King County Property Tax Senior Discount Form - Learn more about exemptions and deferrals for senior citizens, persons with disabilities, and disabled veterans. Property tax exemptions and property. Senior citizen and people with disabilities exemption program for reduction to property taxes due in 2024 the exemption program is a. Find out how to qualify and. To be eligible for the property tax exemption, you must own and occupy a primary residence in washington and have a qualifying income. State law provides a tax benefit program for senior citizens, persons with disabilities, and disabled veterans: Click here to apply online, or apply. For a reduction on your 2025, 2026 and 2027 property taxes, your household income, after deduction of qualified expenses, is $84,000 or.

Property tax exemptions and property. Learn more about exemptions and deferrals for senior citizens, persons with disabilities, and disabled veterans. State law provides a tax benefit program for senior citizens, persons with disabilities, and disabled veterans: Find out how to qualify and. Click here to apply online, or apply. Senior citizen and people with disabilities exemption program for reduction to property taxes due in 2024 the exemption program is a. For a reduction on your 2025, 2026 and 2027 property taxes, your household income, after deduction of qualified expenses, is $84,000 or. To be eligible for the property tax exemption, you must own and occupy a primary residence in washington and have a qualifying income.

Find out how to qualify and. State law provides a tax benefit program for senior citizens, persons with disabilities, and disabled veterans: Click here to apply online, or apply. Property tax exemptions and property. Senior citizen and people with disabilities exemption program for reduction to property taxes due in 2024 the exemption program is a. Learn more about exemptions and deferrals for senior citizens, persons with disabilities, and disabled veterans. For a reduction on your 2025, 2026 and 2027 property taxes, your household income, after deduction of qualified expenses, is $84,000 or. To be eligible for the property tax exemption, you must own and occupy a primary residence in washington and have a qualifying income.

King County Property Tax Exemption 2025 Stephen E. Stanley

Senior citizen and people with disabilities exemption program for reduction to property taxes due in 2024 the exemption program is a. Property tax exemptions and property. For a reduction on your 2025, 2026 and 2027 property taxes, your household income, after deduction of qualified expenses, is $84,000 or. Learn more about exemptions and deferrals for senior citizens, persons with disabilities,.

