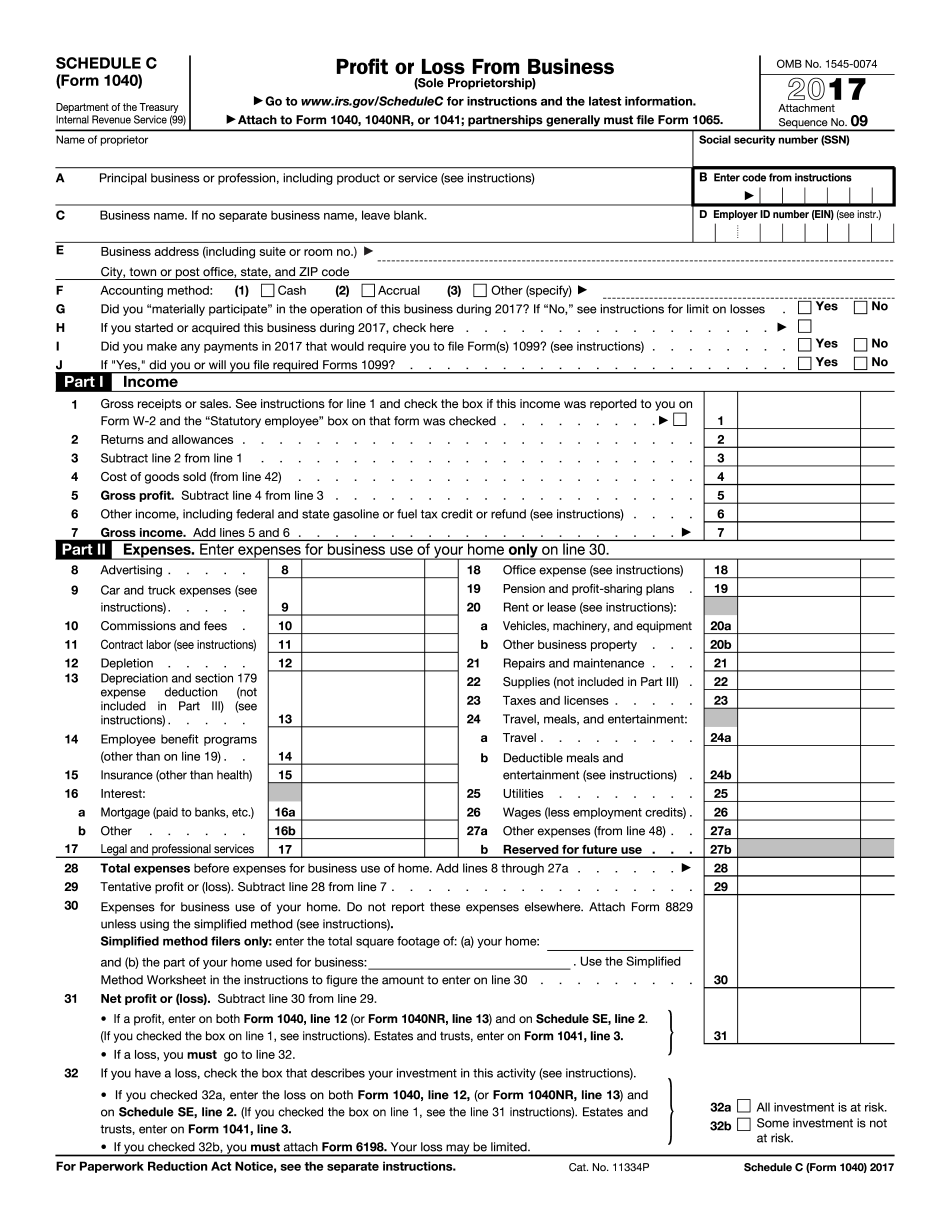

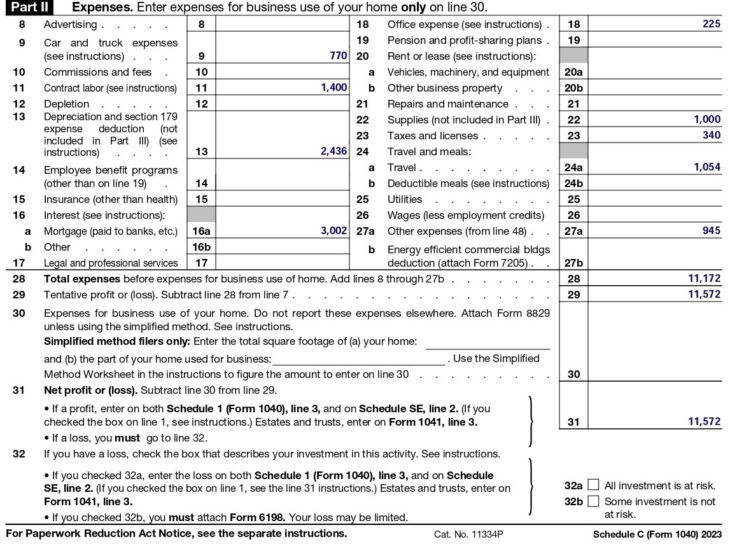

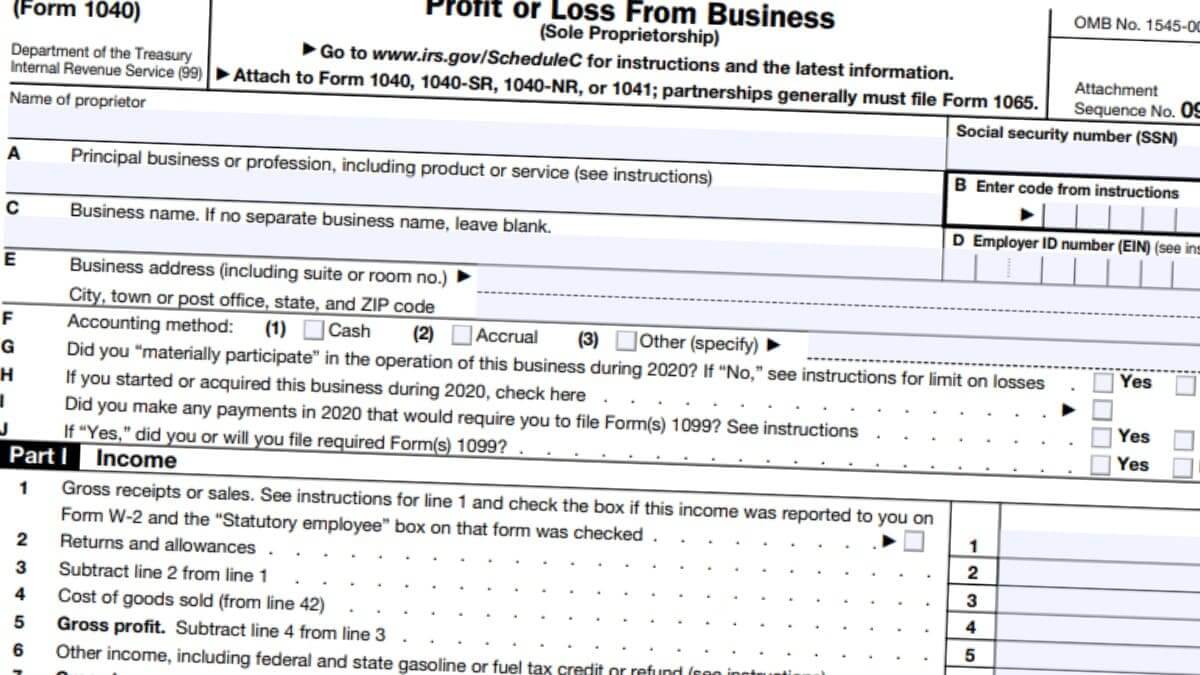

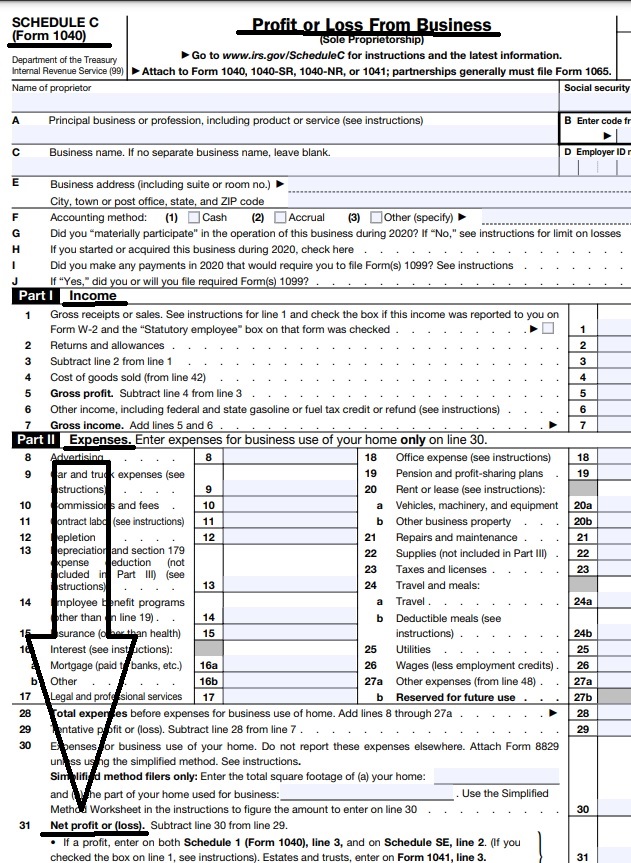

Schedule C Fillable Form 2024 - (if you checked the box on. • if you checked 32a, enter the loss on both schedule 1 (form 1040), line 3, and on schedule se, line 2. Profit or loss from business (sch. The 2024 form 1040 schedule c profit or loss from business (sole proprietorship) is used to report the income and expenses of a sole. 1m+ visitors in the past month 51business income (schedule c) (cont.)

1m+ visitors in the past month 51business income (schedule c) (cont.) (if you checked the box on. The 2024 form 1040 schedule c profit or loss from business (sole proprietorship) is used to report the income and expenses of a sole. Profit or loss from business (sch. • if you checked 32a, enter the loss on both schedule 1 (form 1040), line 3, and on schedule se, line 2.

1m+ visitors in the past month (if you checked the box on. 51business income (schedule c) (cont.) Profit or loss from business (sch. The 2024 form 1040 schedule c profit or loss from business (sole proprietorship) is used to report the income and expenses of a sole. • if you checked 32a, enter the loss on both schedule 1 (form 1040), line 3, and on schedule se, line 2.

