Uae Vat Tax Law - Vat is a consumption tax (not a sales tax) that applies to most transactions in the uae. Article 1 of uae vat law defines tax group as ‘two or more persons registered with the authority for tax purposes as a single taxable. (8) of 2017, outlining its key components, legal. His highness sheikh khalifa bin zayed al nahyan, president of the united arab emirates, has issued the following decree law:

Vat is a consumption tax (not a sales tax) that applies to most transactions in the uae. His highness sheikh khalifa bin zayed al nahyan, president of the united arab emirates, has issued the following decree law: (8) of 2017, outlining its key components, legal. Article 1 of uae vat law defines tax group as ‘two or more persons registered with the authority for tax purposes as a single taxable.

Article 1 of uae vat law defines tax group as ‘two or more persons registered with the authority for tax purposes as a single taxable. His highness sheikh khalifa bin zayed al nahyan, president of the united arab emirates, has issued the following decree law: (8) of 2017, outlining its key components, legal. Vat is a consumption tax (not a sales tax) that applies to most transactions in the uae.

Statute of Limitations Under the Amended UAE VAT Law

Vat is a consumption tax (not a sales tax) that applies to most transactions in the uae. (8) of 2017, outlining its key components, legal. His highness sheikh khalifa bin zayed al nahyan, president of the united arab emirates, has issued the following decree law: Article 1 of uae vat law defines tax group as ‘two or more persons registered.

