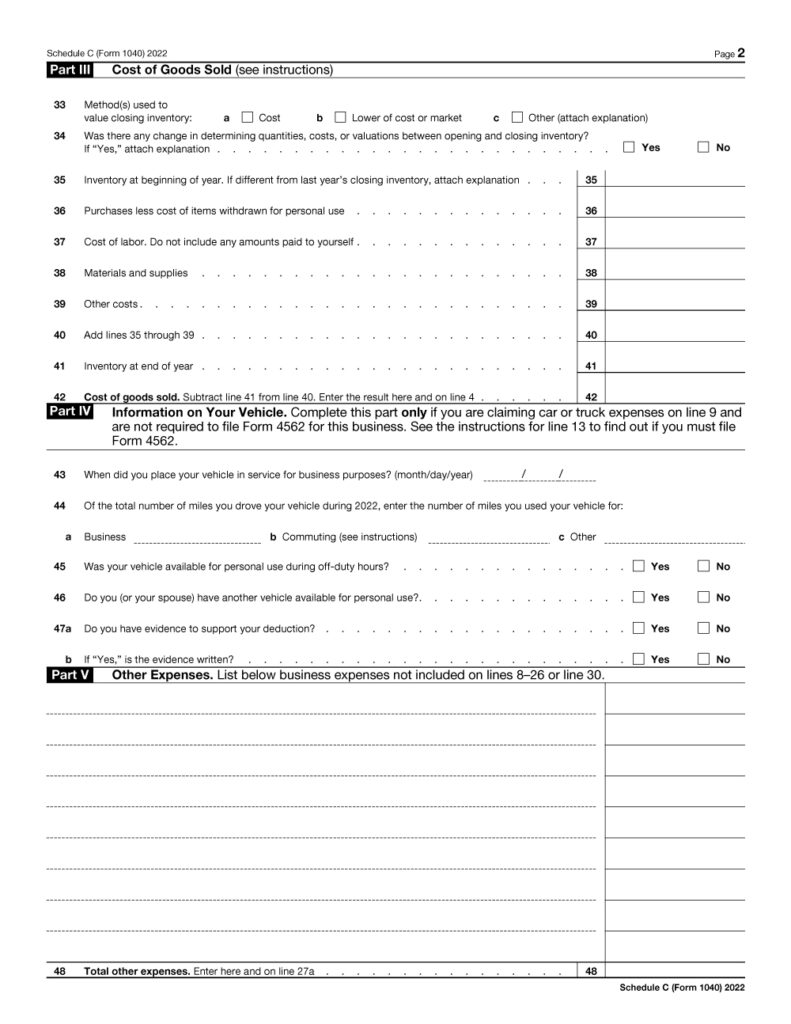

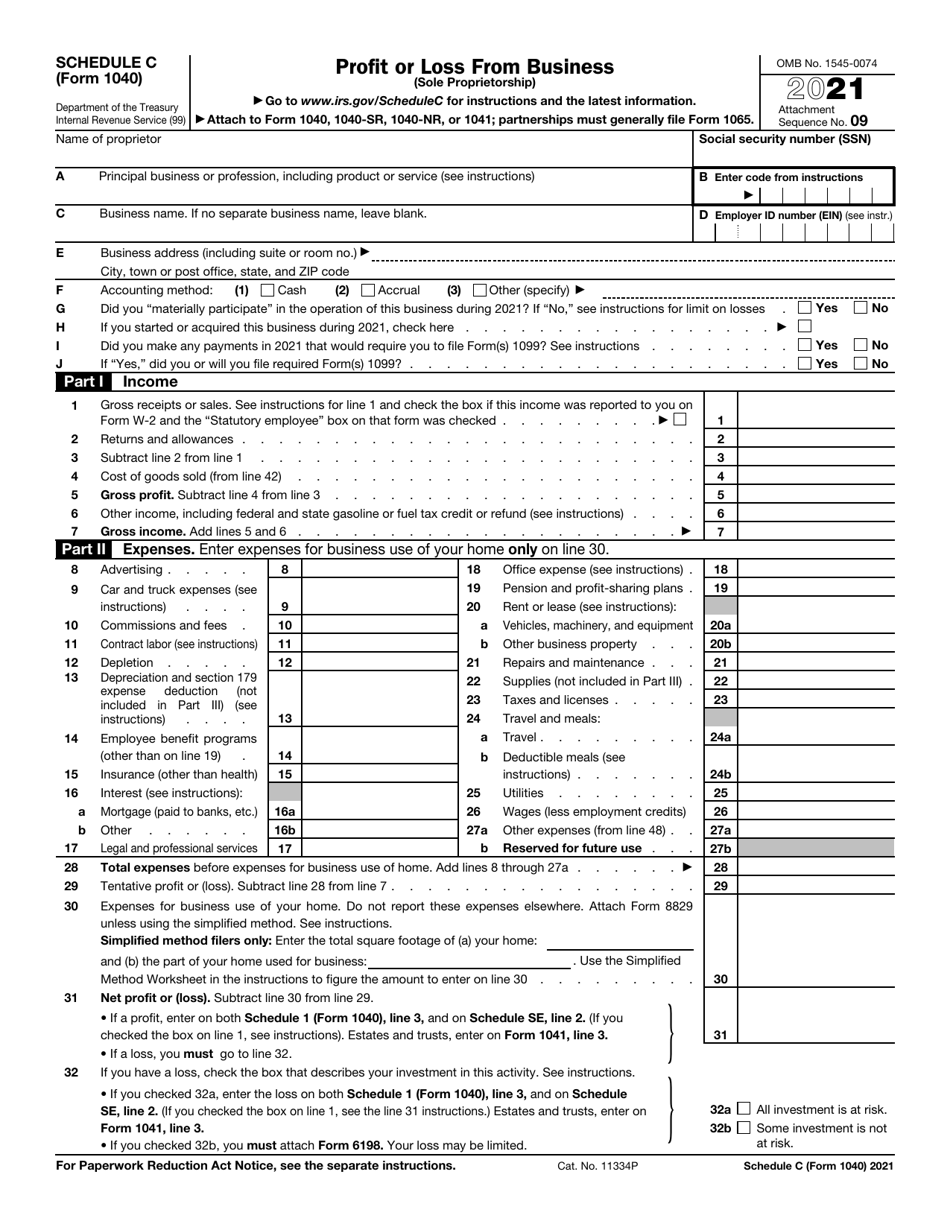

Irs Tax Forms 2023 Printable Schedule C - Accurate completion of this schedule. Use schedule c to report income or loss from a business or profession in which you were the sole proprietor. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. Schedule c (form 1040) is used to report income or loss from a business operated as a sole proprietorship. This essential form also helps.

Use schedule c to report income or loss from a business or profession in which you were the sole proprietor. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. This essential form also helps. Accurate completion of this schedule. Schedule c (form 1040) is used to report income or loss from a business operated as a sole proprietorship.

Schedule c (form 1040) is used to report income or loss from a business operated as a sole proprietorship. Accurate completion of this schedule. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. This essential form also helps. Use schedule c to report income or loss from a business or profession in which you were the sole proprietor.

