Kansas Form K-41 Instructions - The fiduciary of a resident estate or trust must withhold kansas income tax from amounts distributed (or distributable) to each. Email here to order any kansas tax form not available on this site. Under kansas law the executor, administrator, trustee or other fiduciary of an estate or trust is required to withhold 2.5% (.025) of the amount. Can’t find the form you are looking.

The fiduciary of a resident estate or trust must withhold kansas income tax from amounts distributed (or distributable) to each. Can’t find the form you are looking. Email here to order any kansas tax form not available on this site. Under kansas law the executor, administrator, trustee or other fiduciary of an estate or trust is required to withhold 2.5% (.025) of the amount.

The fiduciary of a resident estate or trust must withhold kansas income tax from amounts distributed (or distributable) to each. Can’t find the form you are looking. Under kansas law the executor, administrator, trustee or other fiduciary of an estate or trust is required to withhold 2.5% (.025) of the amount. Email here to order any kansas tax form not available on this site.

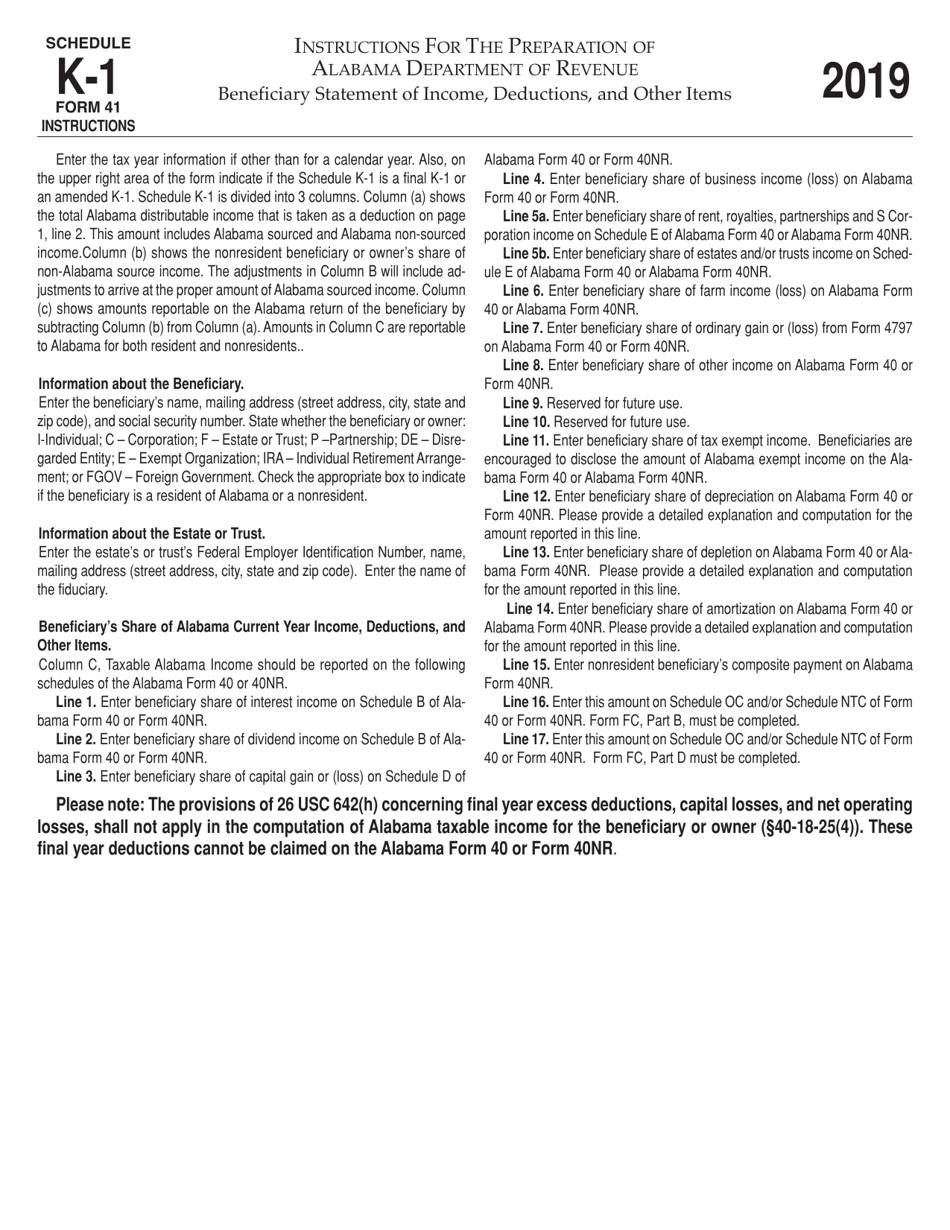

Download Instructions for Form 41 Schedule K1 Fiduciary Tax

The fiduciary of a resident estate or trust must withhold kansas income tax from amounts distributed (or distributable) to each. Can’t find the form you are looking. Under kansas law the executor, administrator, trustee or other fiduciary of an estate or trust is required to withhold 2.5% (.025) of the amount. Email here to order any kansas tax form not.

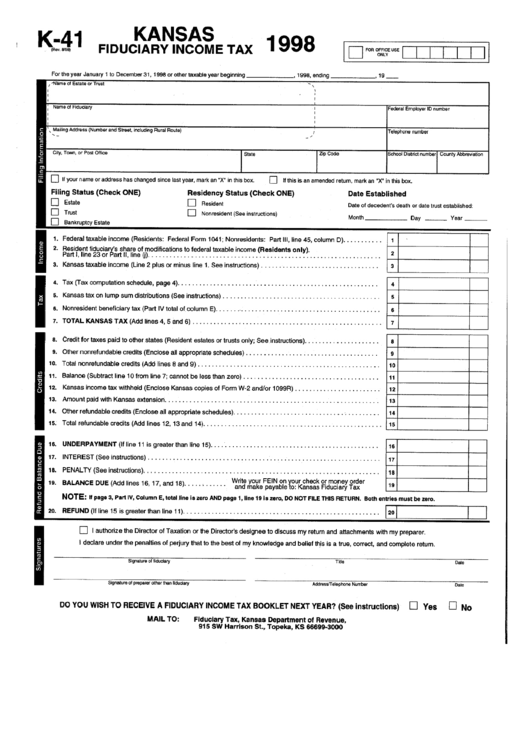

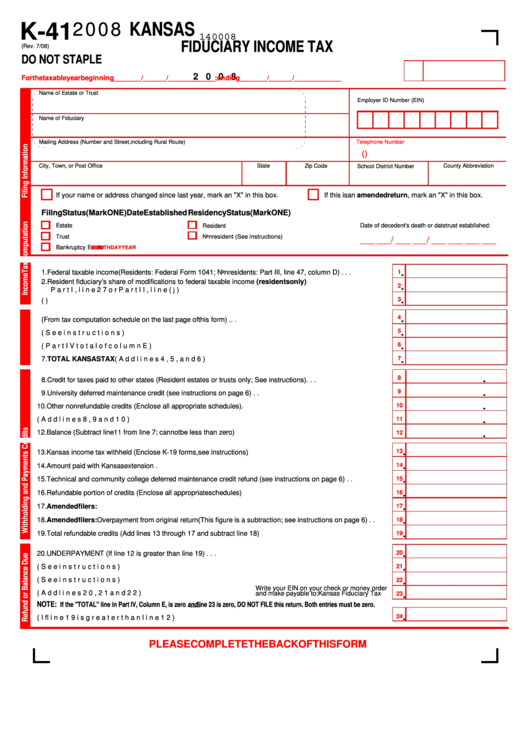

Fillable Form K41 Kansas Fiduciary Tax 1998 printable pdf

Under kansas law the executor, administrator, trustee or other fiduciary of an estate or trust is required to withhold 2.5% (.025) of the amount. The fiduciary of a resident estate or trust must withhold kansas income tax from amounts distributed (or distributable) to each. Email here to order any kansas tax form not available on this site. Can’t find the.

