Npv Calculator With Cash Flows - Npv can be calculated for cashflows with regualr frequency such as annual, semi. One source of truthpreconfigured solutions The npv calculator serves as a useful tool for forecasting future cash flows of your business or investment. Calculate net present value (npv) of a series of cash flows. On this page, you can calculate net present value (npv) of an investment based on a series of cash flows that occur at regular time intervals. Calculate the npv (net present value) of an investment with an unlimited number of cash flows.

One source of truthpreconfigured solutions On this page, you can calculate net present value (npv) of an investment based on a series of cash flows that occur at regular time intervals. Npv can be calculated for cashflows with regualr frequency such as annual, semi. Calculate net present value (npv) of a series of cash flows. Calculate the npv (net present value) of an investment with an unlimited number of cash flows. The npv calculator serves as a useful tool for forecasting future cash flows of your business or investment.

The npv calculator serves as a useful tool for forecasting future cash flows of your business or investment. One source of truthpreconfigured solutions On this page, you can calculate net present value (npv) of an investment based on a series of cash flows that occur at regular time intervals. Calculate the npv (net present value) of an investment with an unlimited number of cash flows. Npv can be calculated for cashflows with regualr frequency such as annual, semi. Calculate net present value (npv) of a series of cash flows.

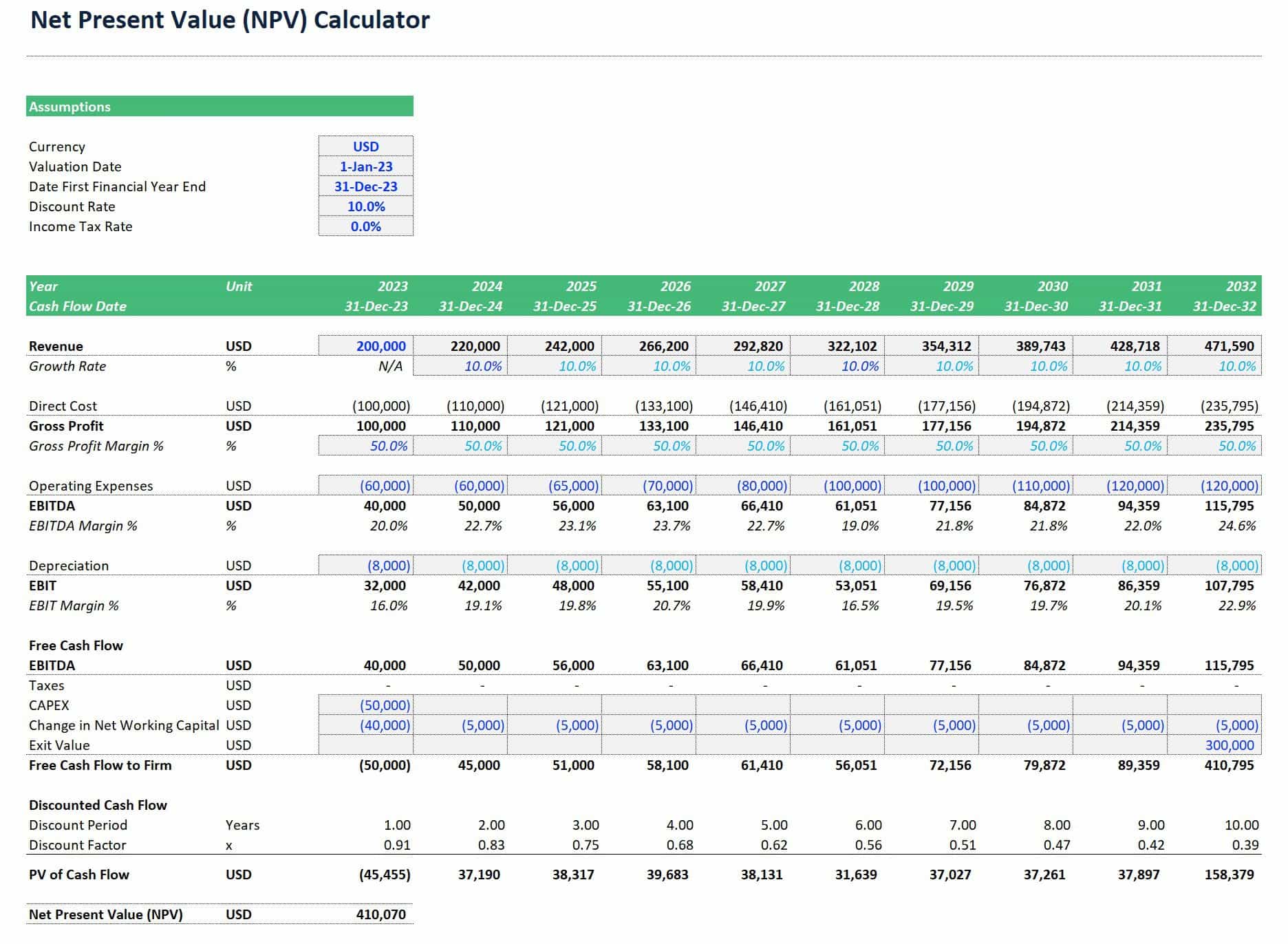

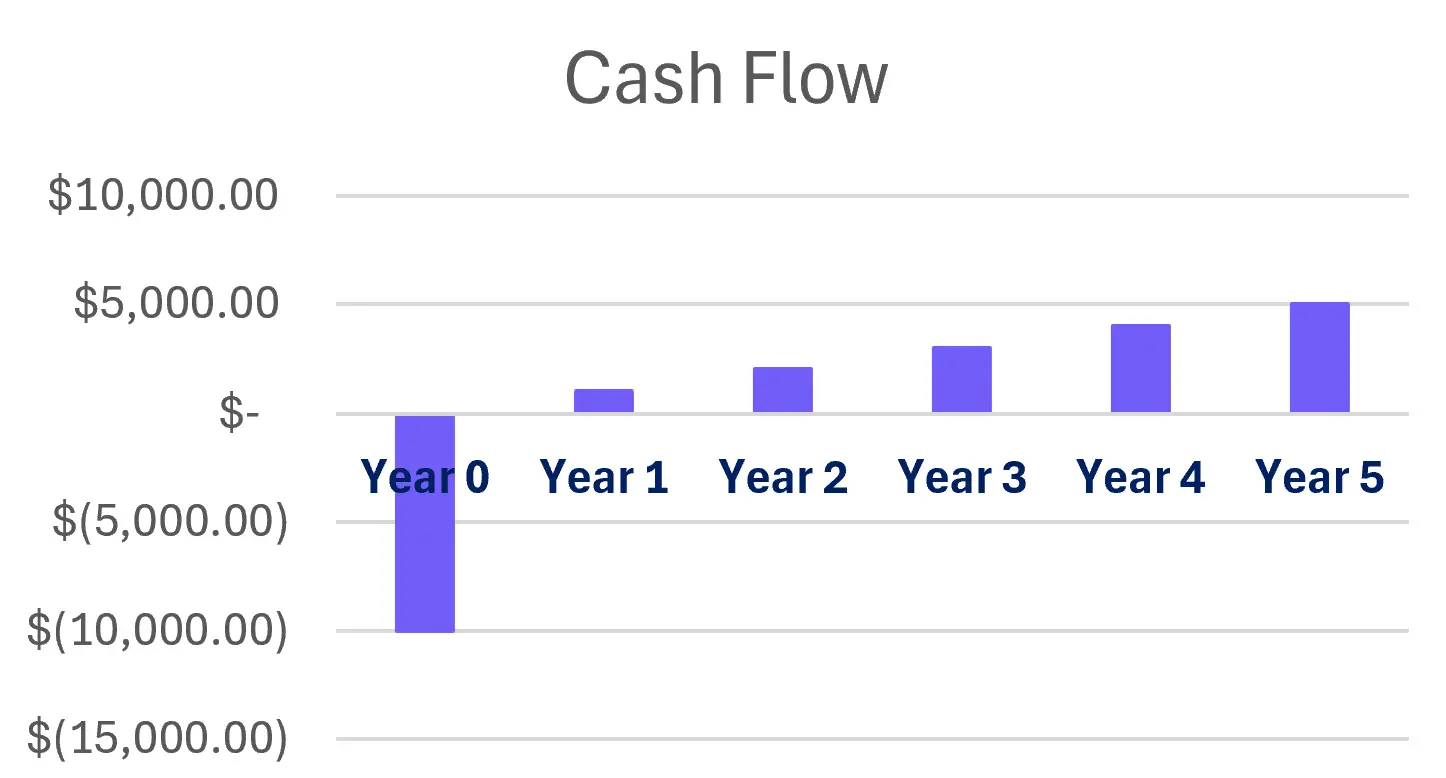

Net Present Value Calculator in Excel eFinancialModels

One source of truthpreconfigured solutions On this page, you can calculate net present value (npv) of an investment based on a series of cash flows that occur at regular time intervals. Calculate the npv (net present value) of an investment with an unlimited number of cash flows. The npv calculator serves as a useful tool for forecasting future cash flows.