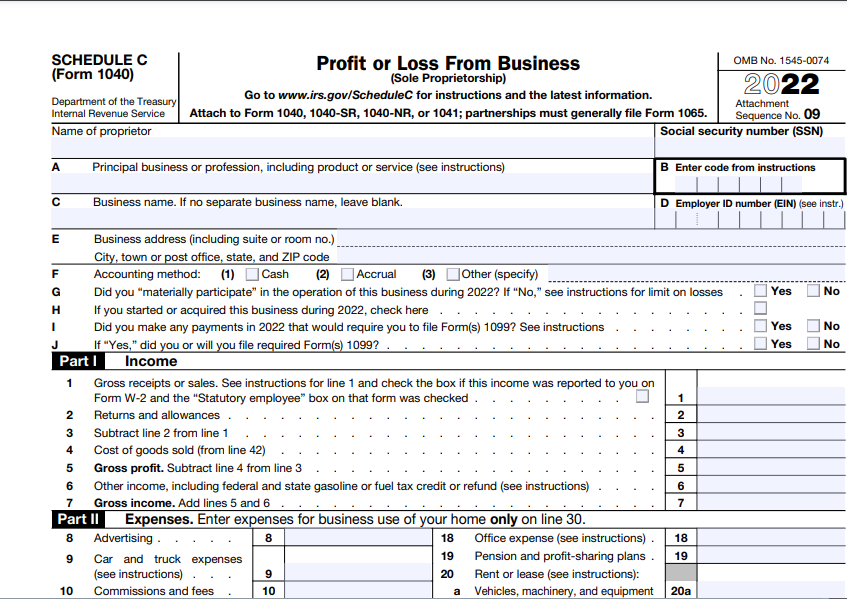

Printable Schedule C 2023

Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. This essential form also helps. Use schedule c to report income or loss from a business or profession in which you were the sole proprietor. Accurate completion of this schedule. Schedule c (form 1040) is used to.

IRS Form 1040 Schedule C Download Fillable PDF or Fill Online Profit or

Use schedule c to report income or loss from a business or profession in which you were the sole proprietor. Accurate completion of this schedule. Schedule c (form 1040) is used to report income or loss from a business operated as a sole proprietorship. Information about schedule c (form 1040), profit or loss from business, used to report income or.

Printable Schedule C 2023

Schedule c (form 1040) is used to report income or loss from a business operated as a sole proprietorship. Use schedule c to report income or loss from a business or profession in which you were the sole proprietor. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated.

