Pv Of Future Cash Flows - Pv is used to evaluate and compare different investment opportunities by calculating the present value of their expected future cash. The present value (pv) formula discounts the future value (fv) of a cash flow received in the future to the estimated amount.

Pv is used to evaluate and compare different investment opportunities by calculating the present value of their expected future cash. The present value (pv) formula discounts the future value (fv) of a cash flow received in the future to the estimated amount.

The present value (pv) formula discounts the future value (fv) of a cash flow received in the future to the estimated amount. Pv is used to evaluate and compare different investment opportunities by calculating the present value of their expected future cash.

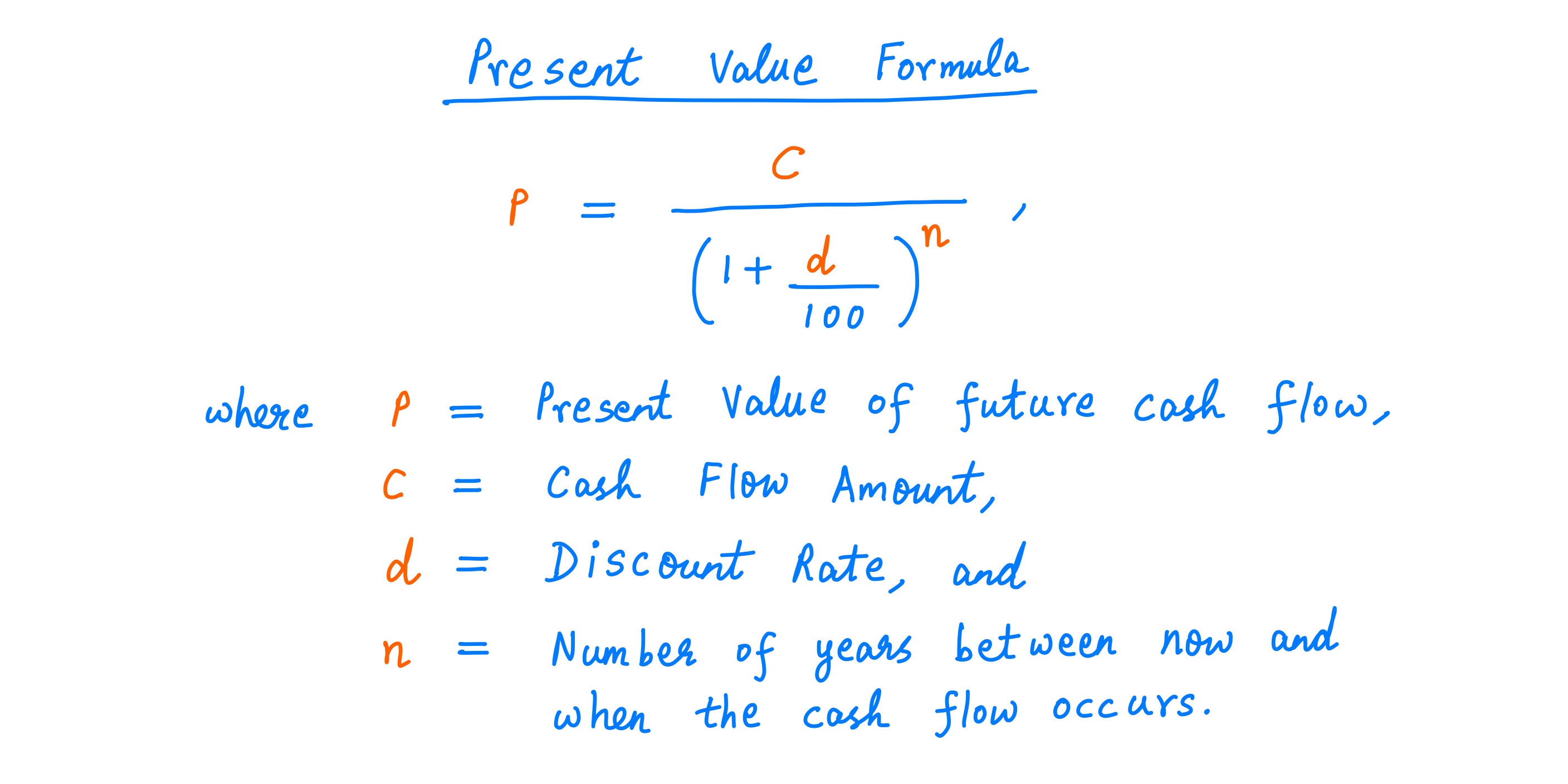

Present Value Formula

The present value (pv) formula discounts the future value (fv) of a cash flow received in the future to the estimated amount. Pv is used to evaluate and compare different investment opportunities by calculating the present value of their expected future cash.