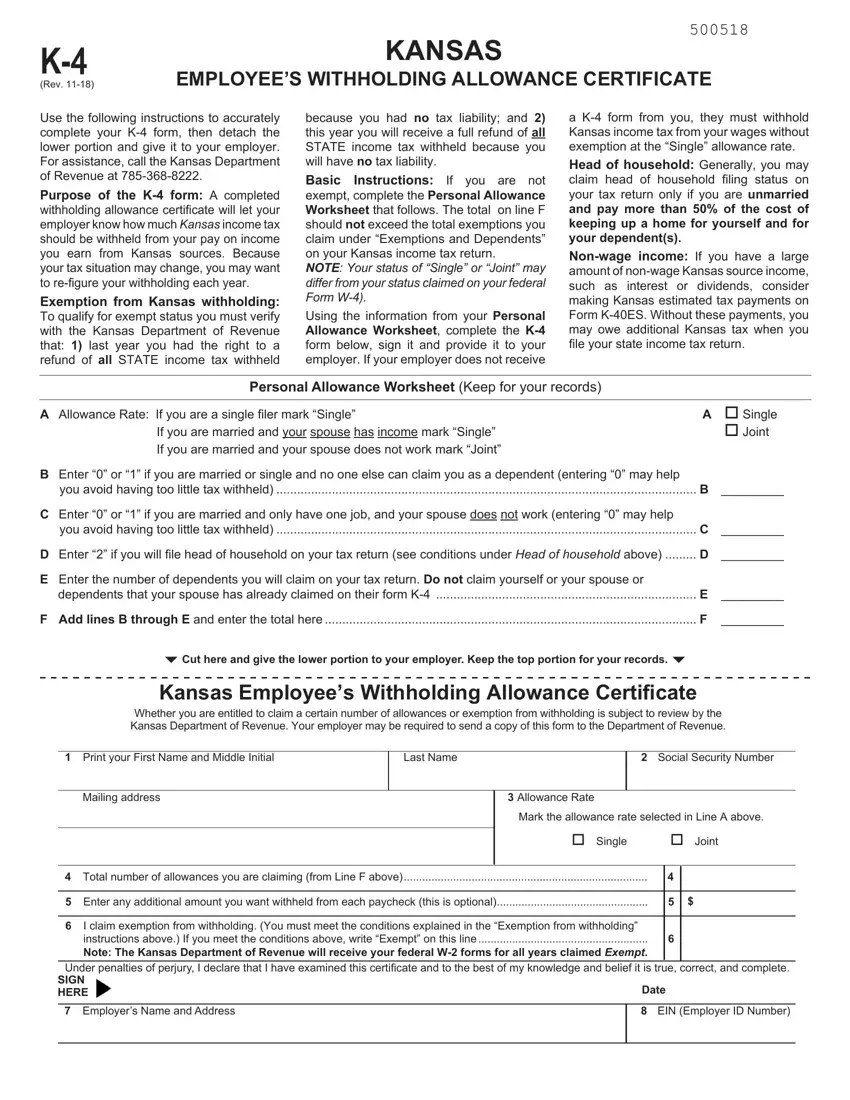

Kansas Tax 2025 Instructions Terrie W. Evans

Under kansas law the executor, administrator, trustee or other fiduciary of an estate or trust is required to withhold 2.5% (.025) of the amount. The fiduciary of a resident estate or trust must withhold kansas income tax from amounts distributed (or distributable) to each. Can’t find the form you are looking. Email here to order any kansas tax form not.

