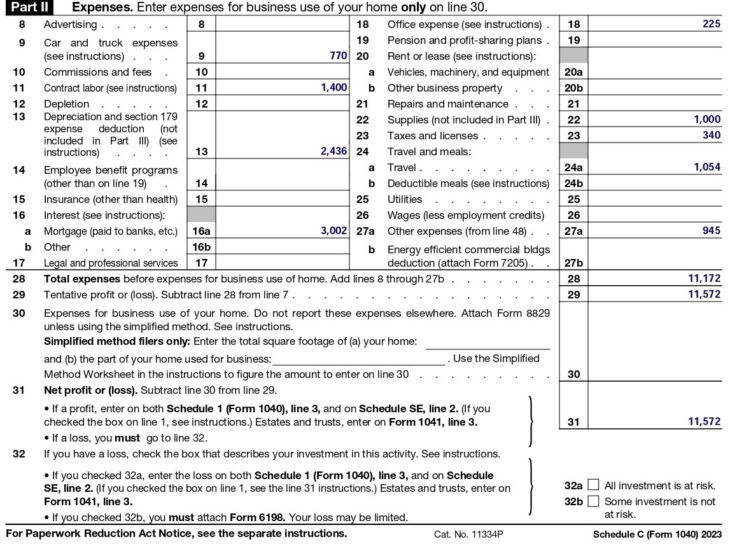

Schedule C Tax Form 2024 - If you are completing federal schedule c (form 1040) profit or loss from business, you will enter the income and expenses which will then. Learn how to use schedule c to report the income and expenses of a sole proprietorship, which is a business owned and operated by one individual. The schedule c tax form, also known as the “profit or loss from business” form, is used by sole proprietors to report income or.

Learn how to use schedule c to report the income and expenses of a sole proprietorship, which is a business owned and operated by one individual. If you are completing federal schedule c (form 1040) profit or loss from business, you will enter the income and expenses which will then. The schedule c tax form, also known as the “profit or loss from business” form, is used by sole proprietors to report income or.

Learn how to use schedule c to report the income and expenses of a sole proprietorship, which is a business owned and operated by one individual. If you are completing federal schedule c (form 1040) profit or loss from business, you will enter the income and expenses which will then. The schedule c tax form, also known as the “profit or loss from business” form, is used by sole proprietors to report income or.

Irs Fillable Forms 2024 Schedule C Penny Blondell

If you are completing federal schedule c (form 1040) profit or loss from business, you will enter the income and expenses which will then. The schedule c tax form, also known as the “profit or loss from business” form, is used by sole proprietors to report income or. Learn how to use schedule c to report the income and expenses.

IRS Schedule C (Form 1040) Instructions 2024 Guide Excel Capital

The schedule c tax form, also known as the “profit or loss from business” form, is used by sole proprietors to report income or. Learn how to use schedule c to report the income and expenses of a sole proprietorship, which is a business owned and operated by one individual. If you are completing federal schedule c (form 1040) profit.

Schedule C Form 2024 For 2024 anne regina

The schedule c tax form, also known as the “profit or loss from business” form, is used by sole proprietors to report income or. Learn how to use schedule c to report the income and expenses of a sole proprietorship, which is a business owned and operated by one individual. If you are completing federal schedule c (form 1040) profit.

2024 Schedule C Form Orel Tracey

If you are completing federal schedule c (form 1040) profit or loss from business, you will enter the income and expenses which will then. Learn how to use schedule c to report the income and expenses of a sole proprietorship, which is a business owned and operated by one individual. The schedule c tax form, also known as the “profit.

IRS Schedule C (Form 1040) Instructions 2024 Guide Excel Capital

The schedule c tax form, also known as the “profit or loss from business” form, is used by sole proprietors to report income or. If you are completing federal schedule c (form 1040) profit or loss from business, you will enter the income and expenses which will then. Learn how to use schedule c to report the income and expenses.

2024 Form 1040 Schedule C Instructions Meaning Lydia Rochell

The schedule c tax form, also known as the “profit or loss from business” form, is used by sole proprietors to report income or. Learn how to use schedule c to report the income and expenses of a sole proprietorship, which is a business owned and operated by one individual. If you are completing federal schedule c (form 1040) profit.

Schedule C Deductions 2024 Form Nita Terese

The schedule c tax form, also known as the “profit or loss from business” form, is used by sole proprietors to report income or. Learn how to use schedule c to report the income and expenses of a sole proprietorship, which is a business owned and operated by one individual. If you are completing federal schedule c (form 1040) profit.

How To Fill Out Schedule C in 2024 (With Example)

If you are completing federal schedule c (form 1040) profit or loss from business, you will enter the income and expenses which will then. The schedule c tax form, also known as the “profit or loss from business” form, is used by sole proprietors to report income or. Learn how to use schedule c to report the income and expenses.

Schedule C Tax Form 2024 Libbi Roseanne

If you are completing federal schedule c (form 1040) profit or loss from business, you will enter the income and expenses which will then. The schedule c tax form, also known as the “profit or loss from business” form, is used by sole proprietors to report income or. Learn how to use schedule c to report the income and expenses.

Schedule C 2024 Herta Giralda

If you are completing federal schedule c (form 1040) profit or loss from business, you will enter the income and expenses which will then. The schedule c tax form, also known as the “profit or loss from business” form, is used by sole proprietors to report income or. Learn how to use schedule c to report the income and expenses.

The Schedule C Tax Form, Also Known As The “Profit Or Loss From Business” Form, Is Used By Sole Proprietors To Report Income Or.

If you are completing federal schedule c (form 1040) profit or loss from business, you will enter the income and expenses which will then. Learn how to use schedule c to report the income and expenses of a sole proprietorship, which is a business owned and operated by one individual.