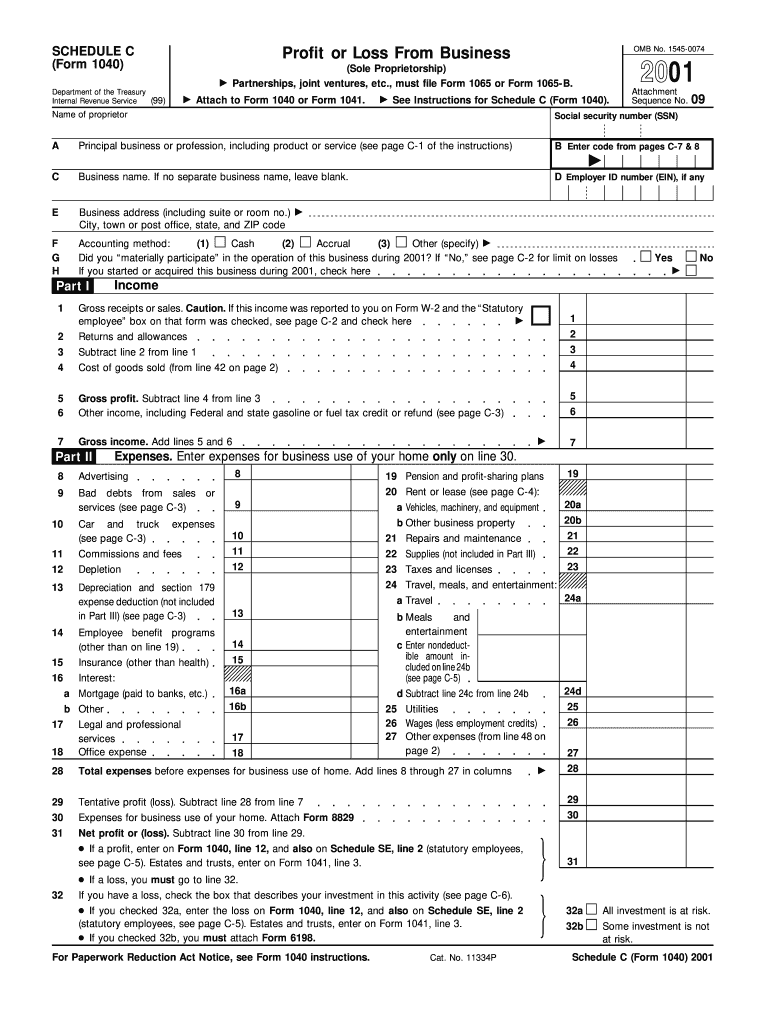

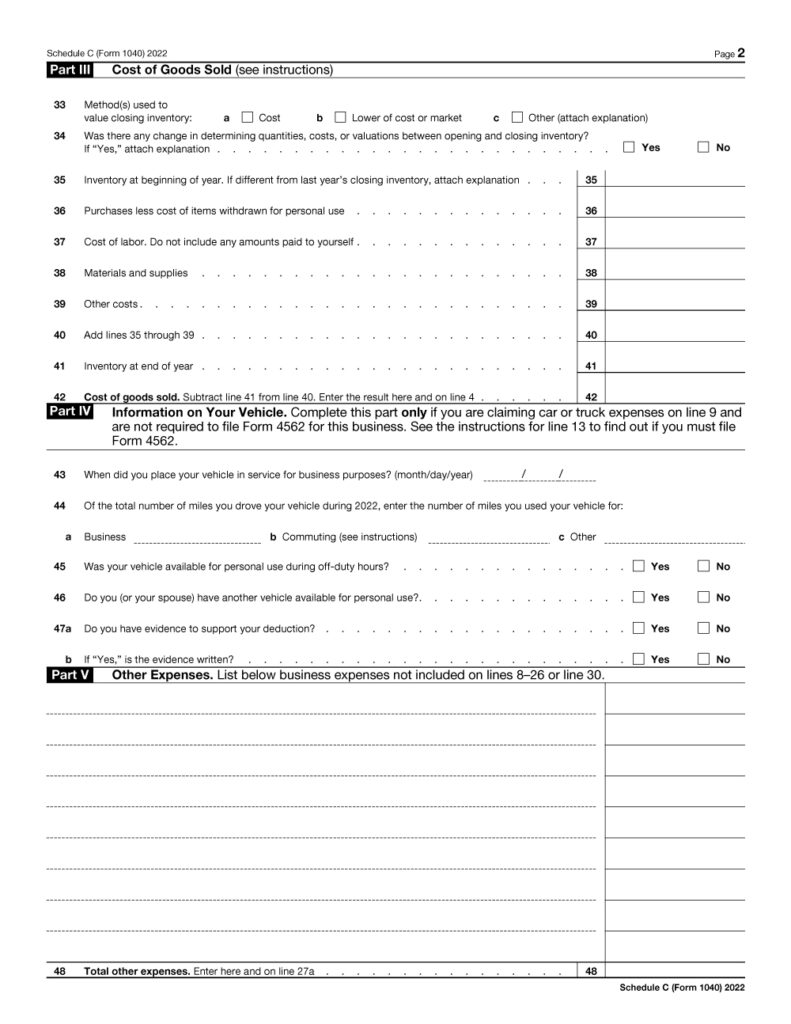

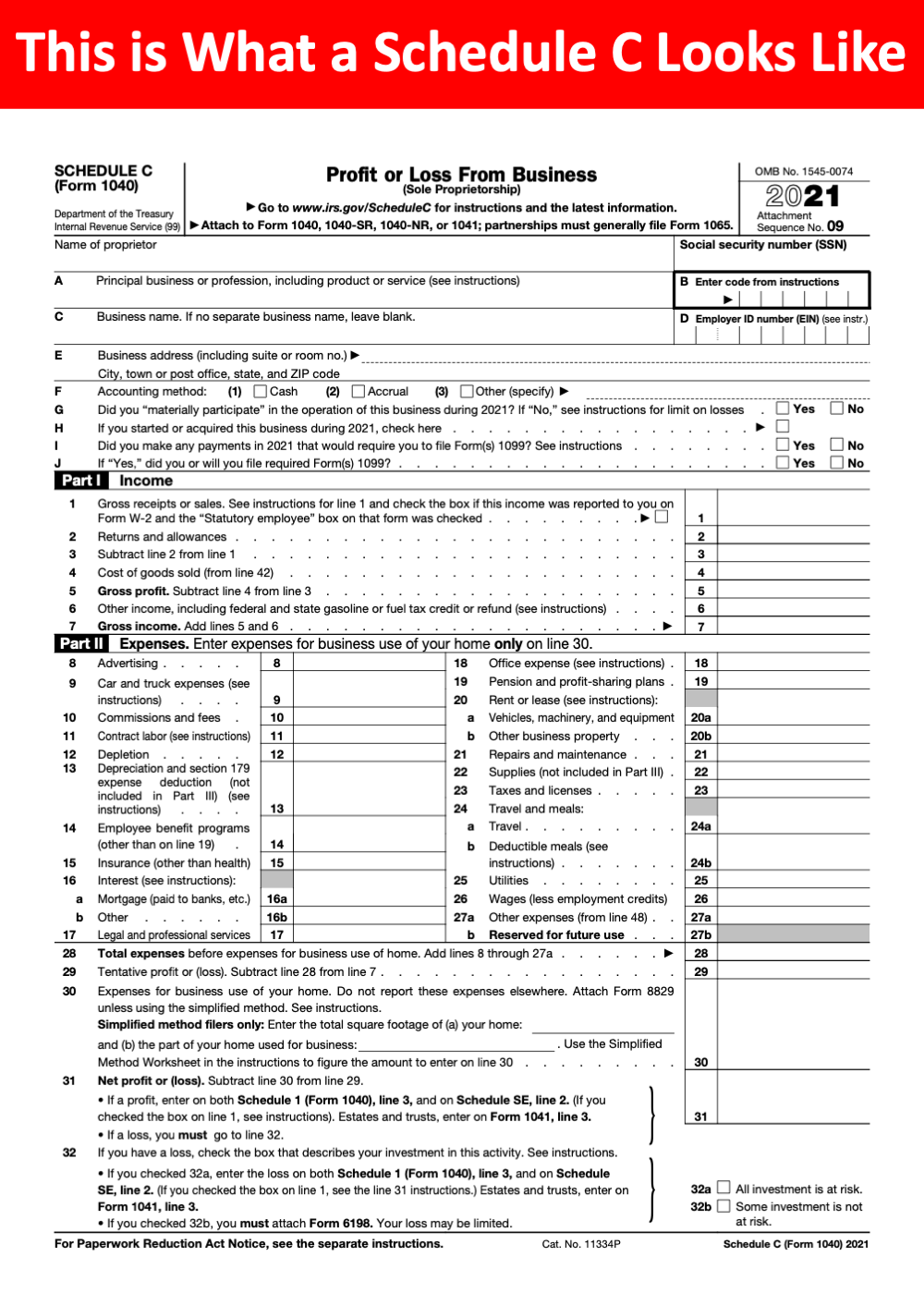

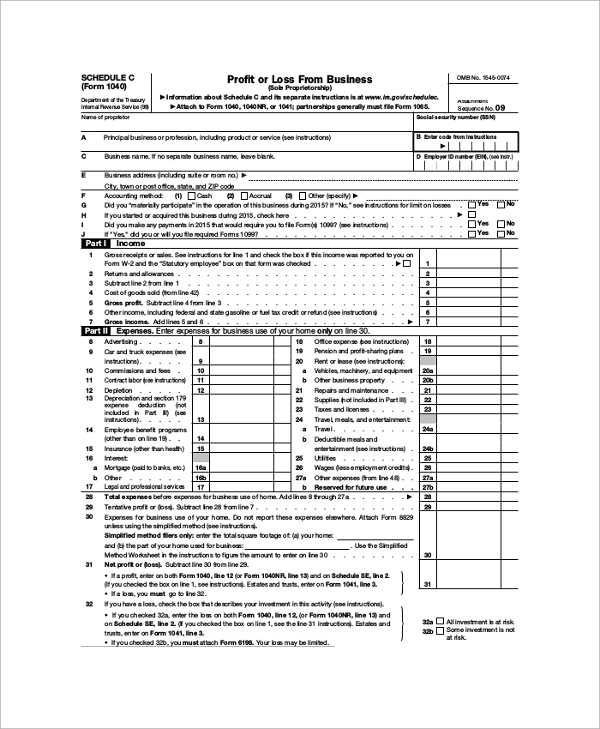

Schedule C 2023 Printable - If no separate business name, leave blank. Go to www.irs.gov/schedulec for instructions and the latest information. Schedule c (form 1040) is used to report income or loss from a business operated as a sole proprietorship. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. This essential form also helps. Maximize your business deductions and accurately calculate your profit or loss with federal form 1040 schedule c.

Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. If no separate business name, leave blank. This essential form also helps. Schedule c (form 1040) is used to report income or loss from a business operated as a sole proprietorship. Maximize your business deductions and accurately calculate your profit or loss with federal form 1040 schedule c. Go to www.irs.gov/schedulec for instructions and the latest information.

Maximize your business deductions and accurately calculate your profit or loss with federal form 1040 schedule c. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. If no separate business name, leave blank. Schedule c (form 1040) is used to report income or loss from a business operated as a sole proprietorship. This essential form also helps. Go to www.irs.gov/schedulec for instructions and the latest information.

2023 Form IRS Instructions 1040 Schedule C Fill Online, Printable

Schedule c (form 1040) is used to report income or loss from a business operated as a sole proprietorship. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. Go to www.irs.gov/schedulec for instructions and the latest information. If no separate business name, leave blank. This essential.