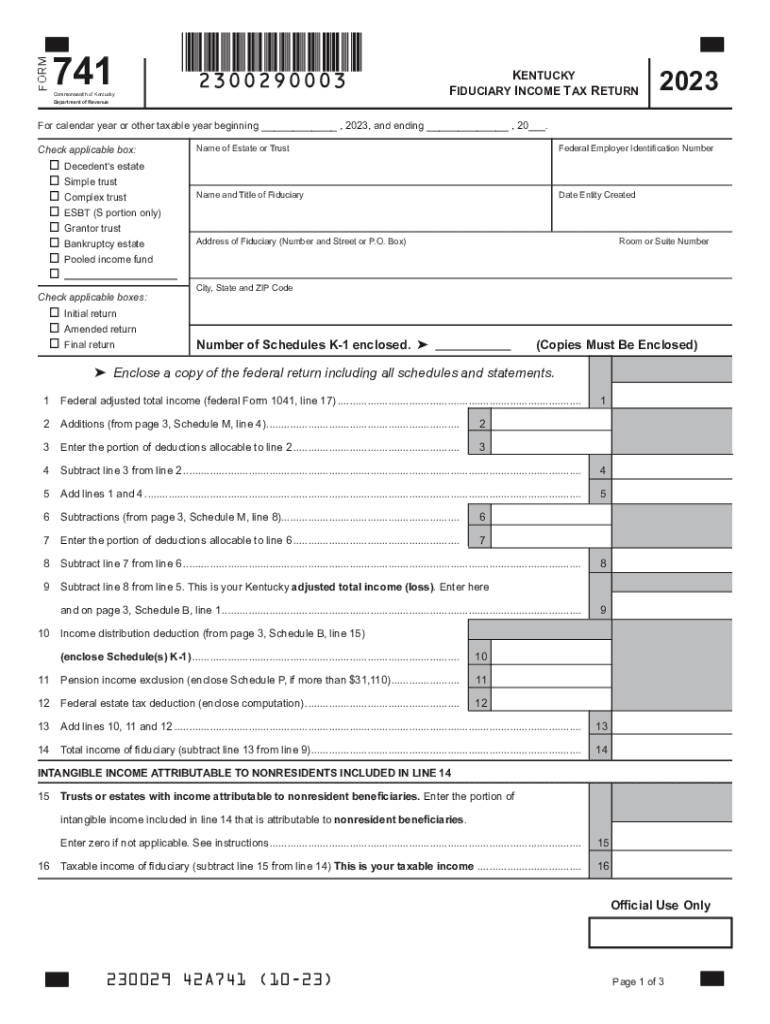

Fiduciary Tax K 41 Rev 6 14 Fill Out and Sign Printable PDF

The fiduciary of a resident estate or trust must withhold kansas income tax from amounts distributed (or distributable) to each. Can’t find the form you are looking. Under kansas law the executor, administrator, trustee or other fiduciary of an estate or trust is required to withhold 2.5% (.025) of the amount. Email here to order any kansas tax form not.

