Uae Vat Invoice Requirements - Required for supplies made to vat. You need a valid tax invoice that meets specific standards. There are two types of vat invoices recognized by the uae fta: Tax invoice (full vat invoice): Uae vat laws have clear rules about claiming input vat.

Tax invoice (full vat invoice): You need a valid tax invoice that meets specific standards. Uae vat laws have clear rules about claiming input vat. Required for supplies made to vat. There are two types of vat invoices recognized by the uae fta:

Tax invoice (full vat invoice): Required for supplies made to vat. You need a valid tax invoice that meets specific standards. Uae vat laws have clear rules about claiming input vat. There are two types of vat invoices recognized by the uae fta:

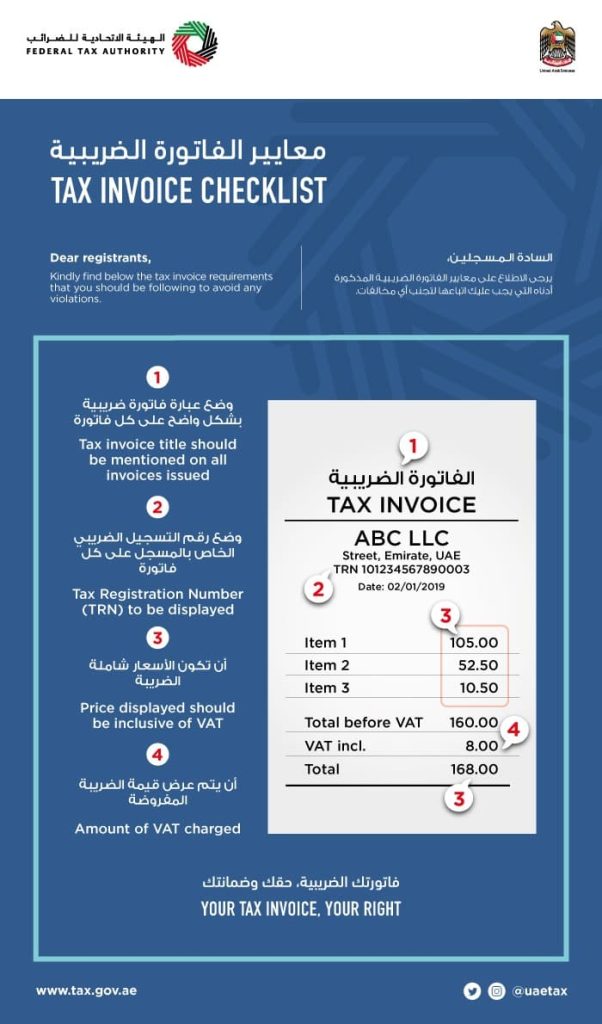

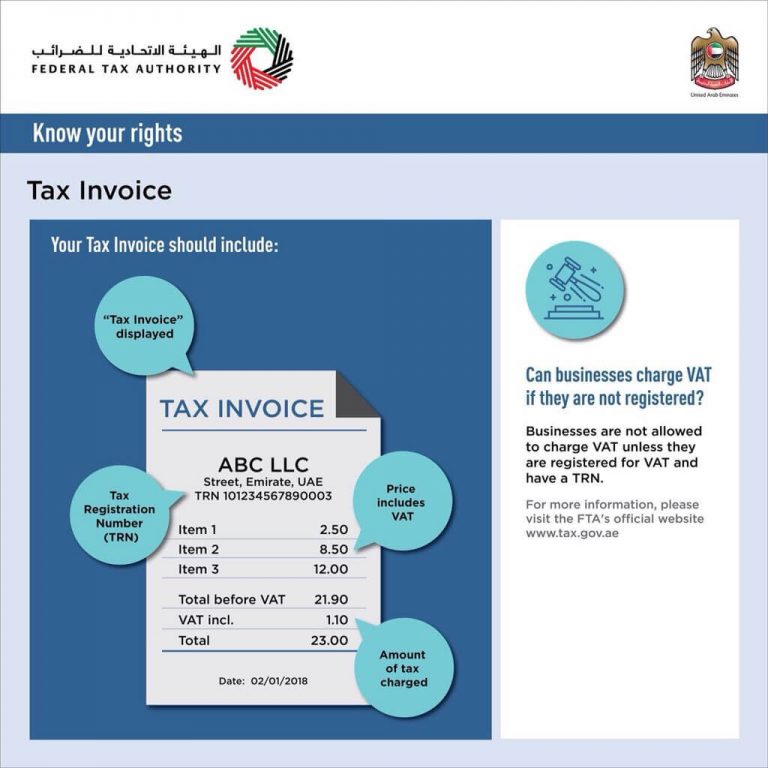

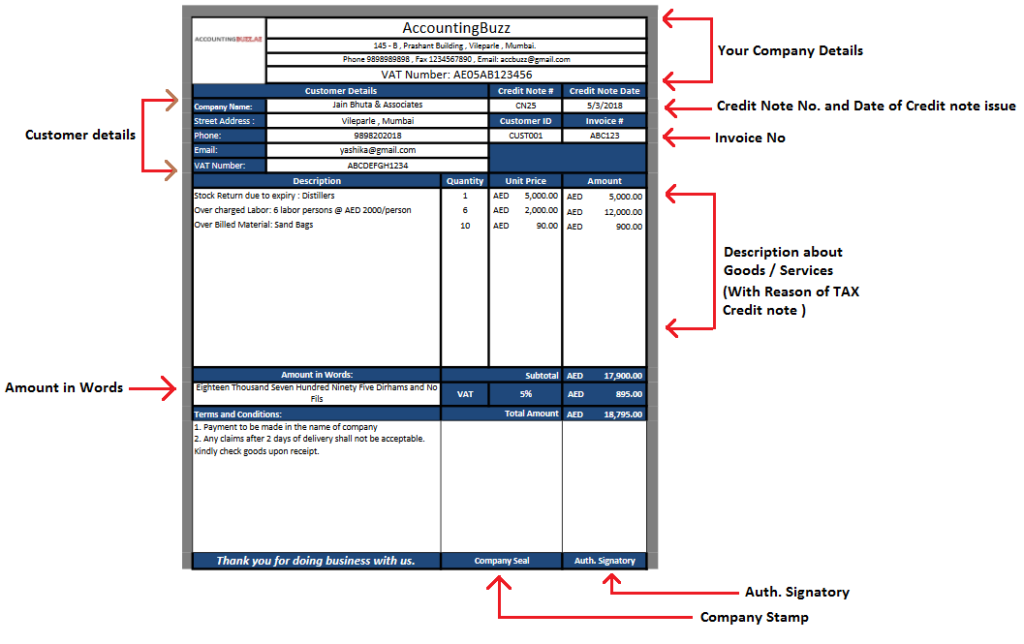

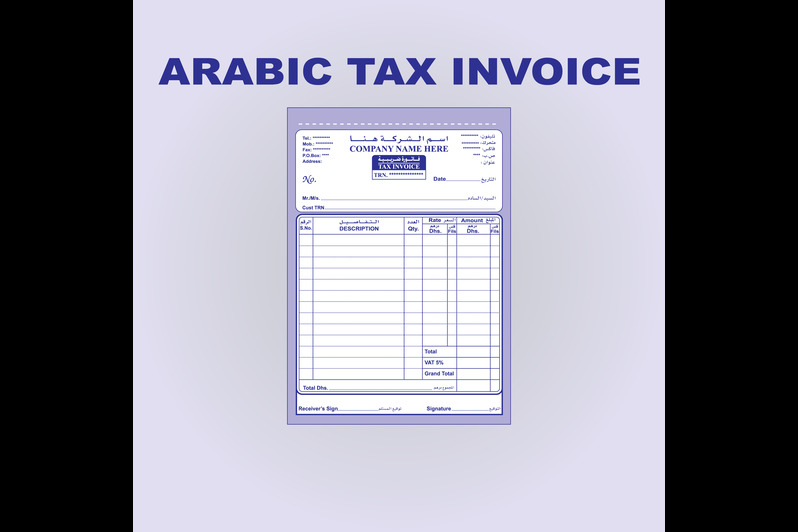

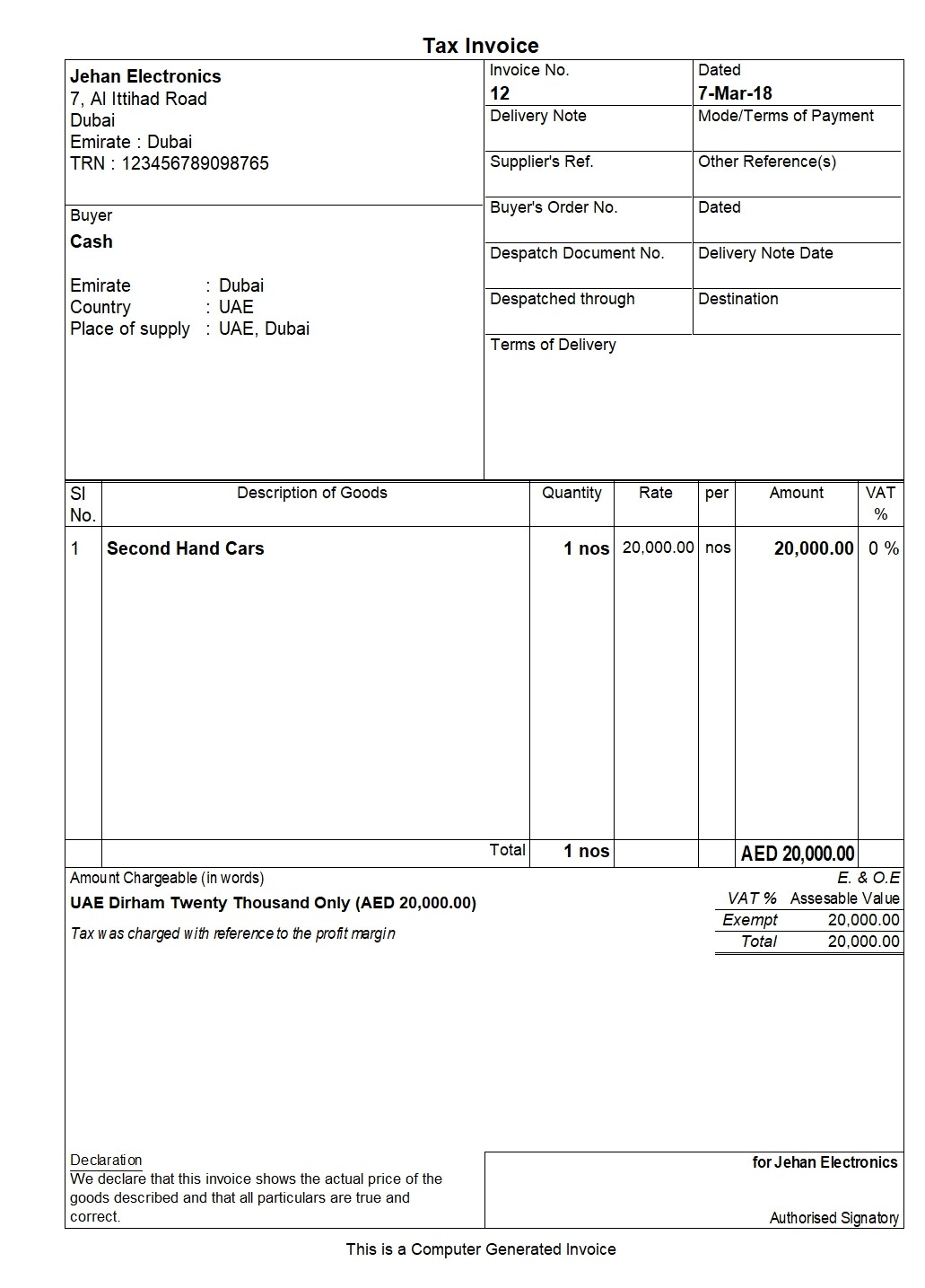

Tax Invoice Under Vat In Uae Tax Invoice Requirements And Format

Uae vat laws have clear rules about claiming input vat. Required for supplies made to vat. Tax invoice (full vat invoice): There are two types of vat invoices recognized by the uae fta: You need a valid tax invoice that meets specific standards.

Fully Automated UAE VAT Invoice Template MSOfficeGeek