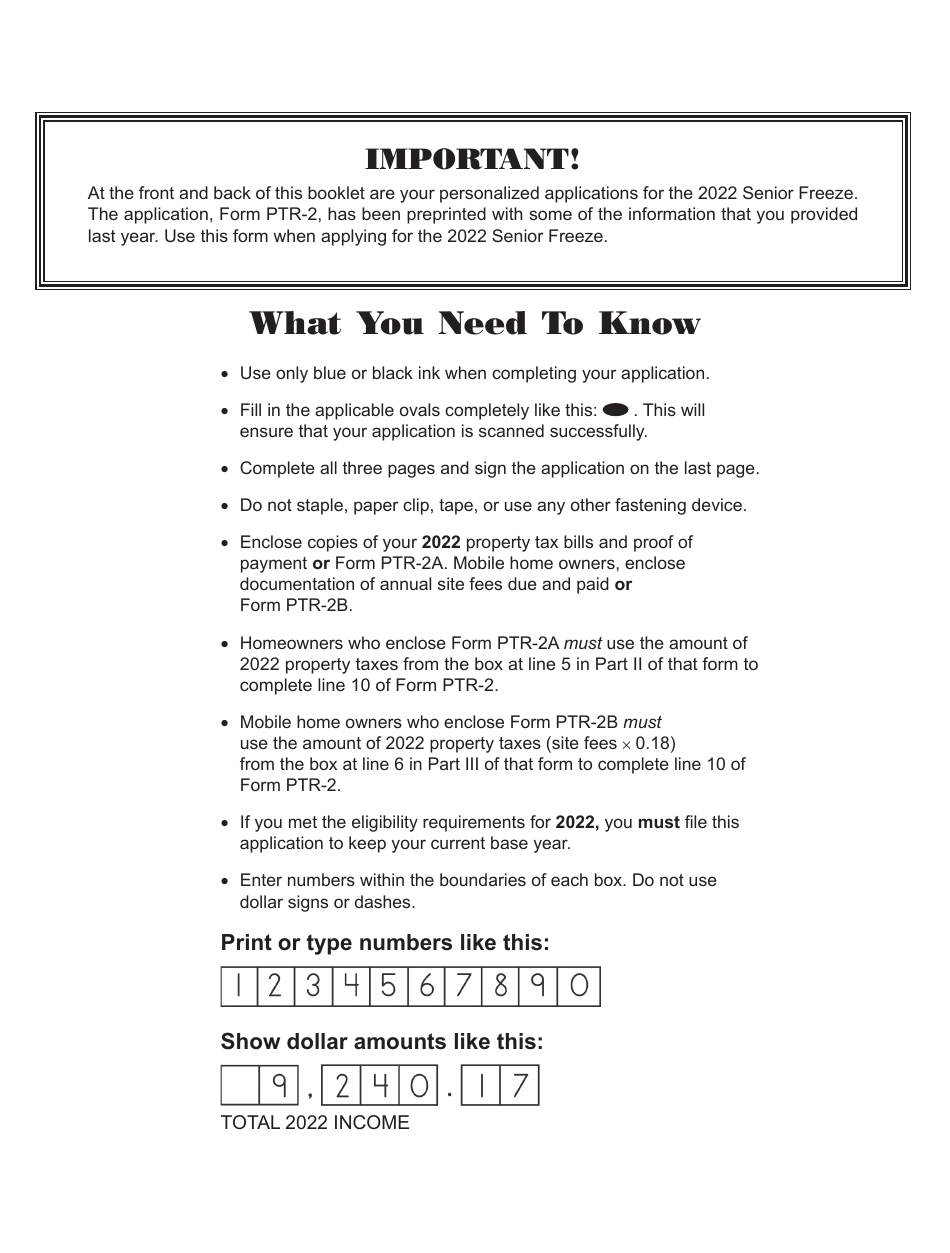

Download Instructions for Form PTR2 Senior Freeze (Property Tax

Property tax exemptions and property. Click here to apply online, or apply. State law provides a tax benefit program for senior citizens, persons with disabilities, and disabled veterans: For a reduction on your 2025, 2026 and 2027 property taxes, your household income, after deduction of qualified expenses, is $84,000 or. Senior citizen and people with disabilities exemption program for reduction.

