Vat Invoice Or Proforma Invoice Uk - Broadly, using proformas, requests for payment, or similar documents rather than issuing an invoice, defers a tax point and. If you issue vat invoices in a foreign currency for supplies of goods or services that take place in the uk, you must convert the. My understanding is that it should and that the customer pays this vat upfront.

My understanding is that it should and that the customer pays this vat upfront. If you issue vat invoices in a foreign currency for supplies of goods or services that take place in the uk, you must convert the. Broadly, using proformas, requests for payment, or similar documents rather than issuing an invoice, defers a tax point and.

Broadly, using proformas, requests for payment, or similar documents rather than issuing an invoice, defers a tax point and. My understanding is that it should and that the customer pays this vat upfront. If you issue vat invoices in a foreign currency for supplies of goods or services that take place in the uk, you must convert the.

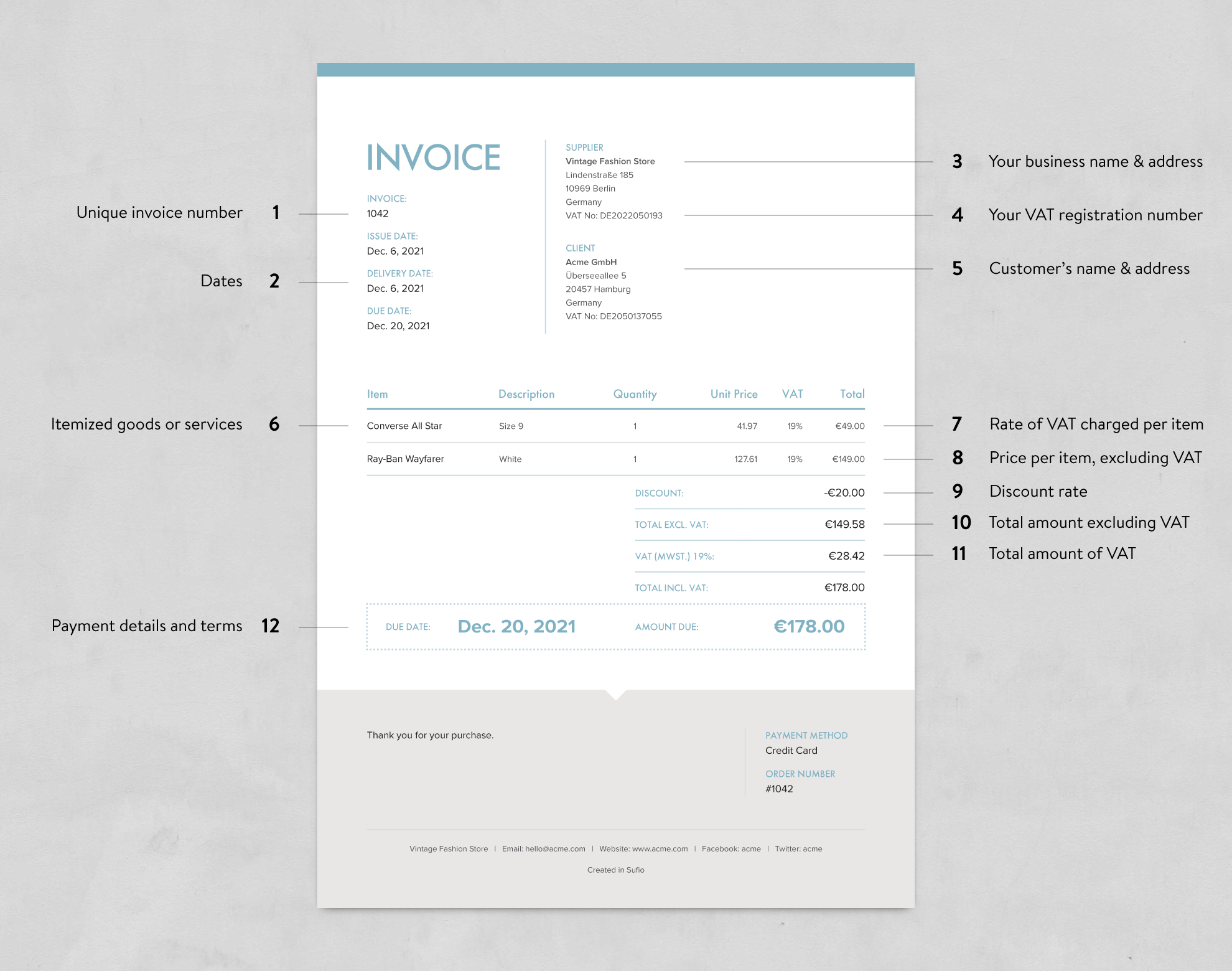

Invoices Explained What Are the Different Types? Sufio

If you issue vat invoices in a foreign currency for supplies of goods or services that take place in the uk, you must convert the. Broadly, using proformas, requests for payment, or similar documents rather than issuing an invoice, defers a tax point and. My understanding is that it should and that the customer pays this vat upfront.

Free Vat Invoice Template Invoice Template Ideas Riset

Broadly, using proformas, requests for payment, or similar documents rather than issuing an invoice, defers a tax point and. If you issue vat invoices in a foreign currency for supplies of goods or services that take place in the uk, you must convert the. My understanding is that it should and that the customer pays this vat upfront.

Excel Invoice Template Uk

If you issue vat invoices in a foreign currency for supplies of goods or services that take place in the uk, you must convert the. Broadly, using proformas, requests for payment, or similar documents rather than issuing an invoice, defers a tax point and. My understanding is that it should and that the customer pays this vat upfront.

