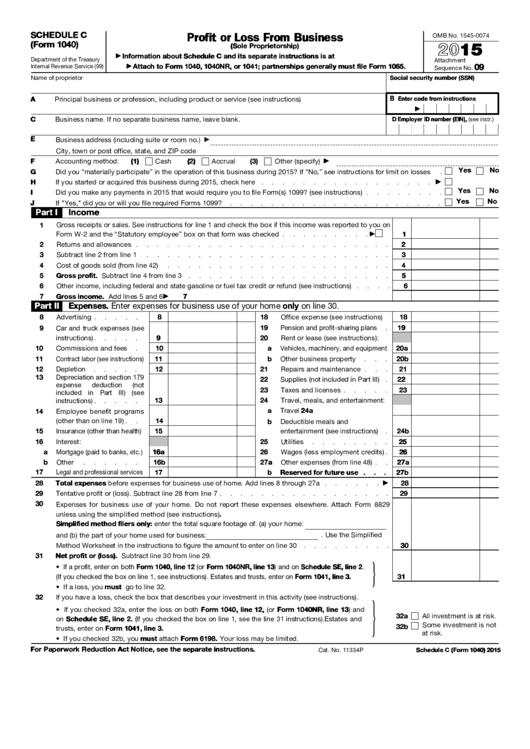

Schedule C Fillable Form 2022 - The primary purpose of schedule c (form 1040) is to report income or loss from a business operated as a sole proprietorship. Business address (including suite or room no.) city, town or post office, state, and zip code Use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. Accurate asset valuationconvenient for clients Use schedule c to report income or loss from a business or profession in which you were the sole proprietor. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession.

Business address (including suite or room no.) city, town or post office, state, and zip code Use schedule c to report income or loss from a business or profession in which you were the sole proprietor. The primary purpose of schedule c (form 1040) is to report income or loss from a business operated as a sole proprietorship. Accurate asset valuationconvenient for clients Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. Use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor.

Business address (including suite or room no.) city, town or post office, state, and zip code Use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. Accurate asset valuationconvenient for clients Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. Use schedule c to report income or loss from a business or profession in which you were the sole proprietor. The primary purpose of schedule c (form 1040) is to report income or loss from a business operated as a sole proprietorship.

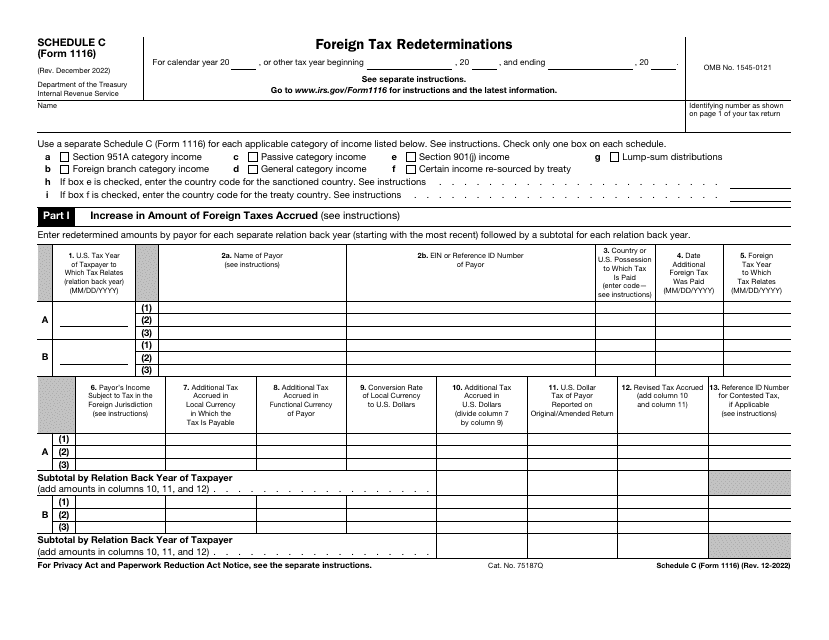

IRS Form 1116 Schedule C Download Fillable PDF or Fill Online Foreign

The primary purpose of schedule c (form 1040) is to report income or loss from a business operated as a sole proprietorship. Accurate asset valuationconvenient for clients Use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. Information about schedule c (form 1040), profit or loss.

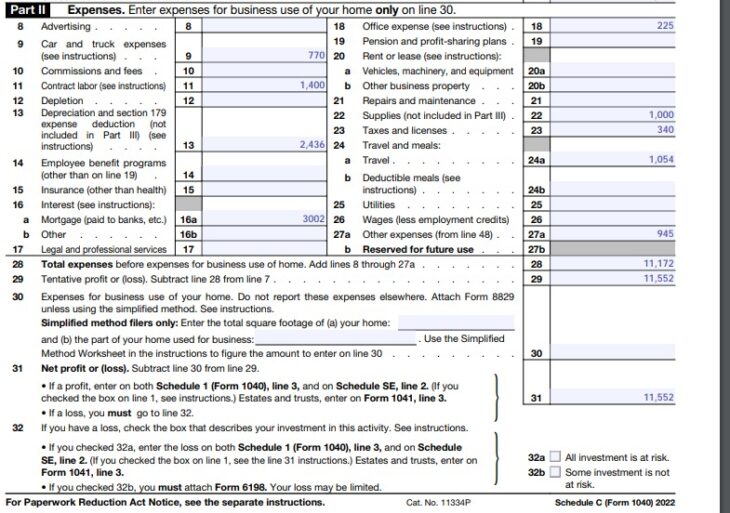

IRS Form 1040 Schedule C (2022) Profit or Loss From Business

Use schedule c to report income or loss from a business or profession in which you were the sole proprietor. Business address (including suite or room no.) city, town or post office, state, and zip code Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. Use.

