Npv Calculation Financial Calculator - Calculate the npv (net present value) of an investment with an unlimited number of cash flows. This npv calculator calculates the net present value of an investment by taking account of its initial cost, discount rate and the sum of all. On this page, you can calculate net present value (npv) of an investment based on a series of cash flows that occur at regular time intervals.

On this page, you can calculate net present value (npv) of an investment based on a series of cash flows that occur at regular time intervals. This npv calculator calculates the net present value of an investment by taking account of its initial cost, discount rate and the sum of all. Calculate the npv (net present value) of an investment with an unlimited number of cash flows.

This npv calculator calculates the net present value of an investment by taking account of its initial cost, discount rate and the sum of all. On this page, you can calculate net present value (npv) of an investment based on a series of cash flows that occur at regular time intervals. Calculate the npv (net present value) of an investment with an unlimited number of cash flows.

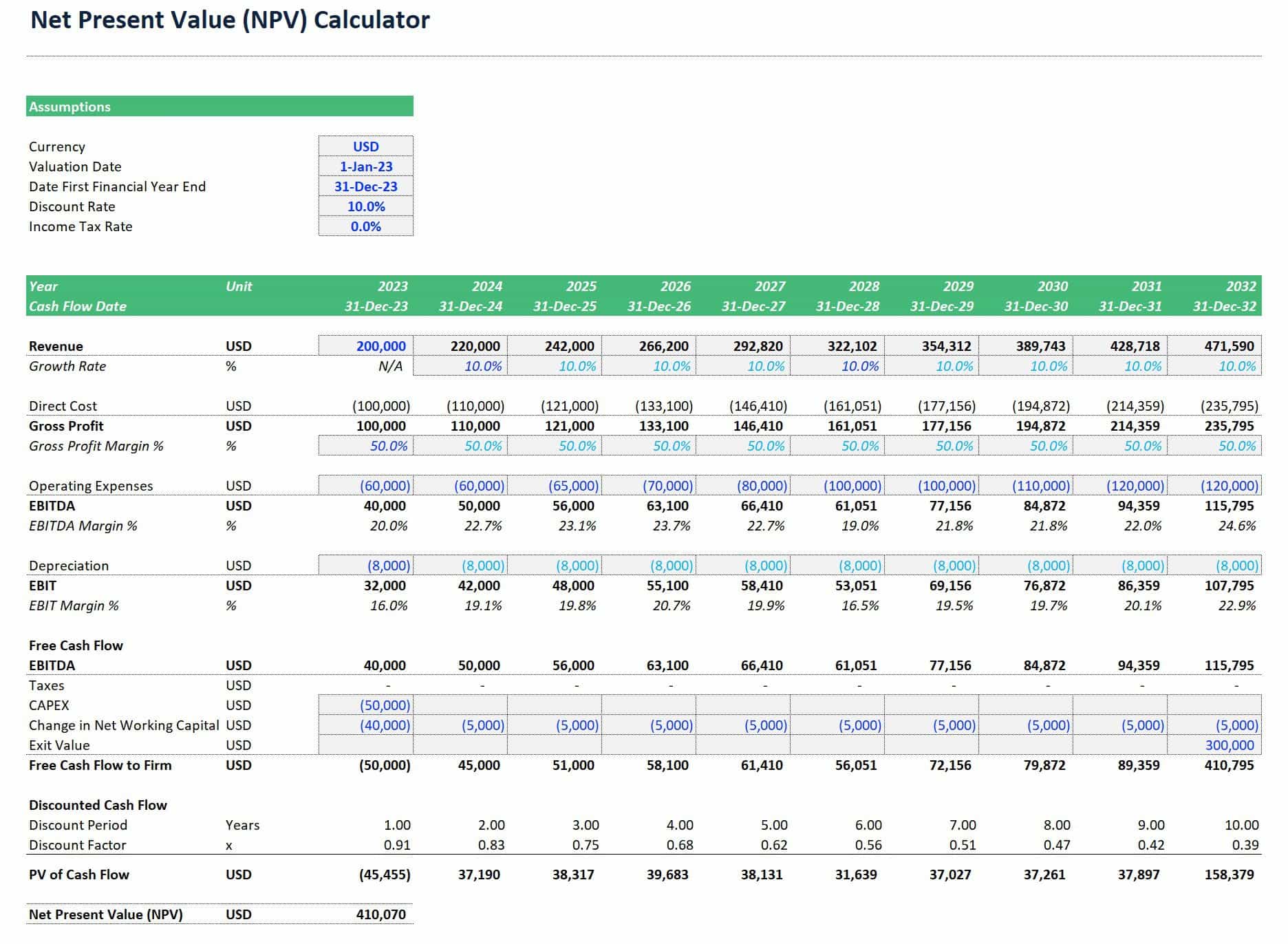

Net Present Value Calculator in Excel eFinancialModels

On this page, you can calculate net present value (npv) of an investment based on a series of cash flows that occur at regular time intervals. This npv calculator calculates the net present value of an investment by taking account of its initial cost, discount rate and the sum of all. Calculate the npv (net present value) of an investment.