Required for supplies made to vat. Tax invoice (full vat invoice): There are two types of vat invoices recognized by the uae fta: Uae vat laws have clear rules about claiming input vat. You need a valid tax invoice that meets specific standards.

Tax Invoice Format UAE FTA VAT Invoice UAE Shuraa Tax

Required for supplies made to vat. There are two types of vat invoices recognized by the uae fta: You need a valid tax invoice that meets specific standards. Tax invoice (full vat invoice): Uae vat laws have clear rules about claiming input vat.

Fully Automated UAE VAT Invoice Template MSOfficeGeek

There are two types of vat invoices recognized by the uae fta: Tax invoice (full vat invoice): Required for supplies made to vat. You need a valid tax invoice that meets specific standards. Uae vat laws have clear rules about claiming input vat.

VAT Invoice Format in UAE FTA Tax Invoice Format UAE

There are two types of vat invoices recognized by the uae fta: Tax invoice (full vat invoice): Required for supplies made to vat. Uae vat laws have clear rules about claiming input vat. You need a valid tax invoice that meets specific standards.

Fully Automated UAE VAT Invoice Template MSOfficeGeek

You need a valid tax invoice that meets specific standards. There are two types of vat invoices recognized by the uae fta: Uae vat laws have clear rules about claiming input vat. Required for supplies made to vat. Tax invoice (full vat invoice):

Tax Invoice Format for VAT in UAE by Karna Soneji Medium

Tax invoice (full vat invoice): Required for supplies made to vat. There are two types of vat invoices recognized by the uae fta: You need a valid tax invoice that meets specific standards. Uae vat laws have clear rules about claiming input vat.

VAT Invoice in UAE Requirements and Format Guide

Uae vat laws have clear rules about claiming input vat. Tax invoice (full vat invoice): Required for supplies made to vat. There are two types of vat invoices recognized by the uae fta: You need a valid tax invoice that meets specific standards.

VAT Invoice in UAE Definition, Sample and Creation

You need a valid tax invoice that meets specific standards. Tax invoice (full vat invoice): Uae vat laws have clear rules about claiming input vat. There are two types of vat invoices recognized by the uae fta: Required for supplies made to vat.

Tax Invoice Under Vat In Uae Tax Invoice Requirements And Format

There are two types of vat invoices recognized by the uae fta: Uae vat laws have clear rules about claiming input vat. You need a valid tax invoice that meets specific standards. Tax invoice (full vat invoice): Required for supplies made to vat.

You Need A Valid Tax Invoice That Meets Specific Standards.

Uae vat laws have clear rules about claiming input vat. Required for supplies made to vat. There are two types of vat invoices recognized by the uae fta: Tax invoice (full vat invoice):