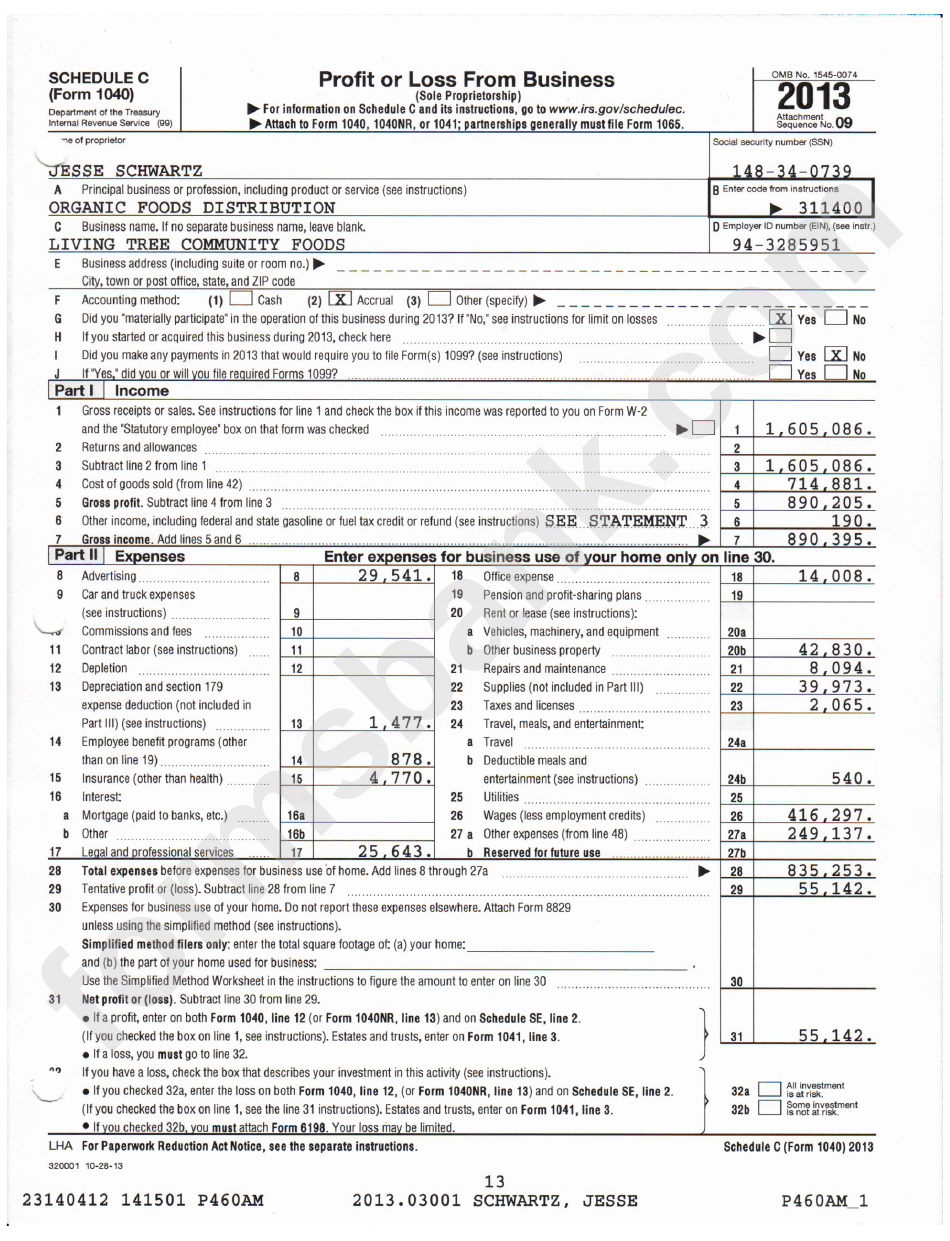

IRS Form 1040 Schedule C. Profit or Loss From Business Forms Docs

Accurate completion of this schedule. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. This essential form also helps. Use schedule c to report income or loss from a business or profession in which you were the sole proprietor. Schedule c (form 1040) is used to.

Download Fillable Schedule C Form

Use schedule c to report income or loss from a business or profession in which you were the sole proprietor. Accurate completion of this schedule. This essential form also helps. Schedule c (form 1040) is used to report income or loss from a business operated as a sole proprietorship. Information about schedule c (form 1040), profit or loss from business,.

Form 1040 Schedule C Sample Profit Or Loss From Busin vrogue.co

Use schedule c to report income or loss from a business or profession in which you were the sole proprietor. This essential form also helps. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. Accurate completion of this schedule. Schedule c (form 1040) is used to.

Printable Schedule C

Use schedule c to report income or loss from a business or profession in which you were the sole proprietor. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. Schedule c (form 1040) is used to report income or loss from a business operated as a.

Tax Return 2023 Chart Printable Forms Free Online

Accurate completion of this schedule. Schedule c (form 1040) is used to report income or loss from a business operated as a sole proprietorship. This essential form also helps. Use schedule c to report income or loss from a business or profession in which you were the sole proprietor. Information about schedule c (form 1040), profit or loss from business,.