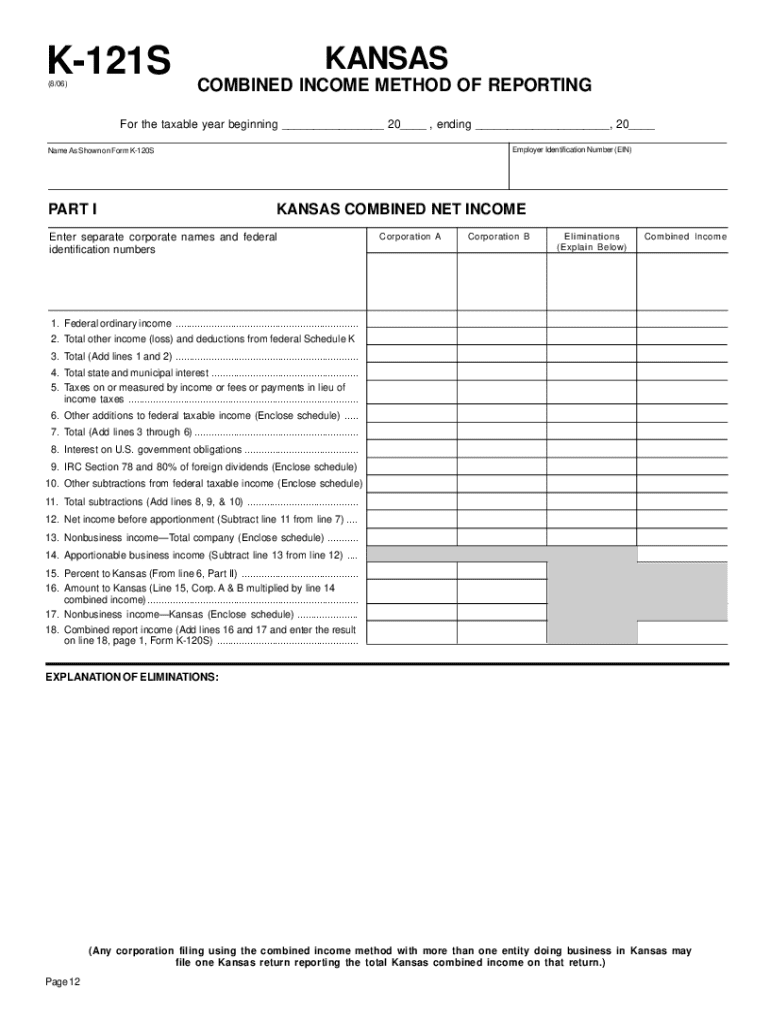

Kansas partnership tax return Fill out & sign online DocHub

Under kansas law the executor, administrator, trustee or other fiduciary of an estate or trust is required to withhold 2.5% (.025) of the amount. The fiduciary of a resident estate or trust must withhold kansas income tax from amounts distributed (or distributable) to each. Email here to order any kansas tax form not available on this site. Can’t find the.

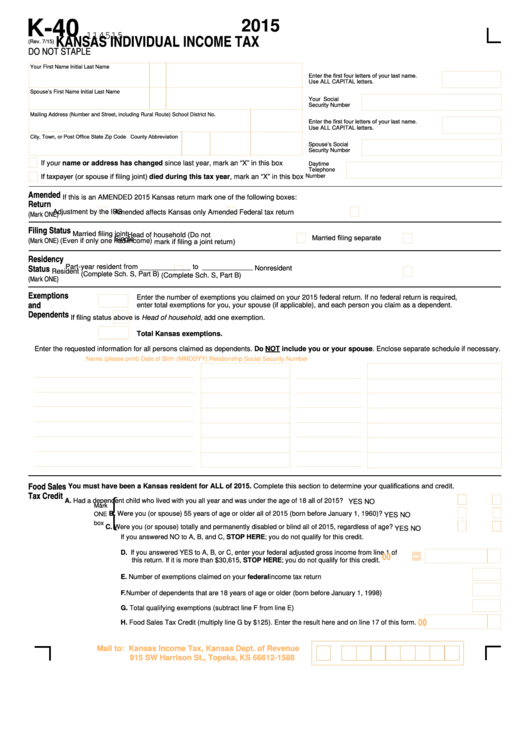

Free Printable Kansas Tax Forms Printable Forms Free Online

Email here to order any kansas tax form not available on this site. The fiduciary of a resident estate or trust must withhold kansas income tax from amounts distributed (or distributable) to each. Can’t find the form you are looking. Under kansas law the executor, administrator, trustee or other fiduciary of an estate or trust is required to withhold 2.5%.

Free Printable Kansas Tax Forms Printable Forms Free Online

The fiduciary of a resident estate or trust must withhold kansas income tax from amounts distributed (or distributable) to each. Email here to order any kansas tax form not available on this site. Under kansas law the executor, administrator, trustee or other fiduciary of an estate or trust is required to withhold 2.5% (.025) of the amount. Can’t find the.

Kansas form 41 Fill out & sign online DocHub

Under kansas law the executor, administrator, trustee or other fiduciary of an estate or trust is required to withhold 2.5% (.025) of the amount. Email here to order any kansas tax form not available on this site. Can’t find the form you are looking. The fiduciary of a resident estate or trust must withhold kansas income tax from amounts distributed.

