Professional Tax In Salary Slip - It is also applicable to. For people with salaried income, employers are responsible for professional tax deductions from employees and paying it to the government. Easily track pto & morediy payroll If you ever pay close attention to your pay slips, you’ll see a monthly deduction called ‘ professional tax ’. Learn what is professional tax, its applicability, and tax slab. Professional tax is a tax that is imposed by the state on salaried employees and businesses. Every salaried individual, working and earning a monthly income, is liable to pay a certain part of his/her earnings to the respective state. Professional tax is deducted from your gross salary with tds and epf. Learn how to calculate professional tax on salary effortlessly! Discover tax slab rates, deductions, & tips to maximize.

Every salaried individual, working and earning a monthly income, is liable to pay a certain part of his/her earnings to the respective state. It is also applicable to. Learn what is professional tax, its applicability, and tax slab. Easily track pto & morediy payroll Professional tax is a tax that is imposed by the state on salaried employees and businesses. For people with salaried income, employers are responsible for professional tax deductions from employees and paying it to the government. Discover tax slab rates, deductions, & tips to maximize. Professional tax is deducted from your gross salary with tds and epf. If you ever pay close attention to your pay slips, you’ll see a monthly deduction called ‘ professional tax ’. Learn how to calculate professional tax on salary effortlessly!

Professional tax is deducted from your gross salary with tds and epf. Professional tax is a tax that is imposed by the state on salaried employees and businesses. Learn how to calculate professional tax on salary effortlessly! Learn what is professional tax, its applicability, and tax slab. If you ever pay close attention to your pay slips, you’ll see a monthly deduction called ‘ professional tax ’. Easily track pto & morediy payroll Every salaried individual, working and earning a monthly income, is liable to pay a certain part of his/her earnings to the respective state. For people with salaried income, employers are responsible for professional tax deductions from employees and paying it to the government. Discover tax slab rates, deductions, & tips to maximize. It is also applicable to.

