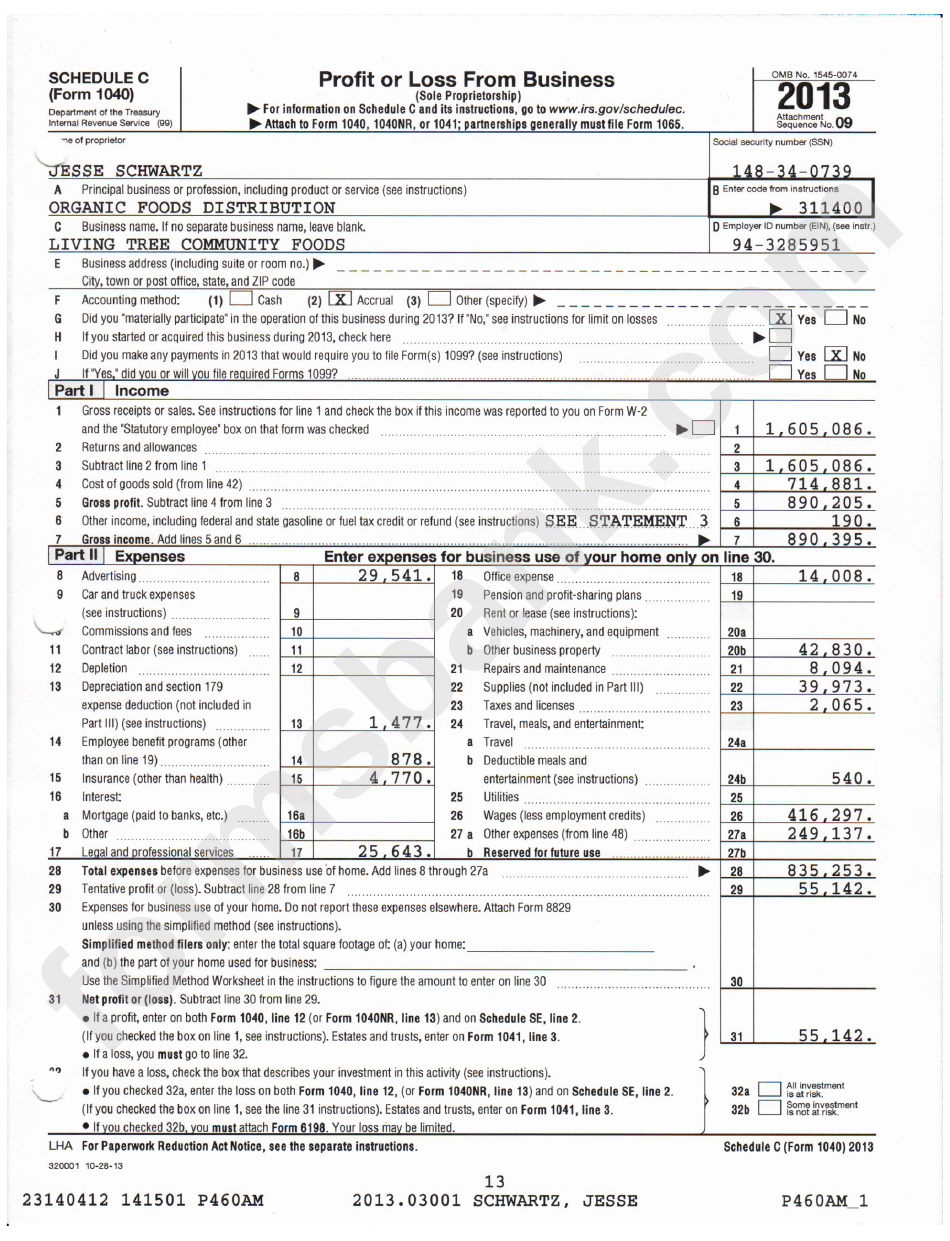

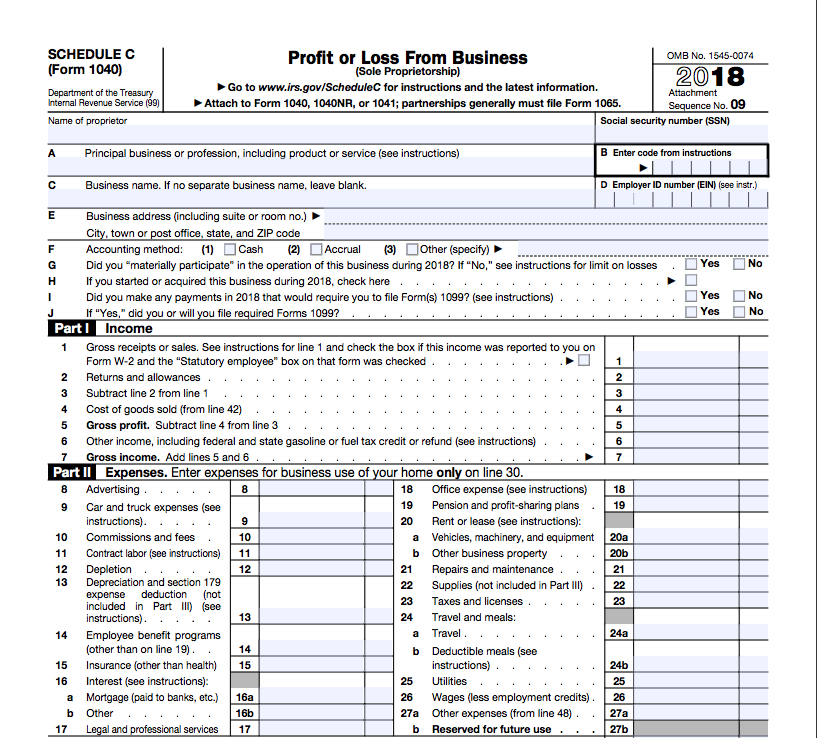

Schedule C Form Example - The schedule c tax form, also known as the “profit or loss from business” form, is used by sole proprietors to report income or. If no separate business name, leave blank. Here’s what the schedule c (form 1040) looks like: To complete schedule c for your small business taxes, you'll need your business income, costs of goods sold, and more. A schedule c is a tax form to report your. Go to www.irs.gov/schedulec for instructions and the latest information. What is schedule c form?

A schedule c is a tax form to report your. What is schedule c form? If no separate business name, leave blank. The schedule c tax form, also known as the “profit or loss from business” form, is used by sole proprietors to report income or. Go to www.irs.gov/schedulec for instructions and the latest information. To complete schedule c for your small business taxes, you'll need your business income, costs of goods sold, and more. Here’s what the schedule c (form 1040) looks like:

To complete schedule c for your small business taxes, you'll need your business income, costs of goods sold, and more. If no separate business name, leave blank. The schedule c tax form, also known as the “profit or loss from business” form, is used by sole proprietors to report income or. A schedule c is a tax form to report your. What is schedule c form? Go to www.irs.gov/schedulec for instructions and the latest information. Here’s what the schedule c (form 1040) looks like:

Schedule C What Is It, How To Fill, Example, Vs Schedule E

If no separate business name, leave blank. To complete schedule c for your small business taxes, you'll need your business income, costs of goods sold, and more. Here’s what the schedule c (form 1040) looks like: The schedule c tax form, also known as the “profit or loss from business” form, is used by sole proprietors to report income or..

Schedule C Form Template

Here’s what the schedule c (form 1040) looks like: If no separate business name, leave blank. The schedule c tax form, also known as the “profit or loss from business” form, is used by sole proprietors to report income or. A schedule c is a tax form to report your. Go to www.irs.gov/schedulec for instructions and the latest information.

Schedule C What Is It, How To Fill, Example, Vs Schedule E

To complete schedule c for your small business taxes, you'll need your business income, costs of goods sold, and more. What is schedule c form? Here’s what the schedule c (form 1040) looks like: Go to www.irs.gov/schedulec for instructions and the latest information. The schedule c tax form, also known as the “profit or loss from business” form, is used.

Free Printable Schedule C Tax Form