Printable Schedule C 2023

This essential form also helps. Schedule c (form 1040) is used to report income or loss from a business operated as a sole proprietorship. Maximize your business deductions and accurately calculate your profit or loss with federal form 1040 schedule c. If no separate business name, leave blank. Information about schedule c (form 1040), profit or loss from business, used.

Tax Return 2023 Chart Printable Forms Free Online

Maximize your business deductions and accurately calculate your profit or loss with federal form 1040 schedule c. Schedule c (form 1040) is used to report income or loss from a business operated as a sole proprietorship. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. Go.

Printable Schedule C 2023

If no separate business name, leave blank. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. Go to www.irs.gov/schedulec for instructions and the latest information. Maximize your business deductions and accurately calculate your profit or loss with federal form 1040 schedule c. This essential form also.

Printable Schedule C 2023

Go to www.irs.gov/schedulec for instructions and the latest information. Schedule c (form 1040) is used to report income or loss from a business operated as a sole proprietorship. This essential form also helps. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. Maximize your business deductions.

Printable Schedule C 2023

Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. This essential form also helps. Schedule c (form 1040) is used to report income or loss from a business operated as a sole proprietorship. Maximize your business deductions and accurately calculate your profit or loss with federal.

Schedule C 2023 Form Printable Forms Free Online

This essential form also helps. Maximize your business deductions and accurately calculate your profit or loss with federal form 1040 schedule c. If no separate business name, leave blank. Go to www.irs.gov/schedulec for instructions and the latest information. Schedule c (form 1040) is used to report income or loss from a business operated as a sole proprietorship.

Printable Schedule C 2023

Go to www.irs.gov/schedulec for instructions and the latest information. If no separate business name, leave blank. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. Maximize your business deductions and accurately calculate your profit or loss with federal form 1040 schedule c. Schedule c (form 1040).

Schedule C Printable Guide

Go to www.irs.gov/schedulec for instructions and the latest information. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. This essential form also helps. If no separate business name, leave blank. Schedule c (form 1040) is used to report income or loss from a business operated as.

Printable Schedule C

This essential form also helps. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. Go to www.irs.gov/schedulec for instructions and the latest information. Maximize your business deductions and accurately calculate your profit or loss with federal form 1040 schedule c. If no separate business name, leave.

Maximize Your Business Deductions And Accurately Calculate Your Profit Or Loss With Federal Form 1040 Schedule C.

Schedule c (form 1040) is used to report income or loss from a business operated as a sole proprietorship. If no separate business name, leave blank. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. This essential form also helps.