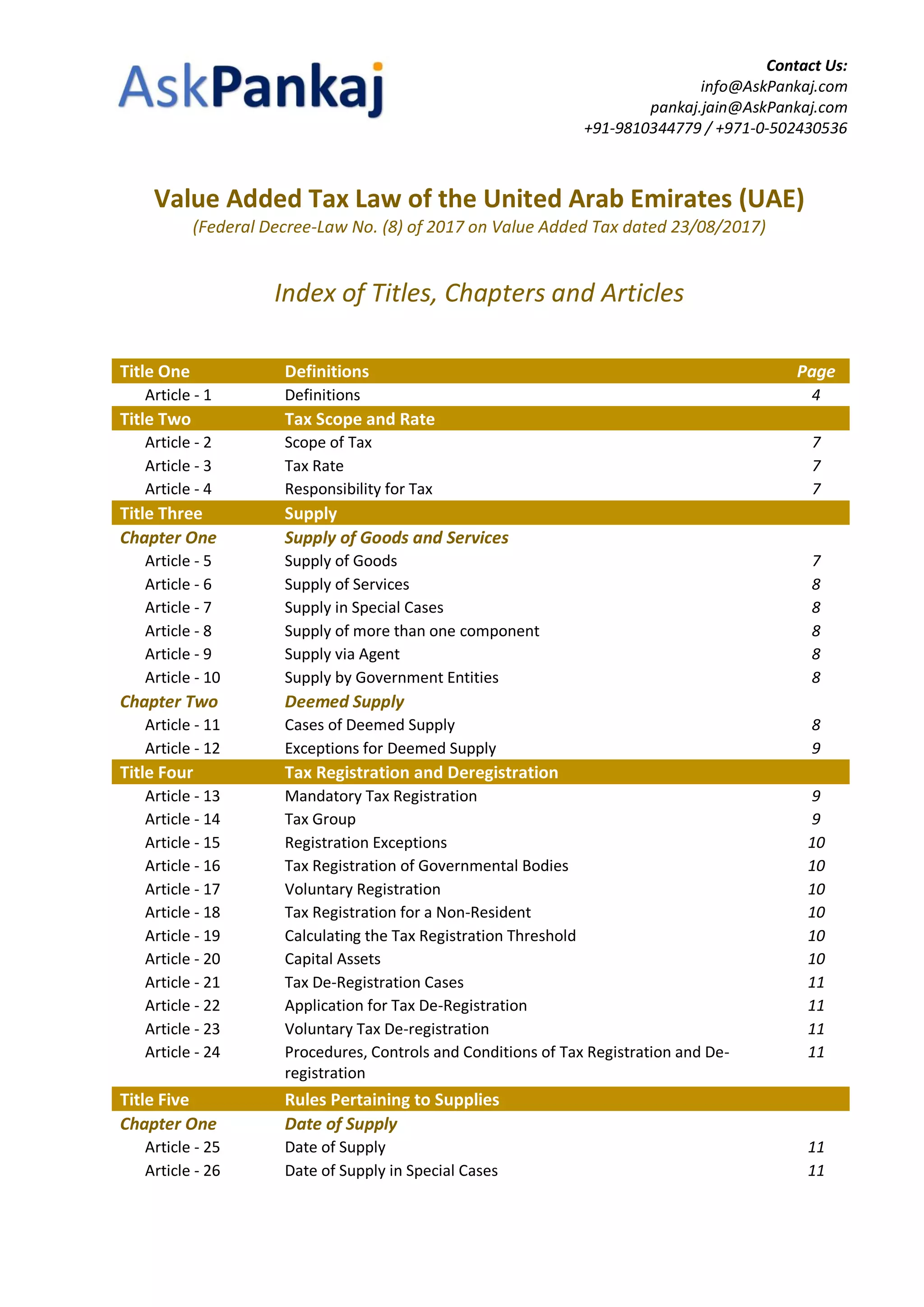

AskPankaj Value Added Tax (VAT) law of the United Arab Emirates (UAE

Article 1 of uae vat law defines tax group as ‘two or more persons registered with the authority for tax purposes as a single taxable. (8) of 2017, outlining its key components, legal. His highness sheikh khalifa bin zayed al nahyan, president of the united arab emirates, has issued the following decree law: Vat is a consumption tax (not a.

UAE Tax Laws for Businesses VAT and Corporate tax

Article 1 of uae vat law defines tax group as ‘two or more persons registered with the authority for tax purposes as a single taxable. His highness sheikh khalifa bin zayed al nahyan, president of the united arab emirates, has issued the following decree law: Vat is a consumption tax (not a sales tax) that applies to most transactions in.

