Vat Invoice Or Proforma Invoice Rules - My understanding is that it should and that the customer pays this vat upfront. A proforma is not required to follow any set form, apart from the facts that they must not have an invoice number and must state that. Proforma invoices are not legally binding documents, which serve as estimates or quotations for potential transactions.

Proforma invoices are not legally binding documents, which serve as estimates or quotations for potential transactions. A proforma is not required to follow any set form, apart from the facts that they must not have an invoice number and must state that. My understanding is that it should and that the customer pays this vat upfront.

Proforma invoices are not legally binding documents, which serve as estimates or quotations for potential transactions. My understanding is that it should and that the customer pays this vat upfront. A proforma is not required to follow any set form, apart from the facts that they must not have an invoice number and must state that.

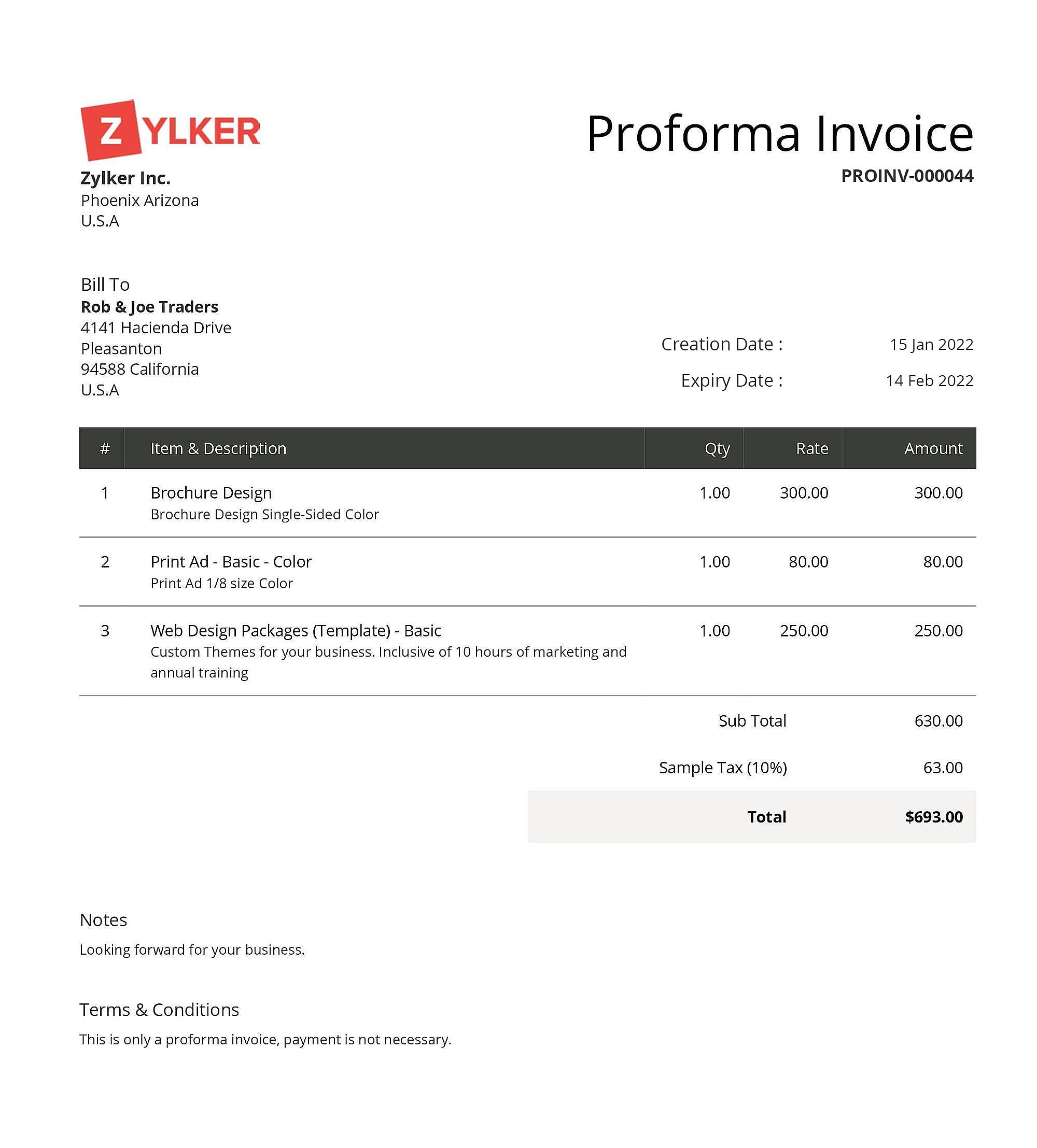

Free Printable Proforma Invoice Templates [Word, Excel, PDF]

Proforma invoices are not legally binding documents, which serve as estimates or quotations for potential transactions. A proforma is not required to follow any set form, apart from the facts that they must not have an invoice number and must state that. My understanding is that it should and that the customer pays this vat upfront.

Proforma Invoice example, uses, definition

A proforma is not required to follow any set form, apart from the facts that they must not have an invoice number and must state that. My understanding is that it should and that the customer pays this vat upfront. Proforma invoices are not legally binding documents, which serve as estimates or quotations for potential transactions.

What is Proforma Invoice? 5 Free Templates to Billing

Proforma invoices are not legally binding documents, which serve as estimates or quotations for potential transactions. A proforma is not required to follow any set form, apart from the facts that they must not have an invoice number and must state that. My understanding is that it should and that the customer pays this vat upfront.