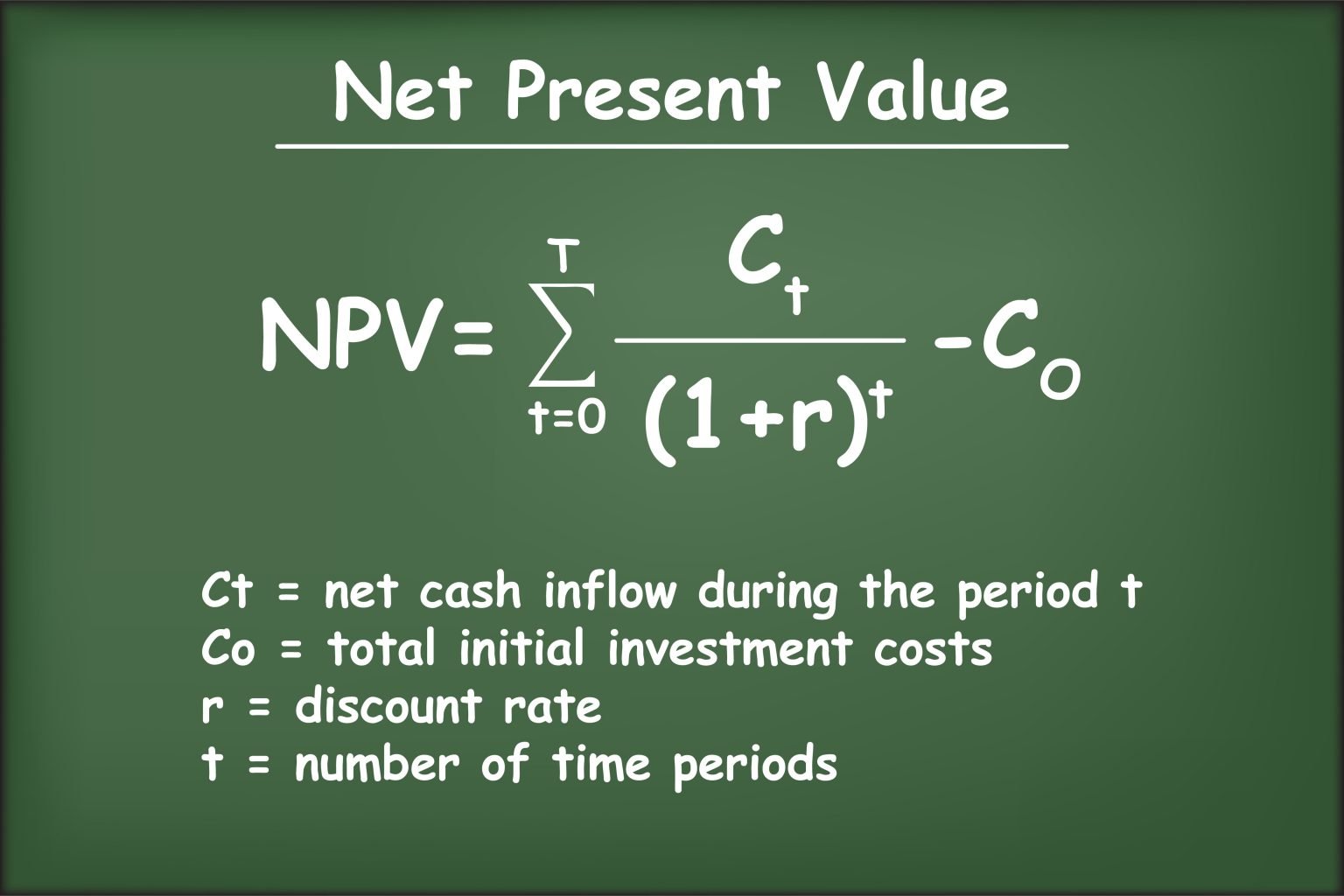

What is Net Present Value (NPV)? Formula + Free Calculator

This npv calculator calculates the net present value of an investment by taking account of its initial cost, discount rate and the sum of all. Calculate the npv (net present value) of an investment with an unlimited number of cash flows. On this page, you can calculate net present value (npv) of an investment based on a series of cash.

How to Calculate Net Present Value (NPV)? eFinancialModels

On this page, you can calculate net present value (npv) of an investment based on a series of cash flows that occur at regular time intervals. Calculate the npv (net present value) of an investment with an unlimited number of cash flows. This npv calculator calculates the net present value of an investment by taking account of its initial cost,.

Free FREE NPV Calculator to Maximize Investment Value with Explanatory

This npv calculator calculates the net present value of an investment by taking account of its initial cost, discount rate and the sum of all. On this page, you can calculate net present value (npv) of an investment based on a series of cash flows that occur at regular time intervals. Calculate the npv (net present value) of an investment.

Net Present Value Calculator

Calculate the npv (net present value) of an investment with an unlimited number of cash flows. On this page, you can calculate net present value (npv) of an investment based on a series of cash flows that occur at regular time intervals. This npv calculator calculates the net present value of an investment by taking account of its initial cost,.