The schedule c tax form, also known as the “profit or loss from business” form, is used by sole proprietors to report income or. What is schedule c form? If no separate business name, leave blank. Here’s what the schedule c (form 1040) looks like: A schedule c is a tax form to report your.

Schedule C Printable Guide

The schedule c tax form, also known as the “profit or loss from business” form, is used by sole proprietors to report income or. A schedule c is a tax form to report your. To complete schedule c for your small business taxes, you'll need your business income, costs of goods sold, and more. What is schedule c form? Here’s.

Calculate Schedule C Tax

The schedule c tax form, also known as the “profit or loss from business” form, is used by sole proprietors to report income or. A schedule c is a tax form to report your. What is schedule c form? To complete schedule c for your small business taxes, you'll need your business income, costs of goods sold, and more. Go.

How to Fill Out Your Schedule C Perfectly (With Examples!)

Here’s what the schedule c (form 1040) looks like: A schedule c is a tax form to report your. What is schedule c form? To complete schedule c for your small business taxes, you'll need your business income, costs of goods sold, and more. The schedule c tax form, also known as the “profit or loss from business” form, is.

Irs Form 1040 Schedule C 2025 Michael Harris

Go to www.irs.gov/schedulec for instructions and the latest information. Here’s what the schedule c (form 1040) looks like: To complete schedule c for your small business taxes, you'll need your business income, costs of goods sold, and more. A schedule c is a tax form to report your. What is schedule c form?

Schedule C Instructions How to Fill Out Form 1040 Excel Capital

Go to www.irs.gov/schedulec for instructions and the latest information. To complete schedule c for your small business taxes, you'll need your business income, costs of goods sold, and more. What is schedule c form? If no separate business name, leave blank. A schedule c is a tax form to report your.

Free Printable Schedule C Tax Form

To complete schedule c for your small business taxes, you'll need your business income, costs of goods sold, and more. Here’s what the schedule c (form 1040) looks like: If no separate business name, leave blank. A schedule c is a tax form to report your. What is schedule c form?

If No Separate Business Name, Leave Blank.

Here’s what the schedule c (form 1040) looks like: A schedule c is a tax form to report your. The schedule c tax form, also known as the “profit or loss from business” form, is used by sole proprietors to report income or. What is schedule c form?

Go To Www.irs.gov/Schedulec For Instructions And The Latest Information.

To complete schedule c for your small business taxes, you'll need your business income, costs of goods sold, and more.

:max_bytes(150000):strip_icc()/ScheduleC-ProfitorLossfromBusiness-1-2b9fe42e669342c783bbaae69e570415.png)