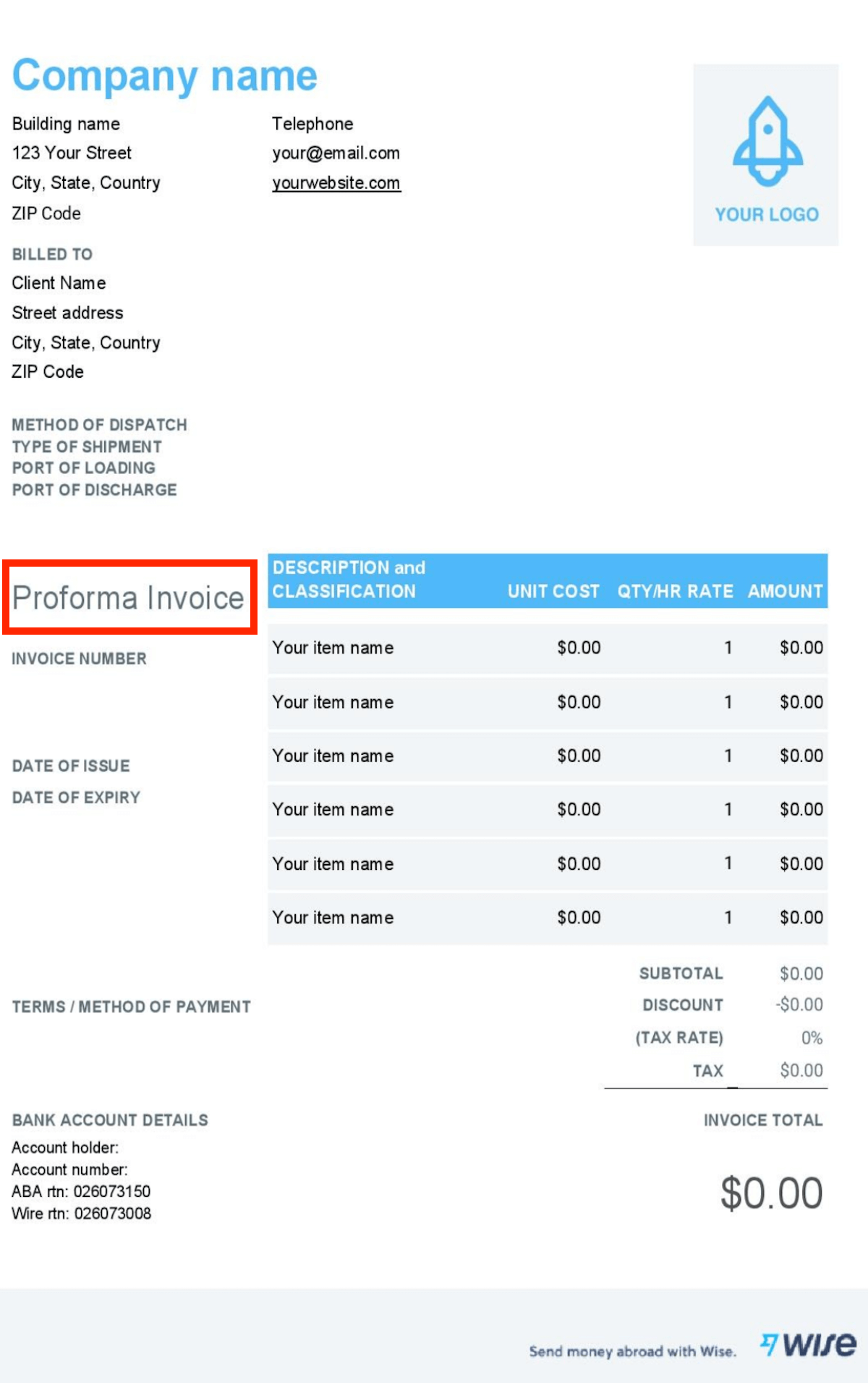

What is a proforma invoice? When and why to use Wise

Proforma invoices are not legally binding documents, which serve as estimates or quotations for potential transactions. My understanding is that it should and that the customer pays this vat upfront. A proforma is not required to follow any set form, apart from the facts that they must not have an invoice number and must state that.

