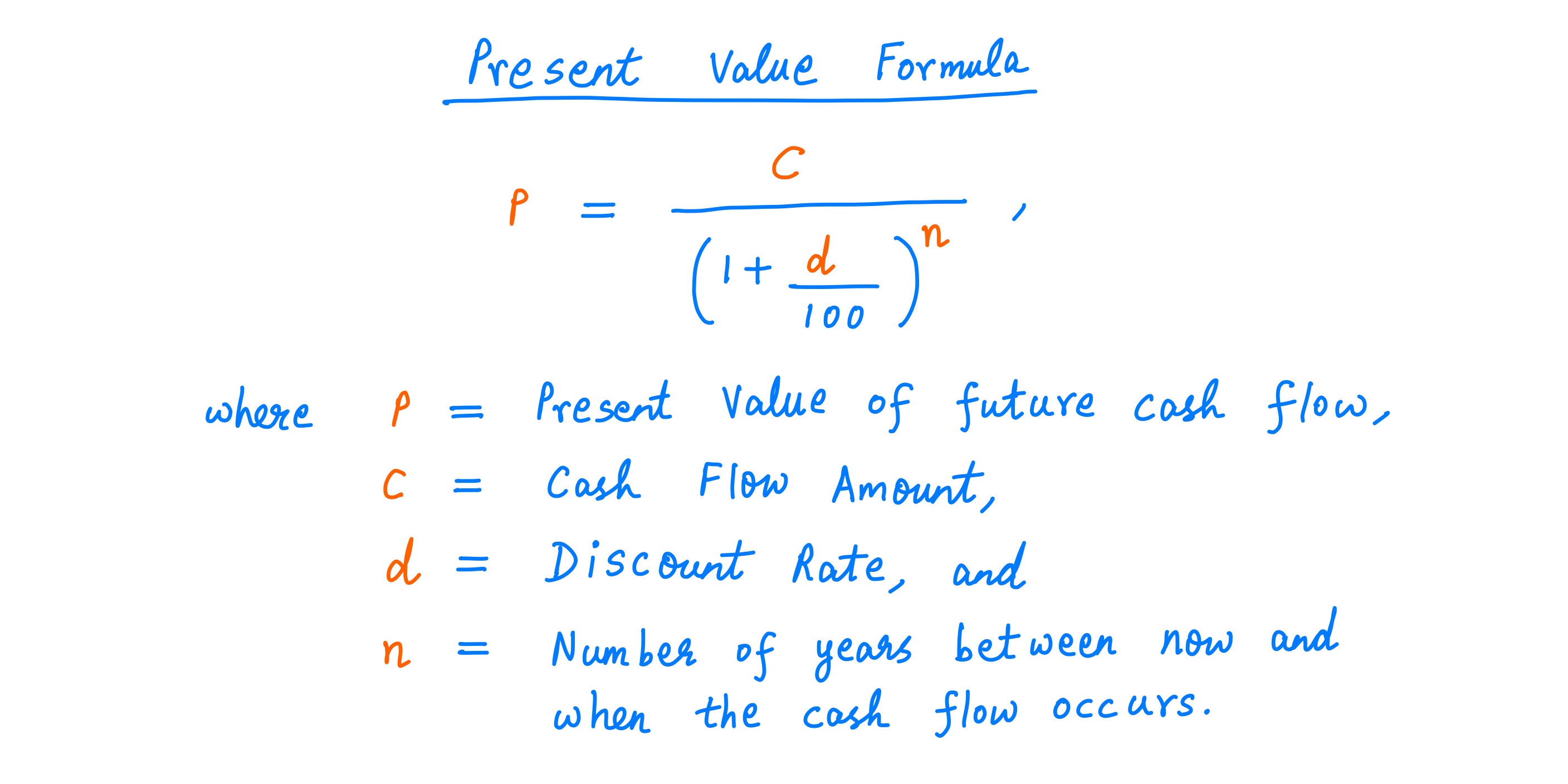

Present Value Formula

Calculate the npv (net present value) of an investment with an unlimited number of cash flows. How to calculate net present value (npv) the net present value (npv) represents the discounted values of future cash inflows and. Net present value is a financial metric used to determine the value of an investment by calculating the difference.

Net Present Value Calculator with Example + Steps

How to calculate net present value (npv) the net present value (npv) represents the discounted values of future cash inflows and. Calculate the npv (net present value) of an investment with an unlimited number of cash flows. Net present value is a financial metric used to determine the value of an investment by calculating the difference.

How to Calculate Present Value of Future Cash Flows in Excel

How to calculate net present value (npv) the net present value (npv) represents the discounted values of future cash inflows and. Calculate the npv (net present value) of an investment with an unlimited number of cash flows. Net present value is a financial metric used to determine the value of an investment by calculating the difference.

