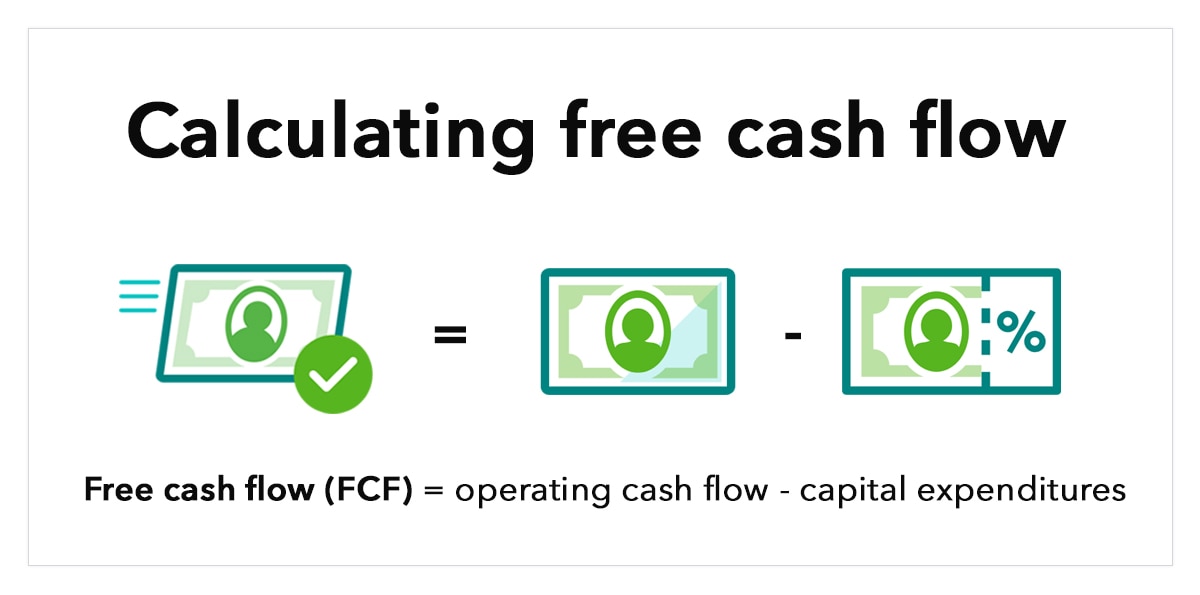

What Is Free Cash Flow Calculation - Free cash flow (fcf) is the cash that remains after a company pays to support its operations and makes any capital expenditures. What is the free cash flow (fcf) formula? The generic free cash flow (fcf) formula is equal to cash from operations minus capital. It measures how much cash a. Free cash flow (fcf) is the cash flow to the firm or equity after all the debt and other obligations are paid off.

Free cash flow (fcf) is the cash flow to the firm or equity after all the debt and other obligations are paid off. It measures how much cash a. Free cash flow (fcf) is the cash that remains after a company pays to support its operations and makes any capital expenditures. What is the free cash flow (fcf) formula? The generic free cash flow (fcf) formula is equal to cash from operations minus capital.

The generic free cash flow (fcf) formula is equal to cash from operations minus capital. It measures how much cash a. Free cash flow (fcf) is the cash that remains after a company pays to support its operations and makes any capital expenditures. What is the free cash flow (fcf) formula? Free cash flow (fcf) is the cash flow to the firm or equity after all the debt and other obligations are paid off.

Discounted Cash Flow Formula

It measures how much cash a. Free cash flow (fcf) is the cash flow to the firm or equity after all the debt and other obligations are paid off. The generic free cash flow (fcf) formula is equal to cash from operations minus capital. Free cash flow (fcf) is the cash that remains after a company pays to support its.

Free Cash Flow What it is and how to calculate it Example and

It measures how much cash a. The generic free cash flow (fcf) formula is equal to cash from operations minus capital. Free cash flow (fcf) is the cash flow to the firm or equity after all the debt and other obligations are paid off. Free cash flow (fcf) is the cash that remains after a company pays to support its.

(FCF) Free Cash Flow Formula and Calculation Financial

Free cash flow (fcf) is the cash that remains after a company pays to support its operations and makes any capital expenditures. What is the free cash flow (fcf) formula? Free cash flow (fcf) is the cash flow to the firm or equity after all the debt and other obligations are paid off. The generic free cash flow (fcf) formula.

Free Cash Flow What it is and how to calculate it Example and

The generic free cash flow (fcf) formula is equal to cash from operations minus capital. Free cash flow (fcf) is the cash flow to the firm or equity after all the debt and other obligations are paid off. What is the free cash flow (fcf) formula? It measures how much cash a. Free cash flow (fcf) is the cash that.

Free Cash Flow (FCF) Definition, Formula and How to Calculate Stock

The generic free cash flow (fcf) formula is equal to cash from operations minus capital. Free cash flow (fcf) is the cash that remains after a company pays to support its operations and makes any capital expenditures. It measures how much cash a. What is the free cash flow (fcf) formula? Free cash flow (fcf) is the cash flow to.

Free Cash Flow (FCF) Formula

It measures how much cash a. Free cash flow (fcf) is the cash flow to the firm or equity after all the debt and other obligations are paid off. What is the free cash flow (fcf) formula? The generic free cash flow (fcf) formula is equal to cash from operations minus capital. Free cash flow (fcf) is the cash that.

Free Cash Flow (FCF) Formula to Calculate and Interpret It

Free cash flow (fcf) is the cash that remains after a company pays to support its operations and makes any capital expenditures. It measures how much cash a. What is the free cash flow (fcf) formula? Free cash flow (fcf) is the cash flow to the firm or equity after all the debt and other obligations are paid off. The.

Free Cash Flow Plan Projections

It measures how much cash a. Free cash flow (fcf) is the cash that remains after a company pays to support its operations and makes any capital expenditures. What is the free cash flow (fcf) formula? Free cash flow (fcf) is the cash flow to the firm or equity after all the debt and other obligations are paid off. The.

Free Cash Flow (FCF) How to Calculate and Interpret It

Free cash flow (fcf) is the cash flow to the firm or equity after all the debt and other obligations are paid off. It measures how much cash a. Free cash flow (fcf) is the cash that remains after a company pays to support its operations and makes any capital expenditures. The generic free cash flow (fcf) formula is equal.

Free Cash Flow What it is and how to calculate it Example and

What is the free cash flow (fcf) formula? Free cash flow (fcf) is the cash flow to the firm or equity after all the debt and other obligations are paid off. Free cash flow (fcf) is the cash that remains after a company pays to support its operations and makes any capital expenditures. The generic free cash flow (fcf) formula.

It Measures How Much Cash A.

Free cash flow (fcf) is the cash that remains after a company pays to support its operations and makes any capital expenditures. Free cash flow (fcf) is the cash flow to the firm or equity after all the debt and other obligations are paid off. The generic free cash flow (fcf) formula is equal to cash from operations minus capital. What is the free cash flow (fcf) formula?

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-01-369e05314df242c3a81b8ac8ef135c52.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-02-9523034ce2944e6ebef6f54272396bfc.jpg)