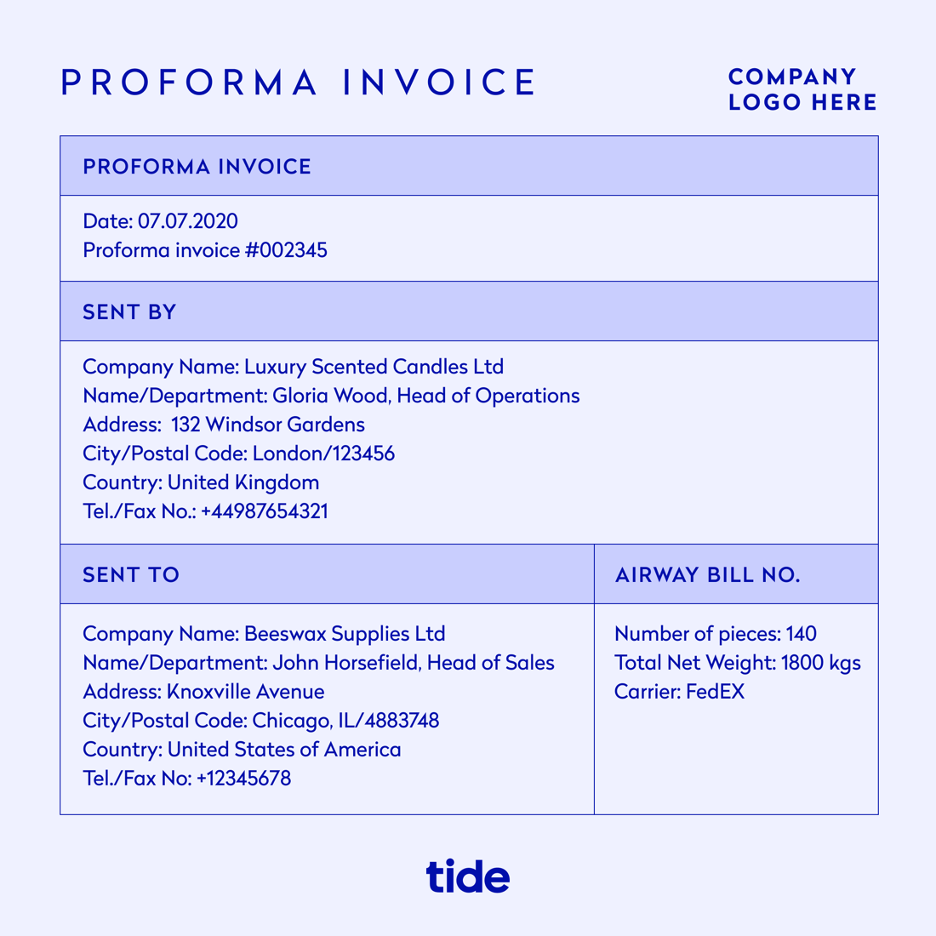

What is a proforma invoice? How and when to use one Tide Business

Proforma invoices are not legally binding documents, which serve as estimates or quotations for potential transactions. A proforma is not required to follow any set form, apart from the facts that they must not have an invoice number and must state that. My understanding is that it should and that the customer pays this vat upfront.

Free Printable Proforma Invoice Templates [Word, Excel, PDF]

Proforma invoices are not legally binding documents, which serve as estimates or quotations for potential transactions. A proforma is not required to follow any set form, apart from the facts that they must not have an invoice number and must state that. My understanding is that it should and that the customer pays this vat upfront.

Proforma Invoice Format Sample Formats for Use & Benefits

My understanding is that it should and that the customer pays this vat upfront. Proforma invoices are not legally binding documents, which serve as estimates or quotations for potential transactions. A proforma is not required to follow any set form, apart from the facts that they must not have an invoice number and must state that.

Proforma Invoice Pengertian, Contoh, dan Cara Membuatnya

A proforma is not required to follow any set form, apart from the facts that they must not have an invoice number and must state that. Proforma invoices are not legally binding documents, which serve as estimates or quotations for potential transactions. My understanding is that it should and that the customer pays this vat upfront.