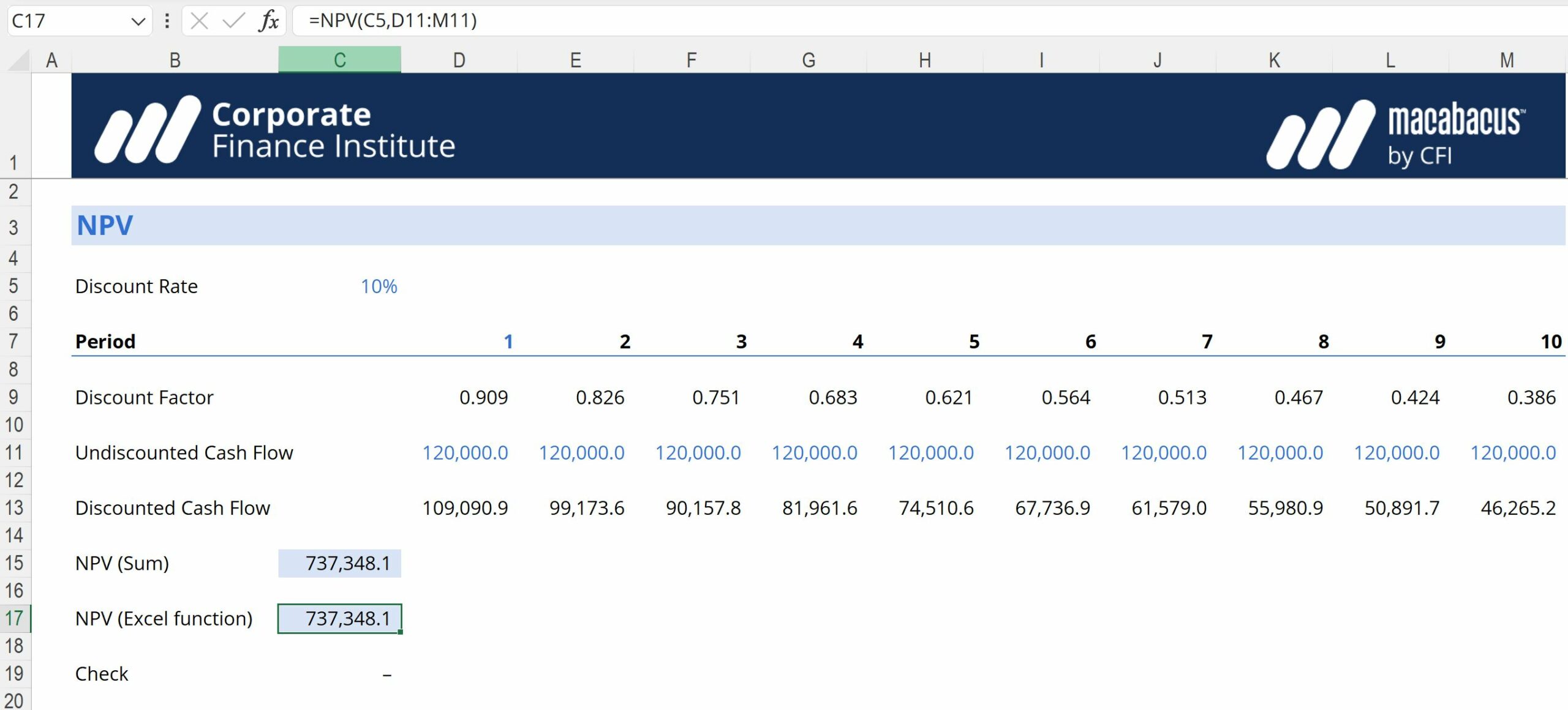

NPV Function Formula, Examples, How to Calculate NPV in Excel

On this page, you can calculate net present value (npv) of an investment based on a series of cash flows that occur at regular time intervals. Calculate the npv (net present value) of an investment with an unlimited number of cash flows. One source of truthpreconfigured solutions The npv calculator serves as a useful tool for forecasting future cash flows.

Calculate NPV for Monthly Cash Flows with Formula in Excel

The npv calculator serves as a useful tool for forecasting future cash flows of your business or investment. Npv can be calculated for cashflows with regualr frequency such as annual, semi. On this page, you can calculate net present value (npv) of an investment based on a series of cash flows that occur at regular time intervals. Calculate net present.

Free NPV Calculator Online Calculate Net Present Value AI For Data

On this page, you can calculate net present value (npv) of an investment based on a series of cash flows that occur at regular time intervals. One source of truthpreconfigured solutions Calculate net present value (npv) of a series of cash flows. Calculate the npv (net present value) of an investment with an unlimited number of cash flows. Npv can.

Net Present Value Calculator

Calculate the npv (net present value) of an investment with an unlimited number of cash flows. Npv can be calculated for cashflows with regualr frequency such as annual, semi. One source of truthpreconfigured solutions The npv calculator serves as a useful tool for forecasting future cash flows of your business or investment. On this page, you can calculate net present.