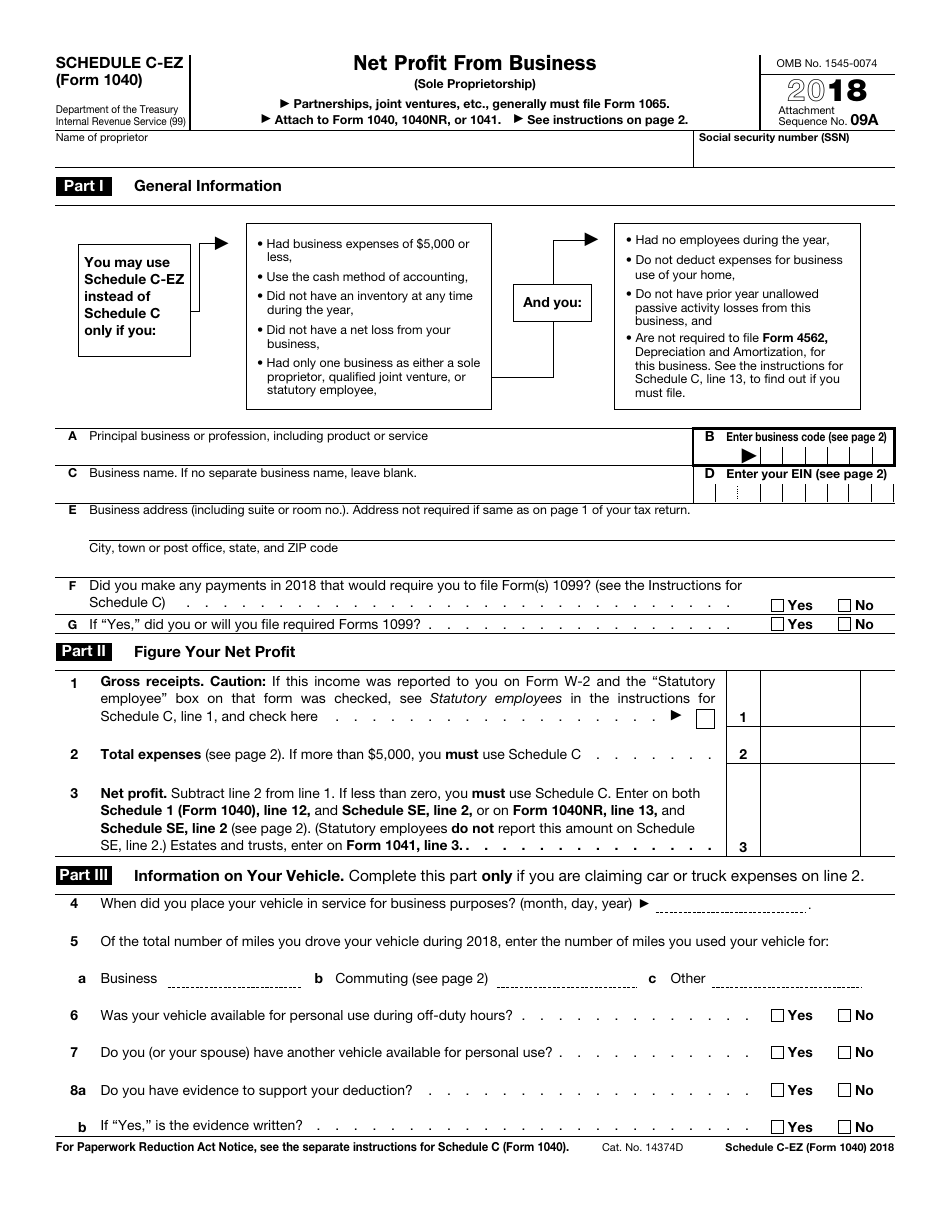

Irs Fillable Forms 2024 Schedule C Penny Blondell

51business income (schedule c) (cont.) 1m+ visitors in the past month • if you checked 32a, enter the loss on both schedule 1 (form 1040), line 3, and on schedule se, line 2. Profit or loss from business (sch. The 2024 form 1040 schedule c profit or loss from business (sole proprietorship) is used to report the income and expenses.

2024 Schedule C Form Orel Tracey

• if you checked 32a, enter the loss on both schedule 1 (form 1040), line 3, and on schedule se, line 2. 51business income (schedule c) (cont.) (if you checked the box on. 1m+ visitors in the past month Profit or loss from business (sch.

Irs Fillable Forms 2024 Schedule C Micki Stormie

Profit or loss from business (sch. 1m+ visitors in the past month (if you checked the box on. 51business income (schedule c) (cont.) The 2024 form 1040 schedule c profit or loss from business (sole proprietorship) is used to report the income and expenses of a sole.

How To Fill Out Schedule C in 2024 (With Example)

The 2024 form 1040 schedule c profit or loss from business (sole proprietorship) is used to report the income and expenses of a sole. Profit or loss from business (sch. 1m+ visitors in the past month • if you checked 32a, enter the loss on both schedule 1 (form 1040), line 3, and on schedule se, line 2. 51business income.

Irs Schedule C 2024 Tove Ainslie

The 2024 form 1040 schedule c profit or loss from business (sole proprietorship) is used to report the income and expenses of a sole. (if you checked the box on. Profit or loss from business (sch. 51business income (schedule c) (cont.) 1m+ visitors in the past month

2024 Irs Schedule C 2024 Calendar Template Excel