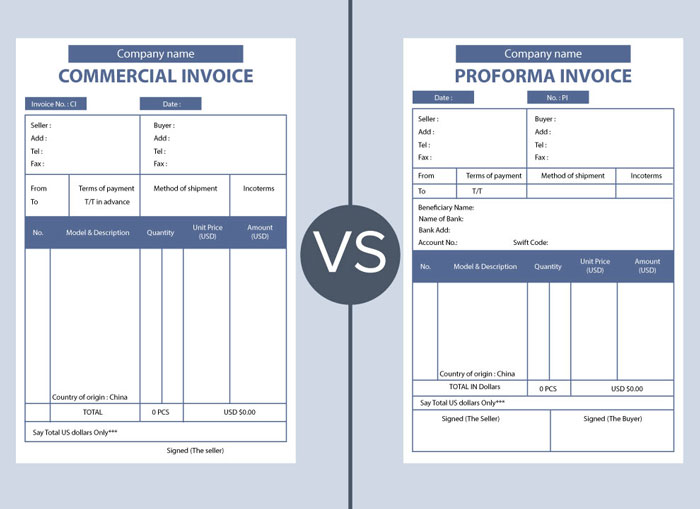

Proforma Invoice vs Commercial Invoice What's the Difference?

Proforma invoices are not legally binding documents, which serve as estimates or quotations for potential transactions. A proforma is not required to follow any set form, apart from the facts that they must not have an invoice number and must state that. My understanding is that it should and that the customer pays this vat upfront.

What is a proforma invoice? Meaning, uses, format, example Essential

A proforma is not required to follow any set form, apart from the facts that they must not have an invoice number and must state that. Proforma invoices are not legally binding documents, which serve as estimates or quotations for potential transactions. My understanding is that it should and that the customer pays this vat upfront.

A Proforma Is Not Required To Follow Any Set Form, Apart From The Facts That They Must Not Have An Invoice Number And Must State That.

My understanding is that it should and that the customer pays this vat upfront. Proforma invoices are not legally binding documents, which serve as estimates or quotations for potential transactions.

![Free Printable Proforma Invoice Templates [Word, Excel, PDF]](https://www.typecalendar.com/wp-content/uploads/2023/07/Proforma-Invoice-Free-Template.jpg?gid=724)

![Free Printable Proforma Invoice Templates [Word, Excel, PDF]](https://www.typecalendar.com/wp-content/uploads/2023/06/Proforma-Invoice-1536x864.jpg)