Vat On Proforma Invoice - The vat on a pro forma invoice is calculated by applying the vat rate to the net amount of the goods or services. Broadly, using proformas, requests for payment, or similar documents rather than issuing an invoice, defers a tax point and.

Broadly, using proformas, requests for payment, or similar documents rather than issuing an invoice, defers a tax point and. The vat on a pro forma invoice is calculated by applying the vat rate to the net amount of the goods or services.

Broadly, using proformas, requests for payment, or similar documents rather than issuing an invoice, defers a tax point and. The vat on a pro forma invoice is calculated by applying the vat rate to the net amount of the goods or services.

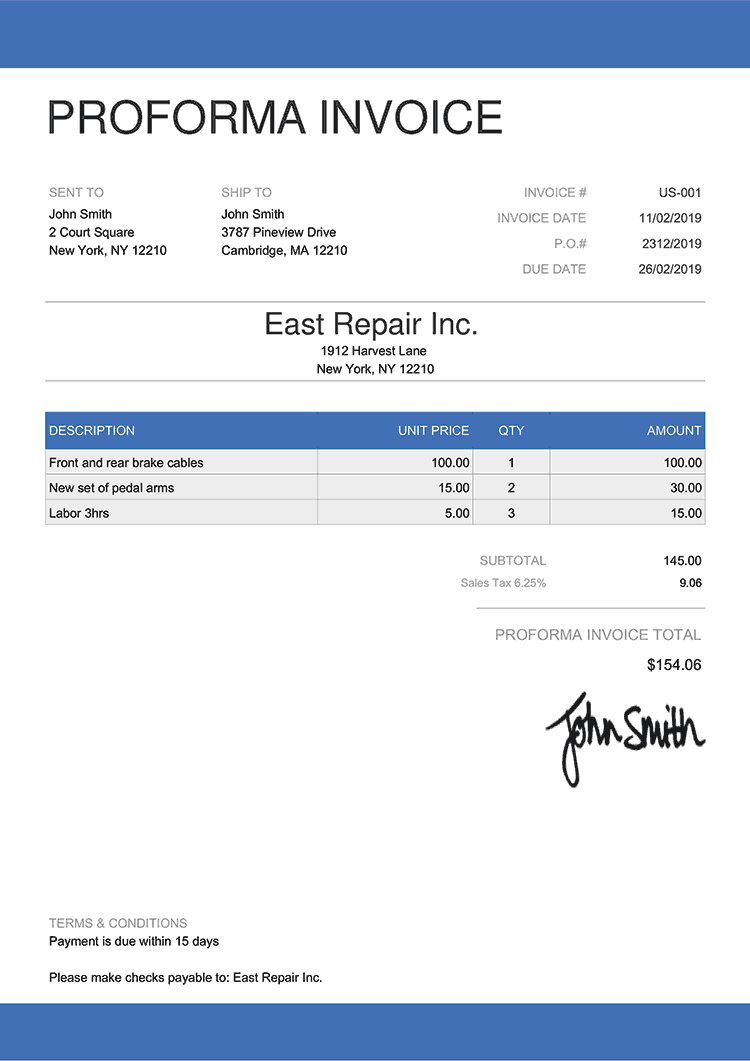

Proforma Invoice PDF Invoice Value Added Tax

Broadly, using proformas, requests for payment, or similar documents rather than issuing an invoice, defers a tax point and. The vat on a pro forma invoice is calculated by applying the vat rate to the net amount of the goods or services.