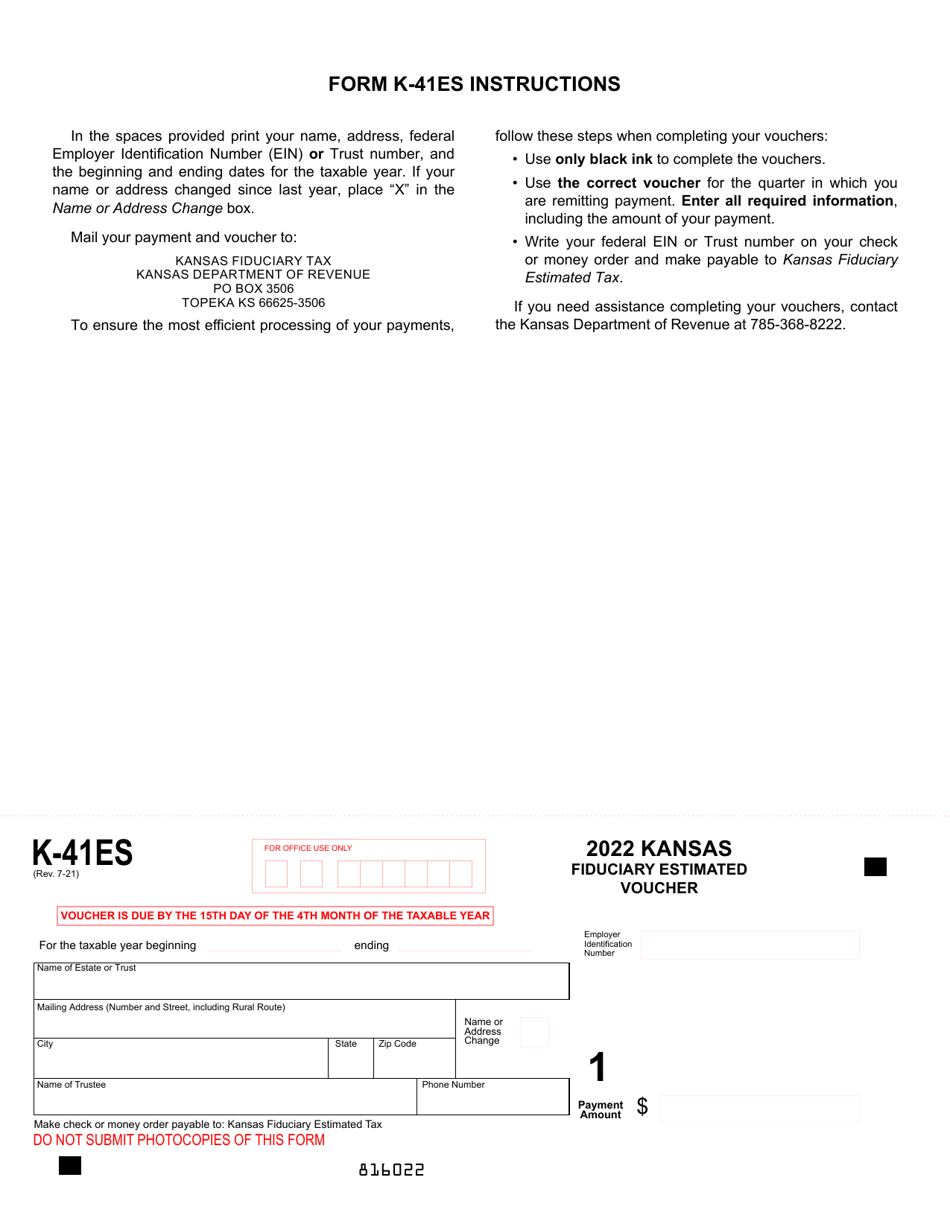

Form K41ES Download Fillable PDF or Fill Online Kansas Fiduciary

The fiduciary of a resident estate or trust must withhold kansas income tax from amounts distributed (or distributable) to each. Under kansas law the executor, administrator, trustee or other fiduciary of an estate or trust is required to withhold 2.5% (.025) of the amount. Can’t find the form you are looking. Email here to order any kansas tax form not.

