How To Report Freelance Income - Obtain a copy of irs schedule c (form. Find forms, keep records, deduct expenses and file taxes for gig work. To report your freelance income on a tax return, you must fill out schedules c and se for form 1040. Do you earn income as a rideshare driver, rental host or online seller?

To report your freelance income on a tax return, you must fill out schedules c and se for form 1040. Obtain a copy of irs schedule c (form. Do you earn income as a rideshare driver, rental host or online seller? Find forms, keep records, deduct expenses and file taxes for gig work.

Do you earn income as a rideshare driver, rental host or online seller? Obtain a copy of irs schedule c (form. To report your freelance income on a tax return, you must fill out schedules c and se for form 1040. Find forms, keep records, deduct expenses and file taxes for gig work.

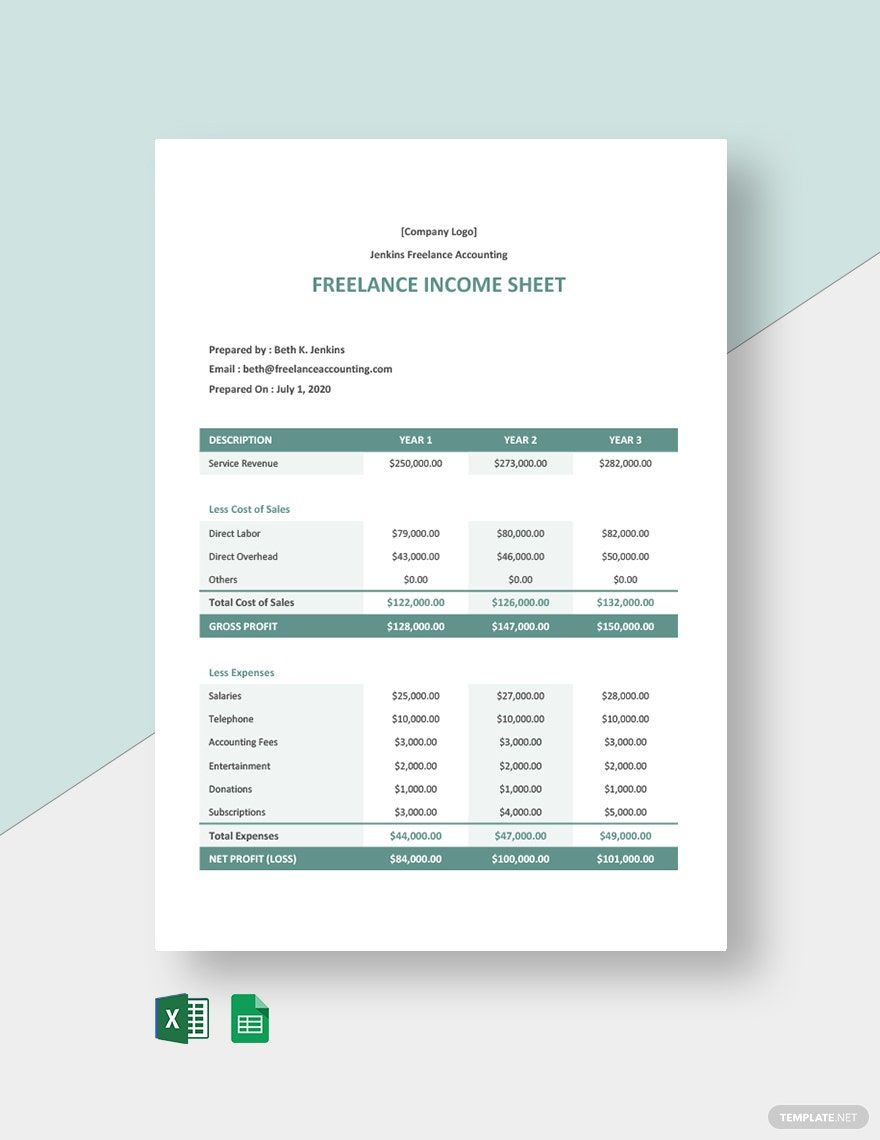

Editable Freelancer Sheet Templates in Google Docs to Download

To report your freelance income on a tax return, you must fill out schedules c and se for form 1040. Do you earn income as a rideshare driver, rental host or online seller? Obtain a copy of irs schedule c (form. Find forms, keep records, deduct expenses and file taxes for gig work.

Laura Gariepy, MBA on LinkedIn How to Report Freelance and Pay

Find forms, keep records, deduct expenses and file taxes for gig work. Do you earn income as a rideshare driver, rental host or online seller? Obtain a copy of irs schedule c (form. To report your freelance income on a tax return, you must fill out schedules c and se for form 1040.

Learn How To Calculate Net for Freelancers In 2025 Invoice Fly

To report your freelance income on a tax return, you must fill out schedules c and se for form 1040. Find forms, keep records, deduct expenses and file taxes for gig work. Do you earn income as a rideshare driver, rental host or online seller? Obtain a copy of irs schedule c (form.

57 Stunning Freelance Statistics 2024 Earnings & the Future

Obtain a copy of irs schedule c (form. Find forms, keep records, deduct expenses and file taxes for gig work. Do you earn income as a rideshare driver, rental host or online seller? To report your freelance income on a tax return, you must fill out schedules c and se for form 1040.

