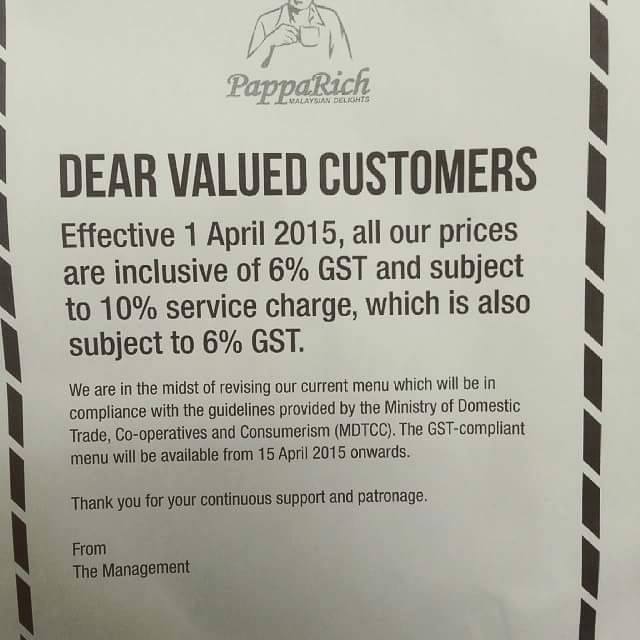

Service Charge In Malaysia - About services tax 1.what is service tax ? This is normally applied in the hospitality. Prior to 1 march 2024, the rate of service tax is 6% ad valorem for all taxable services and digital services except for the provision of charge or. Made in the course or. Tax rate revisions & service scope expansion in line with ongoing fiscal reforms, the ministry of. What’s new in malaysia sst 2025: The malaysian government has increased the sales and service tax (sst) to 8% starting from march 1, 2024, affecting specific. Any provision of taxable services; The effective date to charge sales tax and service tax would be 1 july 2025. • selected imported fruits (i.e.

This is normally applied in the hospitality. The malaysian government has increased the sales and service tax (sst) to 8% starting from march 1, 2024, affecting specific. About services tax 1.what is service tax ? What’s new in malaysia sst 2025: Any provision of taxable services; Made in the course or. Tax rate revisions & service scope expansion in line with ongoing fiscal reforms, the ministry of. The effective date to charge sales tax and service tax would be 1 july 2025. Prior to 1 march 2024, the rate of service tax is 6% ad valorem for all taxable services and digital services except for the provision of charge or. • selected imported fruits (i.e.

This is normally applied in the hospitality. Any provision of taxable services; The effective date to charge sales tax and service tax would be 1 july 2025. • selected imported fruits (i.e. Prior to 1 march 2024, the rate of service tax is 6% ad valorem for all taxable services and digital services except for the provision of charge or. About services tax 1.what is service tax ? The malaysian government has increased the sales and service tax (sst) to 8% starting from march 1, 2024, affecting specific. Made in the course or. Tax rate revisions & service scope expansion in line with ongoing fiscal reforms, the ministry of. What’s new in malaysia sst 2025:

Government May Add New Service Charge for Online Shopping in Malaysia

The effective date to charge sales tax and service tax would be 1 july 2025. About services tax 1.what is service tax ? What’s new in malaysia sst 2025: The malaysian government has increased the sales and service tax (sst) to 8% starting from march 1, 2024, affecting specific. Made in the course or.

Restaurant workers worried over service charge backlash Malay Mail

The effective date to charge sales tax and service tax would be 1 july 2025. The malaysian government has increased the sales and service tax (sst) to 8% starting from march 1, 2024, affecting specific. Tax rate revisions & service scope expansion in line with ongoing fiscal reforms, the ministry of. Made in the course or. Any provision of taxable.

హోటల్ బిల్లు లో వేసే సర్వీస్ ఛార్జ్ మీకు సర్వీస్ నచ్చితేనే

• selected imported fruits (i.e. The malaysian government has increased the sales and service tax (sst) to 8% starting from march 1, 2024, affecting specific. This is normally applied in the hospitality. Any provision of taxable services; The effective date to charge sales tax and service tax would be 1 july 2025.

Service charge used by businesses for their staff, not paid to govt

This is normally applied in the hospitality. The malaysian government has increased the sales and service tax (sst) to 8% starting from march 1, 2024, affecting specific. Tax rate revisions & service scope expansion in line with ongoing fiscal reforms, the ministry of. About services tax 1.what is service tax ? Prior to 1 march 2024, the rate of service.

