Net Present Value Of Future Cash Flows - Because of its simplicity, npv is a useful tool to determine whether a project or. Net present value is a financial calculation used to determine the present value of future cash flows. Calculate the net present value (npv) of a series of future cash flows. It takes into account the time. Net present value (npv) is the value of all future cash flows (positive and negative) over the entire life of an investment discounted to the present. More specifically, you can calculate the present. How to calculate net present value (npv) the net present value (npv) represents the discounted values of future cash inflows and. Net present value (npv) is the present value of all future cash flows of a project. Npv is the sum of all the discounted future cash flows.

Npv is the sum of all the discounted future cash flows. It takes into account the time. Calculate the net present value (npv) of a series of future cash flows. Net present value is a financial calculation used to determine the present value of future cash flows. Net present value (npv) is the present value of all future cash flows of a project. Because of its simplicity, npv is a useful tool to determine whether a project or. Net present value (npv) is the value of all future cash flows (positive and negative) over the entire life of an investment discounted to the present. How to calculate net present value (npv) the net present value (npv) represents the discounted values of future cash inflows and. More specifically, you can calculate the present.

Calculate the net present value (npv) of a series of future cash flows. Npv is the sum of all the discounted future cash flows. Net present value is a financial calculation used to determine the present value of future cash flows. It takes into account the time. How to calculate net present value (npv) the net present value (npv) represents the discounted values of future cash inflows and. Because of its simplicity, npv is a useful tool to determine whether a project or. Net present value (npv) is the value of all future cash flows (positive and negative) over the entire life of an investment discounted to the present. Net present value (npv) is the present value of all future cash flows of a project. More specifically, you can calculate the present.

Net Present Value (NPV) What It Means and Steps to Calculate It

Net present value is a financial calculation used to determine the present value of future cash flows. Net present value (npv) is the value of all future cash flows (positive and negative) over the entire life of an investment discounted to the present. Npv is the sum of all the discounted future cash flows. More specifically, you can calculate the.

