Uae Tax Invoice Requirements Fta - Here you can get answers to the most common questions on the topic of einvoicing. It must include trn, invoice date, vat rate, and total amount. A tax invoice is essential under uae vat law for taxable supplies. Which fields of the einvoice are validated by mof/ fta.

A tax invoice is essential under uae vat law for taxable supplies. Which fields of the einvoice are validated by mof/ fta. Here you can get answers to the most common questions on the topic of einvoicing. It must include trn, invoice date, vat rate, and total amount.

Here you can get answers to the most common questions on the topic of einvoicing. Which fields of the einvoice are validated by mof/ fta. It must include trn, invoice date, vat rate, and total amount. A tax invoice is essential under uae vat law for taxable supplies.

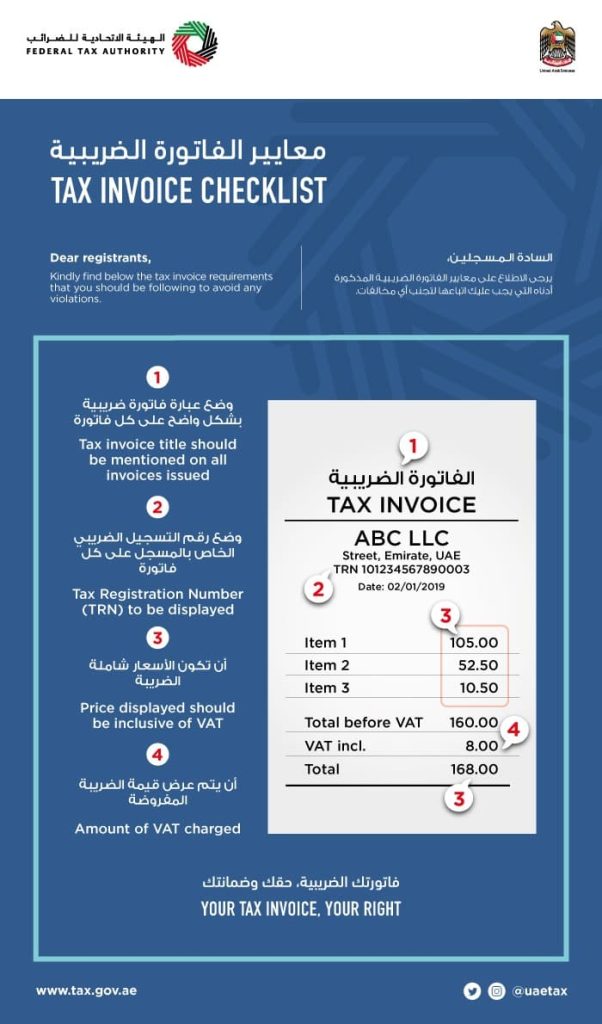

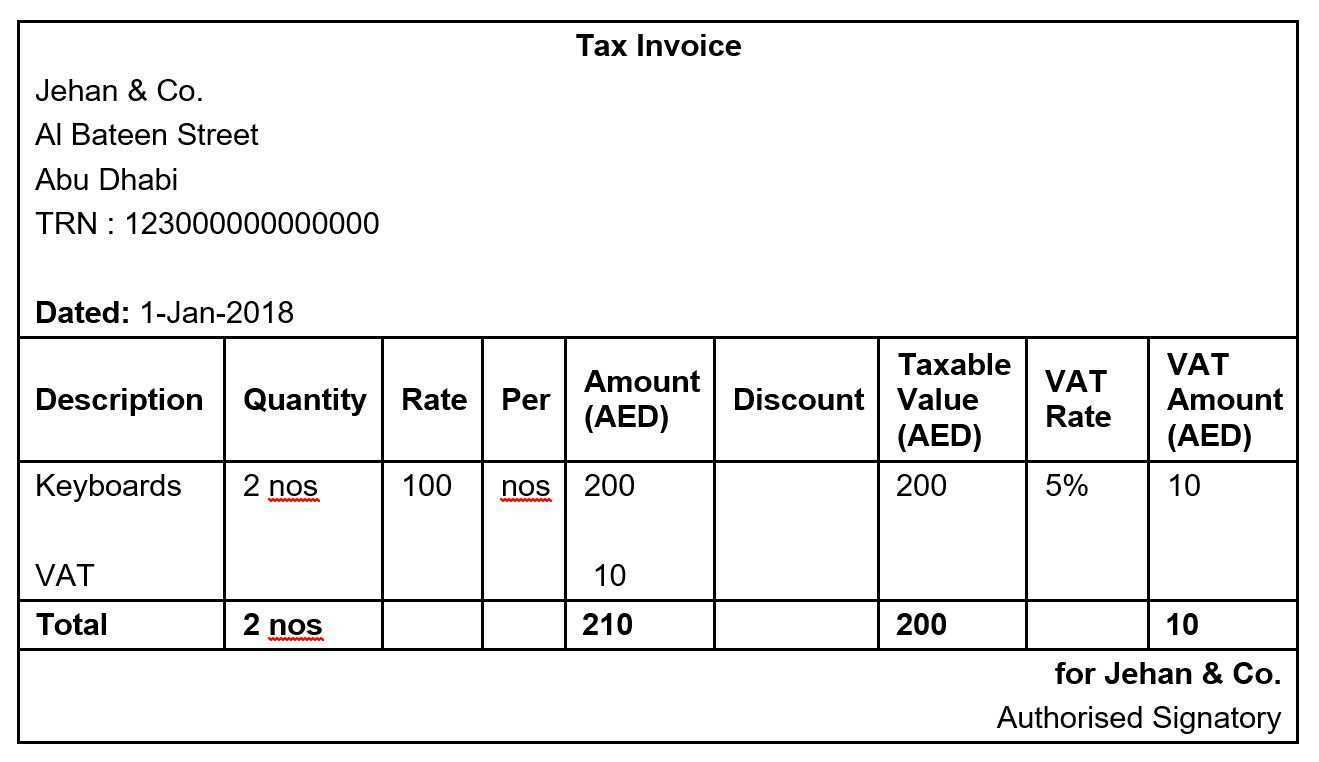

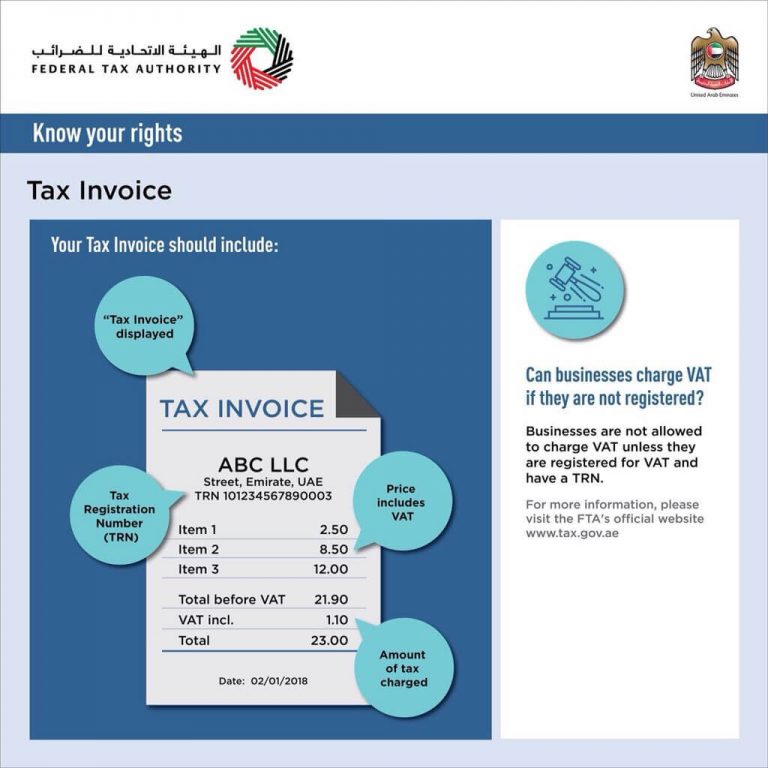

Detailed Tax Invoice All About TAX In UAE

It must include trn, invoice date, vat rate, and total amount. Which fields of the einvoice are validated by mof/ fta. A tax invoice is essential under uae vat law for taxable supplies. Here you can get answers to the most common questions on the topic of einvoicing.

Record Sales and Print Invoices as per FTA (for UAE)

A tax invoice is essential under uae vat law for taxable supplies. It must include trn, invoice date, vat rate, and total amount. Here you can get answers to the most common questions on the topic of einvoicing. Which fields of the einvoice are validated by mof/ fta.

Tax Invoice Format UAE FTA VAT Invoice UAE Shuraa Tax

A tax invoice is essential under uae vat law for taxable supplies. Which fields of the einvoice are validated by mof/ fta. Here you can get answers to the most common questions on the topic of einvoicing. It must include trn, invoice date, vat rate, and total amount.

Tax Invoice Format UAE FTA VAT Invoice UAE Shuraa Tax

Here you can get answers to the most common questions on the topic of einvoicing. A tax invoice is essential under uae vat law for taxable supplies. It must include trn, invoice date, vat rate, and total amount. Which fields of the einvoice are validated by mof/ fta.