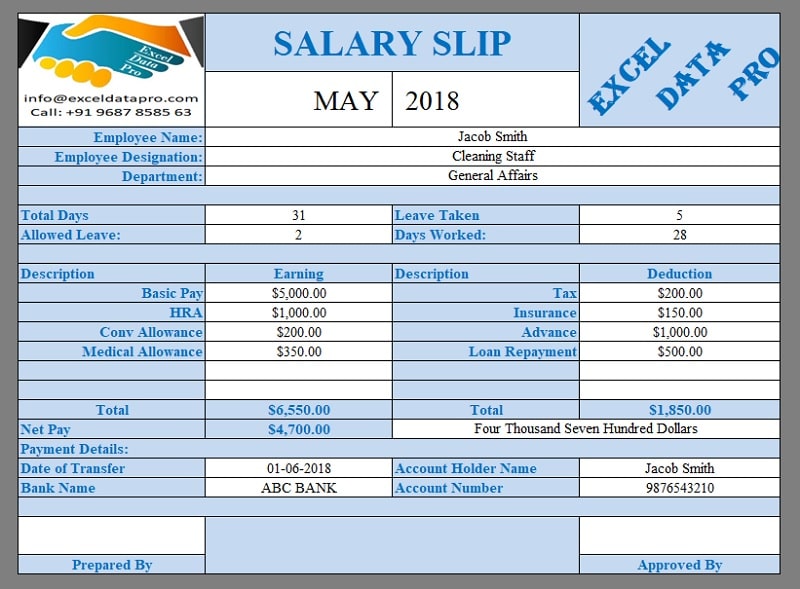

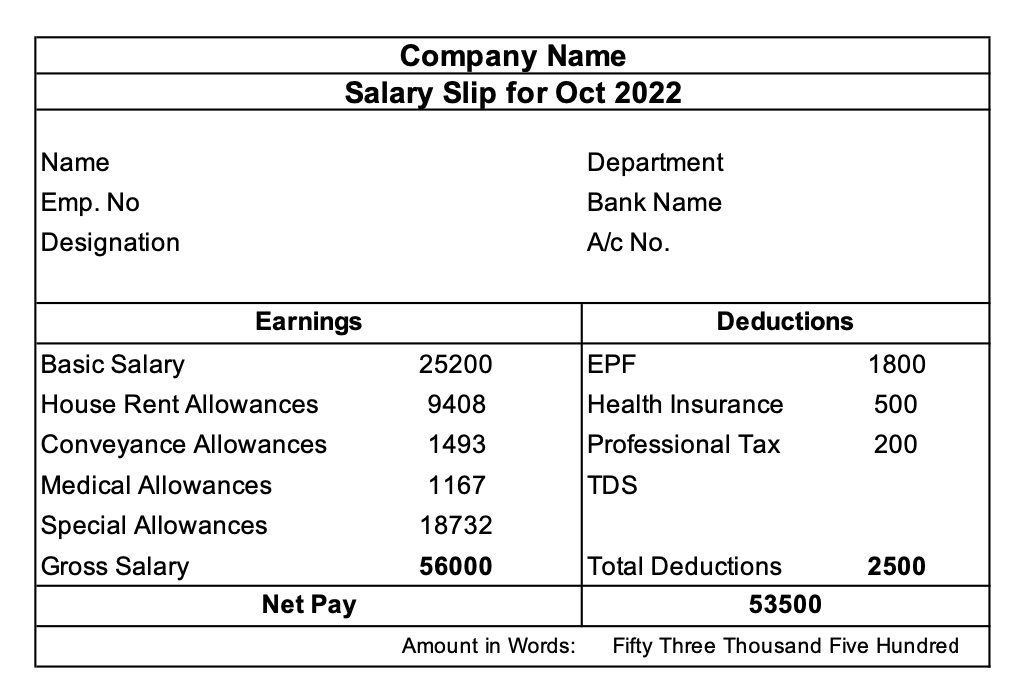

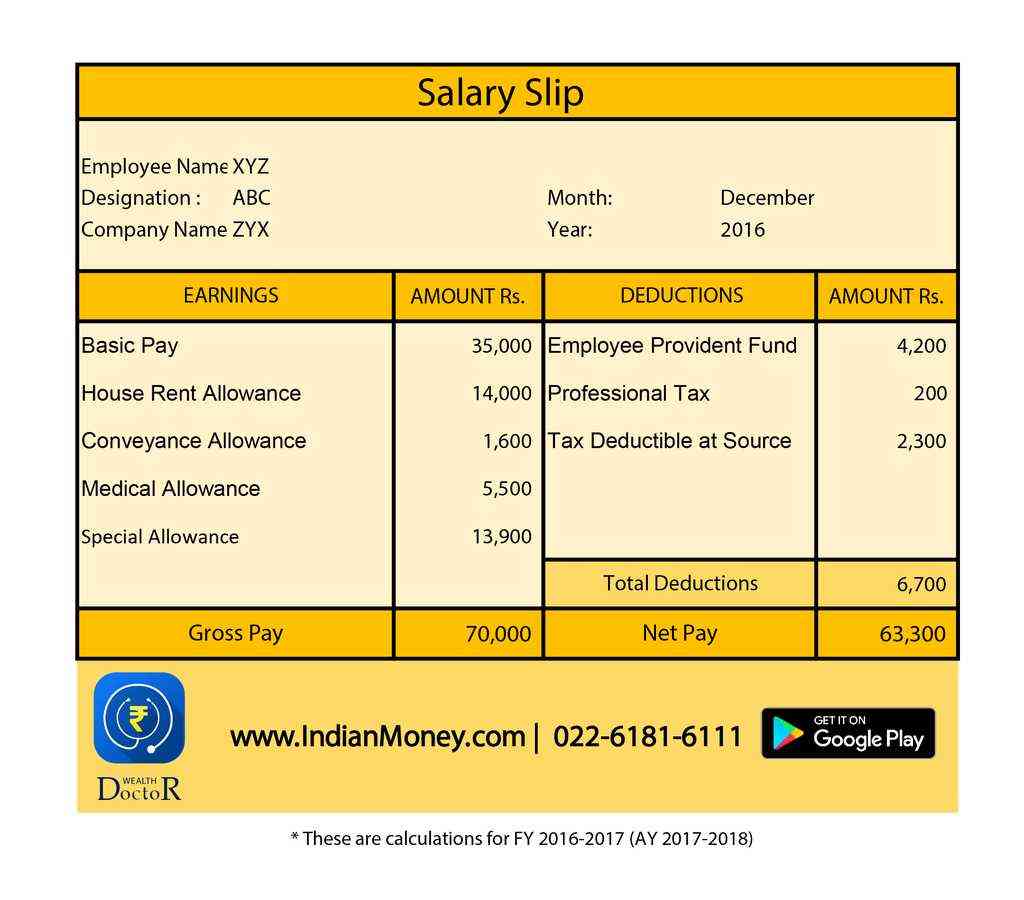

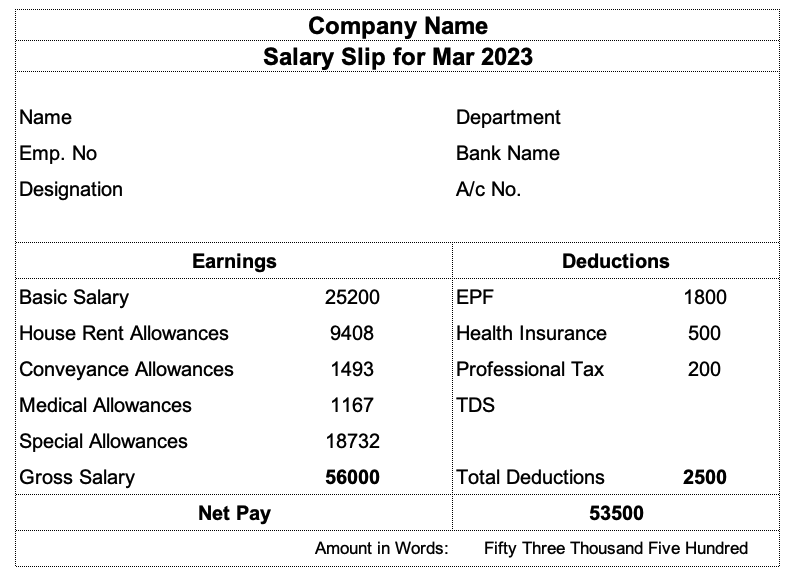

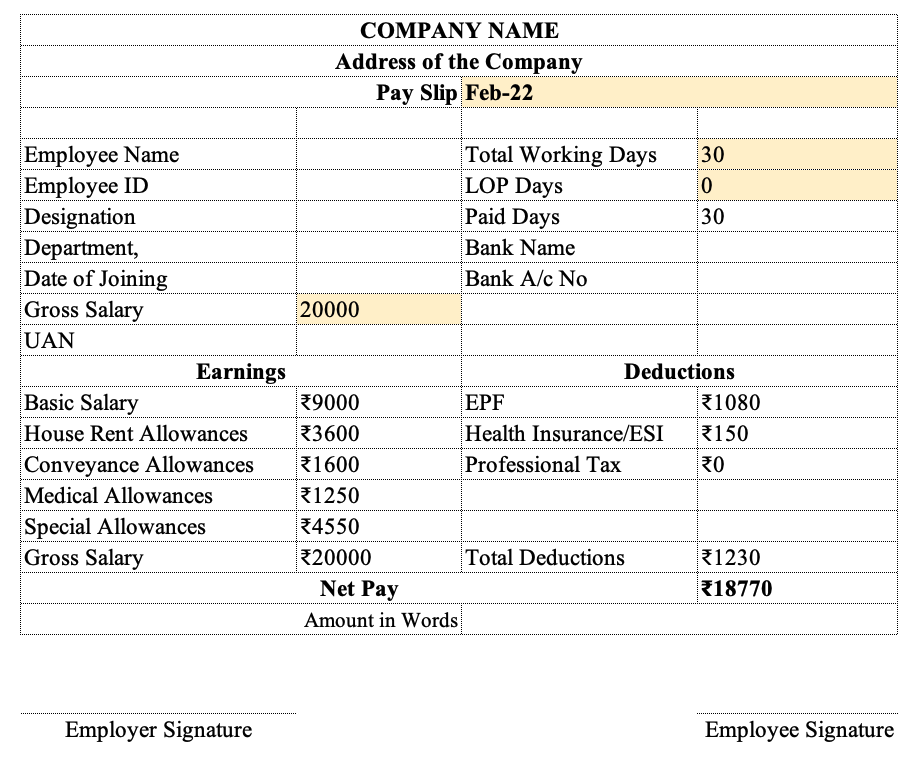

Salary Slip Meaning, Format and Components

It is also applicable to. Easily track pto & morediy payroll Professional tax is deducted from your gross salary with tds and epf. Learn how to calculate professional tax on salary effortlessly! Every salaried individual, working and earning a monthly income, is liable to pay a certain part of his/her earnings to the respective state.

Salary slip excel format vfecasa

