How To Keep Track Of Sales Tax - You’ve got plenty of things to keep track of in your business: Revenue, expenses, inventory, to name just a few. Whenever you make a sale and collect sales tax, you must record two things: For organized records, create a sales tax payable. Quicken tracks sales tax by associating tax categories with transactions and generating reports that summarize taxable and non. I have been encouraged to track the sales tax that i pay throughout the year so i can deduct it from my taxable income.

I have been encouraged to track the sales tax that i pay throughout the year so i can deduct it from my taxable income. Quicken tracks sales tax by associating tax categories with transactions and generating reports that summarize taxable and non. You’ve got plenty of things to keep track of in your business: Revenue, expenses, inventory, to name just a few. Whenever you make a sale and collect sales tax, you must record two things: For organized records, create a sales tax payable.

For organized records, create a sales tax payable. Whenever you make a sale and collect sales tax, you must record two things: I have been encouraged to track the sales tax that i pay throughout the year so i can deduct it from my taxable income. You’ve got plenty of things to keep track of in your business: Revenue, expenses, inventory, to name just a few. Quicken tracks sales tax by associating tax categories with transactions and generating reports that summarize taxable and non.

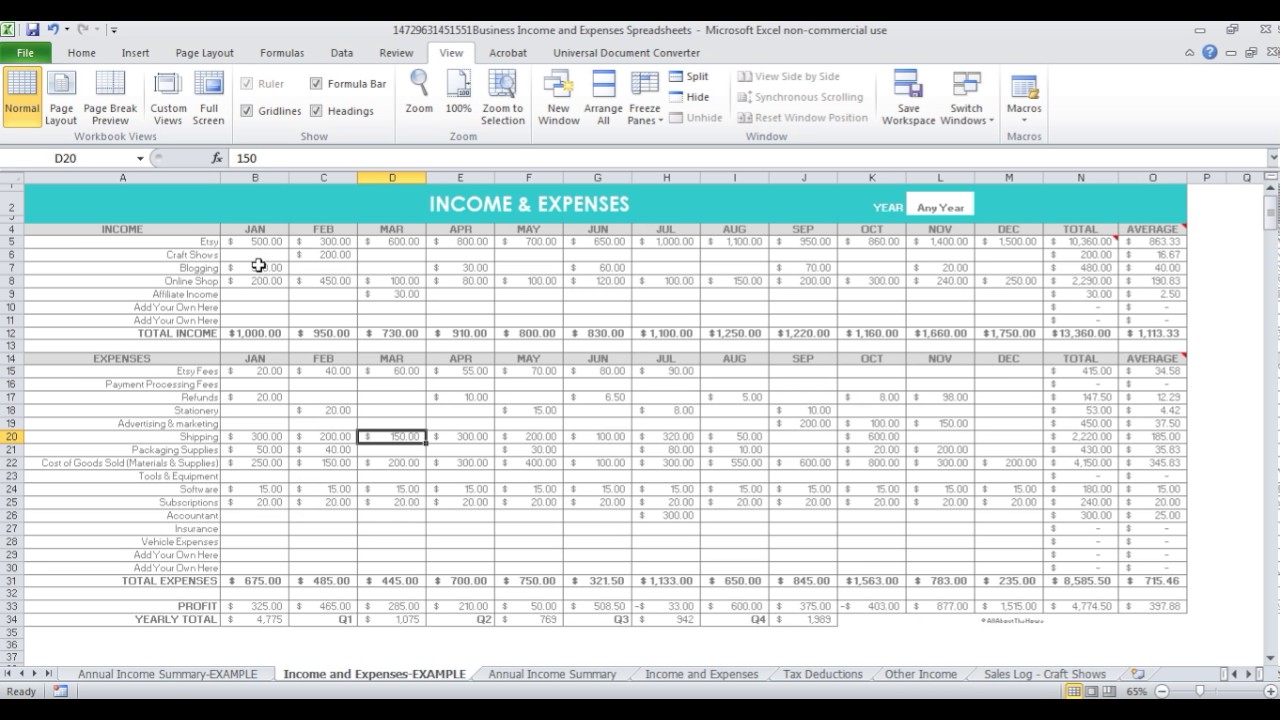

Tax Template Excel

Whenever you make a sale and collect sales tax, you must record two things: For organized records, create a sales tax payable. Quicken tracks sales tax by associating tax categories with transactions and generating reports that summarize taxable and non. I have been encouraged to track the sales tax that i pay throughout the year so i can deduct it.

Invoice Tracker Excel Template

You’ve got plenty of things to keep track of in your business: Revenue, expenses, inventory, to name just a few. Whenever you make a sale and collect sales tax, you must record two things: For organized records, create a sales tax payable. Quicken tracks sales tax by associating tax categories with transactions and generating reports that summarize taxable and non.

Simple spreadsheets to keep track of business and expenses for

I have been encouraged to track the sales tax that i pay throughout the year so i can deduct it from my taxable income. Quicken tracks sales tax by associating tax categories with transactions and generating reports that summarize taxable and non. You’ve got plenty of things to keep track of in your business: Revenue, expenses, inventory, to name just.

Business Tax Organizer Template

For organized records, create a sales tax payable. You’ve got plenty of things to keep track of in your business: Whenever you make a sale and collect sales tax, you must record two things: I have been encouraged to track the sales tax that i pay throughout the year so i can deduct it from my taxable income. Quicken tracks.

Keeper Tax Customers

Whenever you make a sale and collect sales tax, you must record two things: You’ve got plenty of things to keep track of in your business: For organized records, create a sales tax payable. I have been encouraged to track the sales tax that i pay throughout the year so i can deduct it from my taxable income. Revenue, expenses,.

