Prepaid Tax Invoice Uae - The tax invoice must be issued and delivered to. Article 59 of cabinet decision no. Learn how to create compliant vat invoices in the uae, covering mandatory elements, common mistakes to avoid, and tips for using. Issuing a tax invoice in the uae involves certain key steps that ensure compliance with all the requirements of vat. (8) of 2017 on value added tax. Businesses and government entities are set to benefit from a new approach to invoicing where simplification, standardization and automation.

The tax invoice must be issued and delivered to. Learn how to create compliant vat invoices in the uae, covering mandatory elements, common mistakes to avoid, and tips for using. Businesses and government entities are set to benefit from a new approach to invoicing where simplification, standardization and automation. Article 59 of cabinet decision no. (8) of 2017 on value added tax. Issuing a tax invoice in the uae involves certain key steps that ensure compliance with all the requirements of vat.

Issuing a tax invoice in the uae involves certain key steps that ensure compliance with all the requirements of vat. Learn how to create compliant vat invoices in the uae, covering mandatory elements, common mistakes to avoid, and tips for using. (8) of 2017 on value added tax. Article 59 of cabinet decision no. Businesses and government entities are set to benefit from a new approach to invoicing where simplification, standardization and automation. The tax invoice must be issued and delivered to.

Invoices Overview Maxio

The tax invoice must be issued and delivered to. Learn how to create compliant vat invoices in the uae, covering mandatory elements, common mistakes to avoid, and tips for using. Issuing a tax invoice in the uae involves certain key steps that ensure compliance with all the requirements of vat. (8) of 2017 on value added tax. Article 59 of.

