Vat Filing Template Uae - You can download ready to use and easy to customize uae vat invoices, uae vat inventory management, uae vat debit/credit note, uae. Once you have registered for vat in the uae, you are required to file your vat return and make related vat payments within 28 days. How to file vat return? You must file for tax return electronically through the fta portal:

Once you have registered for vat in the uae, you are required to file your vat return and make related vat payments within 28 days. How to file vat return? You can download ready to use and easy to customize uae vat invoices, uae vat inventory management, uae vat debit/credit note, uae. You must file for tax return electronically through the fta portal:

How to file vat return? You must file for tax return electronically through the fta portal: You can download ready to use and easy to customize uae vat invoices, uae vat inventory management, uae vat debit/credit note, uae. Once you have registered for vat in the uae, you are required to file your vat return and make related vat payments within 28 days.

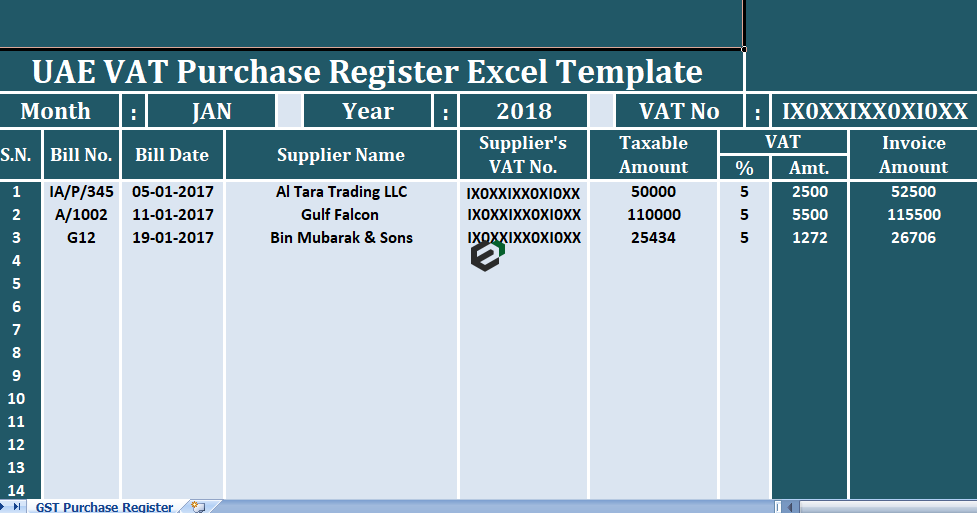

Download Free UAE VAT Purchase Register and Tracking

You must file for tax return electronically through the fta portal: You can download ready to use and easy to customize uae vat invoices, uae vat inventory management, uae vat debit/credit note, uae. How to file vat return? Once you have registered for vat in the uae, you are required to file your vat return and make related vat payments.