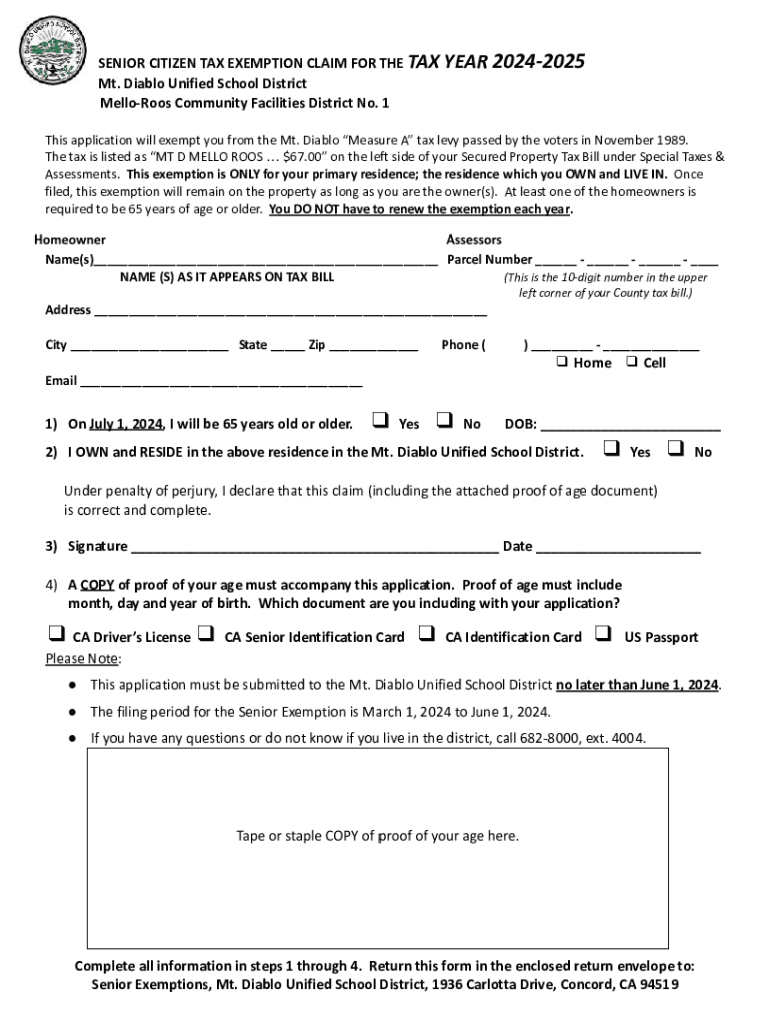

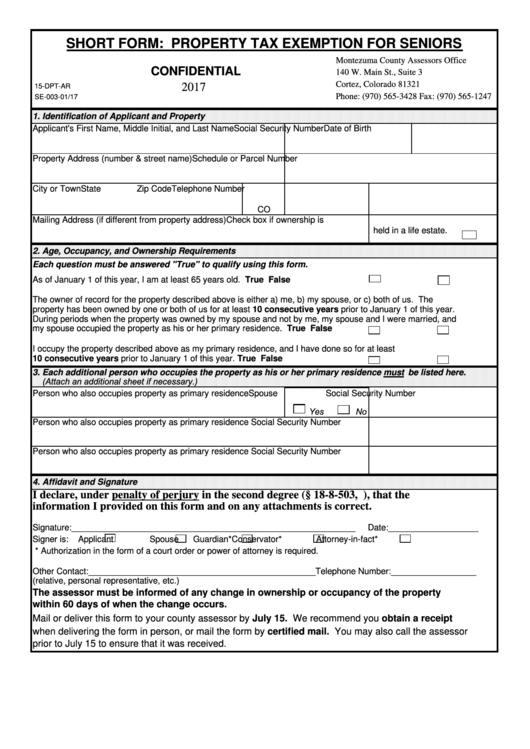

Fillable Online SENIOR CITIZEN TAX EXEMPTION CLAIM FORM FOR THE TAX

Senior citizen and people with disabilities exemption program for reduction to property taxes due in 2024 the exemption program is a. For a reduction on your 2025, 2026 and 2027 property taxes, your household income, after deduction of qualified expenses, is $84,000 or. To be eligible for the property tax exemption, you must own and occupy a primary residence in.

Property Tax King 2025

Senior citizen and people with disabilities exemption program for reduction to property taxes due in 2024 the exemption program is a. For a reduction on your 2025, 2026 and 2027 property taxes, your household income, after deduction of qualified expenses, is $84,000 or. Learn more about exemptions and deferrals for senior citizens, persons with disabilities, and disabled veterans. Find out.

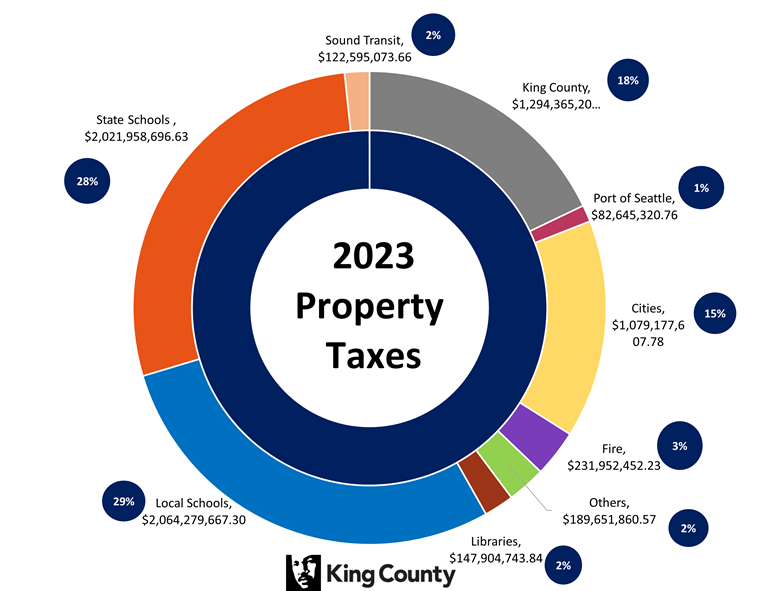

2023 taxes King County, Washington

To be eligible for the property tax exemption, you must own and occupy a primary residence in washington and have a qualifying income. For a reduction on your 2025, 2026 and 2027 property taxes, your household income, after deduction of qualified expenses, is $84,000 or. Click here to apply online, or apply. Find out how to qualify and. Property tax.