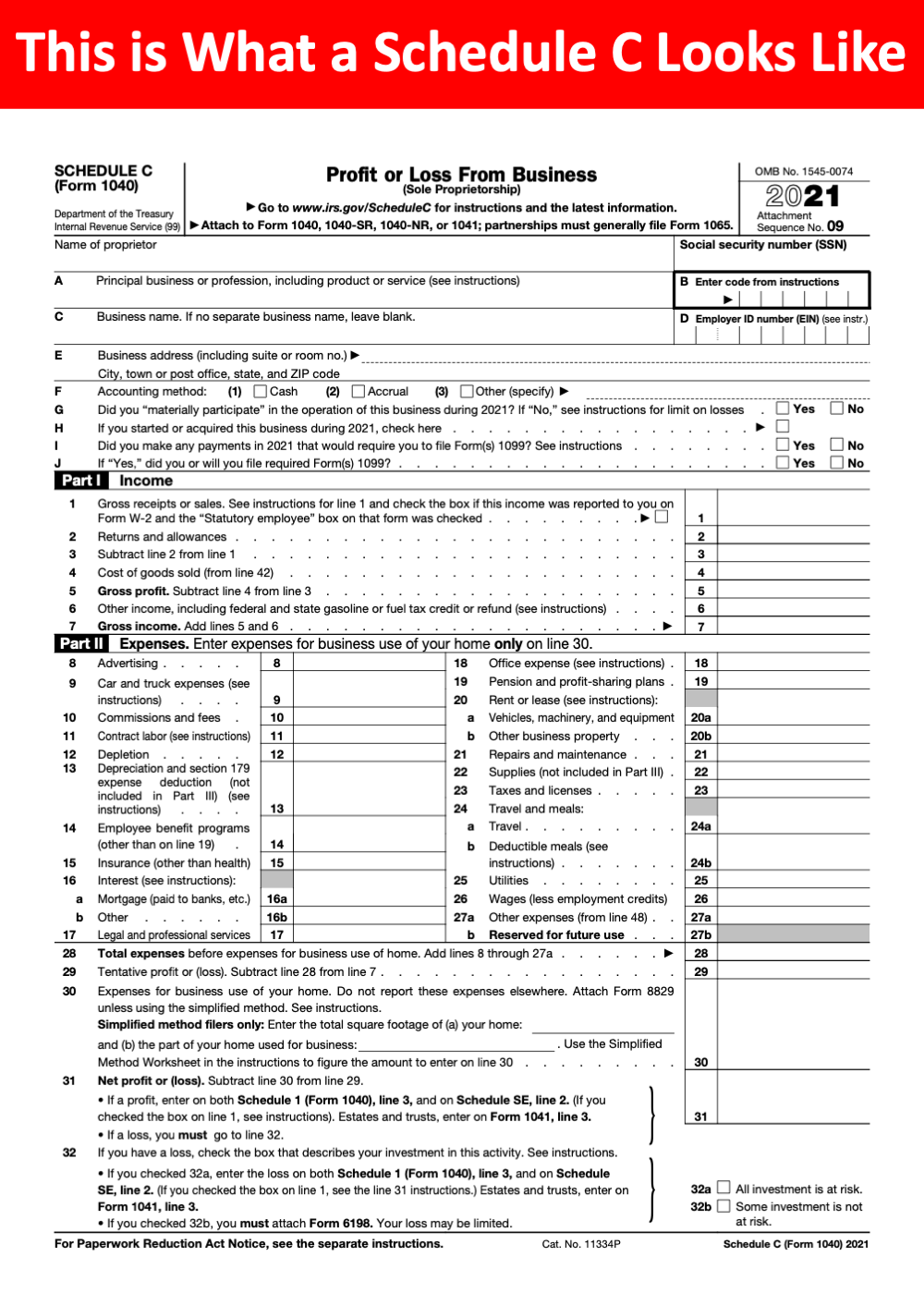

What is an IRS Schedule C Form? What is 1040 Schedule C? (Everything

Accurate completion of this schedule. Schedule c (form 1040) is used to report income or loss from a business operated as a sole proprietorship. This essential form also helps. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. Use schedule c to report income or loss.

Schedule C (Form 1040) 2023 Instructions

Schedule c (form 1040) is used to report income or loss from a business operated as a sole proprietorship. This essential form also helps. Use schedule c to report income or loss from a business or profession in which you were the sole proprietor. Accurate completion of this schedule. Information about schedule c (form 1040), profit or loss from business,.

Schedule C (Form 1040) Is Used To Report Income Or Loss From A Business Operated As A Sole Proprietorship.

Accurate completion of this schedule. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. Use schedule c to report income or loss from a business or profession in which you were the sole proprietor. This essential form also helps.

:max_bytes(150000):strip_icc()/Form1041-36b8feef0014418ab6aa150c951c7609.png)