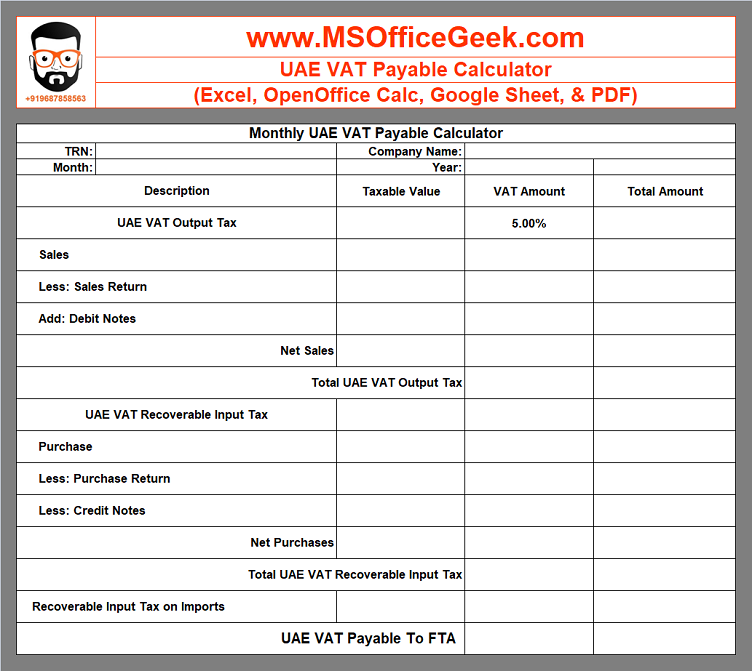

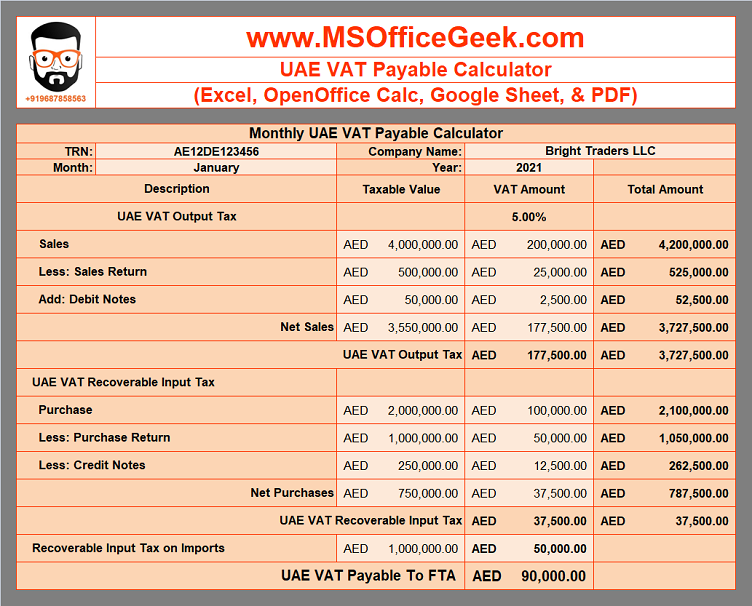

ReadyToUse UAE VAT Payable Calculator Template MSOfficeGeek

How to file vat return? You can download ready to use and easy to customize uae vat invoices, uae vat inventory management, uae vat debit/credit note, uae. Once you have registered for vat in the uae, you are required to file your vat return and make related vat payments within 28 days. You must file for tax return electronically through.

UAE VAT Archives Excel templates

You can download ready to use and easy to customize uae vat invoices, uae vat inventory management, uae vat debit/credit note, uae. Once you have registered for vat in the uae, you are required to file your vat return and make related vat payments within 28 days. You must file for tax return electronically through the fta portal: How to.