King County Senior Property Tax Exemption 2025 Karen K. Ater

Click here to apply online, or apply. Property tax exemptions and property. Find out how to qualify and. For a reduction on your 2025, 2026 and 2027 property taxes, your household income, after deduction of qualified expenses, is $84,000 or. Learn more about exemptions and deferrals for senior citizens, persons with disabilities, and disabled veterans.

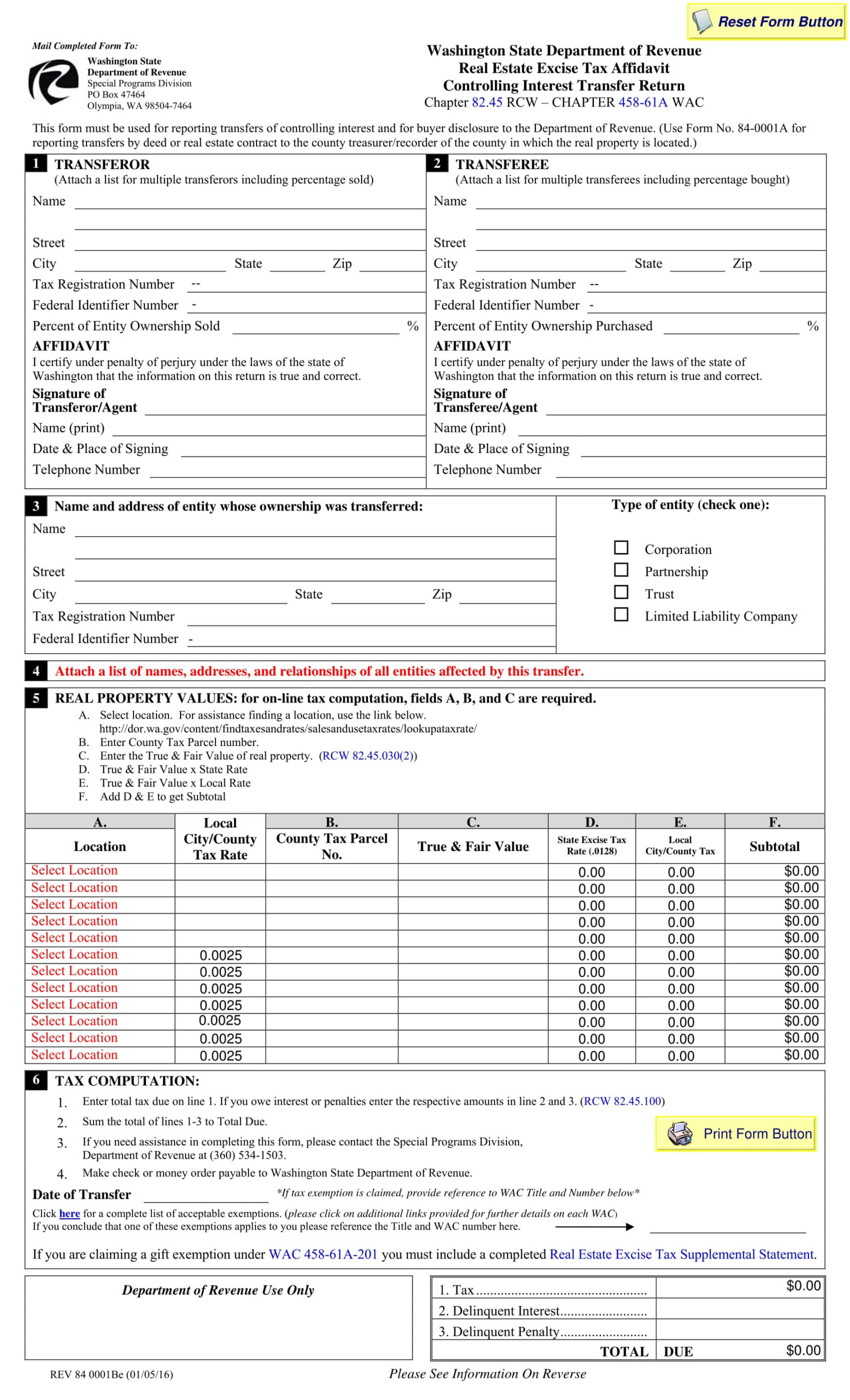

Real Estate Excise Tax Affidavit Form 2024

For a reduction on your 2025, 2026 and 2027 property taxes, your household income, after deduction of qualified expenses, is $84,000 or. To be eligible for the property tax exemption, you must own and occupy a primary residence in washington and have a qualifying income. State law provides a tax benefit program for senior citizens, persons with disabilities, and disabled.

King County Audit Property Tax Exemptions YouTube

State law provides a tax benefit program for senior citizens, persons with disabilities, and disabled veterans: To be eligible for the property tax exemption, you must own and occupy a primary residence in washington and have a qualifying income. Find out how to qualify and. For a reduction on your 2025, 2026 and 2027 property taxes, your household income, after.

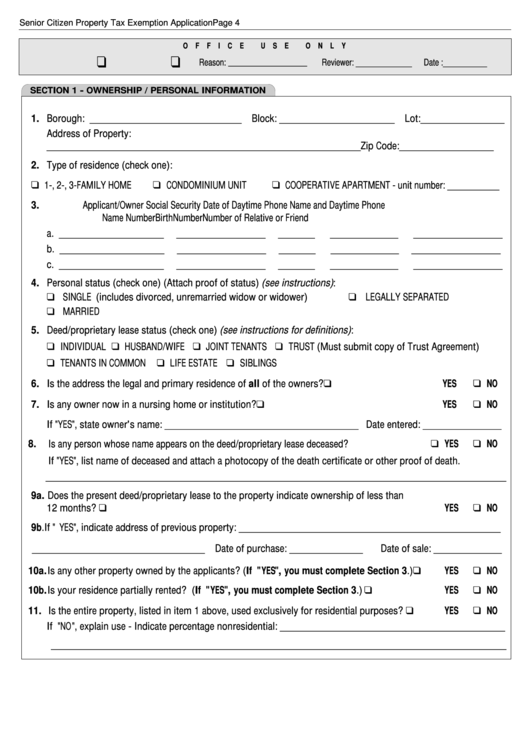

Form PTR 1 Download Fillable PDF Or Fill Online Senior Freeze Property