Invoice Format Word Arabic

Which fields of the einvoice are validated by mof/ fta. It must include trn, invoice date, vat rate, and total amount. Here you can get answers to the most common questions on the topic of einvoicing. A tax invoice is essential under uae vat law for taxable supplies.

34 Customize Our Free Uae Vat Invoice Format Fta Download with Uae Vat

It must include trn, invoice date, vat rate, and total amount. Here you can get answers to the most common questions on the topic of einvoicing. Which fields of the einvoice are validated by mof/ fta. A tax invoice is essential under uae vat law for taxable supplies.

VAT Invoice Format in UAE FTA Tax Invoice Format UAE

Which fields of the einvoice are validated by mof/ fta. It must include trn, invoice date, vat rate, and total amount. Here you can get answers to the most common questions on the topic of einvoicing. A tax invoice is essential under uae vat law for taxable supplies.

Record Sales and Print Invoices as per FTA (for UAE)

Which fields of the einvoice are validated by mof/ fta. A tax invoice is essential under uae vat law for taxable supplies. Here you can get answers to the most common questions on the topic of einvoicing. It must include trn, invoice date, vat rate, and total amount.

Difference between VAT and FTA Tax Invoice Format in UAE

Here you can get answers to the most common questions on the topic of einvoicing. A tax invoice is essential under uae vat law for taxable supplies. Which fields of the einvoice are validated by mof/ fta. It must include trn, invoice date, vat rate, and total amount.

Invoices in UAE All You Need to Know

Which fields of the einvoice are validated by mof/ fta. A tax invoice is essential under uae vat law for taxable supplies. Here you can get answers to the most common questions on the topic of einvoicing. It must include trn, invoice date, vat rate, and total amount.

It Must Include Trn, Invoice Date, Vat Rate, And Total Amount.

Here you can get answers to the most common questions on the topic of einvoicing. A tax invoice is essential under uae vat law for taxable supplies. Which fields of the einvoice are validated by mof/ fta.