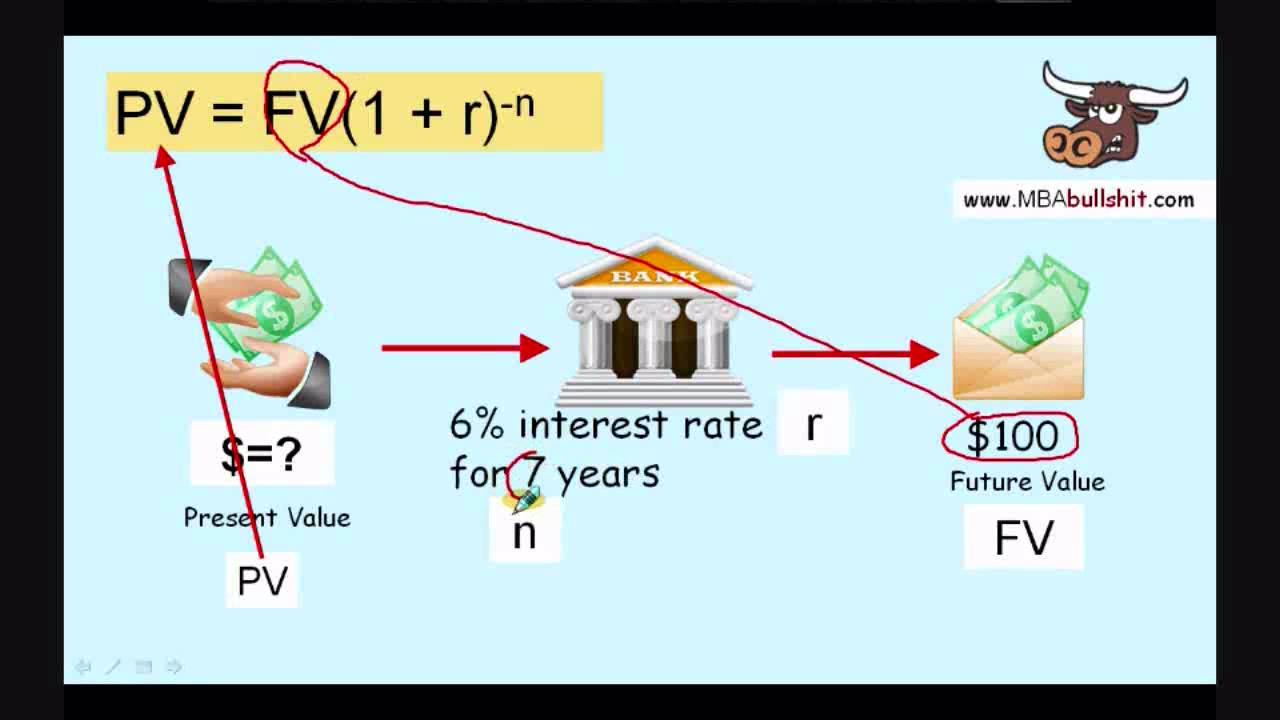

Fv Pv Formula

Pv is used to evaluate and compare different investment opportunities by calculating the present value of their expected future cash. The present value (pv) formula discounts the future value (fv) of a cash flow received in the future to the estimated amount.

Pv of future cash flows calculator SophieRylie

Pv is used to evaluate and compare different investment opportunities by calculating the present value of their expected future cash. The present value (pv) formula discounts the future value (fv) of a cash flow received in the future to the estimated amount.

Present Value of Expected Future Cash Flows of HKL's Bond and Selected

The present value (pv) formula discounts the future value (fv) of a cash flow received in the future to the estimated amount. Pv is used to evaluate and compare different investment opportunities by calculating the present value of their expected future cash.

The present value of future cash flows is divided by an initial cost of

Pv is used to evaluate and compare different investment opportunities by calculating the present value of their expected future cash. The present value (pv) formula discounts the future value (fv) of a cash flow received in the future to the estimated amount.

Pv of future cash flows calculator SophieRylie

The present value (pv) formula discounts the future value (fv) of a cash flow received in the future to the estimated amount. Pv is used to evaluate and compare different investment opportunities by calculating the present value of their expected future cash.

Present Value Formula for Continuous Compounding Kline Durged

The present value (pv) formula discounts the future value (fv) of a cash flow received in the future to the estimated amount. Pv is used to evaluate and compare different investment opportunities by calculating the present value of their expected future cash.

Present Value of Cash Flows Calculator Finance Calculator iCalcula

The present value (pv) formula discounts the future value (fv) of a cash flow received in the future to the estimated amount. Pv is used to evaluate and compare different investment opportunities by calculating the present value of their expected future cash.