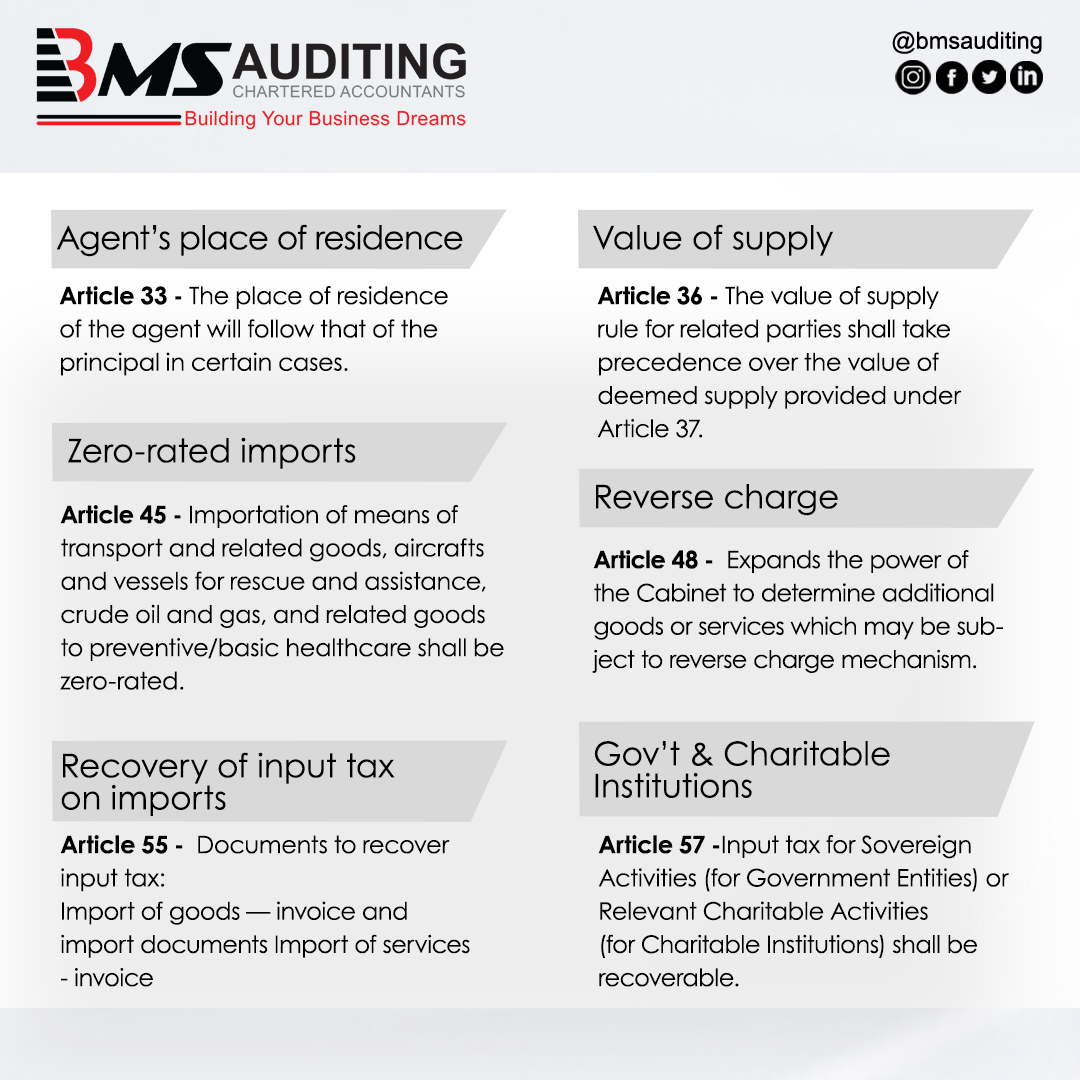

UAE announces changes to VAT provisions (Updated) BMS

His highness sheikh khalifa bin zayed al nahyan, president of the united arab emirates, has issued the following decree law: Article 1 of uae vat law defines tax group as ‘two or more persons registered with the authority for tax purposes as a single taxable. Vat is a consumption tax (not a sales tax) that applies to most transactions in.

UAE VAT Implementation Key Insights Businesses Need to Know

His highness sheikh khalifa bin zayed al nahyan, president of the united arab emirates, has issued the following decree law: Article 1 of uae vat law defines tax group as ‘two or more persons registered with the authority for tax purposes as a single taxable. (8) of 2017, outlining its key components, legal. Vat is a consumption tax (not a.

A Guide to New Amendments to UAE VAT Decree Law

(8) of 2017, outlining its key components, legal. Vat is a consumption tax (not a sales tax) that applies to most transactions in the uae. His highness sheikh khalifa bin zayed al nahyan, president of the united arab emirates, has issued the following decree law: Article 1 of uae vat law defines tax group as ‘two or more persons registered.

UAE VAT Law Key Updates and Expert Advice 2023

Article 1 of uae vat law defines tax group as ‘two or more persons registered with the authority for tax purposes as a single taxable. Vat is a consumption tax (not a sales tax) that applies to most transactions in the uae. (8) of 2017, outlining its key components, legal. His highness sheikh khalifa bin zayed al nahyan, president of.

A COMPREHENSIVE GUIDE ON UAE VALUE ADDED TAX UAE VAT SIMPLIFIED by CA

Vat is a consumption tax (not a sales tax) that applies to most transactions in the uae. (8) of 2017, outlining its key components, legal. His highness sheikh khalifa bin zayed al nahyan, president of the united arab emirates, has issued the following decree law: Article 1 of uae vat law defines tax group as ‘two or more persons registered.