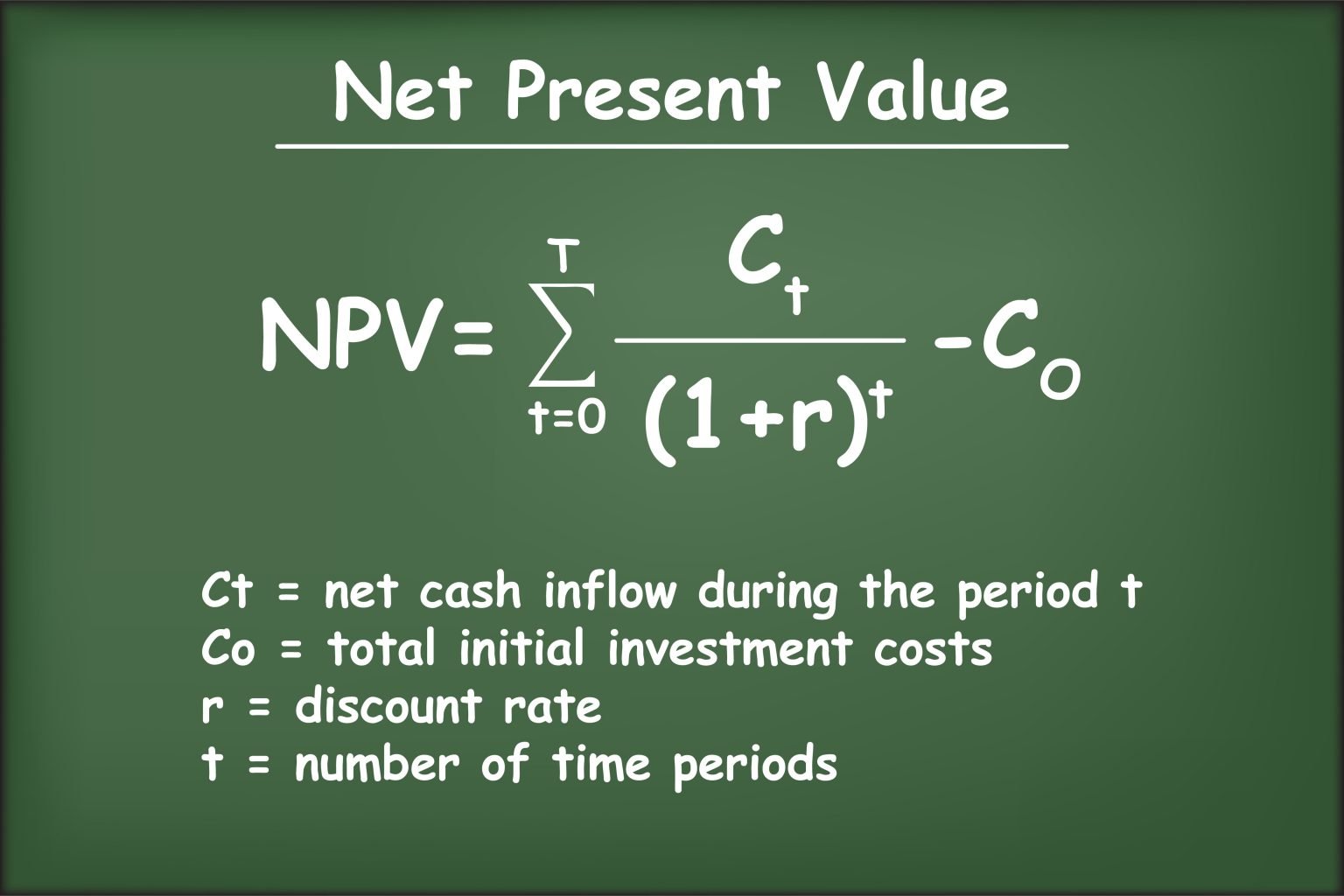

Net Present Value (NPV) What It Means and Steps to Calculate It (2025)

Calculate the npv (net present value) of an investment with an unlimited number of cash flows. One source of truthpreconfigured solutions Calculate net present value (npv) of a series of cash flows. Npv can be calculated for cashflows with regualr frequency such as annual, semi. The npv calculator serves as a useful tool for forecasting future cash flows of your.

4 Ways To Calculate NPV Wikihow Innovator

One source of truthpreconfigured solutions Calculate net present value (npv) of a series of cash flows. Npv can be calculated for cashflows with regualr frequency such as annual, semi. The npv calculator serves as a useful tool for forecasting future cash flows of your business or investment. On this page, you can calculate net present value (npv) of an investment.

Present Value of Cash Flows Calculator Finance Calculator iCalcula

Calculate net present value (npv) of a series of cash flows. The npv calculator serves as a useful tool for forecasting future cash flows of your business or investment. Npv can be calculated for cashflows with regualr frequency such as annual, semi. Calculate the npv (net present value) of an investment with an unlimited number of cash flows. On this.