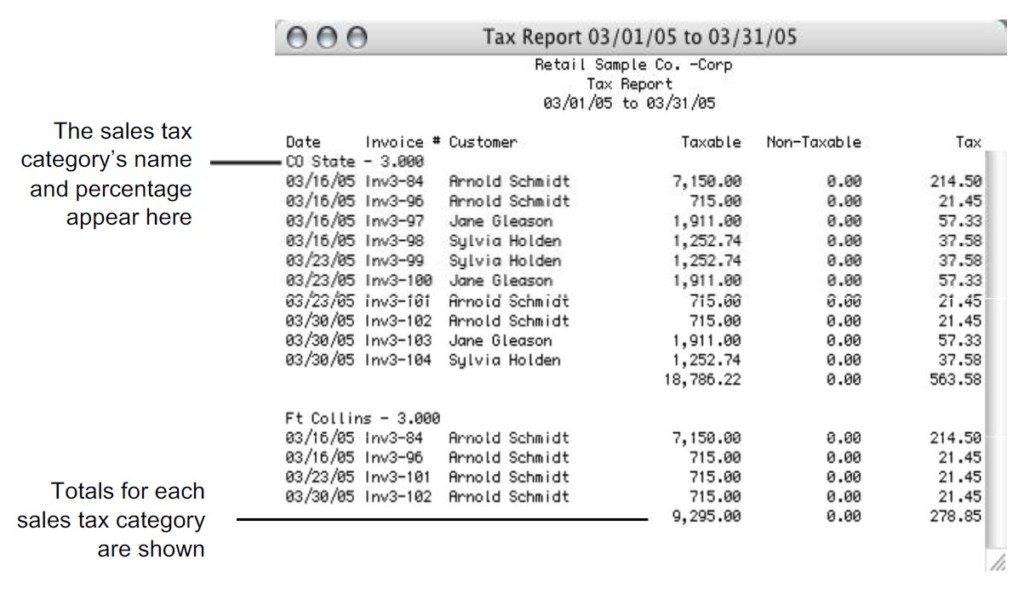

How to Create Sales Tax Reports CheckMark Knowledge Base

I have been encouraged to track the sales tax that i pay throughout the year so i can deduct it from my taxable income. Whenever you make a sale and collect sales tax, you must record two things: Revenue, expenses, inventory, to name just a few. You’ve got plenty of things to keep track of in your business: For organized.

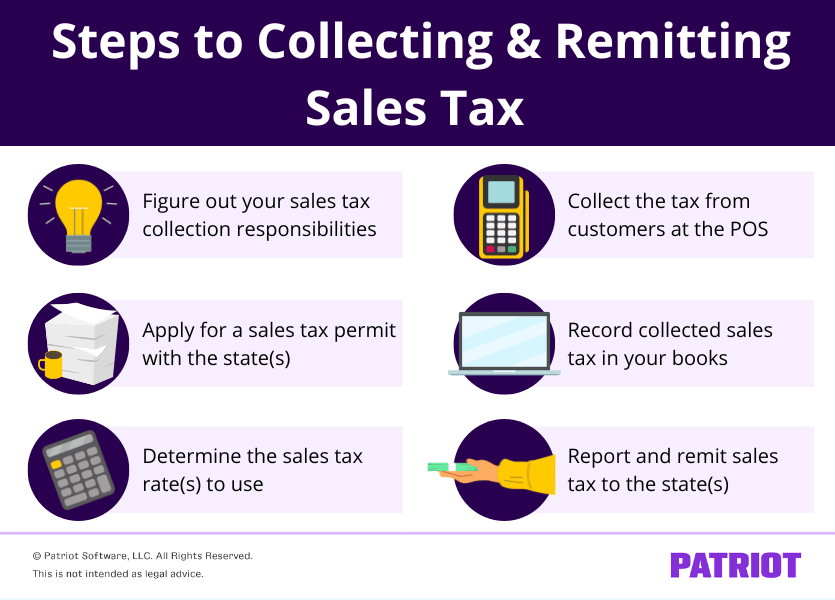

How to Pay Sales Tax for Small Business Guide + Chart

Quicken tracks sales tax by associating tax categories with transactions and generating reports that summarize taxable and non. Revenue, expenses, inventory, to name just a few. Whenever you make a sale and collect sales tax, you must record two things: For organized records, create a sales tax payable. You’ve got plenty of things to keep track of in your business:

Use Tax Tracker Excel Template Google Sheets Instant Download Etsy

You’ve got plenty of things to keep track of in your business: For organized records, create a sales tax payable. Quicken tracks sales tax by associating tax categories with transactions and generating reports that summarize taxable and non. Whenever you make a sale and collect sales tax, you must record two things: I have been encouraged to track the sales.

Sales Tax Spreadsheet Templates

I have been encouraged to track the sales tax that i pay throughout the year so i can deduct it from my taxable income. Whenever you make a sale and collect sales tax, you must record two things: Quicken tracks sales tax by associating tax categories with transactions and generating reports that summarize taxable and non. Revenue, expenses, inventory, to.

Bookkeeping and Tax Excel & Google Sheets Template

For organized records, create a sales tax payable. You’ve got plenty of things to keep track of in your business: I have been encouraged to track the sales tax that i pay throughout the year so i can deduct it from my taxable income. Whenever you make a sale and collect sales tax, you must record two things: Revenue, expenses,.

For Organized Records, Create A Sales Tax Payable.

Quicken tracks sales tax by associating tax categories with transactions and generating reports that summarize taxable and non. Whenever you make a sale and collect sales tax, you must record two things: I have been encouraged to track the sales tax that i pay throughout the year so i can deduct it from my taxable income. You’ve got plenty of things to keep track of in your business: