Operating Cash Flow Formula From Ebitda - Ebitda, which stands for earnings before interest, taxes, depreciation, and amortization, is a widely used metric in. Operating cash flow (ocf) measures the net cash generated from the core operations of a company within a specified.

Ebitda, which stands for earnings before interest, taxes, depreciation, and amortization, is a widely used metric in. Operating cash flow (ocf) measures the net cash generated from the core operations of a company within a specified.

Ebitda, which stands for earnings before interest, taxes, depreciation, and amortization, is a widely used metric in. Operating cash flow (ocf) measures the net cash generated from the core operations of a company within a specified.

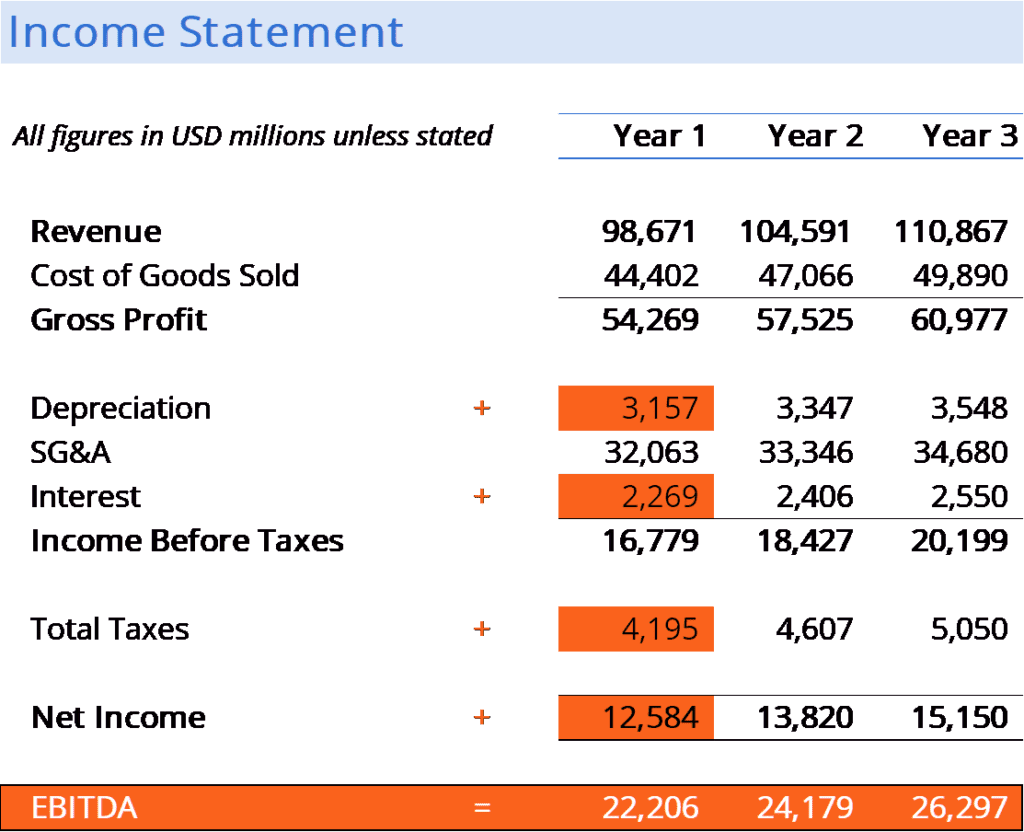

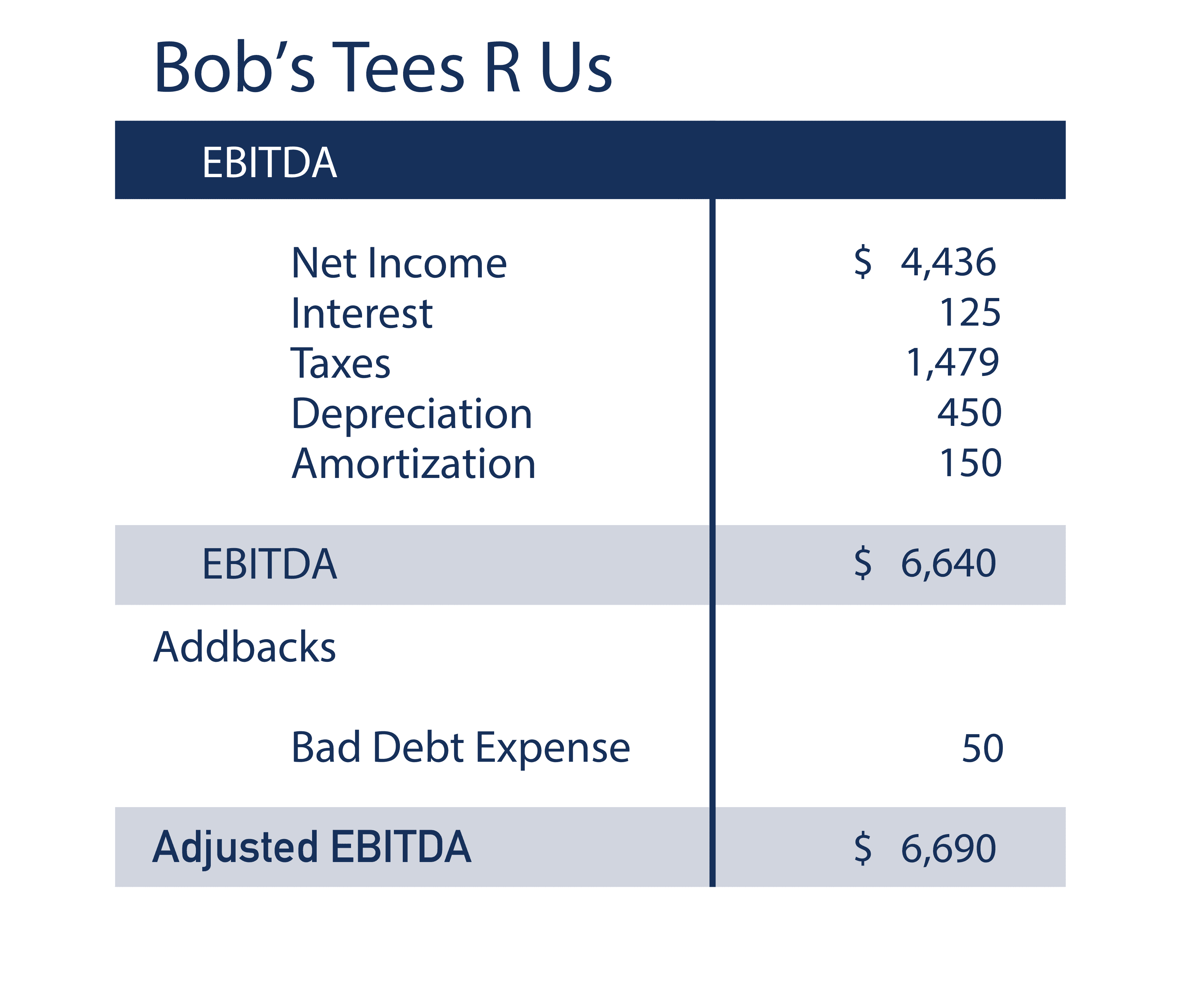

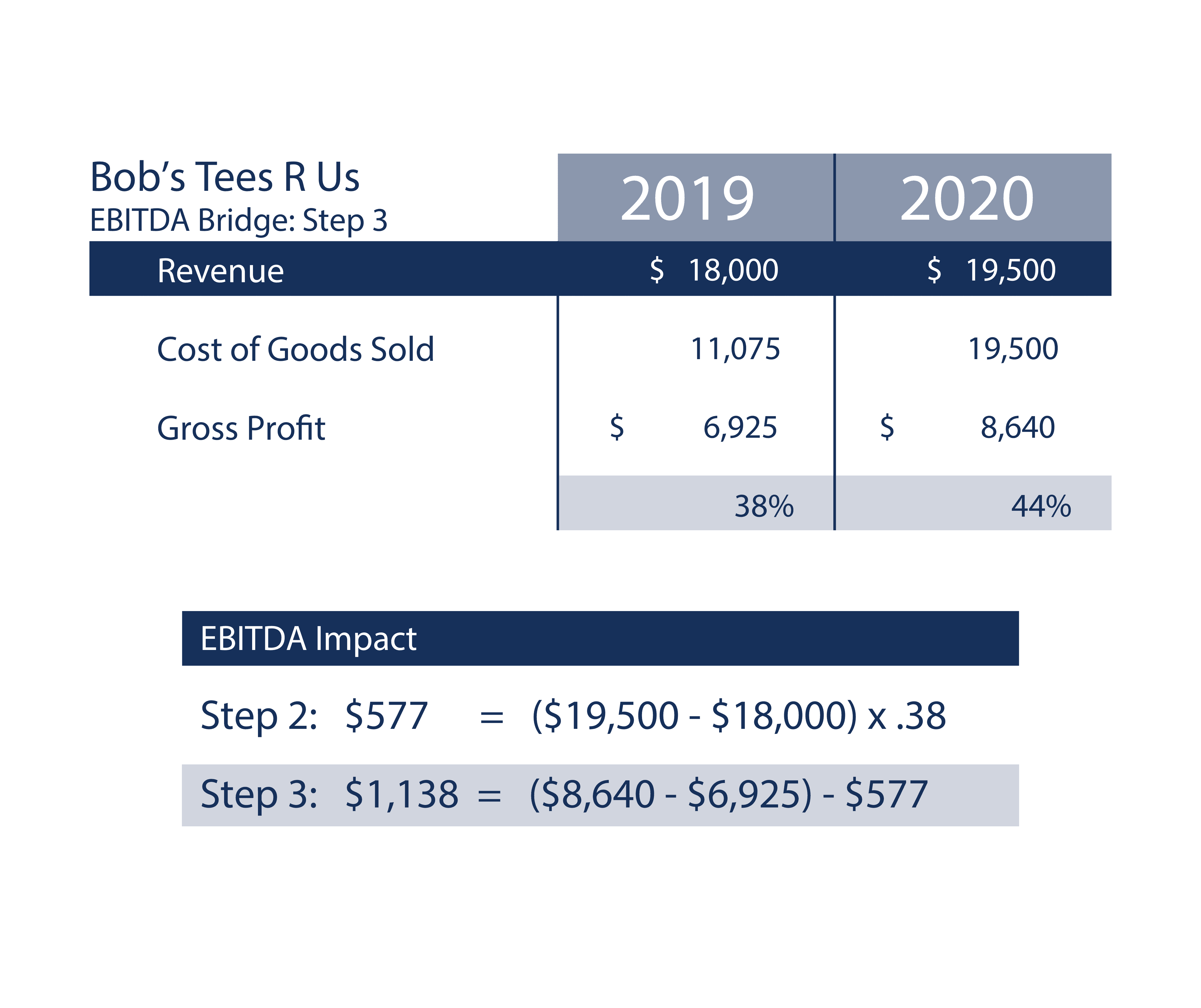

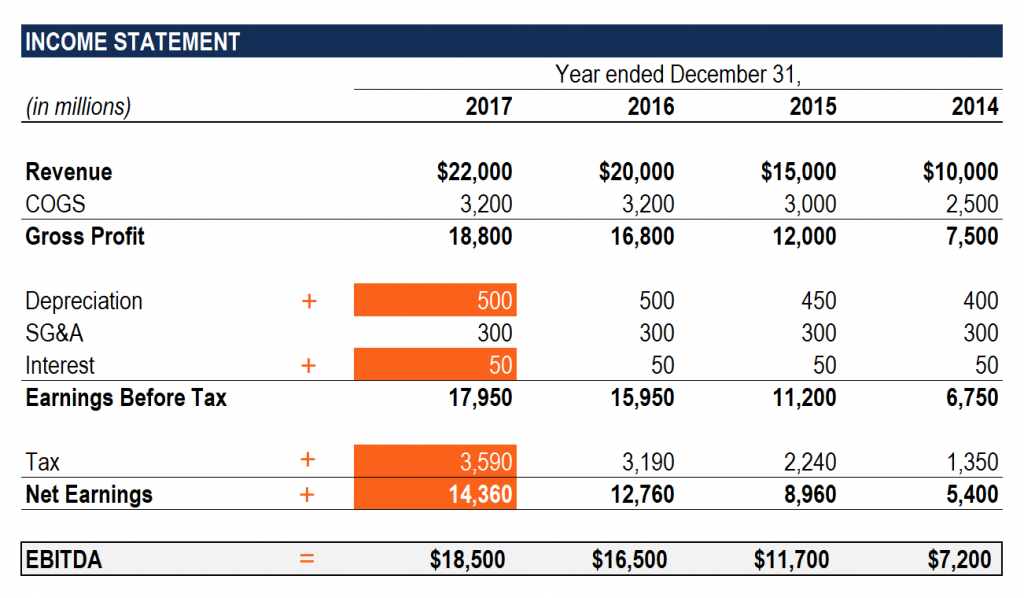

What is EBITDA Formula, Definition and Explanation

Operating cash flow (ocf) measures the net cash generated from the core operations of a company within a specified. Ebitda, which stands for earnings before interest, taxes, depreciation, and amortization, is a widely used metric in.

Full EBITDA Guide What is It & How Investors Use It (Formula)

Ebitda, which stands for earnings before interest, taxes, depreciation, and amortization, is a widely used metric in. Operating cash flow (ocf) measures the net cash generated from the core operations of a company within a specified.