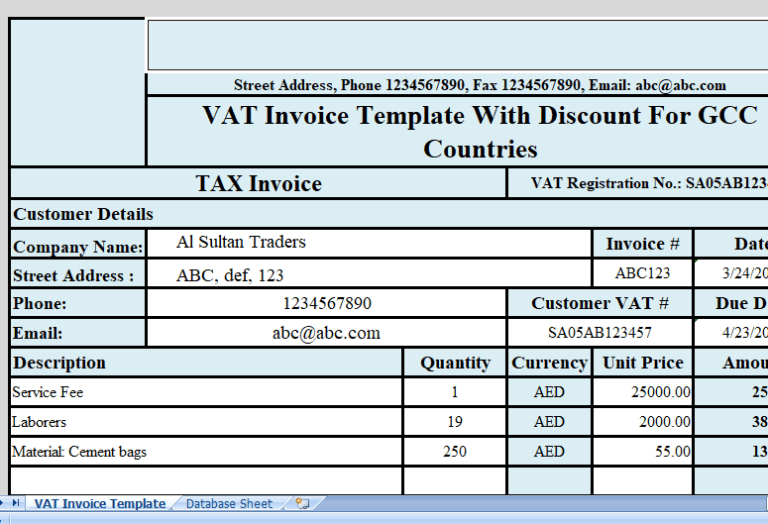

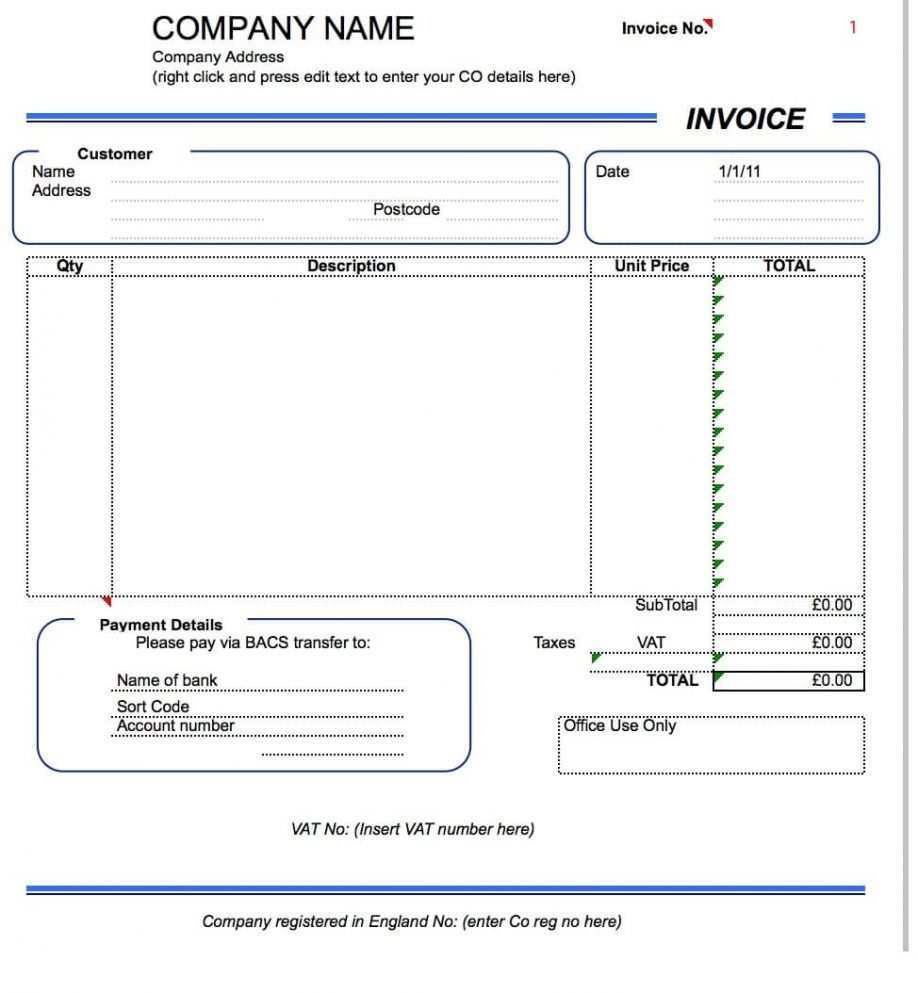

Fully Automated UAE VAT Invoice Template MSOfficeGeek

You must file for tax return electronically through the fta portal: How to file vat return? You can download ready to use and easy to customize uae vat invoices, uae vat inventory management, uae vat debit/credit note, uae. Once you have registered for vat in the uae, you are required to file your vat return and make related vat payments.

Fully Automated UAE VAT Invoice Template MSOfficeGeek

How to file vat return? You can download ready to use and easy to customize uae vat invoices, uae vat inventory management, uae vat debit/credit note, uae. Once you have registered for vat in the uae, you are required to file your vat return and make related vat payments within 28 days. You must file for tax return electronically through.

Fully Automated UAE VAT Invoice Template MSOfficeGeek

Once you have registered for vat in the uae, you are required to file your vat return and make related vat payments within 28 days. You must file for tax return electronically through the fta portal: You can download ready to use and easy to customize uae vat invoices, uae vat inventory management, uae vat debit/credit note, uae. How to.