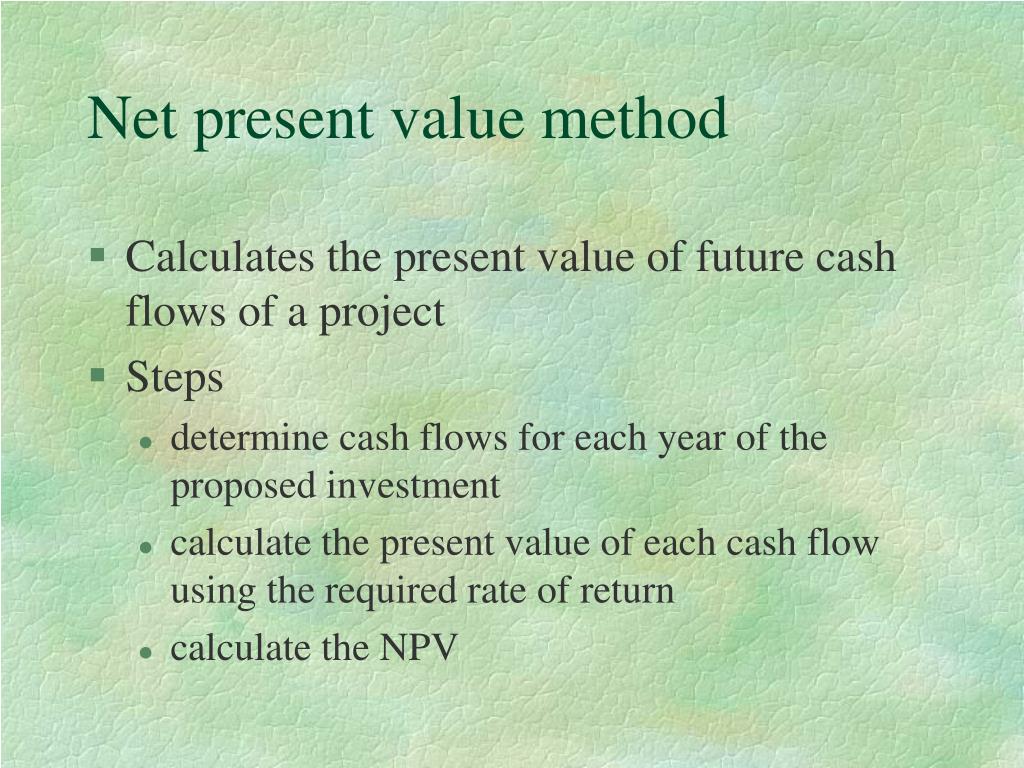

PPT Chapter 18 PowerPoint Presentation, free download ID6122742

How to calculate net present value (npv) the net present value (npv) represents the discounted values of future cash inflows and. Net present value (npv) is the present value of all future cash flows of a project. Because of its simplicity, npv is a useful tool to determine whether a project or. More specifically, you can calculate the present. Calculate.

How to calculate the net present value (NPV) of a UX team Juan

It takes into account the time. Npv is the sum of all the discounted future cash flows. Net present value (npv) is the value of all future cash flows (positive and negative) over the entire life of an investment discounted to the present. Calculate the net present value (npv) of a series of future cash flows. Net present value (npv).

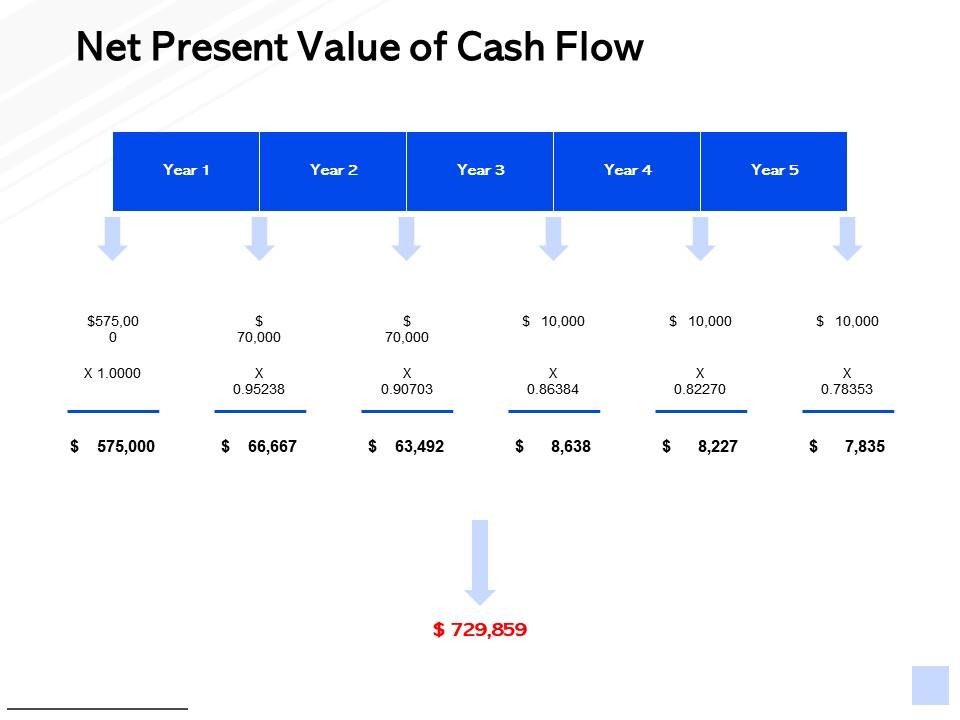

Net Present Value Of Cash Flow Strategy Management Ppt Powerpoint

Net present value (npv) is the present value of all future cash flows of a project. How to calculate net present value (npv) the net present value (npv) represents the discounted values of future cash inflows and. Net present value (npv) is the value of all future cash flows (positive and negative) over the entire life of an investment discounted.

Net Present Value (NPV) What It Means and Steps to Calculate It

Net present value is a financial calculation used to determine the present value of future cash flows. Net present value (npv) is the present value of all future cash flows of a project. How to calculate net present value (npv) the net present value (npv) represents the discounted values of future cash inflows and. Net present value (npv) is the.

If the Net Present Value of a Project Is Zero Quant RL

Net present value is a financial calculation used to determine the present value of future cash flows. Net present value (npv) is the present value of all future cash flows of a project. Because of its simplicity, npv is a useful tool to determine whether a project or. It takes into account the time. Net present value (npv) is the.

NPV Present Value) Definition, Benefits, Formula, and Examples

How to calculate net present value (npv) the net present value (npv) represents the discounted values of future cash inflows and. Net present value is a financial calculation used to determine the present value of future cash flows. More specifically, you can calculate the present. Net present value (npv) is the present value of all future cash flows of a.

4 Net present value of future financial flows at different interest

Npv is the sum of all the discounted future cash flows. Net present value (npv) is the present value of all future cash flows of a project. It takes into account the time. Calculate the net present value (npv) of a series of future cash flows. More specifically, you can calculate the present.

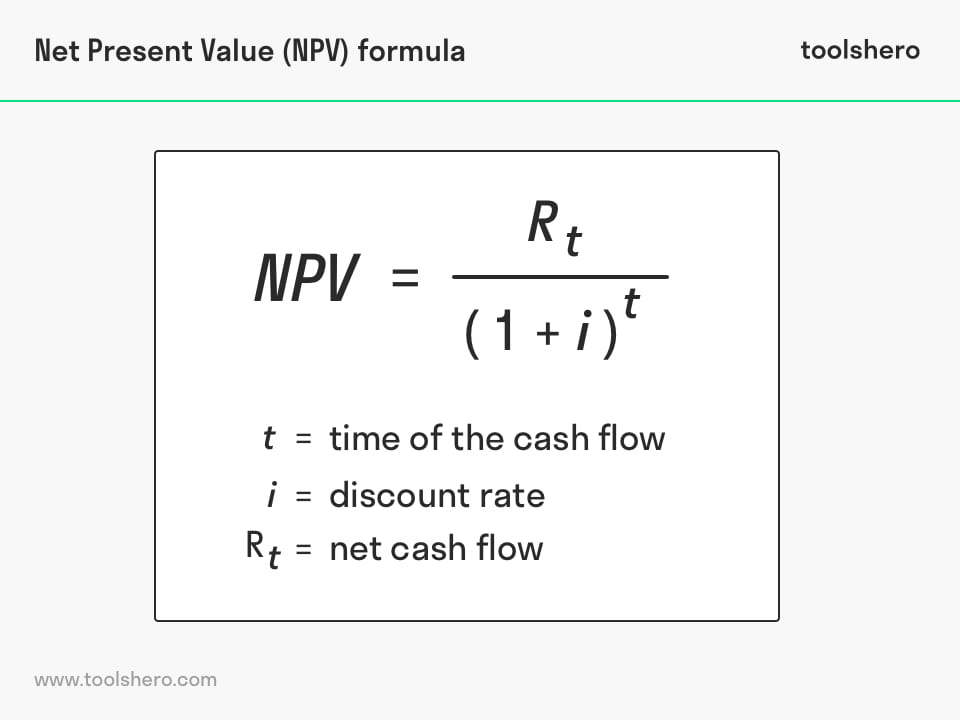

Net Present Value formula and example Toolshero

How to calculate net present value (npv) the net present value (npv) represents the discounted values of future cash inflows and. Net present value (npv) is the present value of all future cash flows of a project. It takes into account the time. More specifically, you can calculate the present. Npv is the sum of all the discounted future cash.

Future Value, Present Value and Net Present Value with Multiple Cash

It takes into account the time. Because of its simplicity, npv is a useful tool to determine whether a project or. Calculate the net present value (npv) of a series of future cash flows. Net present value is a financial calculation used to determine the present value of future cash flows. Net present value (npv) is the value of all.

Calculate The Net Present Value (Npv) Of A Series Of Future Cash Flows.

It takes into account the time. Net present value (npv) is the value of all future cash flows (positive and negative) over the entire life of an investment discounted to the present. How to calculate net present value (npv) the net present value (npv) represents the discounted values of future cash inflows and. More specifically, you can calculate the present.

Npv Is The Sum Of All The Discounted Future Cash Flows.

Net present value is a financial calculation used to determine the present value of future cash flows. Because of its simplicity, npv is a useful tool to determine whether a project or. Net present value (npv) is the present value of all future cash flows of a project.

:max_bytes(150000):strip_icc()/NPV-final-509066b4f3734259a55f52281d155c0b.png)

:max_bytes(150000):strip_icc()/dotdash_Final_Net_Present_Value_NPV_Jul_2020-01-4cf181815e2741debb4174301e1b4b99.jpg)