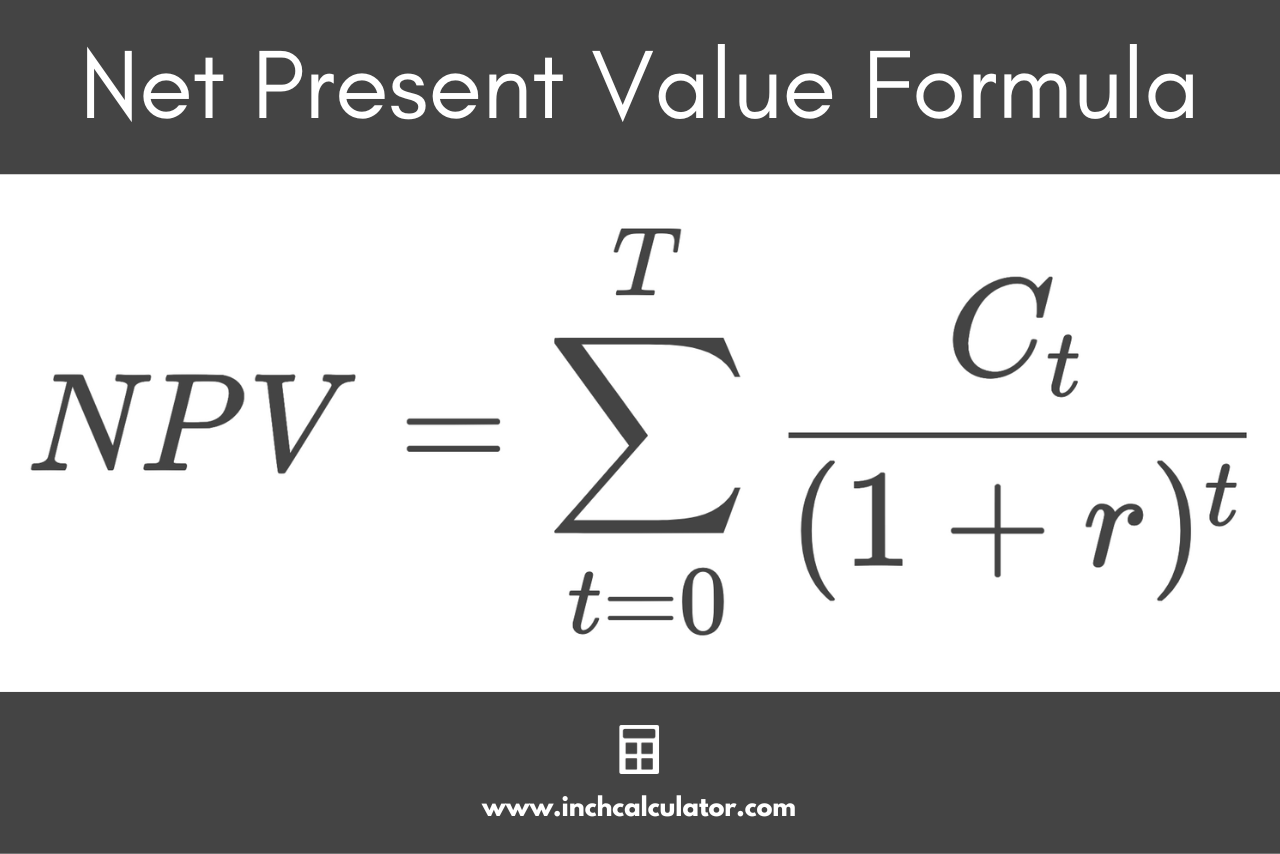

Net Present Value Calculator Inch Calculator

The npv calculator serves as a useful tool for forecasting future cash flows of your business or investment. Npv can be calculated for cashflows with regualr frequency such as annual, semi. One source of truthpreconfigured solutions On this page, you can calculate net present value (npv) of an investment based on a series of cash flows that occur at regular.

Net Present Value Calculating and Using Payment Savvy

Calculate the npv (net present value) of an investment with an unlimited number of cash flows. Npv can be calculated for cashflows with regualr frequency such as annual, semi. One source of truthpreconfigured solutions The npv calculator serves as a useful tool for forecasting future cash flows of your business or investment. Calculate net present value (npv) of a series.

One Source Of Truthpreconfigured Solutions

Calculate the npv (net present value) of an investment with an unlimited number of cash flows. Calculate net present value (npv) of a series of cash flows. Npv can be calculated for cashflows with regualr frequency such as annual, semi. On this page, you can calculate net present value (npv) of an investment based on a series of cash flows that occur at regular time intervals.

:max_bytes(150000):strip_icc()/dotdash_Final_Net_Present_Value_NPV_Jul_2020-01-eea50904f90744e4b1172a9ef38df13f.jpg)

:max_bytes(150000):strip_icc()/ScreenShot2019-06-20at10.46.59AM-f30499c2303c44a5a883c6c1e676569b.png)