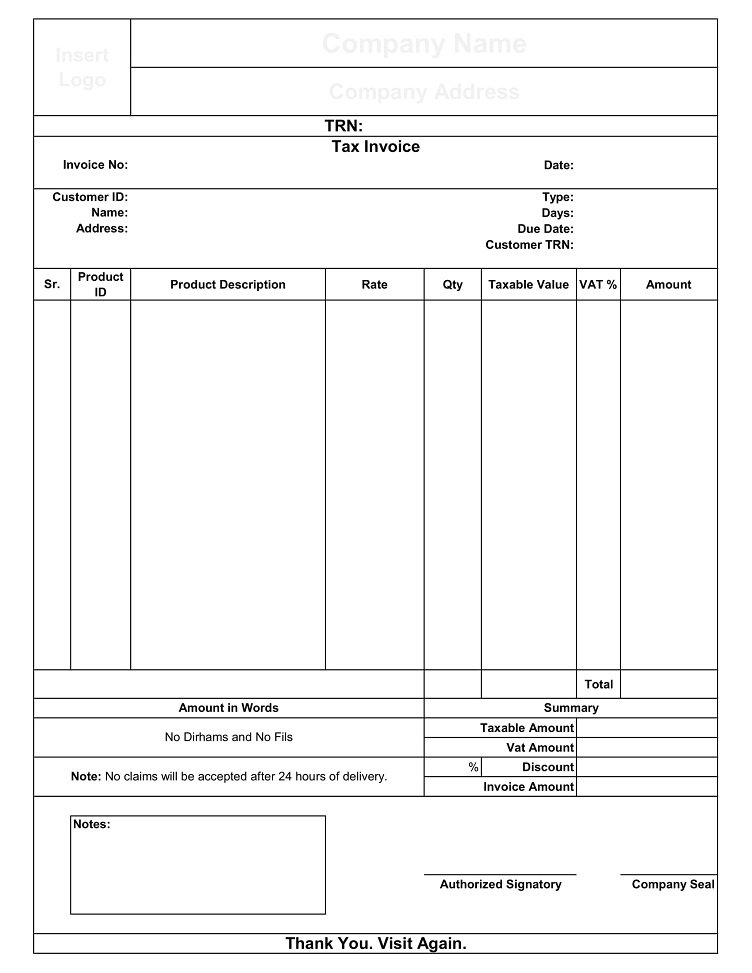

32 Creative Uae Vat Invoice Template Formating with Uae Vat Invoice

You must file for tax return electronically through the fta portal: How to file vat return? Once you have registered for vat in the uae, you are required to file your vat return and make related vat payments within 28 days. You can download ready to use and easy to customize uae vat invoices, uae vat inventory management, uae vat.

ReadyToUse UAE VAT Payable Calculator Template MSOfficeGeek

How to file vat return? You can download ready to use and easy to customize uae vat invoices, uae vat inventory management, uae vat debit/credit note, uae. You must file for tax return electronically through the fta portal: Once you have registered for vat in the uae, you are required to file your vat return and make related vat payments.

Fully Automated UAE VAT Invoice Template MSOfficeGeek

How to file vat return? You can download ready to use and easy to customize uae vat invoices, uae vat inventory management, uae vat debit/credit note, uae. You must file for tax return electronically through the fta portal: Once you have registered for vat in the uae, you are required to file your vat return and make related vat payments.

Fully Automated UAE VAT Invoice Template MSOfficeGeek

Once you have registered for vat in the uae, you are required to file your vat return and make related vat payments within 28 days. You can download ready to use and easy to customize uae vat invoices, uae vat inventory management, uae vat debit/credit note, uae. You must file for tax return electronically through the fta portal: How to.

You Can Download Ready To Use And Easy To Customize Uae Vat Invoices, Uae Vat Inventory Management, Uae Vat Debit/Credit Note, Uae.

Once you have registered for vat in the uae, you are required to file your vat return and make related vat payments within 28 days. How to file vat return? You must file for tax return electronically through the fta portal: