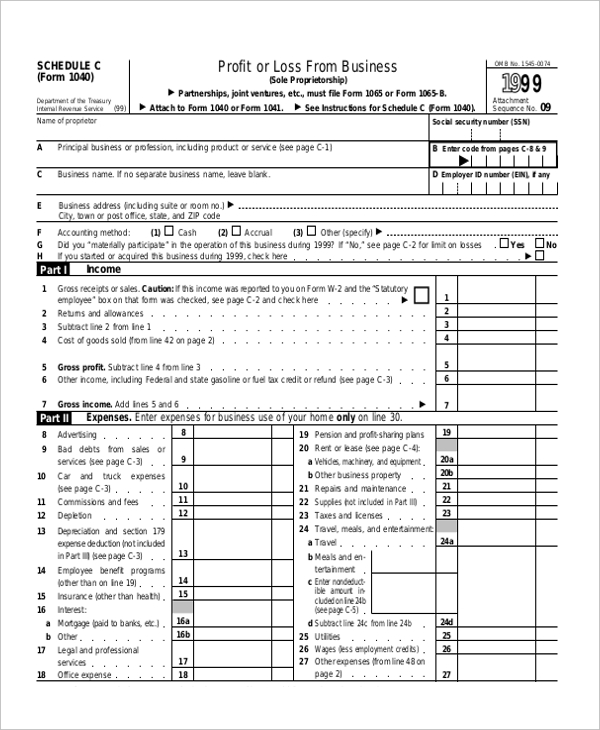

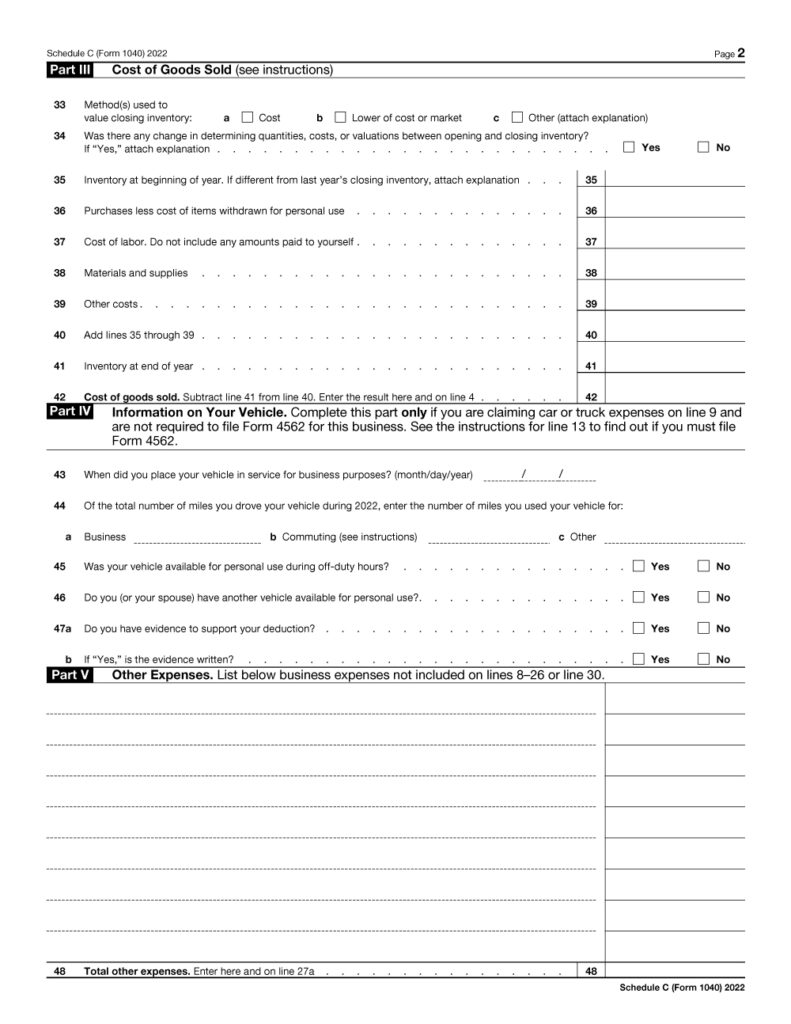

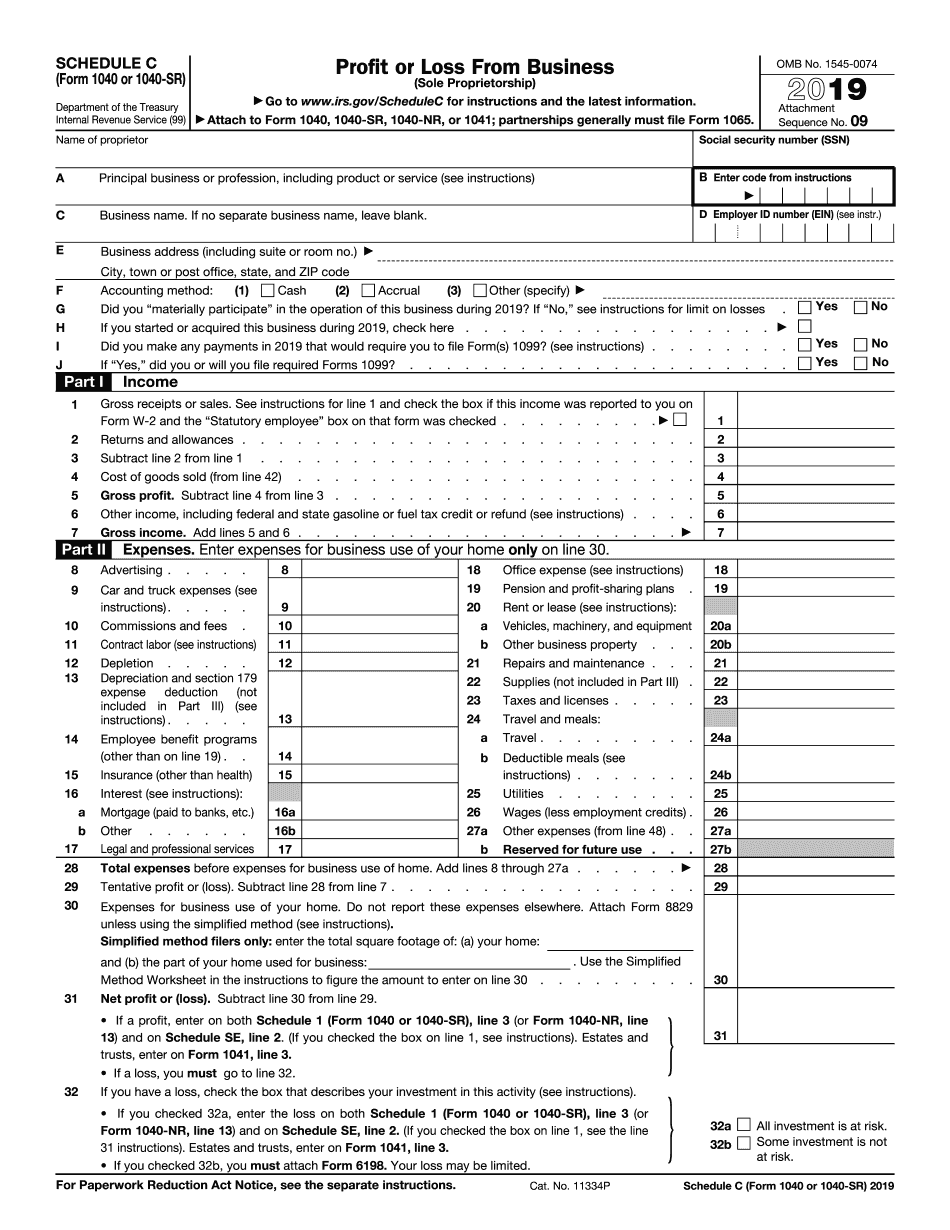

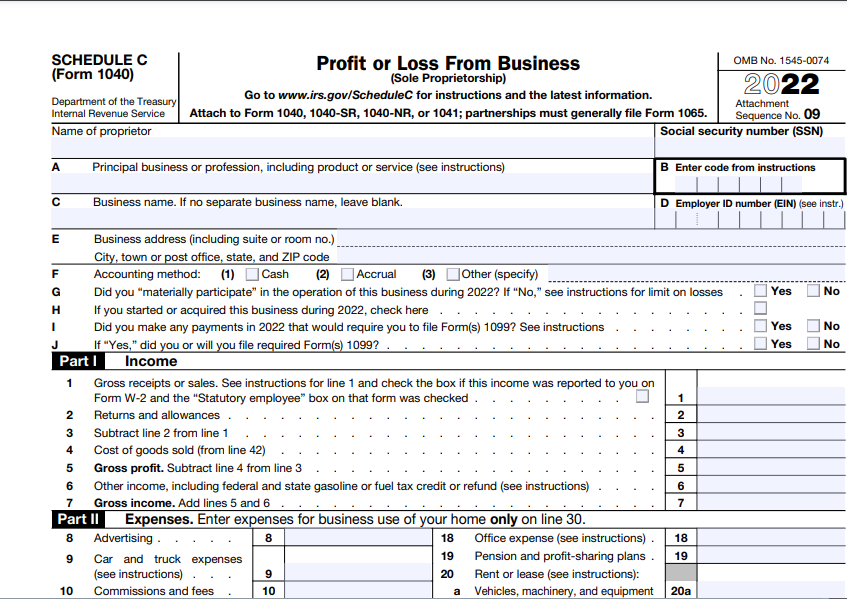

Schedule C Template Pdf - Use separate sheet for each type of. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. Schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file to support all schedule. Supporting business documents purchases, sales, payroll, and other transactions you have in your business will generate supporting documents.

Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. Use separate sheet for each type of. Schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file to support all schedule. Supporting business documents purchases, sales, payroll, and other transactions you have in your business will generate supporting documents.

Supporting business documents purchases, sales, payroll, and other transactions you have in your business will generate supporting documents. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. Schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file to support all schedule. Use separate sheet for each type of.

Schedule C Form Template

Supporting business documents purchases, sales, payroll, and other transactions you have in your business will generate supporting documents. Use separate sheet for each type of. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. Schedule c worksheet for self employed businesses and/or independent contractors irs requires.

FREE 9+ Sample Schedule C Forms in PDF MS Word

Schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file to support all schedule. Use separate sheet for each type of. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. Supporting business documents purchases, sales, payroll, and other transactions you.

