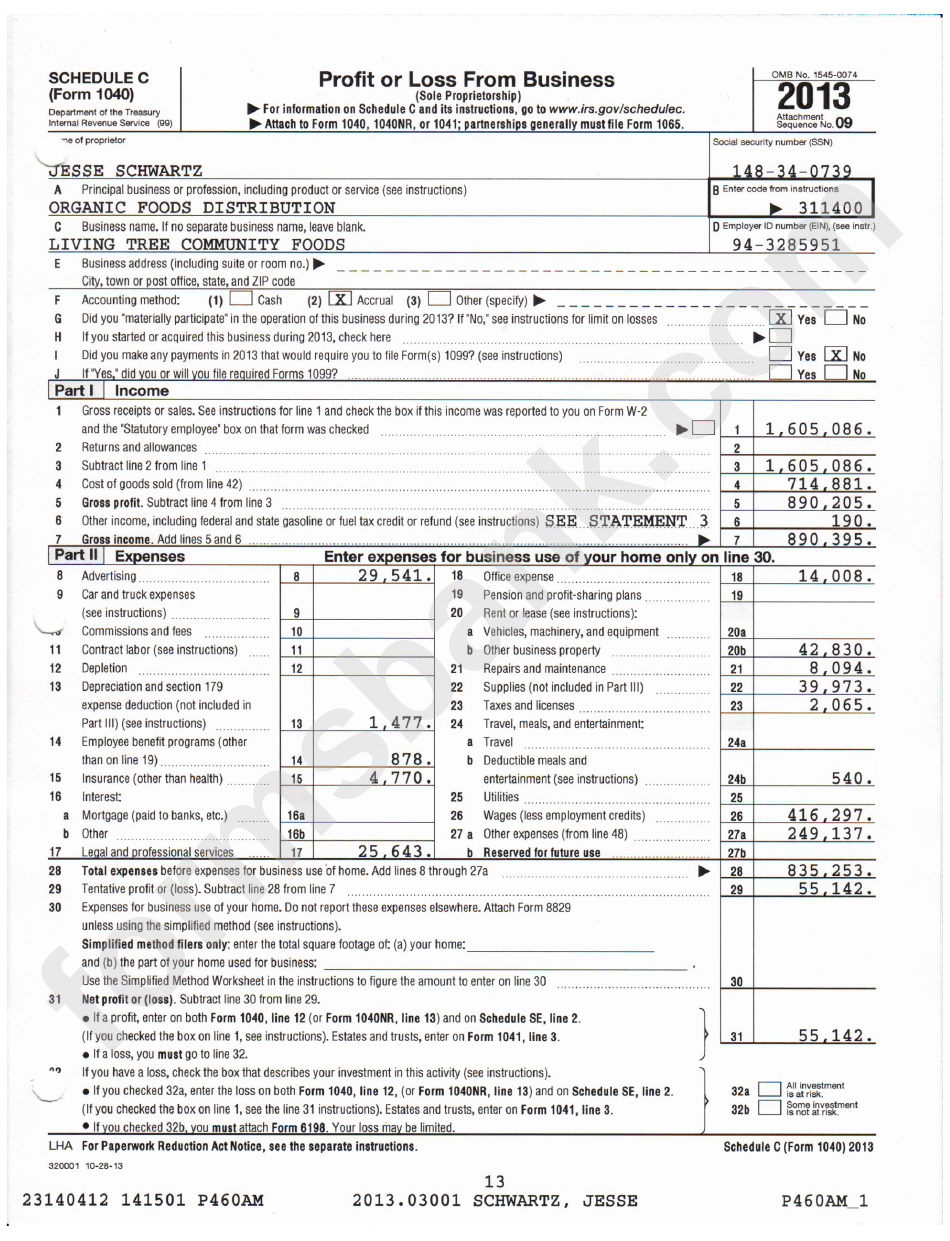

Schedule C 2024 Printable Form - Report income or loss from a business or profession as a sole proprietor using schedule c (form 1040). Use schedule c to report income or loss from a business or profession in which you were the sole proprietor. Download or print the 2024 federal (profit or loss from business (sole proprietorship)) (2024) and other income tax forms from the federal. (if you checked the box on. Find the current and previous. • if you checked 32a, enter the loss on both schedule 1 (form 1040), line 3, and on schedule se, line 2. The 2024 form 1040 schedule c profit or loss from business (sole proprietorship) is used to report the income and expenses of a sole.

Download or print the 2024 federal (profit or loss from business (sole proprietorship)) (2024) and other income tax forms from the federal. Find the current and previous. (if you checked the box on. The 2024 form 1040 schedule c profit or loss from business (sole proprietorship) is used to report the income and expenses of a sole. Report income or loss from a business or profession as a sole proprietor using schedule c (form 1040). Use schedule c to report income or loss from a business or profession in which you were the sole proprietor. • if you checked 32a, enter the loss on both schedule 1 (form 1040), line 3, and on schedule se, line 2.