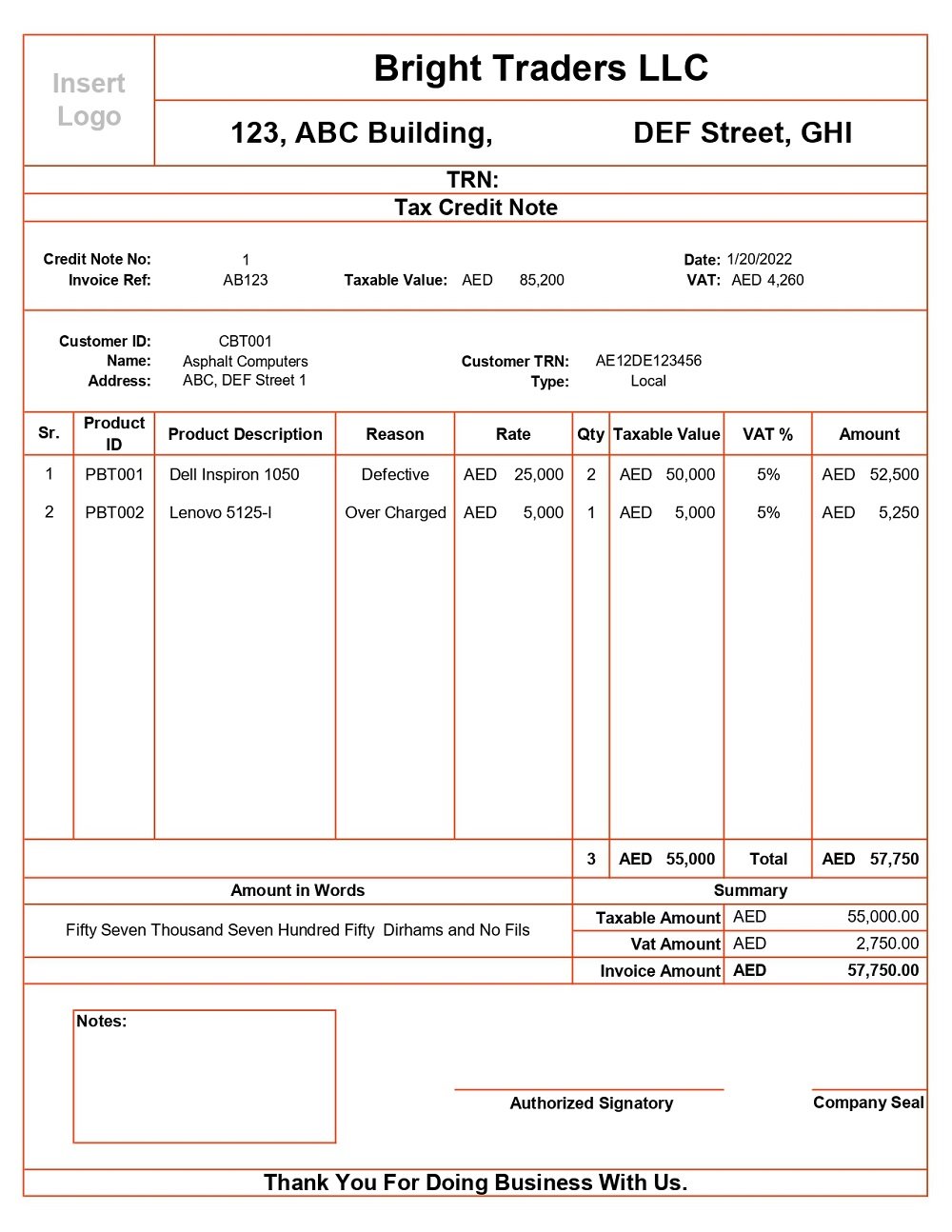

Invoices in UAE All You Need to Know

The tax invoice must be issued and delivered to. (8) of 2017 on value added tax. Businesses and government entities are set to benefit from a new approach to invoicing where simplification, standardization and automation. Learn how to create compliant vat invoices in the uae, covering mandatory elements, common mistakes to avoid, and tips for using. Issuing a tax invoice.

Prepayment Invoice Meaning & Example

Businesses and government entities are set to benefit from a new approach to invoicing where simplification, standardization and automation. Issuing a tax invoice in the uae involves certain key steps that ensure compliance with all the requirements of vat. Learn how to create compliant vat invoices in the uae, covering mandatory elements, common mistakes to avoid, and tips for using..

How to print dates and item prices in Arabic numerals in NetSuite

Article 59 of cabinet decision no. Learn how to create compliant vat invoices in the uae, covering mandatory elements, common mistakes to avoid, and tips for using. (8) of 2017 on value added tax. The tax invoice must be issued and delivered to. Businesses and government entities are set to benefit from a new approach to invoicing where simplification, standardization.

Invoice for VAT nonpayer in UAE Definition, Sample and Creation

(8) of 2017 on value added tax. Issuing a tax invoice in the uae involves certain key steps that ensure compliance with all the requirements of vat. Businesses and government entities are set to benefit from a new approach to invoicing where simplification, standardization and automation. The tax invoice must be issued and delivered to. Article 59 of cabinet decision.

What Is a Prepayment Invoice and How Do I Create One? Blinksale

The tax invoice must be issued and delivered to. Learn how to create compliant vat invoices in the uae, covering mandatory elements, common mistakes to avoid, and tips for using. Article 59 of cabinet decision no. Issuing a tax invoice in the uae involves certain key steps that ensure compliance with all the requirements of vat. (8) of 2017 on.

