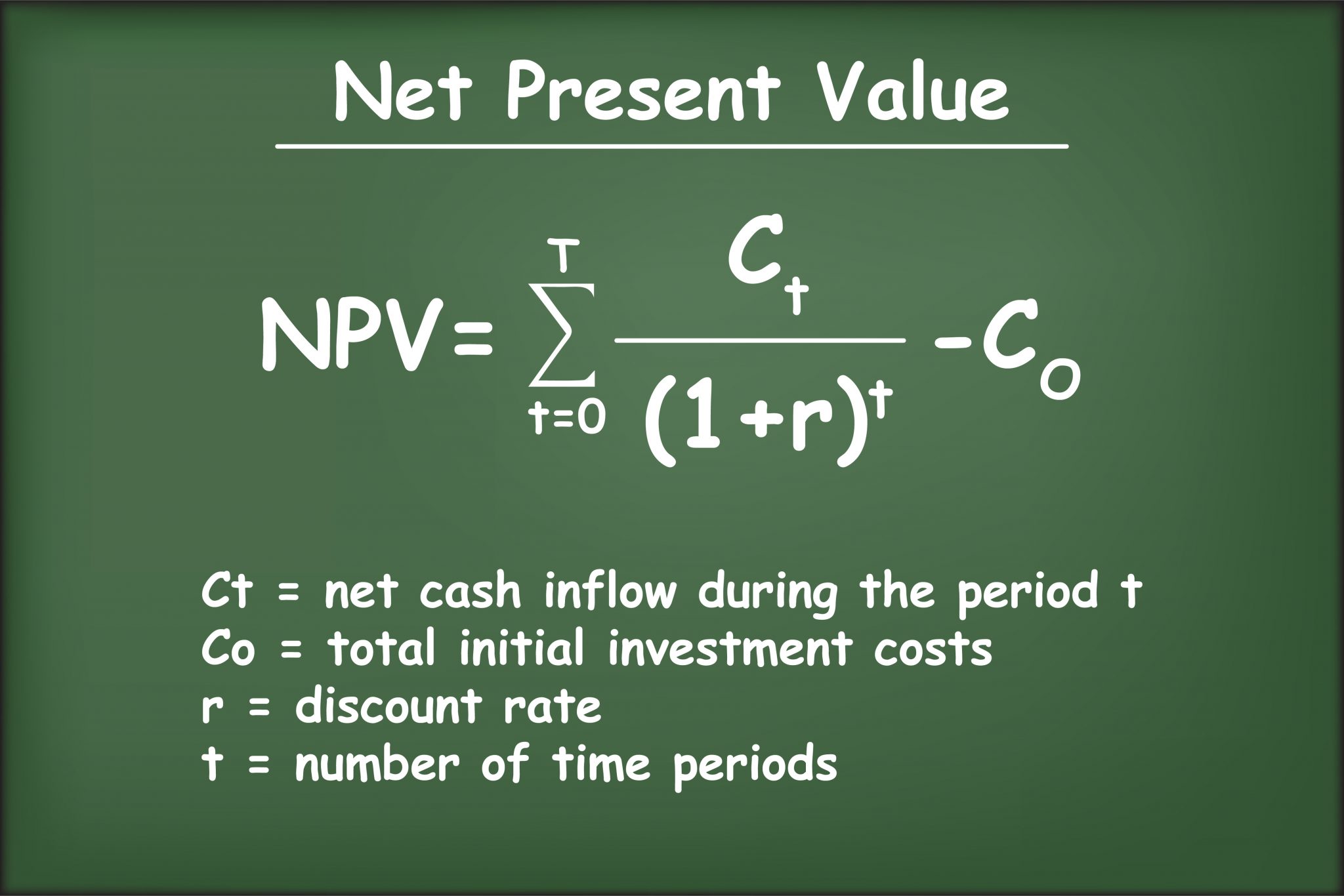

How To Do Npv On Financial Calculator - Net present value (npv) is a capital budgeting method used to determine the profitability of an investment. Calculate the npv (net present value) of an investment with an unlimited number of cash flows.

Calculate the npv (net present value) of an investment with an unlimited number of cash flows. Net present value (npv) is a capital budgeting method used to determine the profitability of an investment.

Calculate the npv (net present value) of an investment with an unlimited number of cash flows. Net present value (npv) is a capital budgeting method used to determine the profitability of an investment.

Net Present Value (NPV) What It Means and Steps to Calculate It (2022)

Net present value (npv) is a capital budgeting method used to determine the profitability of an investment. Calculate the npv (net present value) of an investment with an unlimited number of cash flows.