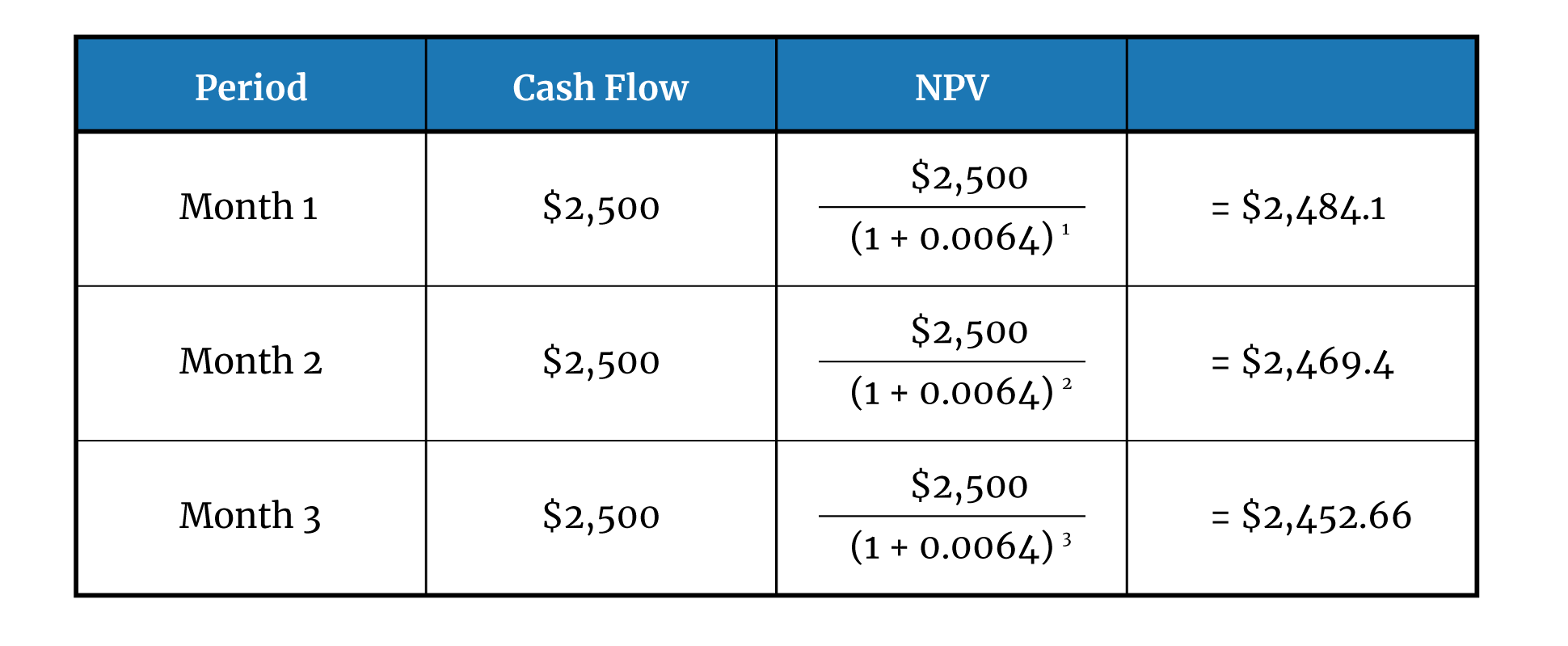

Net Present Value Calculator with Example + Steps

On this page, you can calculate net present value (npv) of an investment based on a series of cash flows that occur at regular time intervals. This npv calculator calculates the net present value of an investment by taking account of its initial cost, discount rate and the sum of all. Calculate the npv (net present value) of an investment.

Net Present Value (NPV) Calculator Online Calculator

This npv calculator calculates the net present value of an investment by taking account of its initial cost, discount rate and the sum of all. On this page, you can calculate net present value (npv) of an investment based on a series of cash flows that occur at regular time intervals. Calculate the npv (net present value) of an investment.

Net Present Value Calculator

On this page, you can calculate net present value (npv) of an investment based on a series of cash flows that occur at regular time intervals. This npv calculator calculates the net present value of an investment by taking account of its initial cost, discount rate and the sum of all. Calculate the npv (net present value) of an investment.

Net Present Value Calculating and Using Payment Savvy

On this page, you can calculate net present value (npv) of an investment based on a series of cash flows that occur at regular time intervals. This npv calculator calculates the net present value of an investment by taking account of its initial cost, discount rate and the sum of all. Calculate the npv (net present value) of an investment.

Net Present Value Calculator in Excel eFinancialModels

On this page, you can calculate net present value (npv) of an investment based on a series of cash flows that occur at regular time intervals. This npv calculator calculates the net present value of an investment by taking account of its initial cost, discount rate and the sum of all. Calculate the npv (net present value) of an investment.

This Npv Calculator Calculates The Net Present Value Of An Investment By Taking Account Of Its Initial Cost, Discount Rate And The Sum Of All.

Calculate the npv (net present value) of an investment with an unlimited number of cash flows. On this page, you can calculate net present value (npv) of an investment based on a series of cash flows that occur at regular time intervals.