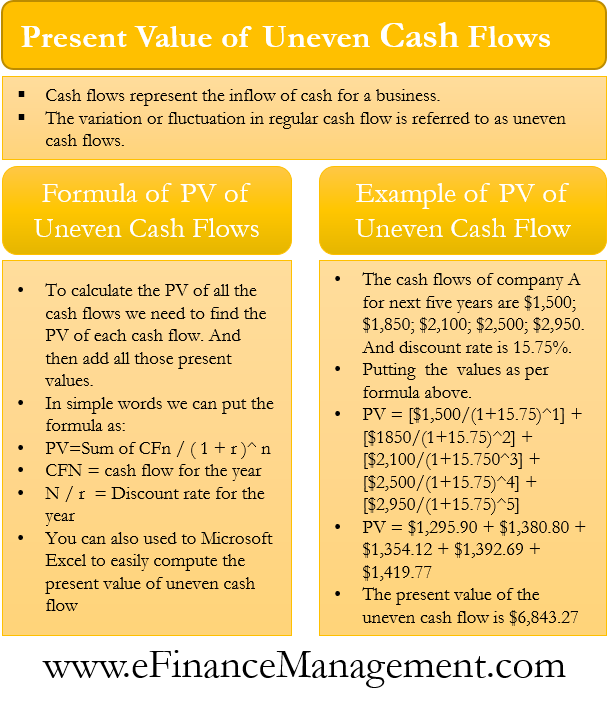

Future Value, Present Value and Net Present Value with Multiple Cash

Pv is used to evaluate and compare different investment opportunities by calculating the present value of their expected future cash. The present value (pv) formula discounts the future value (fv) of a cash flow received in the future to the estimated amount.

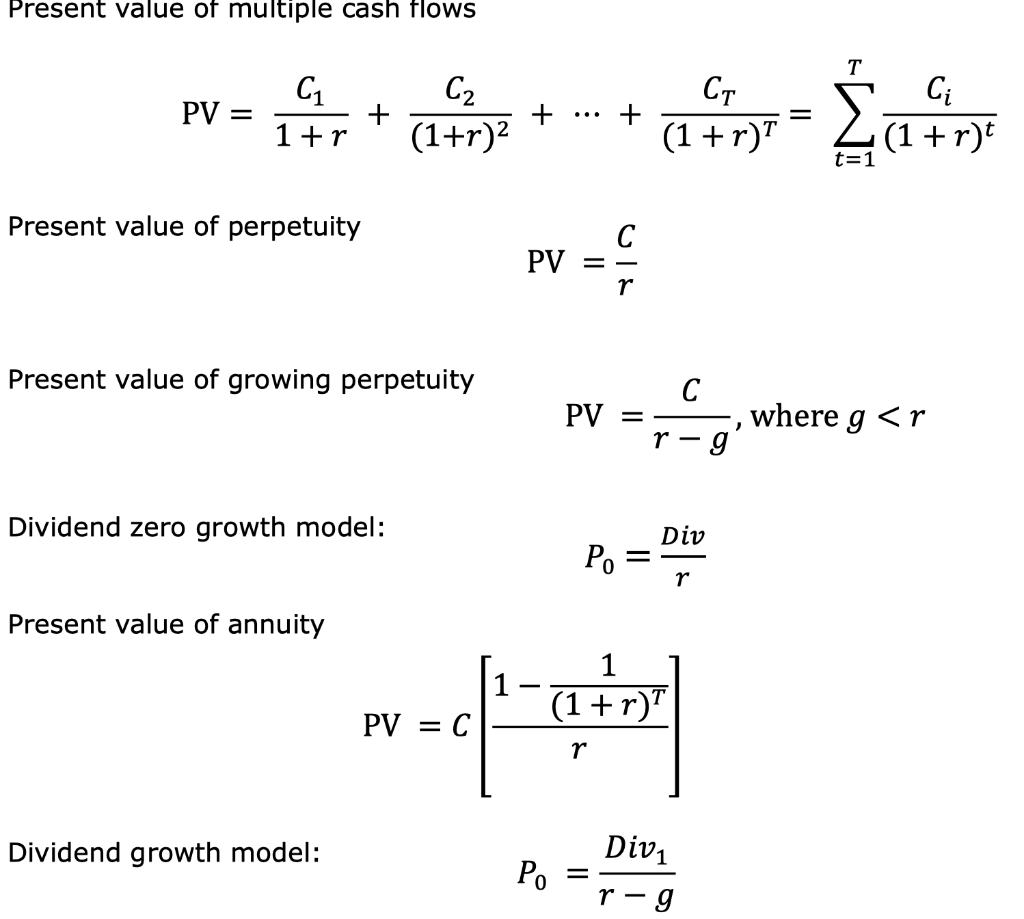

Solved Present value of multiple cash flows CT PV = C1 1+r

The present value (pv) formula discounts the future value (fv) of a cash flow received in the future to the estimated amount. Pv is used to evaluate and compare different investment opportunities by calculating the present value of their expected future cash.

The Present Value (Pv) Formula Discounts The Future Value (Fv) Of A Cash Flow Received In The Future To The Estimated Amount.

Pv is used to evaluate and compare different investment opportunities by calculating the present value of their expected future cash.