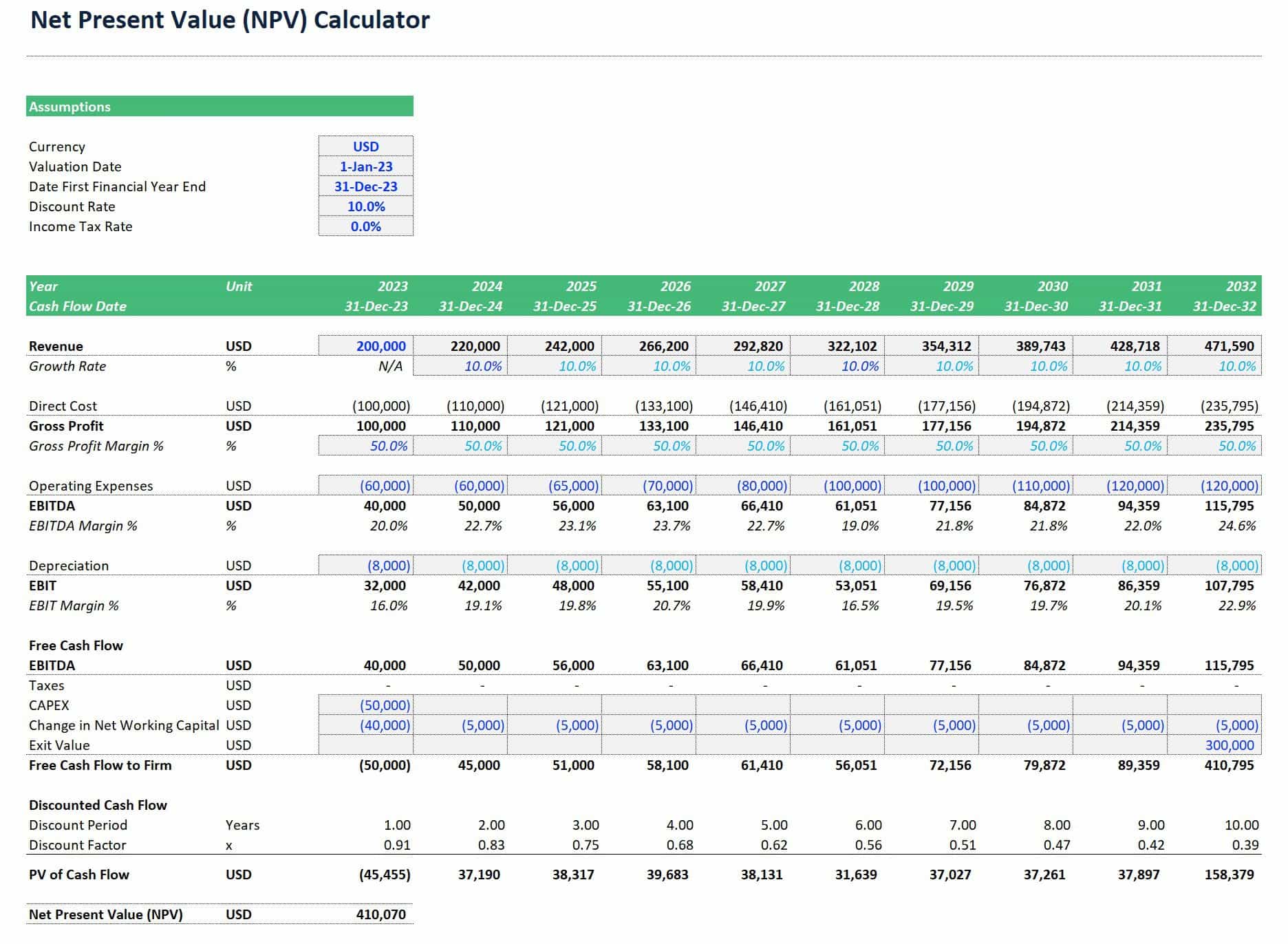

Net Present Value Calculator

Calculate the npv (net present value) of an investment with an unlimited number of cash flows. Net present value (npv) is a capital budgeting method used to determine the profitability of an investment.

Net Present Value (NPV) How to calculate via example and using SHARP

Calculate the npv (net present value) of an investment with an unlimited number of cash flows. Net present value (npv) is a capital budgeting method used to determine the profitability of an investment.

Net Present Value Calculating and Using Payment Savvy

Net present value (npv) is a capital budgeting method used to determine the profitability of an investment. Calculate the npv (net present value) of an investment with an unlimited number of cash flows.

Net Present Value Excel Template Sample Professional Template

Net present value (npv) is a capital budgeting method used to determine the profitability of an investment. Calculate the npv (net present value) of an investment with an unlimited number of cash flows.

Net Present Value Calculator Excel Template Calculate Investments

Net present value (npv) is a capital budgeting method used to determine the profitability of an investment. Calculate the npv (net present value) of an investment with an unlimited number of cash flows.

NPV or net present value in HP 10bii financial calculator HP 10bii

Calculate the npv (net present value) of an investment with an unlimited number of cash flows. Net present value (npv) is a capital budgeting method used to determine the profitability of an investment.

Net Present Value Calculator

Calculate the npv (net present value) of an investment with an unlimited number of cash flows. Net present value (npv) is a capital budgeting method used to determine the profitability of an investment.

Net Present Value (NPV) What It Means and Steps to Calculate It (2025)

Calculate the npv (net present value) of an investment with an unlimited number of cash flows. Net present value (npv) is a capital budgeting method used to determine the profitability of an investment.

Net Present Value (Npv) Is A Capital Budgeting Method Used To Determine The Profitability Of An Investment.

Calculate the npv (net present value) of an investment with an unlimited number of cash flows.

:max_bytes(150000):strip_icc()/dotdash_Final_Net_Present_Value_NPV_Jul_2020-01-eea50904f90744e4b1172a9ef38df13f.jpg)

:max_bytes(150000):strip_icc()/ScreenShot2019-06-20at10.46.59AM-f30499c2303c44a5a883c6c1e676569b.png)