Find the current and previous. Use schedule c to report income or loss from a business or profession in which you were the sole proprietor. (if you checked the box on. Download or print the 2024 federal (profit or loss from business (sole proprietorship)) (2024) and other income tax forms from the federal. Report income or loss from a business or profession as a sole proprietor using schedule c (form 1040). • if you checked 32a, enter the loss on both schedule 1 (form 1040), line 3, and on schedule se, line 2. The 2024 form 1040 schedule c profit or loss from business (sole proprietorship) is used to report the income and expenses of a sole.

Schedule C Tax Form Printable

The 2024 form 1040 schedule c profit or loss from business (sole proprietorship) is used to report the income and expenses of a sole. Use schedule c to report income or loss from a business or profession in which you were the sole proprietor. Download or print the 2024 federal (profit or loss from business (sole proprietorship)) (2024) and other.

2024 1040 Schedule C Ez Bobbi Chrissy

Find the current and previous. • if you checked 32a, enter the loss on both schedule 1 (form 1040), line 3, and on schedule se, line 2. Download or print the 2024 federal (profit or loss from business (sole proprietorship)) (2024) and other income tax forms from the federal. Report income or loss from a business or profession as a.

Download Fillable Schedule C Form

Find the current and previous. (if you checked the box on. Download or print the 2024 federal (profit or loss from business (sole proprietorship)) (2024) and other income tax forms from the federal. • if you checked 32a, enter the loss on both schedule 1 (form 1040), line 3, and on schedule se, line 2. Report income or loss from.

IRS Schedule C (Form 1040) Instructions 2024 Guide Excel Capital

Find the current and previous. Use schedule c to report income or loss from a business or profession in which you were the sole proprietor. The 2024 form 1040 schedule c profit or loss from business (sole proprietorship) is used to report the income and expenses of a sole. Report income or loss from a business or profession as a.

Schedule C 2024 Herta Giralda

• if you checked 32a, enter the loss on both schedule 1 (form 1040), line 3, and on schedule se, line 2. (if you checked the box on. The 2024 form 1040 schedule c profit or loss from business (sole proprietorship) is used to report the income and expenses of a sole. Find the current and previous. Report income or.

Free Printable Schedule C Tax Form

Use schedule c to report income or loss from a business or profession in which you were the sole proprietor. • if you checked 32a, enter the loss on both schedule 1 (form 1040), line 3, and on schedule se, line 2. The 2024 form 1040 schedule c profit or loss from business (sole proprietorship) is used to report the.

2024 Irs Schedule C 2024 Calendar Template Excel

(if you checked the box on. Find the current and previous. Use schedule c to report income or loss from a business or profession in which you were the sole proprietor. • if you checked 32a, enter the loss on both schedule 1 (form 1040), line 3, and on schedule se, line 2. The 2024 form 1040 schedule c profit.

Irs Fillable Forms 2024 Schedule C Penny Blondell

Report income or loss from a business or profession as a sole proprietor using schedule c (form 1040). The 2024 form 1040 schedule c profit or loss from business (sole proprietorship) is used to report the income and expenses of a sole. • if you checked 32a, enter the loss on both schedule 1 (form 1040), line 3, and on.

Download Fillable Schedule C Form

Report income or loss from a business or profession as a sole proprietor using schedule c (form 1040). • if you checked 32a, enter the loss on both schedule 1 (form 1040), line 3, and on schedule se, line 2. Download or print the 2024 federal (profit or loss from business (sole proprietorship)) (2024) and other income tax forms from.

IRS Schedule C (Form 1040) Instructions 2024 Guide Excel Capital

(if you checked the box on. Find the current and previous. • if you checked 32a, enter the loss on both schedule 1 (form 1040), line 3, and on schedule se, line 2. Use schedule c to report income or loss from a business or profession in which you were the sole proprietor. Download or print the 2024 federal (profit.

The 2024 Form 1040 Schedule C Profit Or Loss From Business (Sole Proprietorship) Is Used To Report The Income And Expenses Of A Sole.

Download or print the 2024 federal (profit or loss from business (sole proprietorship)) (2024) and other income tax forms from the federal. Use schedule c to report income or loss from a business or profession in which you were the sole proprietor. Report income or loss from a business or profession as a sole proprietor using schedule c (form 1040). Find the current and previous.

(If You Checked The Box On.

• if you checked 32a, enter the loss on both schedule 1 (form 1040), line 3, and on schedule se, line 2.