To be eligible for the property tax exemption, you must own and occupy a primary residence in washington and have a qualifying income. Click here to apply online, or apply. Learn more about exemptions and deferrals for senior citizens, persons with disabilities, and disabled veterans. Find out how to qualify and. State law provides a tax benefit program for senior.

King County Senior Property Tax Exemption 2025 Lark Aurelia

For a reduction on your 2025, 2026 and 2027 property taxes, your household income, after deduction of qualified expenses, is $84,000 or. Learn more about exemptions and deferrals for senior citizens, persons with disabilities, and disabled veterans. To be eligible for the property tax exemption, you must own and occupy a primary residence in washington and have a qualifying income..

For A Reduction On Your 2025, 2026 And 2027 Property Taxes, Your Household Income, After Deduction Of Qualified Expenses, Is $84,000 Or.

State law provides a tax benefit program for senior citizens, persons with disabilities, and disabled veterans: Find out how to qualify and. Click here to apply online, or apply. Property tax exemptions and property.

To Be Eligible For The Property Tax Exemption, You Must Own And Occupy A Primary Residence In Washington And Have A Qualifying Income.

Senior citizen and people with disabilities exemption program for reduction to property taxes due in 2024 the exemption program is a. Learn more about exemptions and deferrals for senior citizens, persons with disabilities, and disabled veterans.