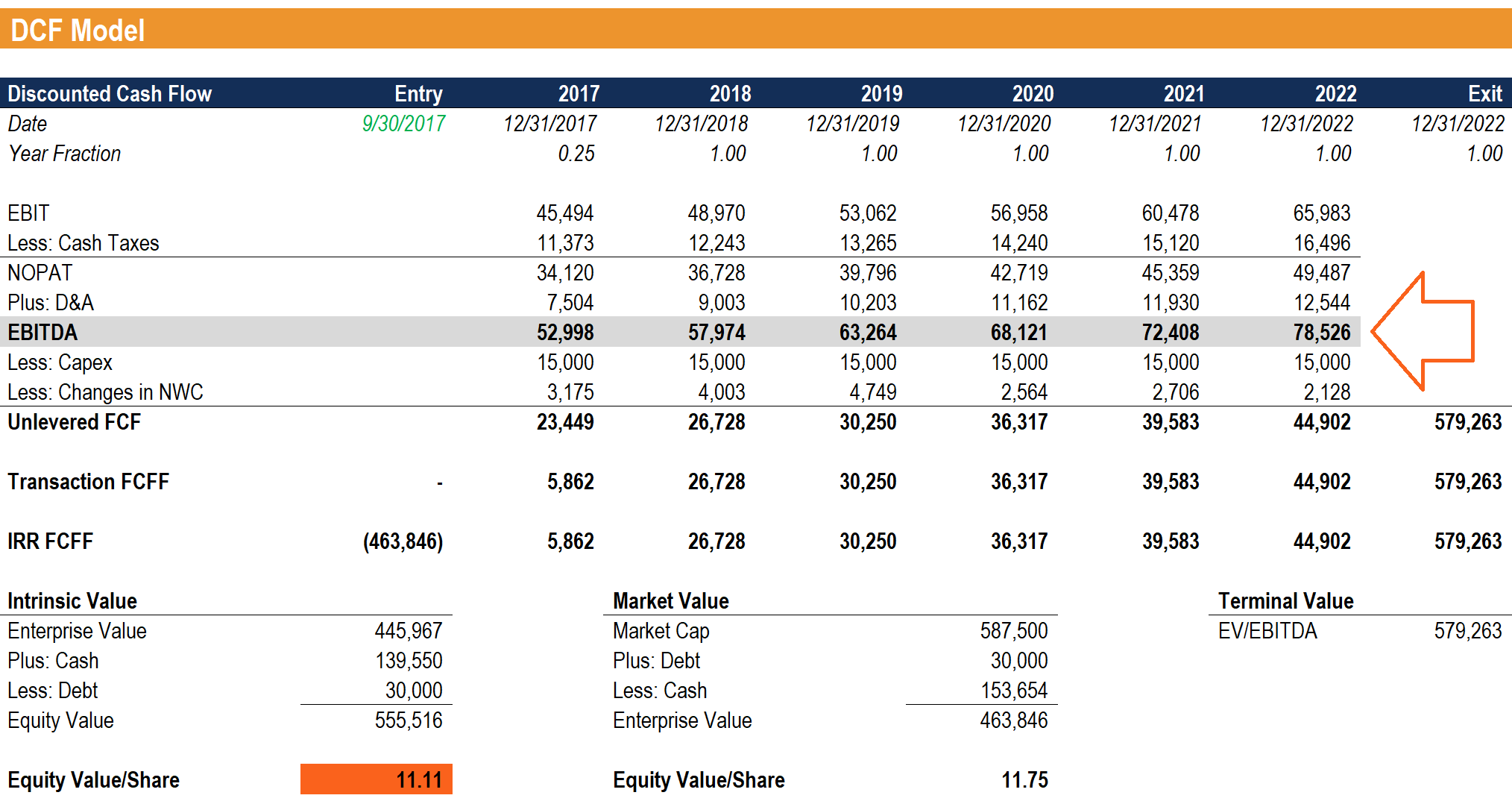

The ultimate cash flow guide ebitda cf fcf fcfe fcff Artofit

Operating cash flow (ocf) measures the net cash generated from the core operations of a company within a specified. Ebitda, which stands for earnings before interest, taxes, depreciation, and amortization, is a widely used metric in.