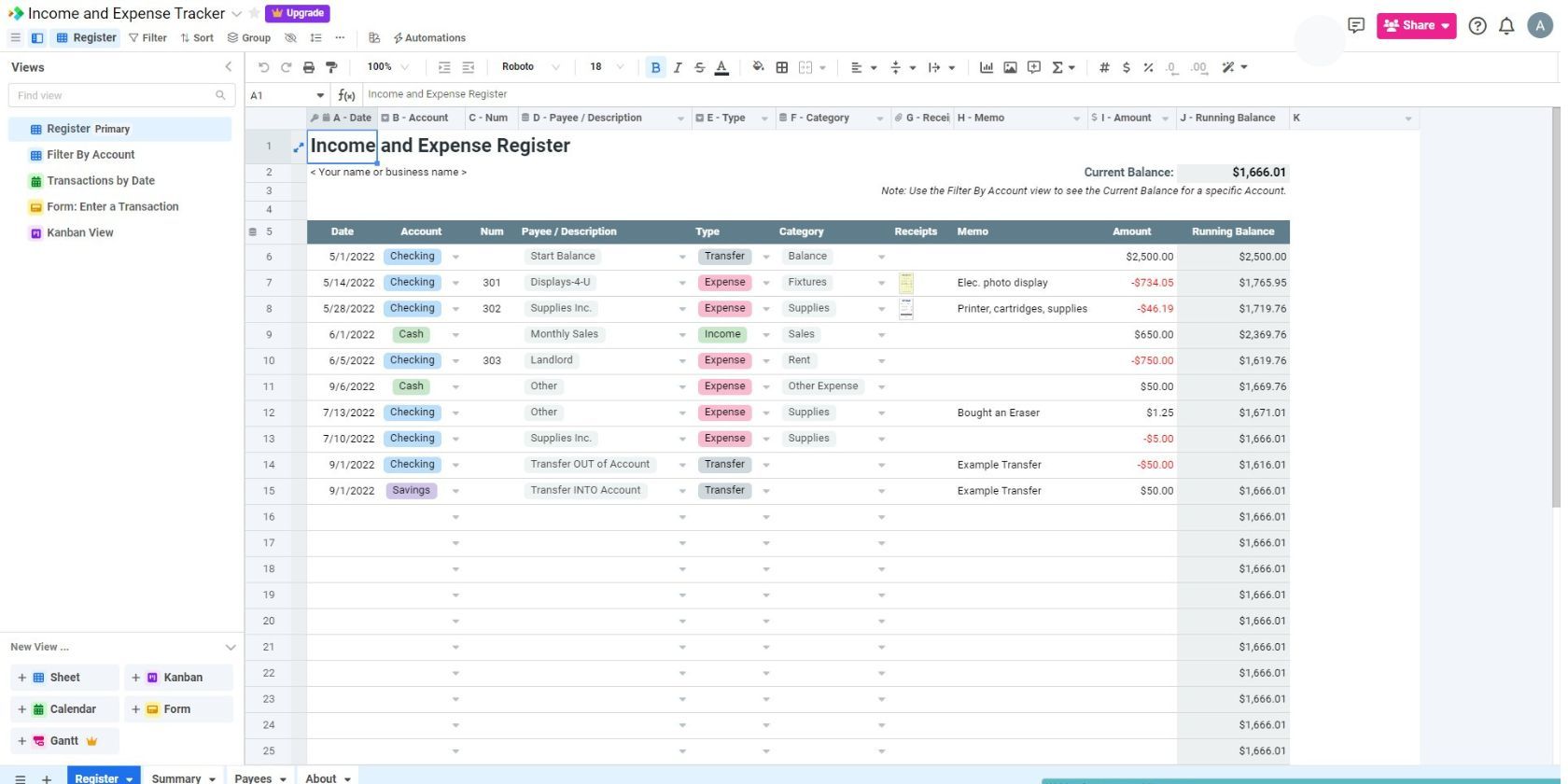

8 Free Tools and Templates for Calculating Your Freelance

To report your freelance income on a tax return, you must fill out schedules c and se for form 1040. Find forms, keep records, deduct expenses and file taxes for gig work. Obtain a copy of irs schedule c (form. Do you earn income as a rideshare driver, rental host or online seller?

How to Report Freelance Without a 1099 Simplified Filing

To report your freelance income on a tax return, you must fill out schedules c and se for form 1040. Find forms, keep records, deduct expenses and file taxes for gig work. Obtain a copy of irs schedule c (form. Do you earn income as a rideshare driver, rental host or online seller?

How to report freelance on your tax return? YouTube

Find forms, keep records, deduct expenses and file taxes for gig work. Do you earn income as a rideshare driver, rental host or online seller? To report your freelance income on a tax return, you must fill out schedules c and se for form 1040. Obtain a copy of irs schedule c (form.

Freelance Business Explained

To report your freelance income on a tax return, you must fill out schedules c and se for form 1040. Find forms, keep records, deduct expenses and file taxes for gig work. Do you earn income as a rideshare driver, rental host or online seller? Obtain a copy of irs schedule c (form.

Freelance Report r/graphic_design

To report your freelance income on a tax return, you must fill out schedules c and se for form 1040. Find forms, keep records, deduct expenses and file taxes for gig work. Obtain a copy of irs schedule c (form. Do you earn income as a rideshare driver, rental host or online seller?

Freelance Projection Free Template Experiencing eLearning

Obtain a copy of irs schedule c (form. Find forms, keep records, deduct expenses and file taxes for gig work. Do you earn income as a rideshare driver, rental host or online seller? To report your freelance income on a tax return, you must fill out schedules c and se for form 1040.

Find Forms, Keep Records, Deduct Expenses And File Taxes For Gig Work.

Do you earn income as a rideshare driver, rental host or online seller? To report your freelance income on a tax return, you must fill out schedules c and se for form 1040. Obtain a copy of irs schedule c (form.