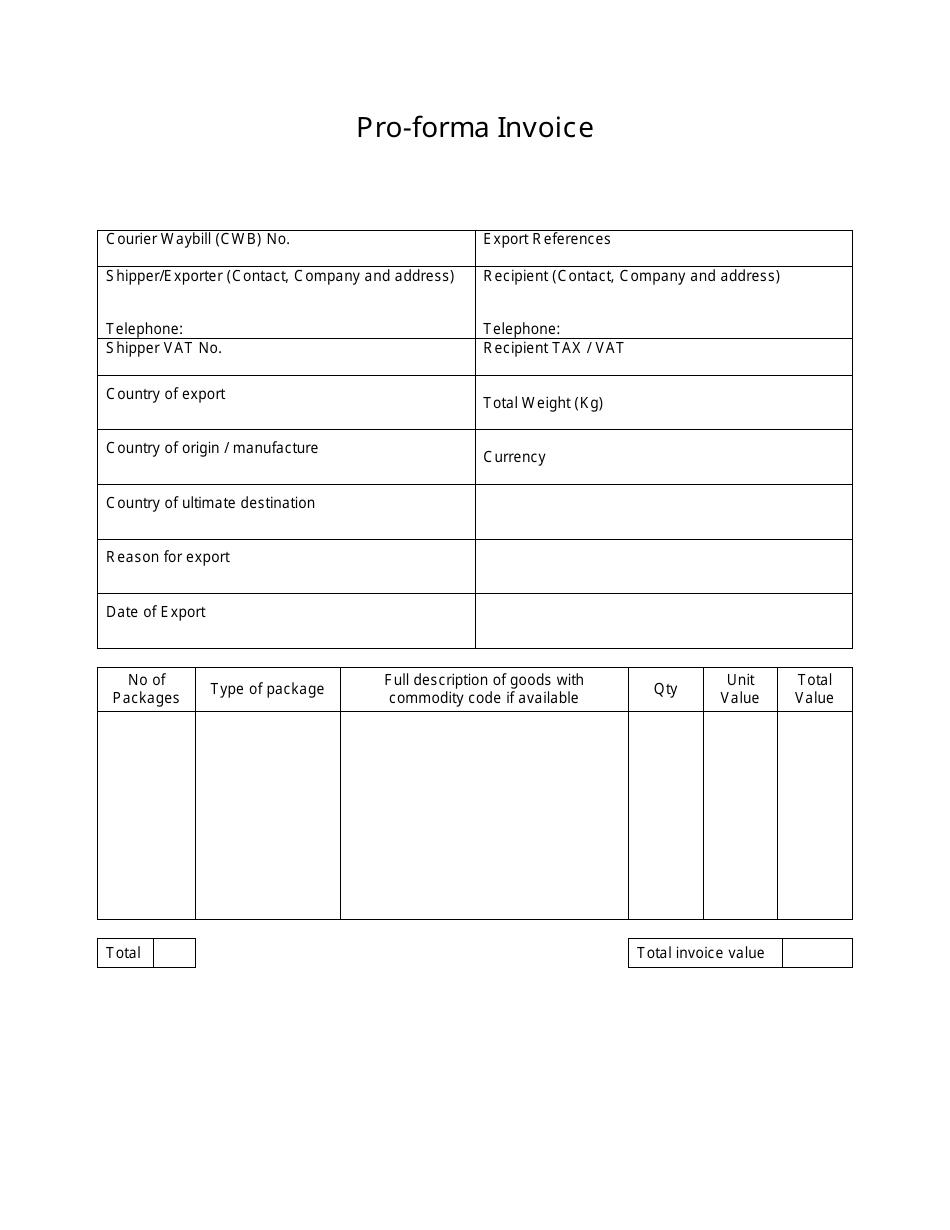

Proforma invoice in the United Kingdom Definition, Sample and Creation

Broadly, using proformas, requests for payment, or similar documents rather than issuing an invoice, defers a tax point and. My understanding is that it should and that the customer pays this vat upfront. If you issue vat invoices in a foreign currency for supplies of goods or services that take place in the uk, you must convert the.

Proforma Invoice How to create + Everything You Need to Know

Broadly, using proformas, requests for payment, or similar documents rather than issuing an invoice, defers a tax point and. My understanding is that it should and that the customer pays this vat upfront. If you issue vat invoices in a foreign currency for supplies of goods or services that take place in the uk, you must convert the.

Sample Invoice Template Uk

Broadly, using proformas, requests for payment, or similar documents rather than issuing an invoice, defers a tax point and. My understanding is that it should and that the customer pays this vat upfront. If you issue vat invoices in a foreign currency for supplies of goods or services that take place in the uk, you must convert the.

Proforma Word Invoice Template Free & Editable Billdu

If you issue vat invoices in a foreign currency for supplies of goods or services that take place in the uk, you must convert the. Broadly, using proformas, requests for payment, or similar documents rather than issuing an invoice, defers a tax point and. My understanding is that it should and that the customer pays this vat upfront.

Master Pro Forma VAT Invoices Your Guide to Streamlined International

Broadly, using proformas, requests for payment, or similar documents rather than issuing an invoice, defers a tax point and. My understanding is that it should and that the customer pays this vat upfront. If you issue vat invoices in a foreign currency for supplies of goods or services that take place in the uk, you must convert the.

Proforma Invoice Explained What You Need to Know

Broadly, using proformas, requests for payment, or similar documents rather than issuing an invoice, defers a tax point and. My understanding is that it should and that the customer pays this vat upfront. If you issue vat invoices in a foreign currency for supplies of goods or services that take place in the uk, you must convert the.

Pro Forma Invoices and VAT A Comprehensive Guide for Seamless Cross

If you issue vat invoices in a foreign currency for supplies of goods or services that take place in the uk, you must convert the. My understanding is that it should and that the customer pays this vat upfront. Broadly, using proformas, requests for payment, or similar documents rather than issuing an invoice, defers a tax point and.

My Understanding Is That It Should And That The Customer Pays This Vat Upfront.

If you issue vat invoices in a foreign currency for supplies of goods or services that take place in the uk, you must convert the. Broadly, using proformas, requests for payment, or similar documents rather than issuing an invoice, defers a tax point and.

/professional_proforma_template.png)