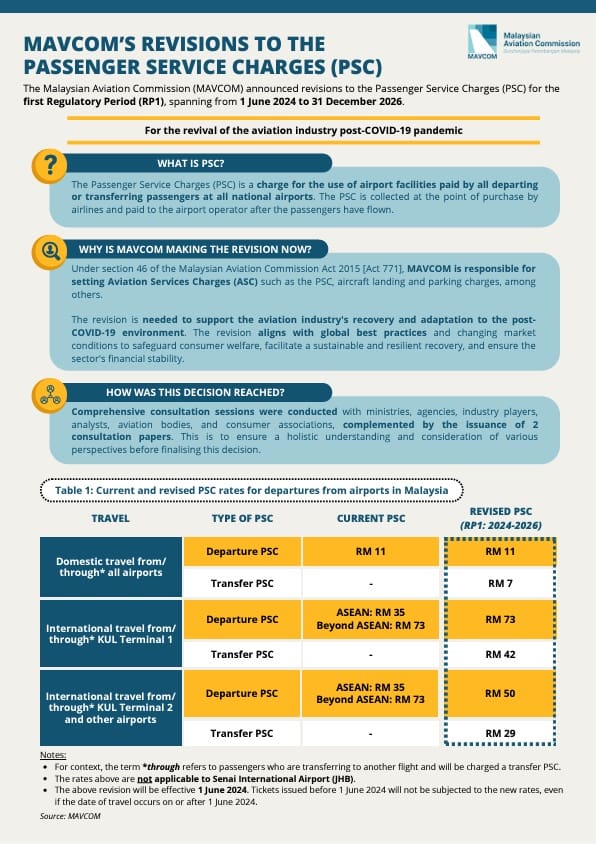

Announces Revisions to the Aviation Services Charges (ASC

What’s new in malaysia sst 2025: • selected imported fruits (i.e. The effective date to charge sales tax and service tax would be 1 july 2025. This is normally applied in the hospitality. Made in the course or.

Service Charge vs. Service Tax in Malaysia (2025) Dining Out World

This is normally applied in the hospitality. Prior to 1 march 2024, the rate of service tax is 6% ad valorem for all taxable services and digital services except for the provision of charge or. Tax rate revisions & service scope expansion in line with ongoing fiscal reforms, the ministry of. About services tax 1.what is service tax ? •.

Regulation of aviation services charges Malaysian Aviation Commission

• selected imported fruits (i.e. Made in the course or. This is normally applied in the hospitality. Tax rate revisions & service scope expansion in line with ongoing fiscal reforms, the ministry of. What’s new in malaysia sst 2025:

Service charge trong kinh doanh khách sạn Những điều bạn cần biết

The effective date to charge sales tax and service tax would be 1 july 2025. What’s new in malaysia sst 2025: Made in the course or. Tax rate revisions & service scope expansion in line with ongoing fiscal reforms, the ministry of. The malaysian government has increased the sales and service tax (sst) to 8% starting from march 1, 2024,.

Sales & Service Tax (SST) in Malaysia VERY Complete Guide

Made in the course or. Prior to 1 march 2024, the rate of service tax is 6% ad valorem for all taxable services and digital services except for the provision of charge or. The effective date to charge sales tax and service tax would be 1 july 2025. The malaysian government has increased the sales and service tax (sst) to.

Service Charge Definition, Types, and Why It's Not a Tip

Any provision of taxable services; About services tax 1.what is service tax ? What’s new in malaysia sst 2025: The malaysian government has increased the sales and service tax (sst) to 8% starting from march 1, 2024, affecting specific. • selected imported fruits (i.e.

Any Provision Of Taxable Services;

The malaysian government has increased the sales and service tax (sst) to 8% starting from march 1, 2024, affecting specific. Made in the course or. Tax rate revisions & service scope expansion in line with ongoing fiscal reforms, the ministry of. This is normally applied in the hospitality.

Prior To 1 March 2024, The Rate Of Service Tax Is 6% Ad Valorem For All Taxable Services And Digital Services Except For The Provision Of Charge Or.

About services tax 1.what is service tax ? What’s new in malaysia sst 2025: The effective date to charge sales tax and service tax would be 1 july 2025. • selected imported fruits (i.e.

:max_bytes(150000):strip_icc()/Service-charge-4189213-FINAL-6fab6812d7ca4f3d9e77387076d623ca.png)