The 2024 form 1040 schedule c profit or loss from business (sole proprietorship) is used to report the income and expenses of a sole. • if you checked 32a, enter the loss on both schedule 1 (form 1040), line 3, and on schedule se, line 2. 51business income (schedule c) (cont.) 1m+ visitors in the past month Profit or loss.

Irs 2024 Form 1040 Schedule C Tasha Fredelia

• if you checked 32a, enter the loss on both schedule 1 (form 1040), line 3, and on schedule se, line 2. 1m+ visitors in the past month The 2024 form 1040 schedule c profit or loss from business (sole proprietorship) is used to report the income and expenses of a sole. Profit or loss from business (sch. 51business income.

2024 Schedule C Form Maren Florentia

51business income (schedule c) (cont.) • if you checked 32a, enter the loss on both schedule 1 (form 1040), line 3, and on schedule se, line 2. (if you checked the box on. 1m+ visitors in the past month Profit or loss from business (sch.

Irs Form 2024 Schedule C 2024 gayel gilligan

51business income (schedule c) (cont.) The 2024 form 1040 schedule c profit or loss from business (sole proprietorship) is used to report the income and expenses of a sole. 1m+ visitors in the past month (if you checked the box on. Profit or loss from business (sch.

IRS Schedule C (Form 1040) Instructions 2024 Guide Excel Capital

(if you checked the box on. 1m+ visitors in the past month • if you checked 32a, enter the loss on both schedule 1 (form 1040), line 3, and on schedule se, line 2. The 2024 form 1040 schedule c profit or loss from business (sole proprietorship) is used to report the income and expenses of a sole. 51business income.

1M+ Visitors In The Past Month

• if you checked 32a, enter the loss on both schedule 1 (form 1040), line 3, and on schedule se, line 2. Profit or loss from business (sch. (if you checked the box on. 51business income (schedule c) (cont.)