For people with salaried income, employers are responsible for professional tax deductions from employees and paying it to the government. Learn how to calculate professional tax on salary effortlessly! If you ever pay close attention to your pay slips, you’ll see a monthly deduction called ‘ professional tax ’. It is also applicable to. Learn what is professional tax, its.

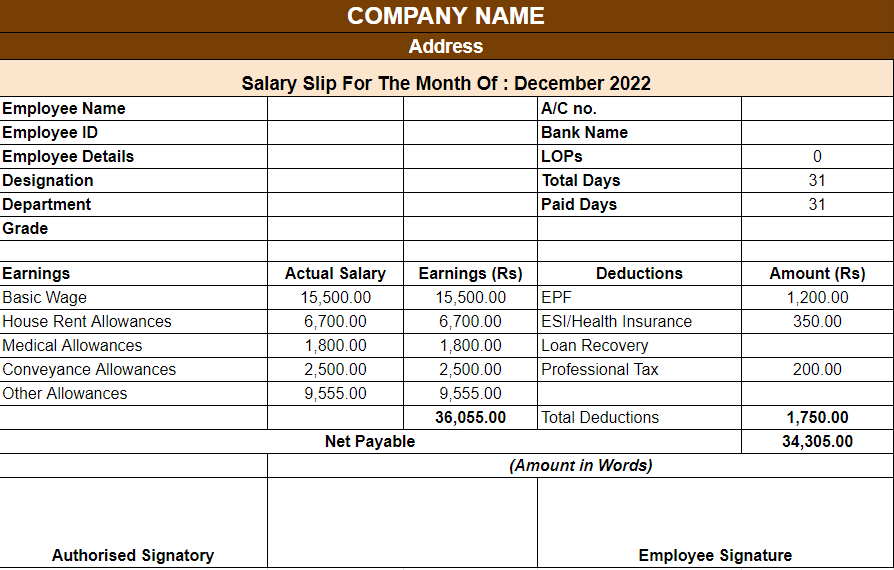

Excel Payslip Template

For people with salaried income, employers are responsible for professional tax deductions from employees and paying it to the government. If you ever pay close attention to your pay slips, you’ll see a monthly deduction called ‘ professional tax ’. Discover tax slab rates, deductions, & tips to maximize. Easily track pto & morediy payroll Professional tax is deducted from.

8 Essential Components Of Salary Slip That You Should vrogue.co

Learn how to calculate professional tax on salary effortlessly! Every salaried individual, working and earning a monthly income, is liable to pay a certain part of his/her earnings to the respective state. It is also applicable to. Learn what is professional tax, its applicability, and tax slab. If you ever pay close attention to your pay slips, you’ll see a.