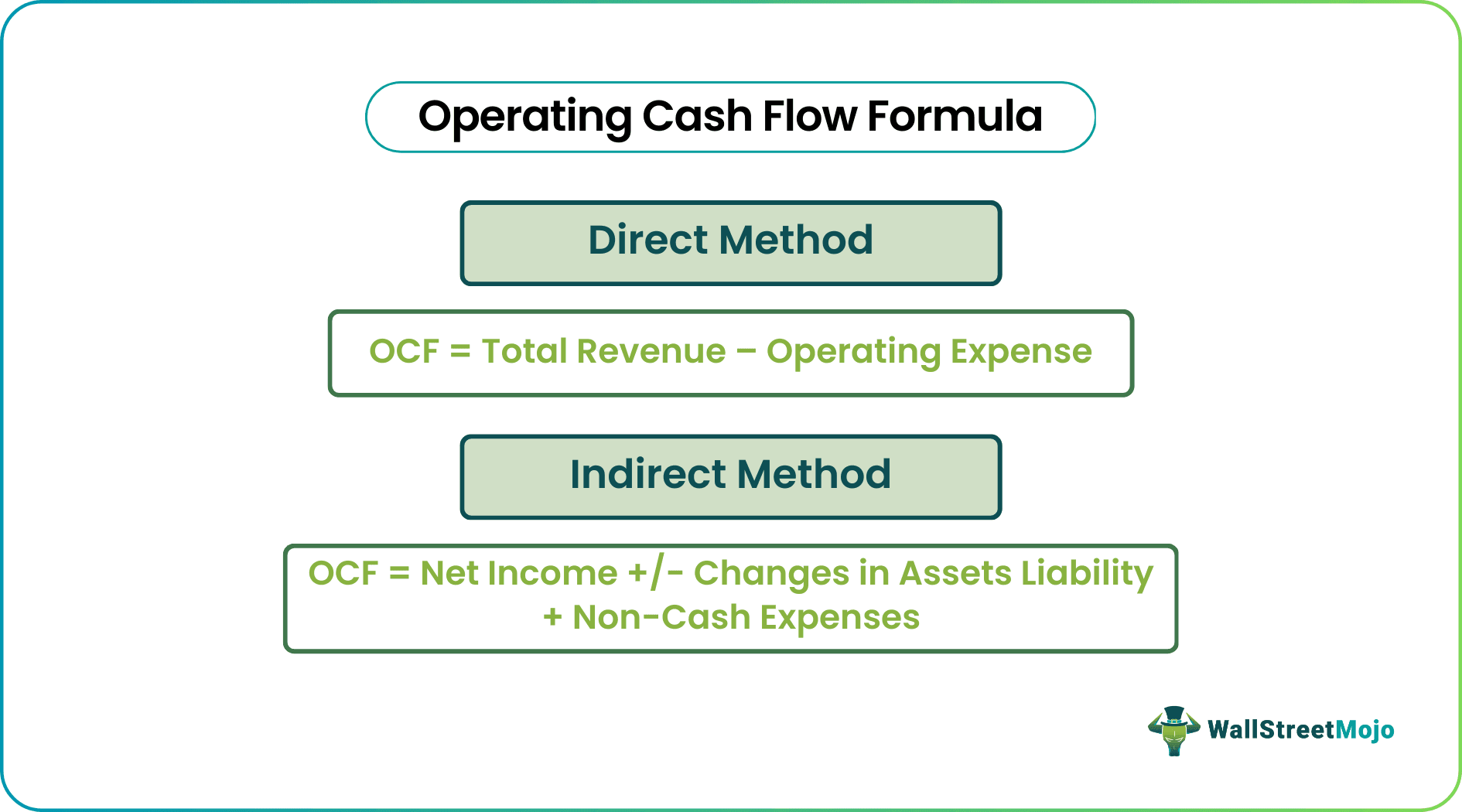

Operating Cash Flow Formula What Is It, How To Calculate

Ebitda, which stands for earnings before interest, taxes, depreciation, and amortization, is a widely used metric in. Operating cash flow (ocf) measures the net cash generated from the core operations of a company within a specified.

Operating Cash Flow Formula What Is It, How To Calculate

Operating cash flow (ocf) measures the net cash generated from the core operations of a company within a specified. Ebitda, which stands for earnings before interest, taxes, depreciation, and amortization, is a widely used metric in.

How to Calculate EBITDA A Comprehensive Guide // celc.pages.dev

Ebitda, which stands for earnings before interest, taxes, depreciation, and amortization, is a widely used metric in. Operating cash flow (ocf) measures the net cash generated from the core operations of a company within a specified.

EBITDA Meaning and Example Calculations

Operating cash flow (ocf) measures the net cash generated from the core operations of a company within a specified. Ebitda, which stands for earnings before interest, taxes, depreciation, and amortization, is a widely used metric in.

The Formula For Calculating EBITDA And Examples

Operating cash flow (ocf) measures the net cash generated from the core operations of a company within a specified. Ebitda, which stands for earnings before interest, taxes, depreciation, and amortization, is a widely used metric in.

Operating cash flow Formula, examples, and analysis Prophix

Ebitda, which stands for earnings before interest, taxes, depreciation, and amortization, is a widely used metric in. Operating cash flow (ocf) measures the net cash generated from the core operations of a company within a specified.

Ebitda, Which Stands For Earnings Before Interest, Taxes, Depreciation, And Amortization, Is A Widely Used Metric In.

Operating cash flow (ocf) measures the net cash generated from the core operations of a company within a specified.