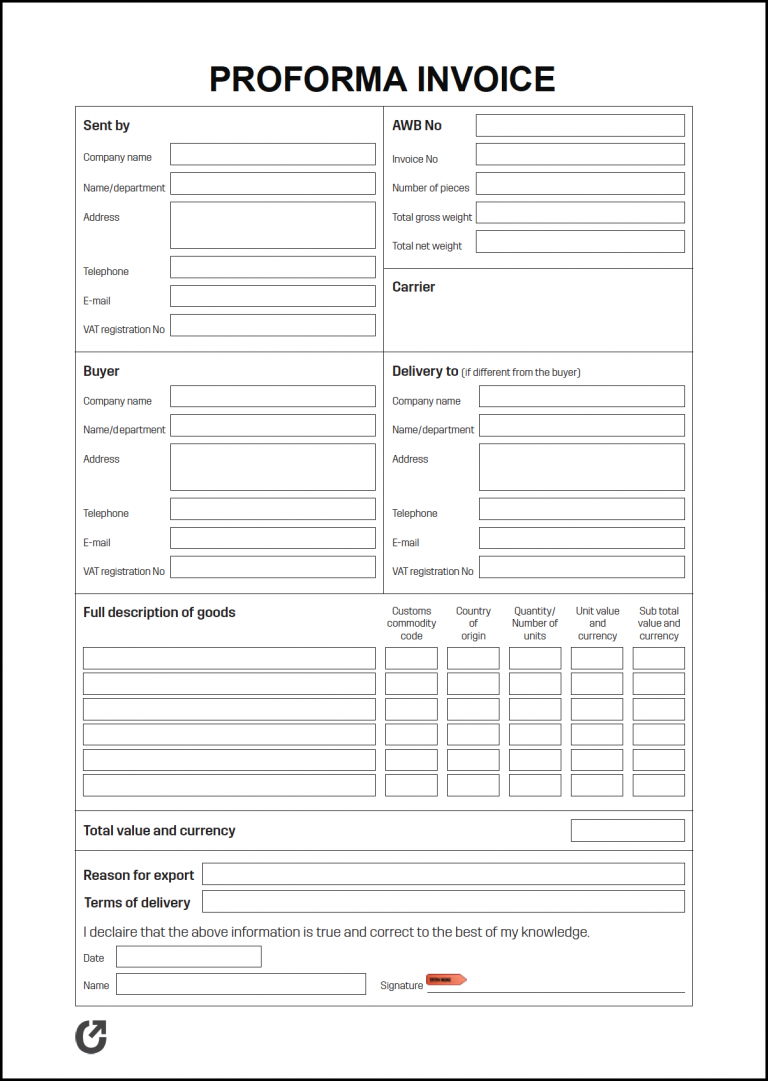

Proforma Invoice Template Free Excel Proforma Template

Broadly, using proformas, requests for payment, or similar documents rather than issuing an invoice, defers a tax point and. The vat on a pro forma invoice is calculated by applying the vat rate to the net amount of the goods or services.

Modelo De Factura Proforma

Broadly, using proformas, requests for payment, or similar documents rather than issuing an invoice, defers a tax point and. The vat on a pro forma invoice is calculated by applying the vat rate to the net amount of the goods or services.

Performa Format

The vat on a pro forma invoice is calculated by applying the vat rate to the net amount of the goods or services. Broadly, using proformas, requests for payment, or similar documents rather than issuing an invoice, defers a tax point and.

Proforma invoice in the United Kingdom Definition, Sample and Creation

The vat on a pro forma invoice is calculated by applying the vat rate to the net amount of the goods or services. Broadly, using proformas, requests for payment, or similar documents rather than issuing an invoice, defers a tax point and.

Free Proforma Invoice Template Invoice

Broadly, using proformas, requests for payment, or similar documents rather than issuing an invoice, defers a tax point and. The vat on a pro forma invoice is calculated by applying the vat rate to the net amount of the goods or services.

Master Pro Forma VAT Invoices Your Guide to Streamlined International

The vat on a pro forma invoice is calculated by applying the vat rate to the net amount of the goods or services. Broadly, using proformas, requests for payment, or similar documents rather than issuing an invoice, defers a tax point and.

What is a proforma invoice? Uses, Formats, and Key Information

The vat on a pro forma invoice is calculated by applying the vat rate to the net amount of the goods or services. Broadly, using proformas, requests for payment, or similar documents rather than issuing an invoice, defers a tax point and.

Proforma Invoice How to create + Everything You Need to Know

Broadly, using proformas, requests for payment, or similar documents rather than issuing an invoice, defers a tax point and. The vat on a pro forma invoice is calculated by applying the vat rate to the net amount of the goods or services.

Broadly, Using Proformas, Requests For Payment, Or Similar Documents Rather Than Issuing An Invoice, Defers A Tax Point And.

The vat on a pro forma invoice is calculated by applying the vat rate to the net amount of the goods or services.

/professional_proforma_template.png)