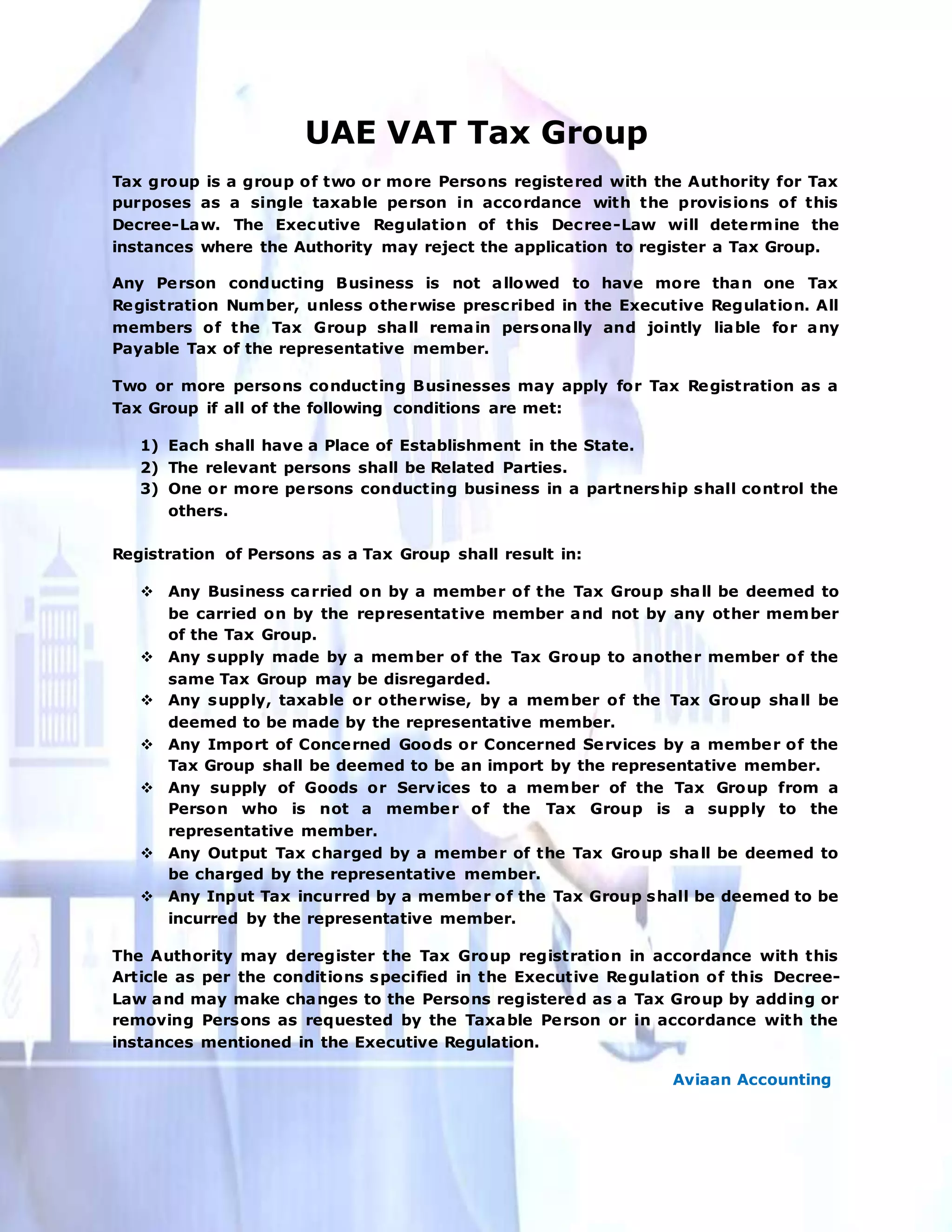

UAE VAT Tax Group PDF

His highness sheikh khalifa bin zayed al nahyan, president of the united arab emirates, has issued the following decree law: Vat is a consumption tax (not a sales tax) that applies to most transactions in the uae. Article 1 of uae vat law defines tax group as ‘two or more persons registered with the authority for tax purposes as a.

Derecho Constitucional Suaed UNAM, 42 OFF

Vat is a consumption tax (not a sales tax) that applies to most transactions in the uae. Article 1 of uae vat law defines tax group as ‘two or more persons registered with the authority for tax purposes as a single taxable. (8) of 2017, outlining its key components, legal. His highness sheikh khalifa bin zayed al nahyan, president of.

Vat Is A Consumption Tax (Not A Sales Tax) That Applies To Most Transactions In The Uae.

His highness sheikh khalifa bin zayed al nahyan, president of the united arab emirates, has issued the following decree law: (8) of 2017, outlining its key components, legal. Article 1 of uae vat law defines tax group as ‘two or more persons registered with the authority for tax purposes as a single taxable.