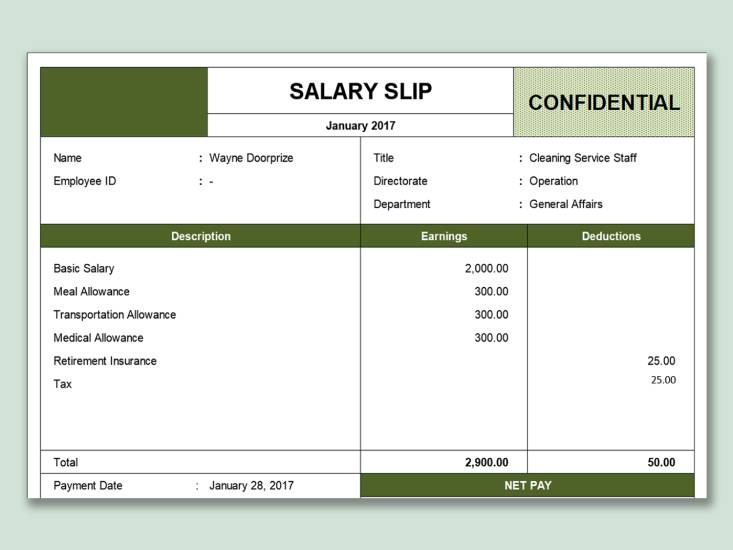

Payslip Sample Template Paysliper, 55 OFF

Discover tax slab rates, deductions, & tips to maximize. Learn what is professional tax, its applicability, and tax slab. Every salaried individual, working and earning a monthly income, is liable to pay a certain part of his/her earnings to the respective state. It is also applicable to. Learn how to calculate professional tax on salary effortlessly!

Salary Slip Template In Excel The Ultimate Guide To Creating And Using

It is also applicable to. Learn how to calculate professional tax on salary effortlessly! Easily track pto & morediy payroll For people with salaried income, employers are responsible for professional tax deductions from employees and paying it to the government. Every salaried individual, working and earning a monthly income, is liable to pay a certain part of his/her earnings to.

Simple Salary Slip Formats in Excel Word PDF Download

Professional tax is deducted from your gross salary with tds and epf. Every salaried individual, working and earning a monthly income, is liable to pay a certain part of his/her earnings to the respective state. Easily track pto & morediy payroll Discover tax slab rates, deductions, & tips to maximize. It is also applicable to.

Creating a Professional Salary Slip Format in MS Excel

Easily track pto & morediy payroll Every salaried individual, working and earning a monthly income, is liable to pay a certain part of his/her earnings to the respective state. Learn what is professional tax, its applicability, and tax slab. If you ever pay close attention to your pay slips, you’ll see a monthly deduction called ‘ professional tax ’. Discover.

Know What is Salary Slip and Why it is Important in Tax Savings

Professional tax is a tax that is imposed by the state on salaried employees and businesses. Every salaried individual, working and earning a monthly income, is liable to pay a certain part of his/her earnings to the respective state. It is also applicable to. Discover tax slab rates, deductions, & tips to maximize. If you ever pay close attention to.

Simple Salary Slip Format in Word, Excel, PDF Pay Slip Free Download

Easily track pto & morediy payroll Learn how to calculate professional tax on salary effortlessly! If you ever pay close attention to your pay slips, you’ll see a monthly deduction called ‘ professional tax ’. For people with salaried income, employers are responsible for professional tax deductions from employees and paying it to the government. Discover tax slab rates, deductions,.

It Is Also Applicable To.

Learn how to calculate professional tax on salary effortlessly! Every salaried individual, working and earning a monthly income, is liable to pay a certain part of his/her earnings to the respective state. Easily track pto & morediy payroll For people with salaried income, employers are responsible for professional tax deductions from employees and paying it to the government.

Discover Tax Slab Rates, Deductions, & Tips To Maximize.

Professional tax is a tax that is imposed by the state on salaried employees and businesses. Learn what is professional tax, its applicability, and tax slab. Professional tax is deducted from your gross salary with tds and epf. If you ever pay close attention to your pay slips, you’ll see a monthly deduction called ‘ professional tax ’.