How to Use NPV in Excel to Calculate the Present Value of Future Cash

Net present value is a financial metric used to determine the value of an investment by calculating the difference. Calculate the npv (net present value) of an investment with an unlimited number of cash flows. How to calculate net present value (npv) the net present value (npv) represents the discounted values of future cash inflows and.

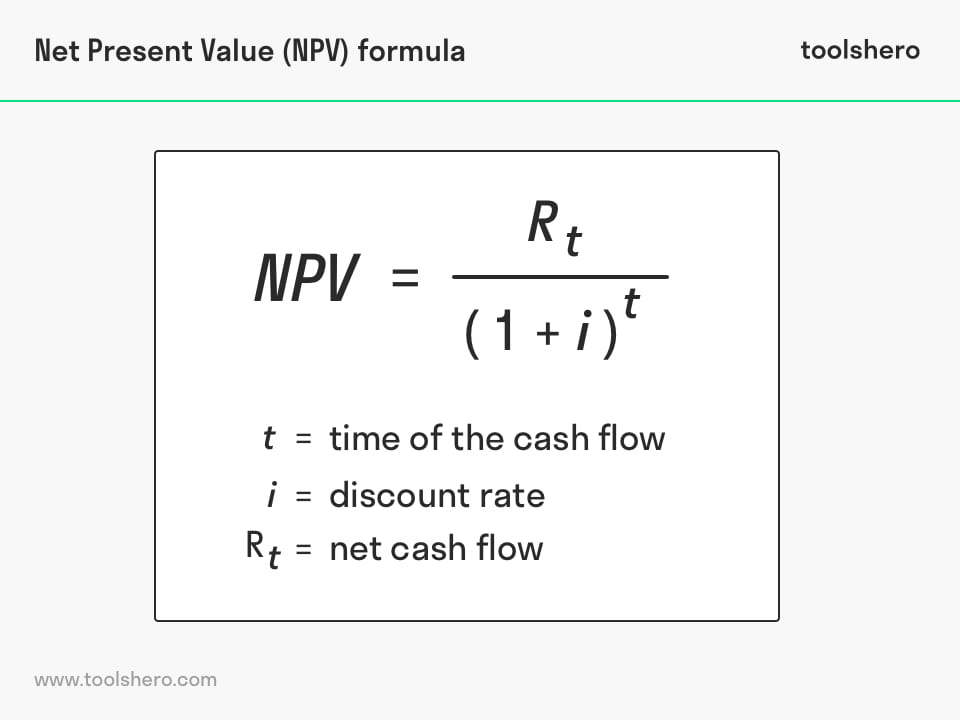

Net Present Value formula and example Toolshero

Net present value is a financial metric used to determine the value of an investment by calculating the difference. How to calculate net present value (npv) the net present value (npv) represents the discounted values of future cash inflows and. Calculate the npv (net present value) of an investment with an unlimited number of cash flows.

NPV Formula Learn How Net Present Value Really Works, Examples

Net present value is a financial metric used to determine the value of an investment by calculating the difference. Calculate the npv (net present value) of an investment with an unlimited number of cash flows. How to calculate net present value (npv) the net present value (npv) represents the discounted values of future cash inflows and.

4 Ways To Calculate NPV Wikihow Innovator

Calculate the npv (net present value) of an investment with an unlimited number of cash flows. Net present value is a financial metric used to determine the value of an investment by calculating the difference. How to calculate net present value (npv) the net present value (npv) represents the discounted values of future cash inflows and.

How to Calculate Future Value of Uneven Cash Flows in Excel

How to calculate net present value (npv) the net present value (npv) represents the discounted values of future cash inflows and. Calculate the npv (net present value) of an investment with an unlimited number of cash flows. Net present value is a financial metric used to determine the value of an investment by calculating the difference.

How to Calculate Present Value of Future Cash Flows in Excel

Net present value is a financial metric used to determine the value of an investment by calculating the difference. Calculate the npv (net present value) of an investment with an unlimited number of cash flows. How to calculate net present value (npv) the net present value (npv) represents the discounted values of future cash inflows and.

Continuous Money Flow Total and Present Value Wilson Whamess

Calculate the npv (net present value) of an investment with an unlimited number of cash flows. Net present value is a financial metric used to determine the value of an investment by calculating the difference. How to calculate net present value (npv) the net present value (npv) represents the discounted values of future cash inflows and.

Calculate The Npv (Net Present Value) Of An Investment With An Unlimited Number Of Cash Flows.

Net present value is a financial metric used to determine the value of an investment by calculating the difference. How to calculate net present value (npv) the net present value (npv) represents the discounted values of future cash inflows and.

:max_bytes(150000):strip_icc()/ScreenShot2019-06-20at10.46.59AM-f30499c2303c44a5a883c6c1e676569b.png)