Schedule C What Is It, How To Fill, Example, Vs Schedule E

Use schedule c to report income or loss from a business or profession in which you were the sole proprietor. Accurate asset valuationconvenient for clients The primary purpose of schedule c (form 1040) is to report income or loss from a business operated as a sole proprietorship. Use schedule c (form 1040) to report income or (loss) from a business.

How To Fill Out Your 2022 Schedule C (With Example)

Use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. Use schedule c to report income or loss from a business or profession in which you were the sole proprietor. Accurate asset valuationconvenient for clients Information about schedule c (form 1040), profit or loss from business,.

2022 Form 1040 Schedule C Fillable PDF Fillable Form 2025

Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. The primary purpose of schedule c (form 1040) is to report income or loss from a business operated as a sole proprietorship. Use schedule c to report income or loss from a business or profession in which.

Schedule c 1040 form 2022 Fill out & sign online DocHub

Use schedule c to report income or loss from a business or profession in which you were the sole proprietor. The primary purpose of schedule c (form 1040) is to report income or loss from a business operated as a sole proprietorship. Use schedule c (form 1040) to report income or (loss) from a business you operated or a profession.

schedule c form Schedule c instructions anacollege

Use schedule c to report income or loss from a business or profession in which you were the sole proprietor. Use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. Accurate asset valuationconvenient for clients Information about schedule c (form 1040), profit or loss from business,.

What Is Schedule C of Form 1040?

Business address (including suite or room no.) city, town or post office, state, and zip code Use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business.

Printable Schedule C Form

The primary purpose of schedule c (form 1040) is to report income or loss from a business operated as a sole proprietorship. Accurate asset valuationconvenient for clients Use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. Information about schedule c (form 1040), profit or loss.

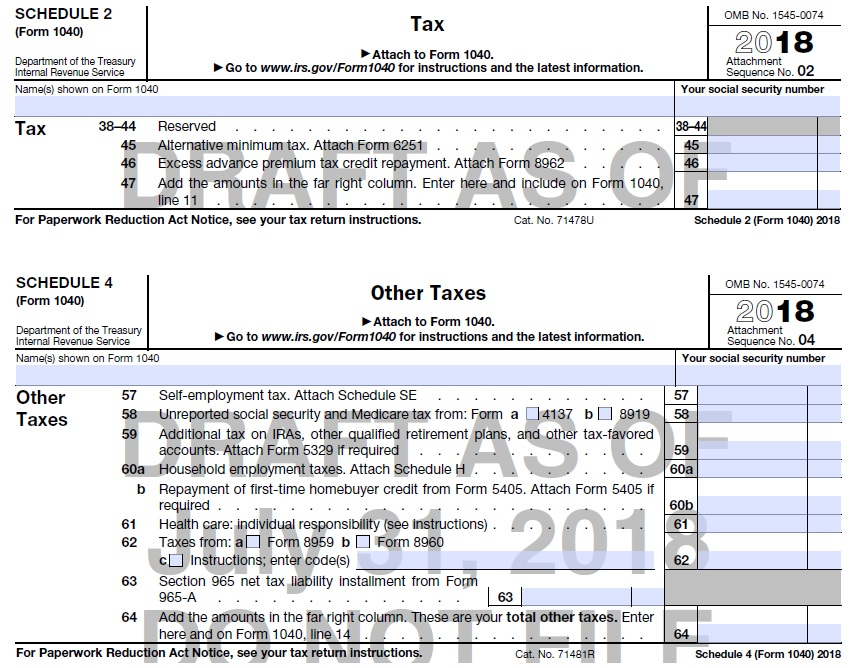

2022 Form IRS 990 or 990EZ Schedule C Fill Online, Printable

The primary purpose of schedule c (form 1040) is to report income or loss from a business operated as a sole proprietorship. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. Accurate asset valuationconvenient for clients Use schedule c to report income or loss from a.

The Primary Purpose Of Schedule C (Form 1040) Is To Report Income Or Loss From A Business Operated As A Sole Proprietorship.

Use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. Business address (including suite or room no.) city, town or post office, state, and zip code Use schedule c to report income or loss from a business or profession in which you were the sole proprietor.

:max_bytes(150000):strip_icc()/ScreenShot2022-12-14at2.10.22PM-ed1958c9bbb642398aec3cacd721b244.png)