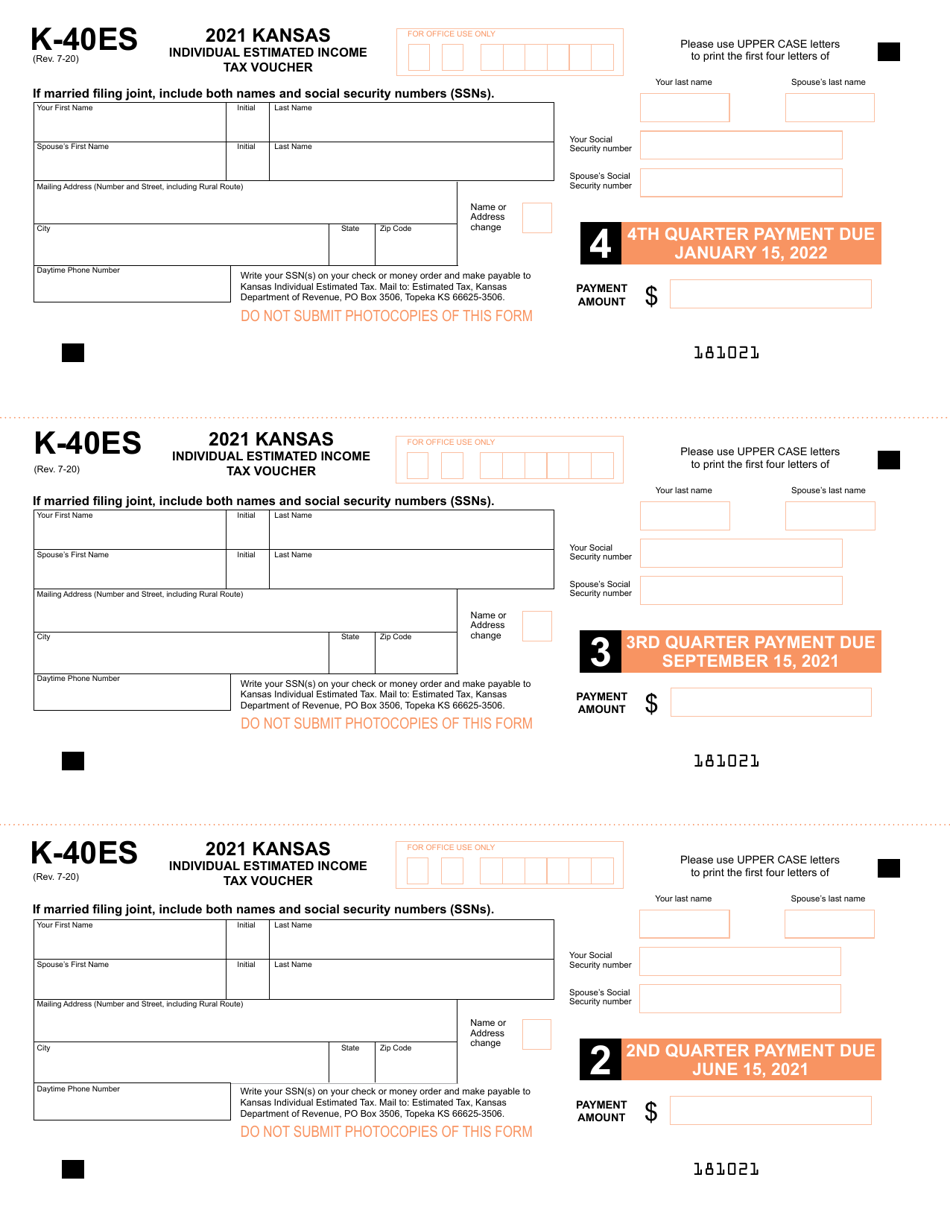

Form K40ES 2021 Fill Out, Sign Online and Download Fillable PDF

Can’t find the form you are looking. Email here to order any kansas tax form not available on this site. The fiduciary of a resident estate or trust must withhold kansas income tax from amounts distributed (or distributable) to each. Under kansas law the executor, administrator, trustee or other fiduciary of an estate or trust is required to withhold 2.5%.

Under Kansas Law The Executor, Administrator, Trustee Or Other Fiduciary Of An Estate Or Trust Is Required To Withhold 2.5% (.025) Of The Amount.

The fiduciary of a resident estate or trust must withhold kansas income tax from amounts distributed (or distributable) to each. Can’t find the form you are looking. Email here to order any kansas tax form not available on this site.