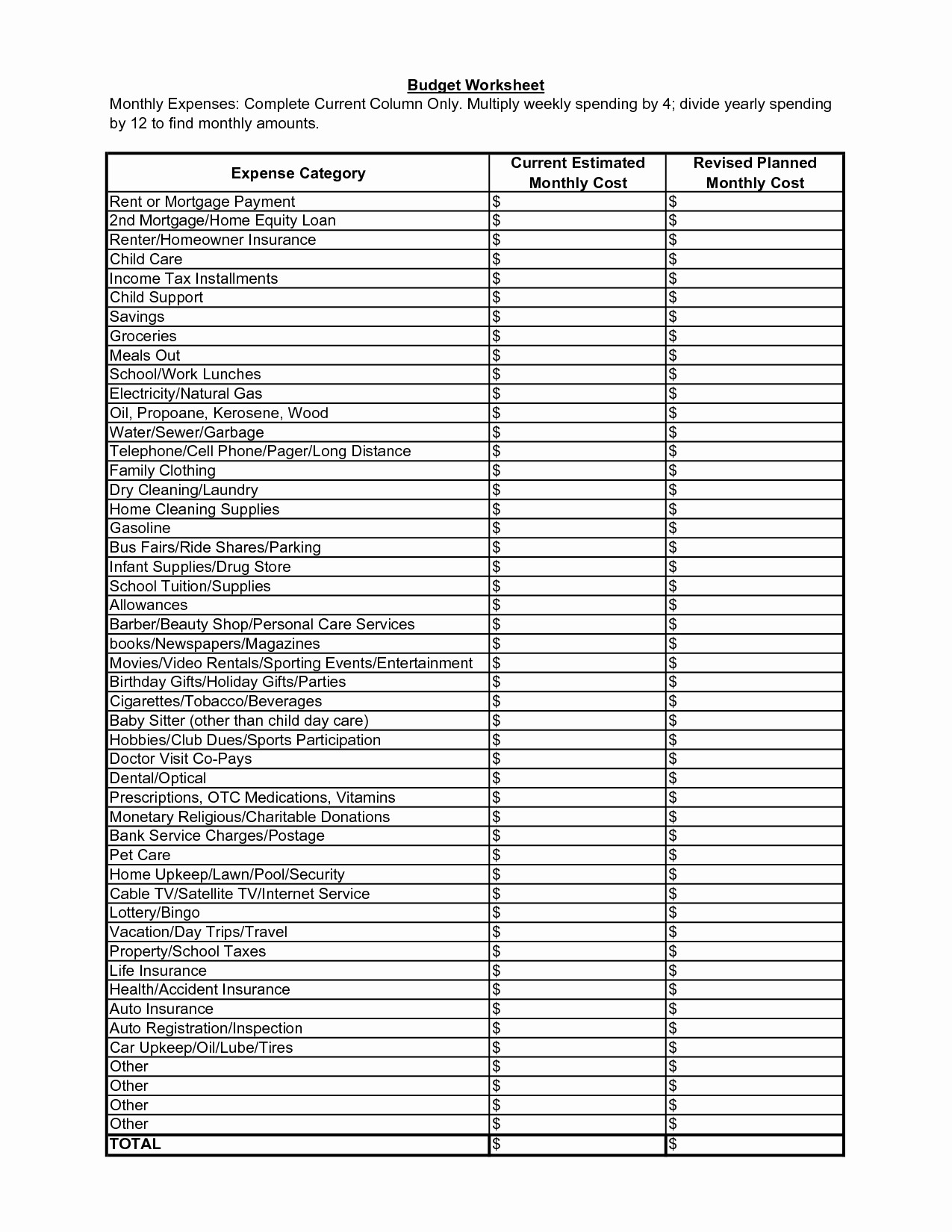

Schedule C Expenses Template

Schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file to support all schedule. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. Supporting business documents purchases, sales, payroll, and other transactions you have in your business will generate supporting.

Schedule C Form Template

Use separate sheet for each type of. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. Supporting business documents purchases, sales, payroll, and other transactions you have in your business will generate supporting documents. Schedule c worksheet for self employed businesses and/or independent contractors irs requires.

IRS Schedule C Instructions Schedule C Form Free Download

Schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file to support all schedule. Use separate sheet for each type of. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. Supporting business documents purchases, sales, payroll, and other transactions you.

Schedule C Printable Form

Schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file to support all schedule. Use separate sheet for each type of. Supporting business documents purchases, sales, payroll, and other transactions you have in your business will generate supporting documents. Information about schedule c (form 1040), profit or loss from business, used to report income.

Schedule C (Form 1040) 2023 Instructions

Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. Schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file to support all schedule. Use separate sheet for each type of. Supporting business documents purchases, sales, payroll, and other transactions you.

Convert PDF To Fillable Schedule C 1040 Or 1040sr Form And Cope With

Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. Supporting business documents purchases, sales, payroll, and other transactions you have in your business will generate supporting documents. Use separate sheet for each type of. Schedule c worksheet for self employed businesses and/or independent contractors irs requires.

IRS Form 1040 Schedule C. Profit or Loss From Business Forms Docs

Supporting business documents purchases, sales, payroll, and other transactions you have in your business will generate supporting documents. Use separate sheet for each type of. Schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file to support all schedule. Information about schedule c (form 1040), profit or loss from business, used to report income.

Schedule C Form Template

Supporting business documents purchases, sales, payroll, and other transactions you have in your business will generate supporting documents. Schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file to support all schedule. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or.

Use Separate Sheet For Each Type Of.

Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. Schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file to support all schedule. Supporting business documents purchases, sales, payroll, and other transactions you have in your business will generate supporting documents.