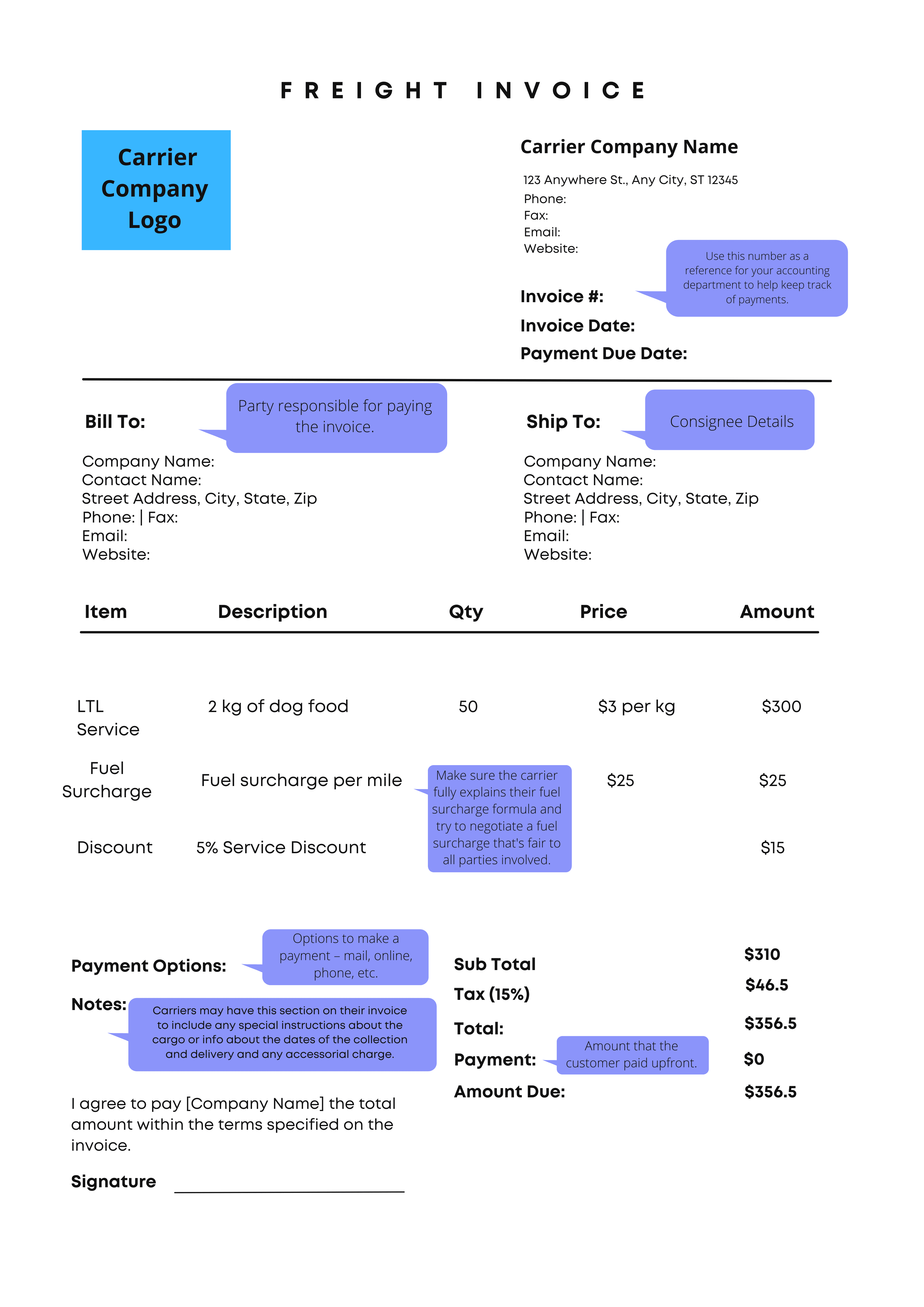

Abf Freight Invoice at Robyn blog

Article 59 of cabinet decision no. Businesses and government entities are set to benefit from a new approach to invoicing where simplification, standardization and automation. Learn how to create compliant vat invoices in the uae, covering mandatory elements, common mistakes to avoid, and tips for using. The tax invoice must be issued and delivered to. Issuing a tax invoice in.

3 Top Invoicing Tools (Free & Paid) for UAE

(8) of 2017 on value added tax. The tax invoice must be issued and delivered to. Businesses and government entities are set to benefit from a new approach to invoicing where simplification, standardization and automation. Issuing a tax invoice in the uae involves certain key steps that ensure compliance with all the requirements of vat. Learn how to create compliant.

Overview Lago

Article 59 of cabinet decision no. The tax invoice must be issued and delivered to. Issuing a tax invoice in the uae involves certain key steps that ensure compliance with all the requirements of vat. Businesses and government entities are set to benefit from a new approach to invoicing where simplification, standardization and automation. (8) of 2017 on value added.

Download Uae Invoice Template With Vat In Excel Arabi vrogue.co

Learn how to create compliant vat invoices in the uae, covering mandatory elements, common mistakes to avoid, and tips for using. The tax invoice must be issued and delivered to. Article 59 of cabinet decision no. Businesses and government entities are set to benefit from a new approach to invoicing where simplification, standardization and automation. (8) of 2017 on value.

Issuing A Tax Invoice In The Uae Involves Certain Key Steps That Ensure Compliance With All The Requirements Of Vat.

Article 59 of cabinet decision no. (8) of 2017 on value added tax. Learn how to create compliant vat invoices in the uae, covering mandatory elements, common mistakes to avoid, and tips for using. Businesses and government entities are set to benefit from a new approach to invoicing where simplification, standardization and automation.